Insights Archives

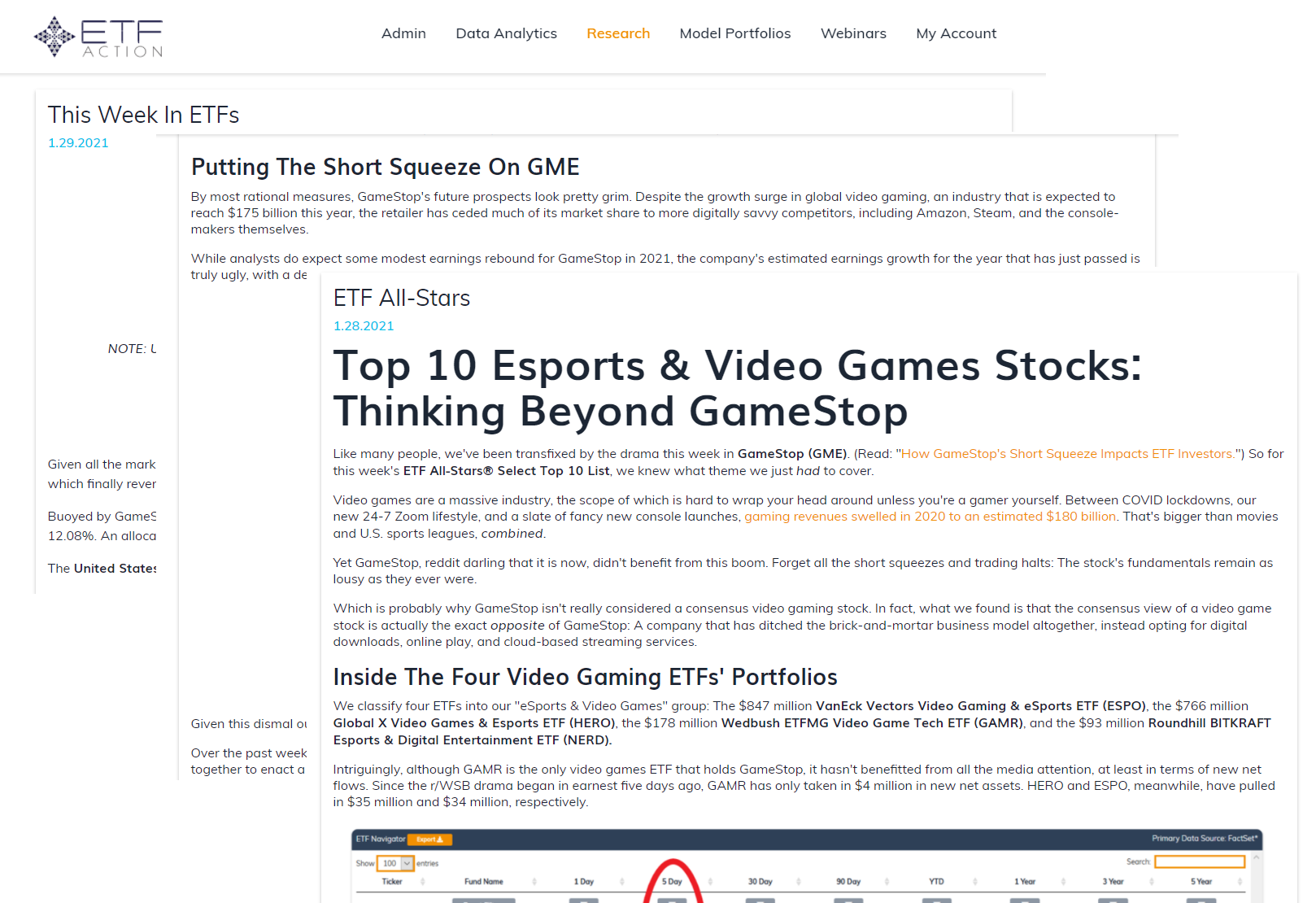

ETF Action Thematic All-Stars Composite Index - February Rebalance Slick

3.7.2024

-The ETF All-Stars Thematic Composite Index added 10 companies and dropped 11 companies in the February rebalance bringing the total number of securities to 120

-Notable adds include Intuit Inc. (INTU) and Micron Technology Inc. (MU)

-Notable drops include Bloom Energy (BE) and Snap (SNAP)

-Broadcom (AVGO) was upweighted 1.35% to a 2.40% weight and Palo Alto Networks (PANW) was upweighted 47 bps to a 2.36% weight

-NVIDIA (NVDA) and Tesla (TSLA) are the only two securities capped at 5% maximum weight

-The Top 10 holdings now represent 31.60% of the index

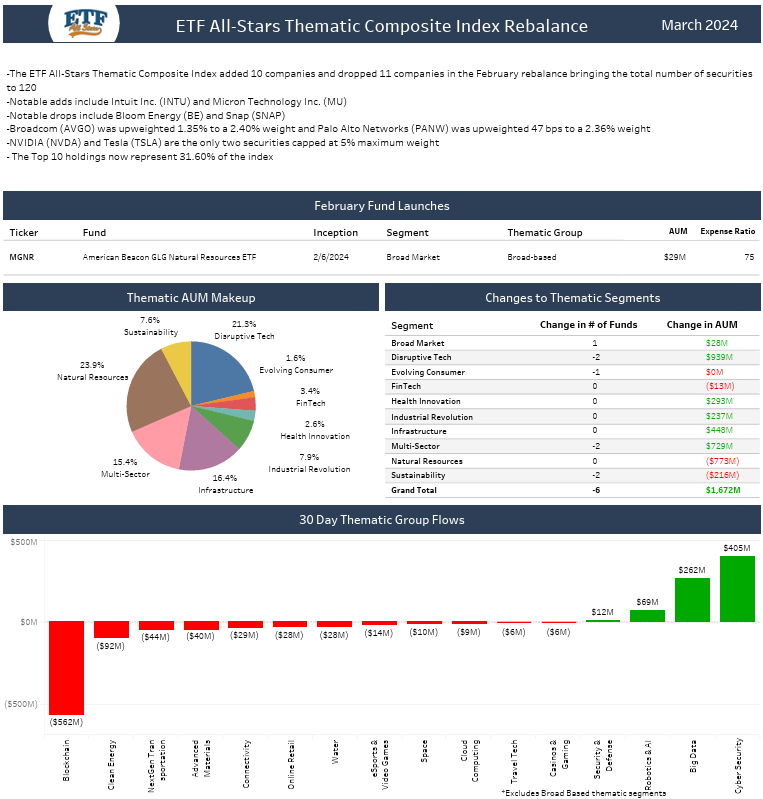

ETF Action Thematic All-Stars Composite Index - March Rebalance Slick

4.5.2023

-The ETF All-Stars Thematic Composite Index added 7 companies and dropped 6 companies in the March rebalance bringing the total number of securities to 134

-Notable adds include Dropbox, Inc. (DBX) and BlackBerry Limited (BB-CA)

-Notable drops include Snowflake (SNOW) and Beam Therapeutics (BEAM)

-Enphase Energy (ENPH) was upweighted 81 bps to a 4.12% weight and Nvidia (NVDA) was downweighted 61 bps to the 5% weight threshold

-NVIDIA (NVDA) and Tesla (TSLA) are the only two securities capped at 5% maximum weight

- The Top 10 holdings now represent 32.08% of the index

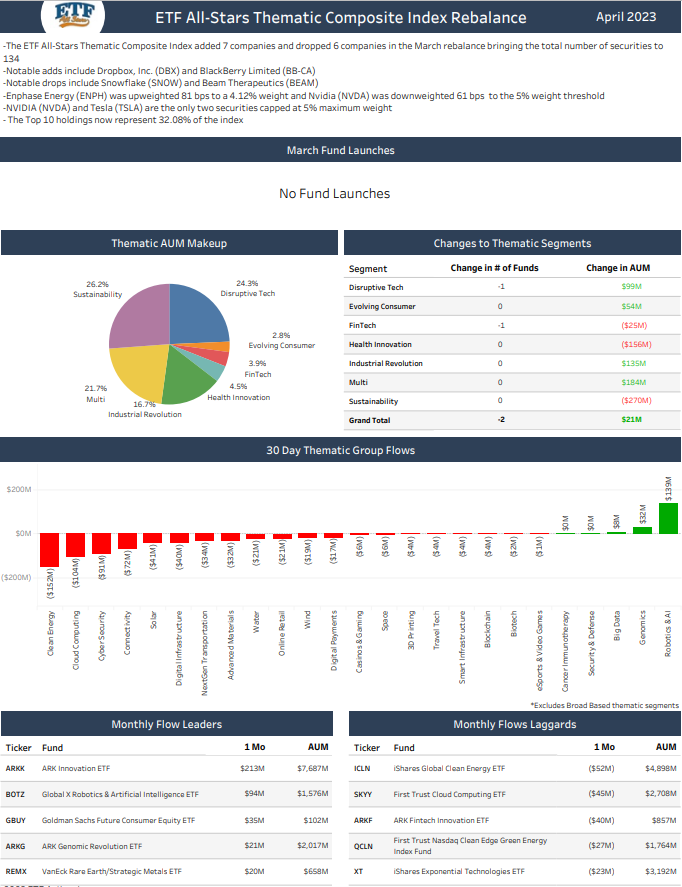

ETF Action Thematic All-Stars Composite Index - July Rebalance Slick

7.5.2022

-The ETF All-Stars Thematic Composite Index added 4 companies and dropped 12 companies in the June rebalance bringing the total number of securities to 136

-Notable adds include ChargePoint Holdings (CHPT) and Beam Therapeutics (BEAM)

-Hewlett Packard (HPE), Honeywell International (HON), Teradyne (TER), and Toyota Motors (7203-JP) were all removed from the index

-NVIDIA (NVDA) was upweighted 45 bps to the maximum 5% level while Advanced Micro Devices (AMD) was downweighted 27 bps to a 1.13% weight

-The Top 10 holdings now represent 30.58% of the index

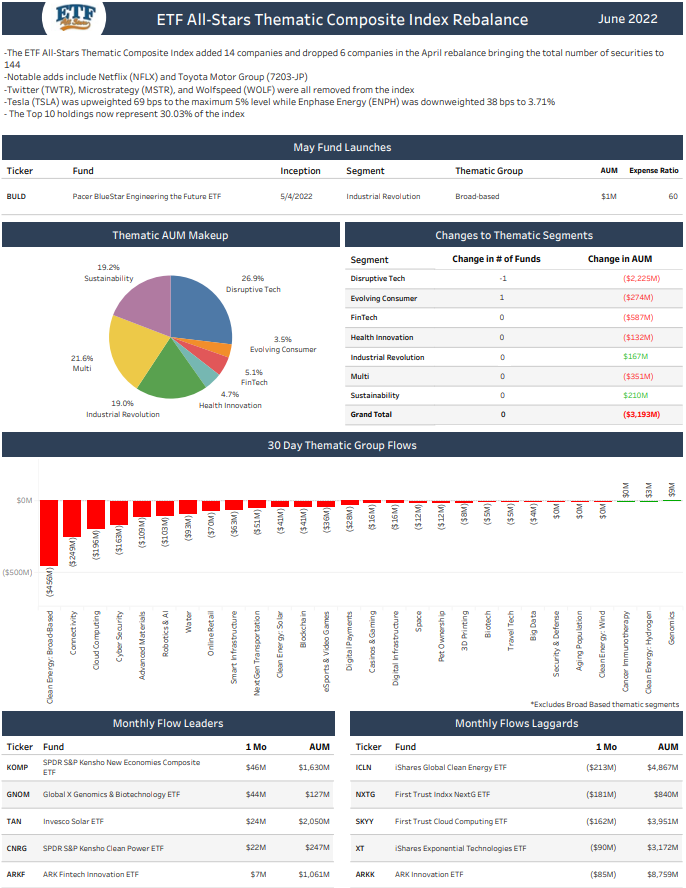

ETF Action Thematic All-Stars Composite Index - June Rebalance Slick

6.8.2022

-The ETF All-Stars Thematic Composite Index added 14 companies and dropped 6 companies in the April rebalance bringing the total number of securities to 144

-Notable adds include Netflix (NFLX) and Toyota Motor Group (7203-JP)

-Twitter (TWTR), Microstrategy (MSTR), and Wolfspeed (WOLF) were all removed from the index

-Tesla (TSLA) was upweighted 69 bps to the maximum 5% level while Enphase Energy (ENPH) was downweighted 38 bps to 3.71%

-The Top 10 holdings now represent 30.03% of the index

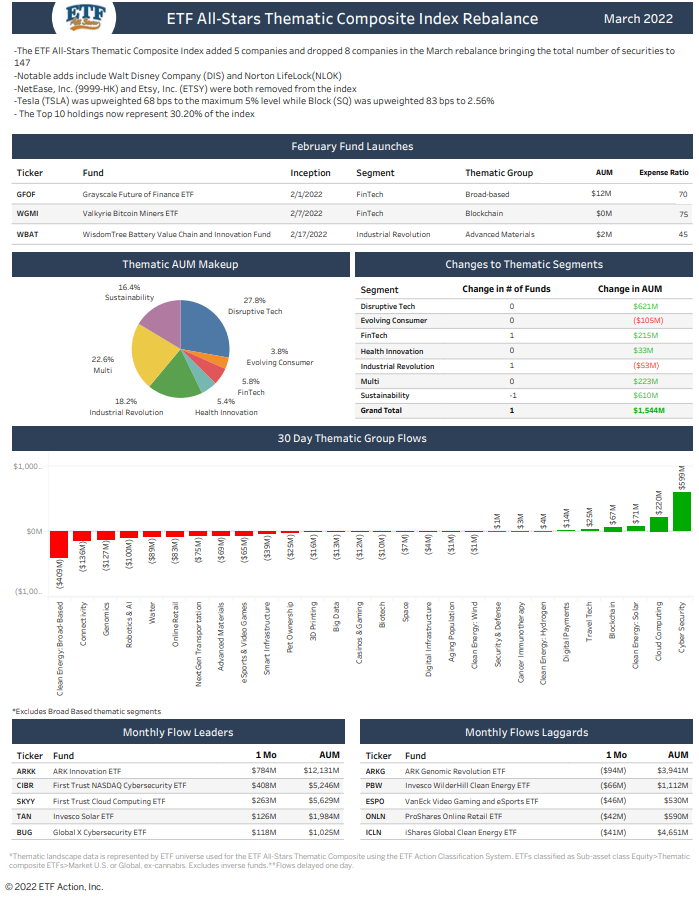

ETF Action Thematic All-Stars Composite Index - March Rebalance Slick

3.9.2022

-The ETF All-Stars Thematic Composite Index added 5 companies and dropped 8 companies in the March rebalance bringing the total number of securities to 147

-Notable adds include Walt Disney Company (DIS) and Norton LifeLock (NLOK)

-NetEase, Inc. (9999-HK) and Etsy, Inc. (ETSY) were both removed from the index

-Tesla (TSLA) was upweighted 68 bps to the maximum 5% level while Block (SQ) was upweighted 83 bps to 2.56%

-The Top 10 holdings now represent 30.20% of the index

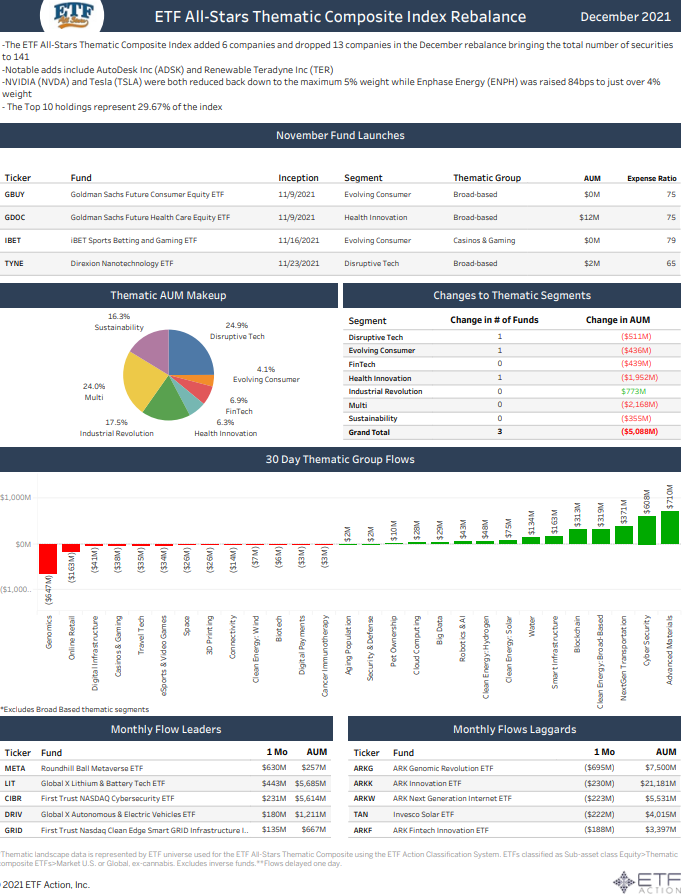

ETF Action Thematic All-Stars Composite Index - November Rebalance Slick

12.6.2021

-The ETF All-Stars Thematic Composite Index added 6 companies and dropped 13 companies in the December rebalance bringing the total number of securities to 141

-Notable adds include AutoDesk Inc (ADSK) and Renewable Teradyne Inc (TER)

-NVIDIA (NVDA) and Tesla (TSLA) were both reduced back down to the maximum 5% weight while Enphase Energy (ENPH) was raised 84bps to just over 4% weight

-The Top 10 holdings represent 29.67% of the index

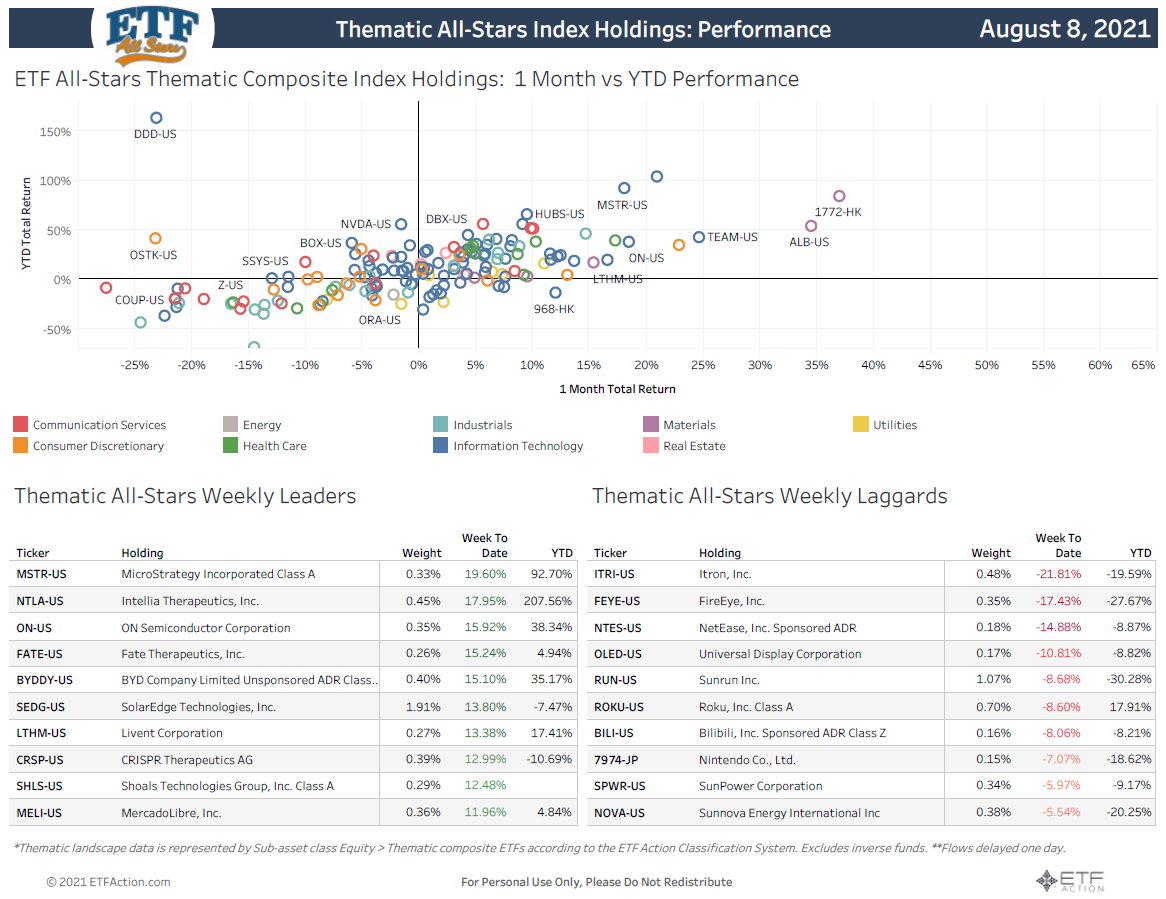

ETF All-Stars Thematic Playbook

8.9.2021

A brief overview of performance, flows, and highlights of the ETF All-Stars Thematic Indexes and the thematic landscape:

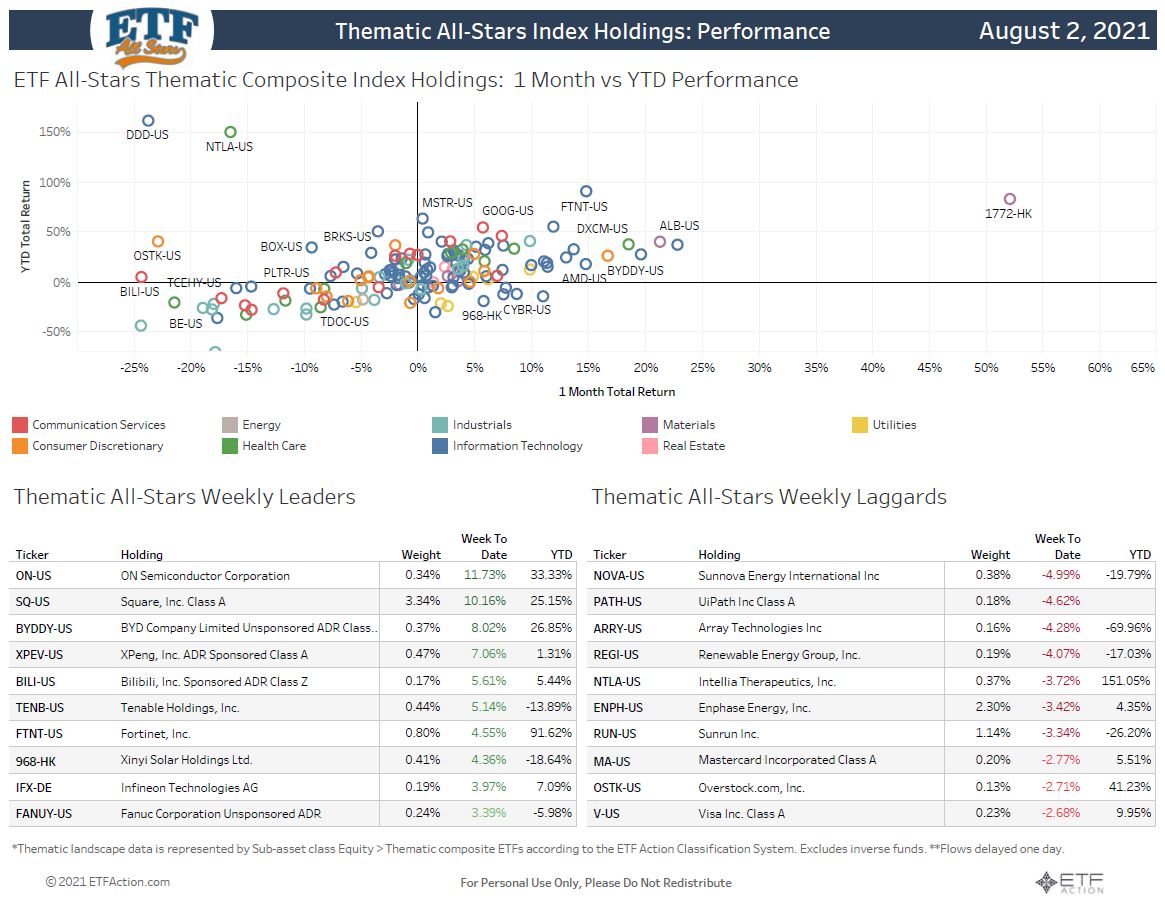

ETF All-Stars Thematic Playbook

8.3.2021

A brief overview of performance, flows, and highlights of the ETF All-Stars Thematic Indexes and the thematic landscape:

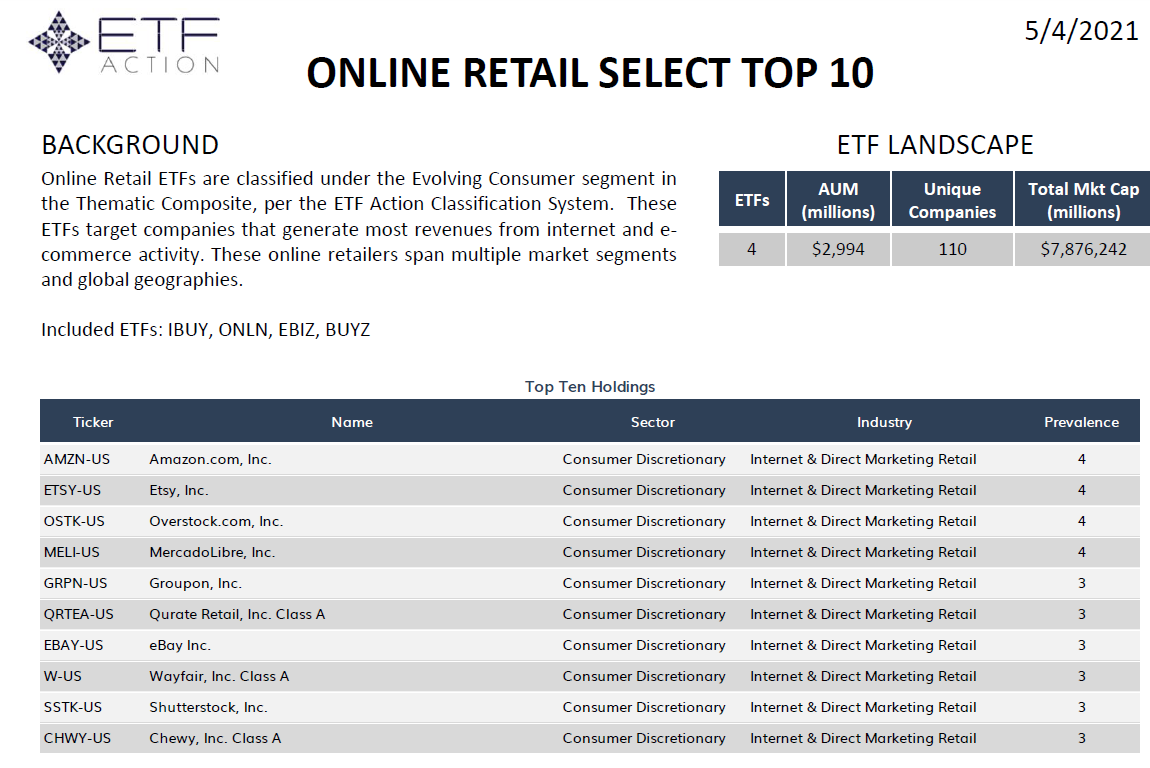

ETF All-Stars: Online Retail

5.5.2021

Top 10 Online Retail Stocks

By and large online retailers have outperformed traditional brick and mortar retail over the last several years as technology adoption has increased, particularly amid the pandemic. Then came February 2021. Yes, the world was continuing to open up in February but we began to see the upward trend in yields which effectively compressed stretched valuation multiples on a number of tech focused strategies. Today we look at what those strategies look like and what companies they hold.

While there are only a few ETFs that cover the space, it is growing quickly in assets and may stand to benefit from the strong secular trend still. Hence, we explore the ETFs and the companies that make up ETF All-Stars Online Retail Select Top 10 List.

Let's begin by looking at the current Online Retail ETF landscape...keep in mind, we only are looking at ETFs that are globally focused and not country or region specific ETFs (ie: China consumer ETFs).

Lower Multiples, More Value: Rebalancing U.S. Factor AIM Portfolio

4.19.2021

Since the last rebalance in November, the U.S. Factor AIM Portfolio has returned 20.31%, outpacing the S&P 500 by nearly 300 basis points. The rebalance across all of the AIM portfolios in November was specific to positioning for a cyclical recovery which proved to be beneficial. While we believe the cyclical recovery is still underway, this week's rebalance is focused specifically on three things:

- Lowering the portfolio valuation multiple

- Increasing value characteristics to stay aligned with ongoing cyclical recovery

- Increased financials exposure and size tilt

.jpeg)