This Week In ETFs

1.15.2021

This Week In ETFs

Week of Jan. 11, 2021

What happened in ETF markets this week? We crunch the numbers below.

NOTE: Unless otherwise stated, data range is from Monday through Thursday's close. ETNs and leveraged/inverse ETFs excluded.

Best Performing ETFs

This week's top performer was the Global X Cannabis ETF (POTX), which rose 26.56%. All five of the top performers were cannabis funds, including The Cannabis ETF (THCX) (up 19.09%), the ETFMG Alternative Harvest ETF (MJ) (up 18.35%), the Amplify Seymour Cannabis ETF (CNBS) (up 15.56%) and the AdvisorShares Pure Cannabis ETF (YOLO) (up 14.25%).

Worst Performing ETFs

The worst performing ETF this week was the ETFMG Prime Junior Silver Miners ETF (SILJ), which fell 5.08%. In fact, three of the five worst performing ETFs this week were silver miners funds, including the Global X Silver Miners ETF (SIL) and the iShares MSCI Global Silver Miners ETF (SLVP), which fell 5.05% and 4.83%, respectively.

ETFs with the Largest 5-Day Net Inflows

Emerging markets led 5-day inflows, with the iShares Core MSCI Emerging Markets ETF (IEMG) pulling in $2.3 billion in new net inflows. Other big gainers included the Financial Select Sector SPDR (XLF), which brought in $1.5 billion; the Vanguard Intermediate-Term Corporate Bond ETF (VCIT), which brought in $1.4 billion; and the iShares MBS ETF (MBB), which brought in $1.3 billion.

And, of course, current media darling ARK Innovation ETF (ARKK), which brought in $1.3 billion in new assets over the five day period.

ETFs with the Largest 5-Day Net Outflows

The SPDR S&P 500 ETF Trust (SPY) led 5-day net outflows, shaving $3.1 billion in assets. Other ETFs seeing outflows last week included the well-traded SPDR Gold Trust (GLD), which saw $1.2 billion in outflows, and the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which lost $843 million. The Vanguard Growth ETF (VUG) also lost $864 million.

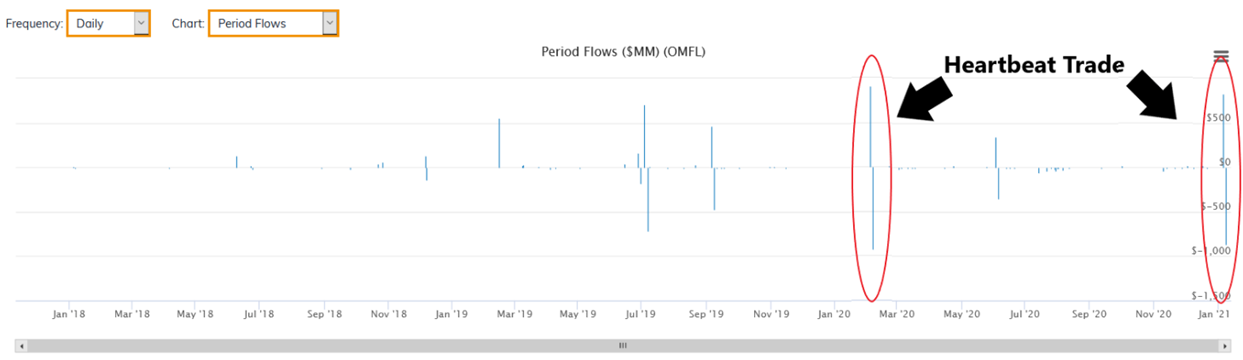

Interestingly, the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL) also posted a significant outflow of $867 million, but this was in fact one half of a "heartbeat trade," a common industry practice used to improve ETF tax efficiency.

Source: ETF Action

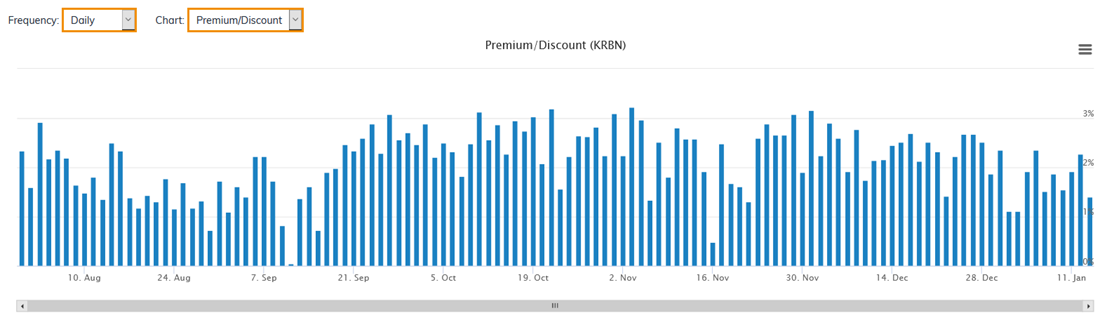

ETF with the Highest Premium

Since its inception last July, the KFA Carbon ETF (KRBN) has never not traded at a premium—usually a fairly steep one, at that. Last week, the fund's median premium reached 2.24%.

Source: ETF Action

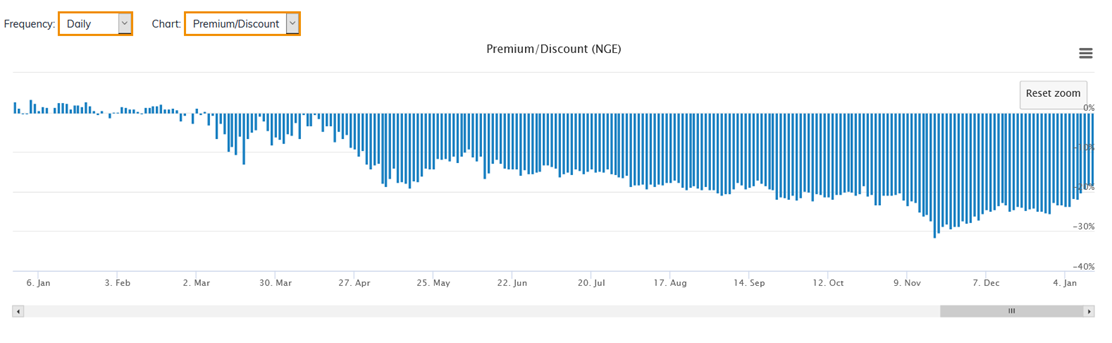

ETF with the Lowest Discount

Since mid-January last year, the Global X Nigeria ETF (NGE) has traded at a persistent and steepening discount, one that's more than a factor of ten larger than the next nearest ETF. Last week, NGE's median discount was 16.15%.

Source: ETF Action

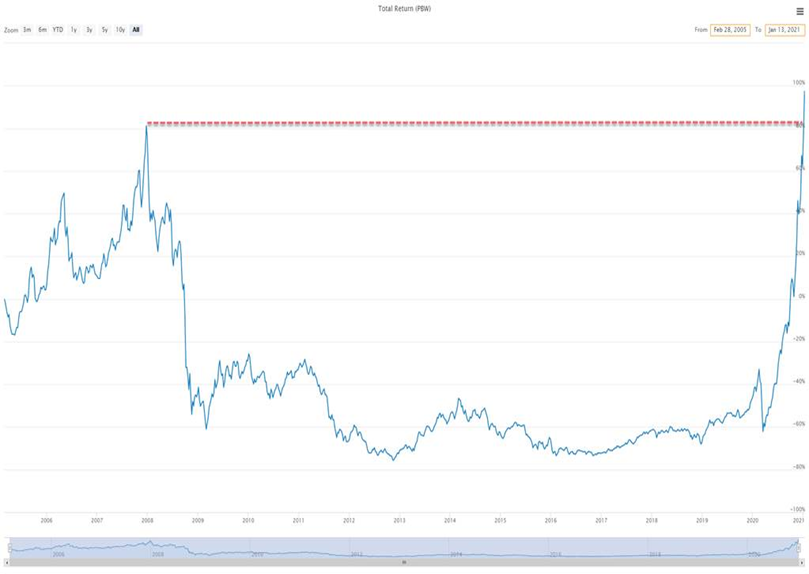

ETF at the Highest % Above Its 52W Low

Many clean energy ETFs are near all-time highs right now, but none has risen farther more sharply than the Invesco WilderHill Clean Energy ETF (PBW). PBW now sits 451.4% above its previous 52-week low.

Relatedly, after 13 years, this week PBW finally struck a new all-time high. Who says 13 is unlucky, anyway?

Source: ETF Action

ETF at the Lowest % Below Its 52W High

As high as clean energy ETFs has risen, oil ETFs have likewise fallen. But the ETF that has fallen the farthest percentage-wise from its previous isn't an oil fund, but a VIX ETF: the ProShares VIX Short-Term Futures ETF (VIXY), which now sits 75.72% below its previous 52-week high.

Source: ETF Action

Notable Launches

- Horizon Kinetics Inflation Beneficiaries ETF (INFL): Tracks stocks likely to benefit from inflationary pressures, including miners, energy E&P, real estate, infrastructure, etc.

- Global X Adaptive U.S. Risk Management ETF (ONOF): Offers broad equity exposure in normal market conditions, then switches to U.S. Treasuries in "risk-off" conditions.

- Merlyn.AI Best-of-Breed Core Momentum ETF (BOB): A momentum-on-the-upside, protection-on-the-downside ETF-of-ETFs that uses AI to select stocks with $10B+ in market cap.

- Franklin Exponential Data ETF (XDAT): A "big data" ETF that tracks companies involved in genomics, e-commerce, artificial intelligence, social media and more.

- American Century Low Volatility ETF (LVOL): Transparent active ETF that uses quantitative models to select low-volatility stocks.

Notable Closures

- No closures this week.

Notable Filings

- ARK files for a space ETF, ARKX, that will compete with UFO and ROKT.

- There's a new Gemini-custodied bitcoin ETF filing… in Canada.

Lara Crigger is the Editor-in-Chief of ETF Action. Contact her at lara@etfaction.com

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.