Performance (as of 5/20/2021)

Index First Value Date is Dec 31 2016. The index Launch Date is Jun 11 2021. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. Index performance calculated by Indxx. Past performance is no guarantee of future performance. Investors cannot invest directly in an index.

*Since Common Inception Date

Establishing a consensus for Thematic Investing.

The ETF All-Stars Thematic Indexes are the first ever suite of indexes harnessing the growth and transparency of thematic ETFs to establish a consensus view on which companies best align with popular investment themes based on publicly available ETF ownership data.

Potential advantages of the ETF All Stars Thematic Indexes include:

-

Access to a diversified basket of companies most widely owned by

thematic ETFs.

-

Indexes are built using an objective methodology that follows a

transparent and repeatable rules based process.

-

Indexes dynamically adapt to ever changing ETF landscape (new

launches and closures) and investor sentiment (ETF flows).

Portfolio Insights

ETF Action Thematic All-Stars Composite Index - February Rebalance Slick

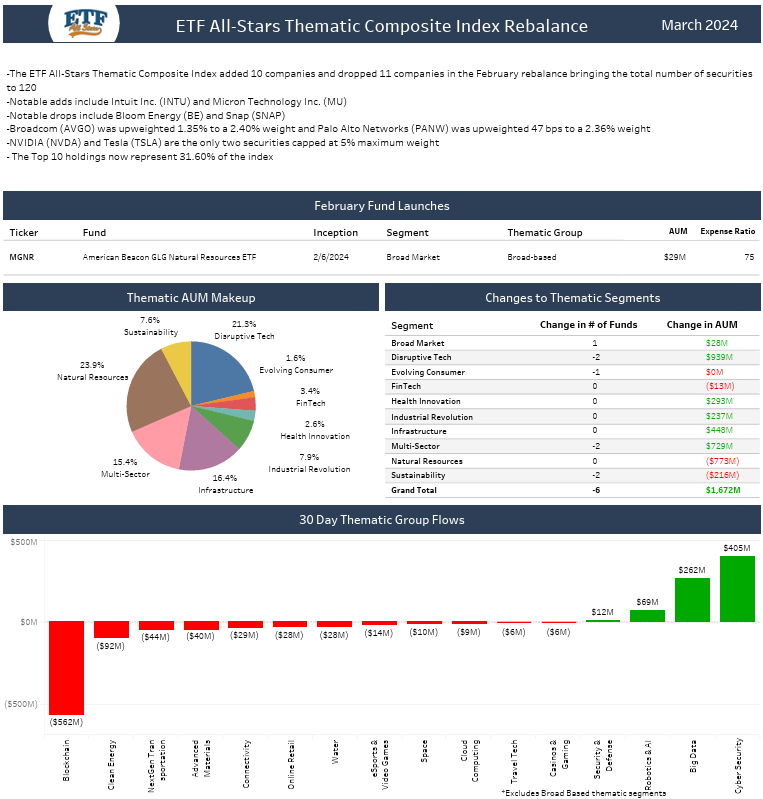

3.7.2024

-The ETF All-Stars Thematic Composite Index added 10 companies and dropped 11 companies in the February rebalance bringing the total number of securities to 120

-Notable adds include Intuit Inc. (INTU) and Micron Technology Inc. (MU)

-Notable drops include Bloom Energy (BE) and Snap (SNAP)

-Broadcom (AVGO) was upweighted 1.35% to a 2.40% weight and Palo Alto Networks (PANW) was upweighted 47 bps to a 2.36% weight

-NVIDIA (NVDA) and Tesla (TSLA) are the only two securities capped at 5% maximum weight

-The Top 10 holdings now represent 31.60% of the index

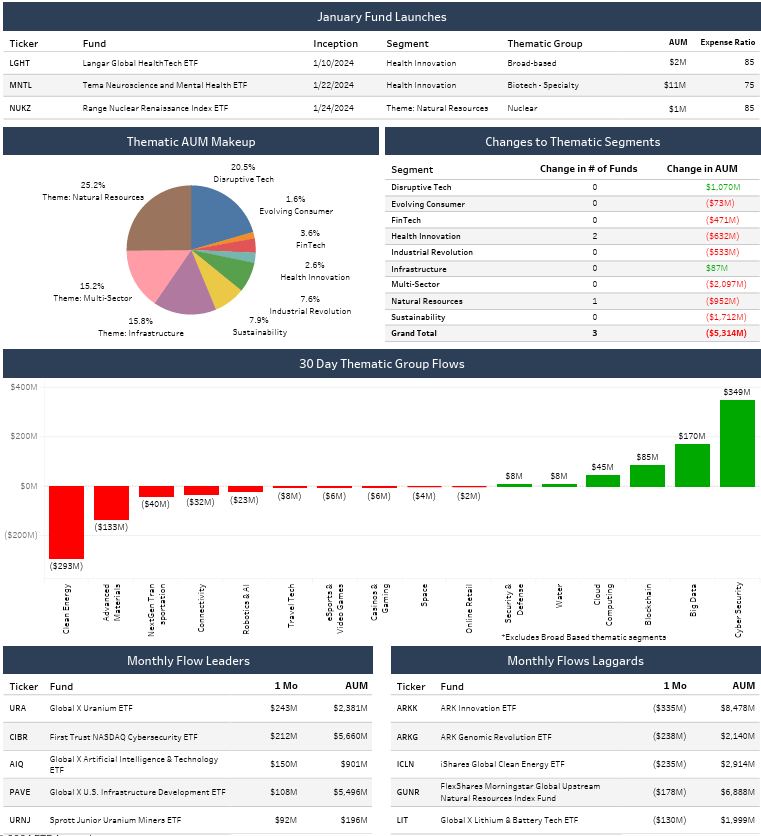

ETF Action Thematic All-Stars Composite Index - January Rebalance Slick

2.6.2024

-The ETF All-Stars Thematic Composite Index added 6 companies and dropped 8 companies in the November rebalance bringing the total number of securities to 122

-Notable adds include Uber Technologies (UBER) and Dropbox, Inc. (BOX)

-Notable drops include Riot Platforms (RIOT) and Sunnova Energy (NOVA)

-Tesla (TSLA) was upweighted 69 bps to the 5% threshold and Nvidia (NVDA) was downweighted 1.38% to the 5% weight threshold

-NVIDIA (NVDA) and Tesla (TSLA) are the only two securities capped at 5% maximum weight

-The Top 10 holdings now represent 30.98% of the index

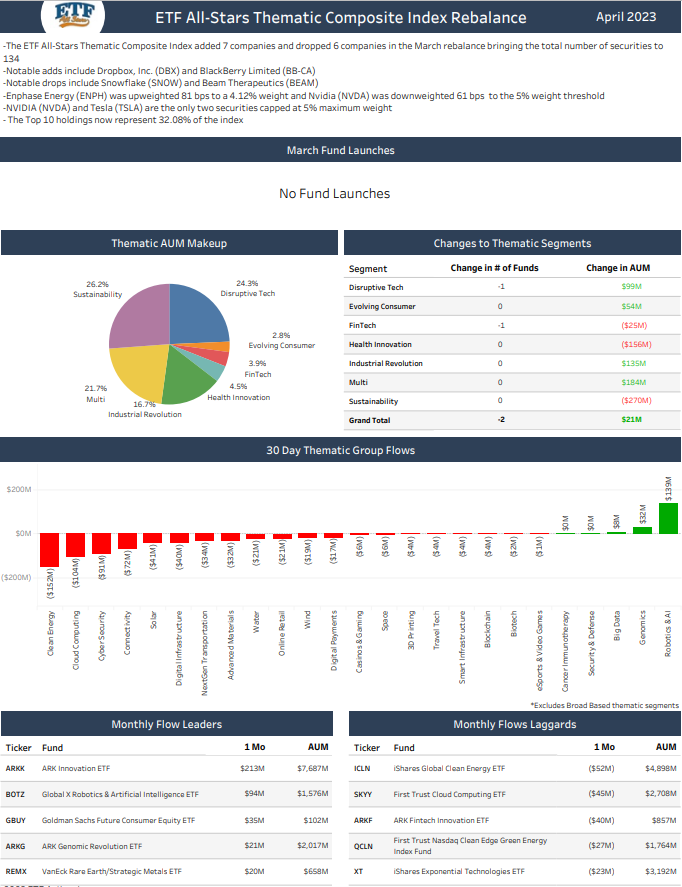

ETF Action Thematic All-Stars Composite Index - March Rebalance Slick

4.5.2023

-The ETF All-Stars Thematic Composite Index added 7 companies and dropped 6 companies in the March rebalance bringing the total number of securities to 134

-Notable adds include Dropbox, Inc. (DBX) and BlackBerry Limited (BB-CA)

-Notable drops include Snowflake (SNOW) and Beam Therapeutics (BEAM)

-Enphase Energy (ENPH) was upweighted 81 bps to a 4.12% weight and Nvidia (NVDA) was downweighted 61 bps to the 5% weight threshold

-NVIDIA (NVDA) and Tesla (TSLA) are the only two securities capped at 5% maximum weight

- The Top 10 holdings now represent 32.08% of the index

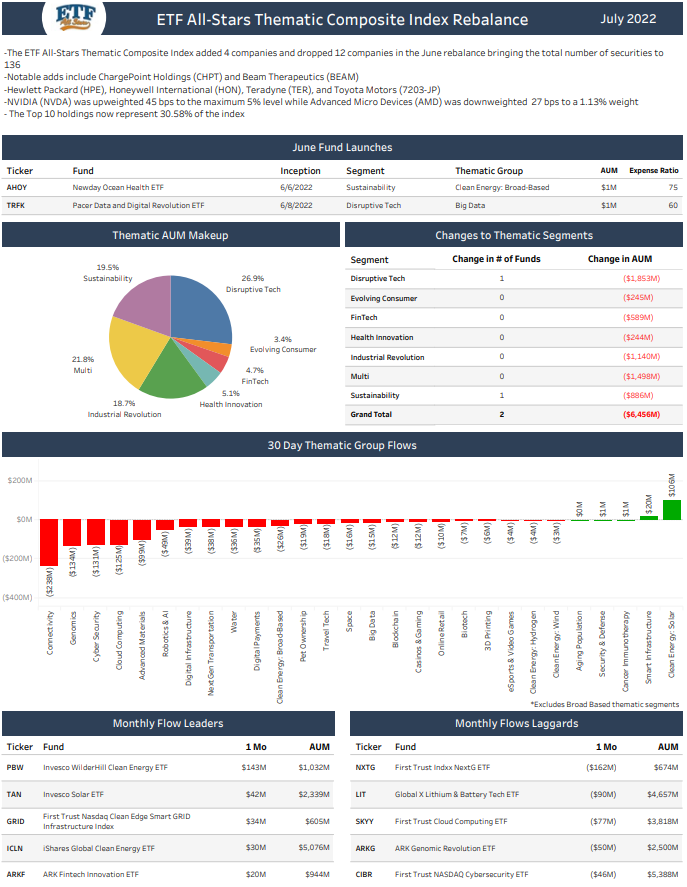

ETF Action Thematic All-Stars Composite Index - July Rebalance Slick

7.5.2022

-The ETF All-Stars Thematic Composite Index added 4 companies and dropped 12 companies in the June rebalance bringing the total number of securities to 136

-Notable adds include ChargePoint Holdings (CHPT) and Beam Therapeutics (BEAM)

-Hewlett Packard (HPE), Honeywell International (HON), Teradyne (TER), and Toyota Motors (7203-JP) were all removed from the index

-NVIDIA (NVDA) was upweighted 45 bps to the maximum 5% level while Advanced Micro Devices (AMD) was downweighted 27 bps to a 1.13% weight

-The Top 10 holdings now represent 30.58% of the index

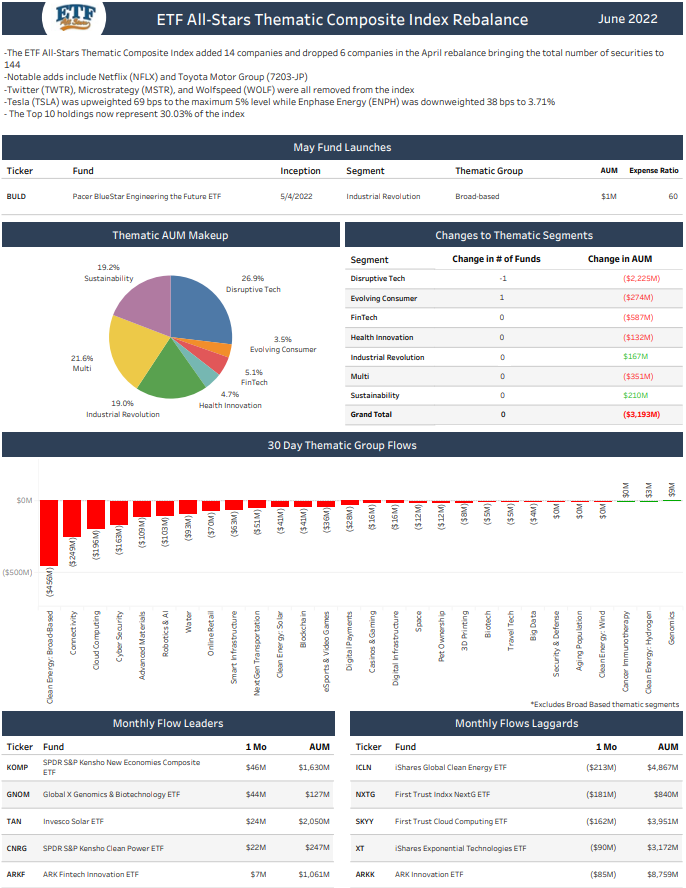

ETF Action Thematic All-Stars Composite Index - June Rebalance Slick

6.8.2022

-The ETF All-Stars Thematic Composite Index added 14 companies and dropped 6 companies in the April rebalance bringing the total number of securities to 144

-Notable adds include Netflix (NFLX) and Toyota Motor Group (7203-JP)

-Twitter (TWTR), Microstrategy (MSTR), and Wolfspeed (WOLF) were all removed from the index

-Tesla (TSLA) was upweighted 69 bps to the maximum 5% level while Enphase Energy (ENPH) was downweighted 38 bps to 3.71%

-The Top 10 holdings now represent 30.03% of the index

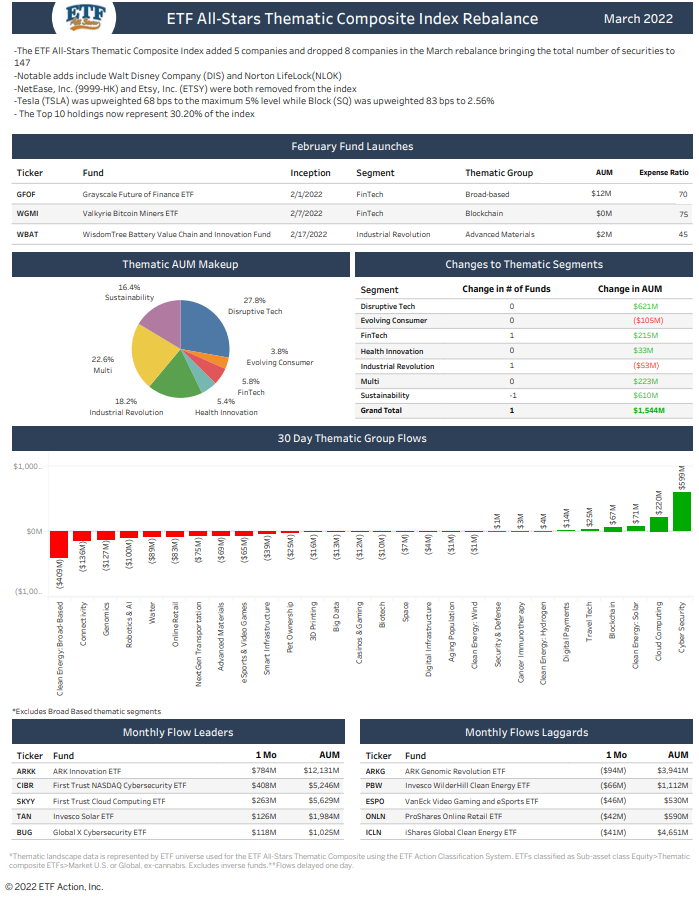

ETF Action Thematic All-Stars Composite Index - March Rebalance Slick

3.9.2022

-The ETF All-Stars Thematic Composite Index added 5 companies and dropped 8 companies in the March rebalance bringing the total number of securities to 147

-Notable adds include Walt Disney Company (DIS) and Norton LifeLock (NLOK)

-NetEase, Inc. (9999-HK) and Etsy, Inc. (ETSY) were both removed from the index

-Tesla (TSLA) was upweighted 68 bps to the maximum 5% level while Block (SQ) was upweighted 83 bps to 2.56%

-The Top 10 holdings now represent 30.20% of the index

ETF Action Thematic All-Stars Composite Index - November Rebalance Slick

12.6.2021

-The ETF All-Stars Thematic Composite Index added 6 companies and dropped 13 companies in the December rebalance bringing the total number of securities to 141

-Notable adds include AutoDesk Inc (ADSK) and Renewable Teradyne Inc (TER)

-NVIDIA (NVDA) and Tesla (TSLA) were both reduced back down to the maximum 5% weight while Enphase Energy (ENPH) was raised 84bps to just over 4% weight

-The Top 10 holdings represent 29.67% of the index

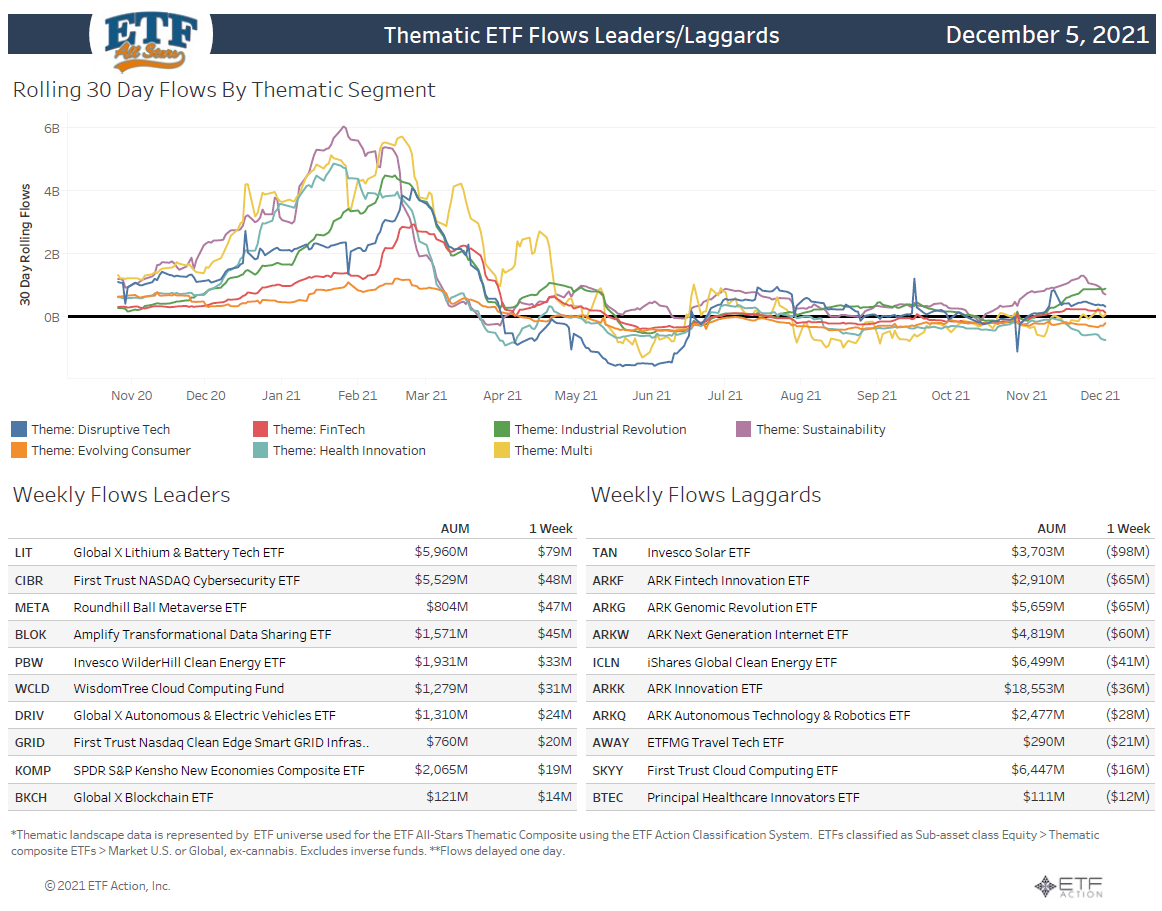

ETF All-Stars Thematic Playbook

12.6.2021

A brief overview of performance, flows, and highlights of the ETF All-Stars Thematic Indexes and the thematic landscape:

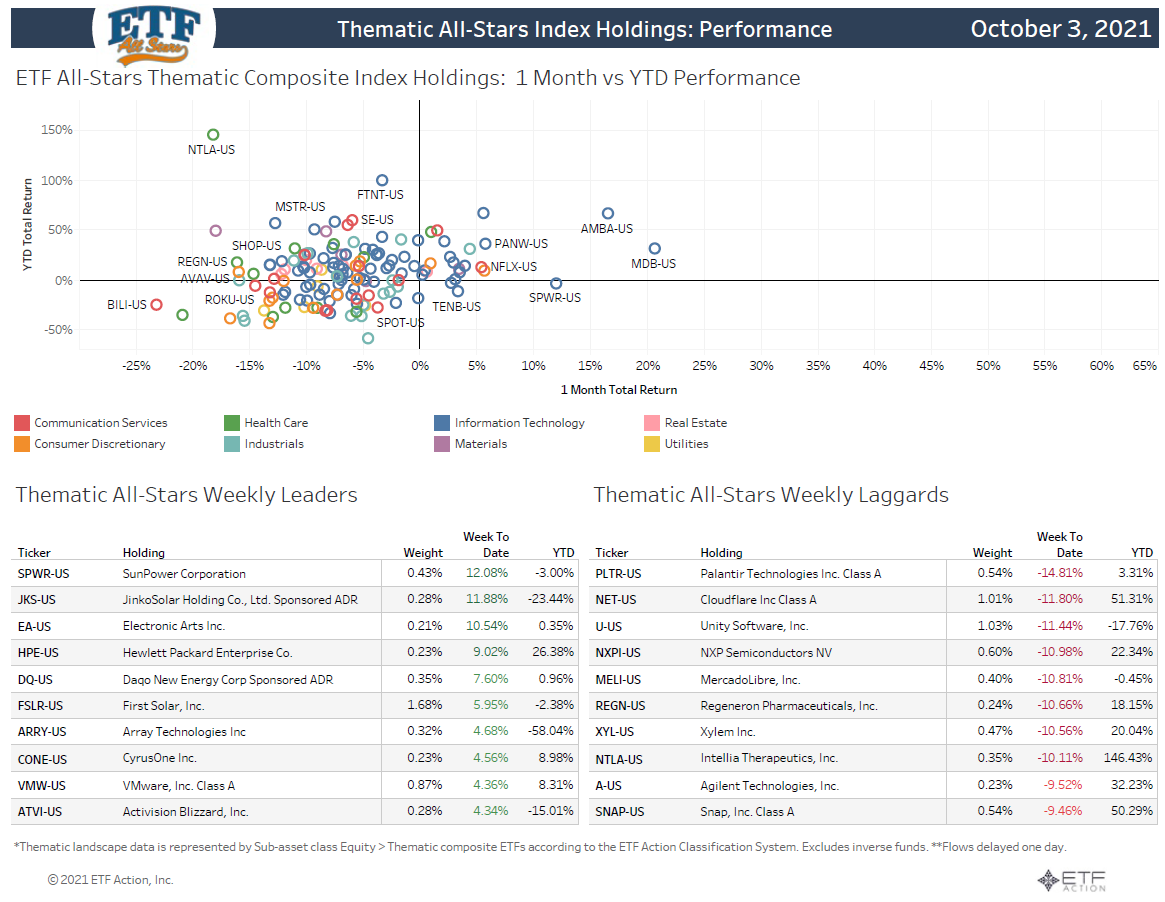

ETF All-Stars Thematic Playbook

10.4.2021

A brief overview of performance, flows, and highlights of the ETF All-Stars Thematic Indexes and the thematic landscape:

ETF All-Stars Thematic Playbook

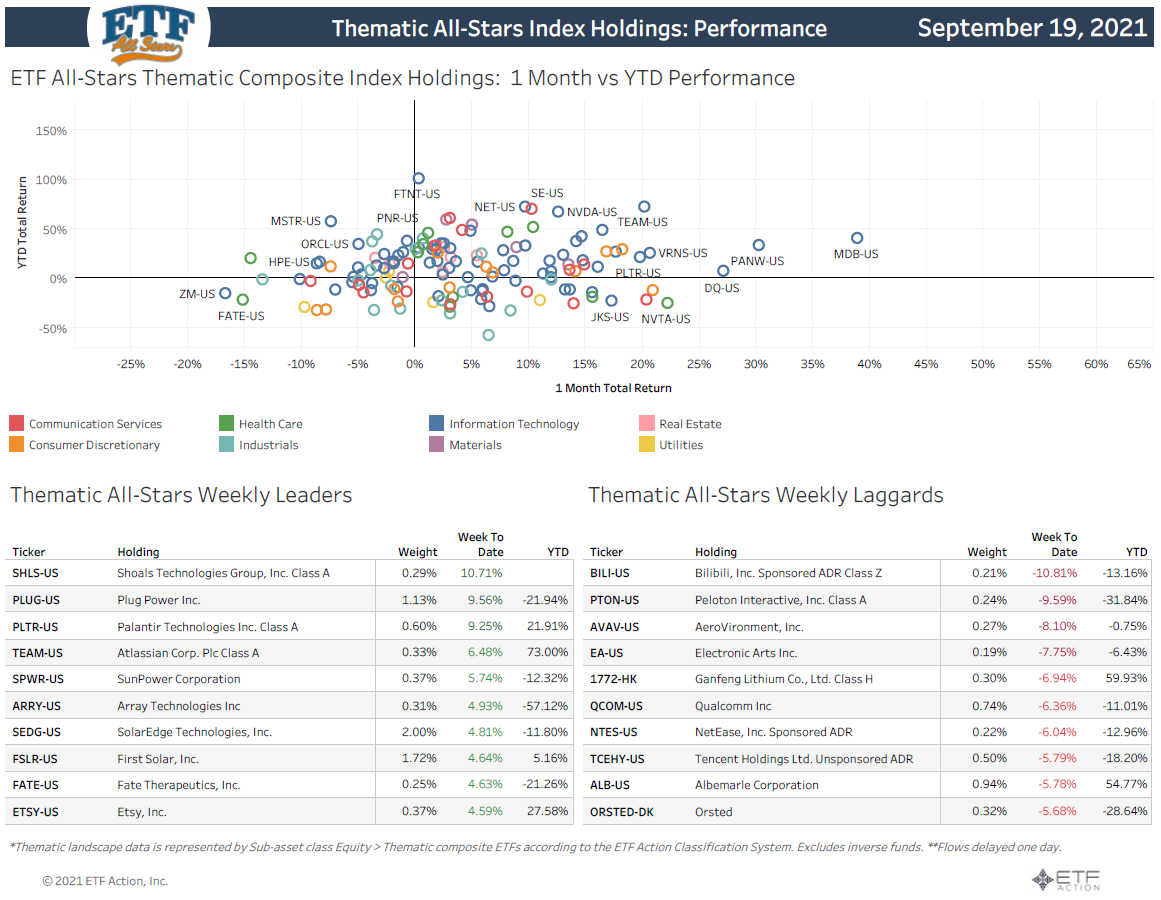

9.20.2021

A brief overview of performance, flows, and highlights of the ETF All-Stars Thematic Indexes and the thematic landscape: