All Research Archives

Daily Note

4.25.2024

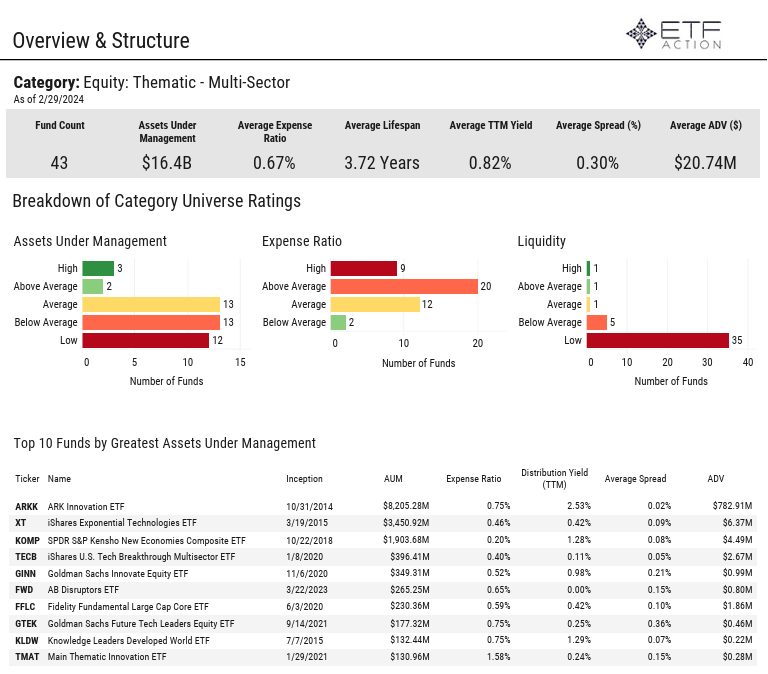

Disruptive Tech Category Report

4.25.2024

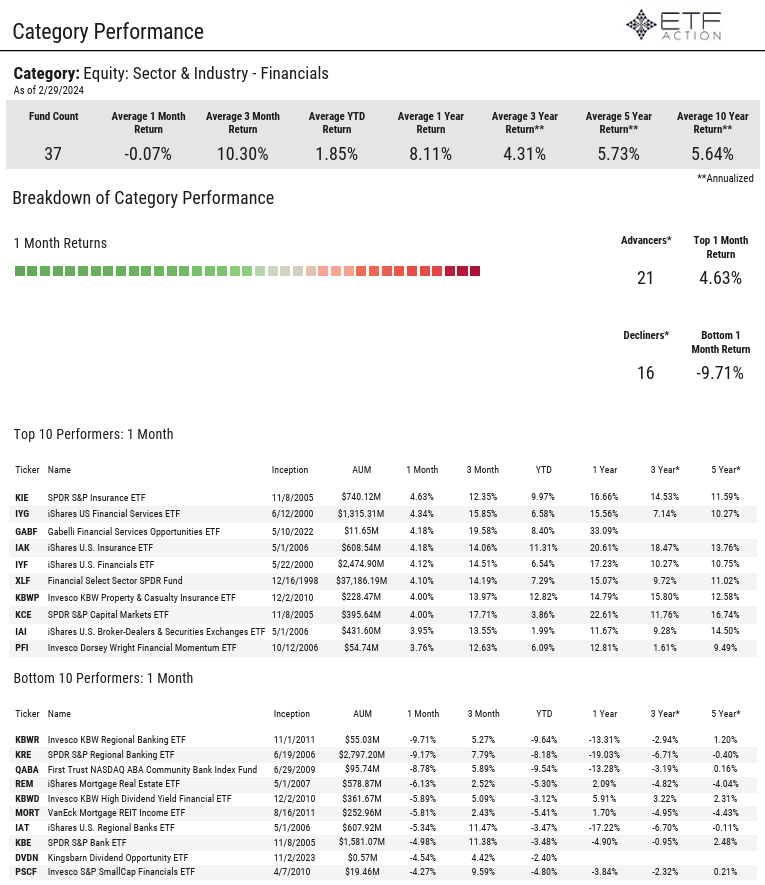

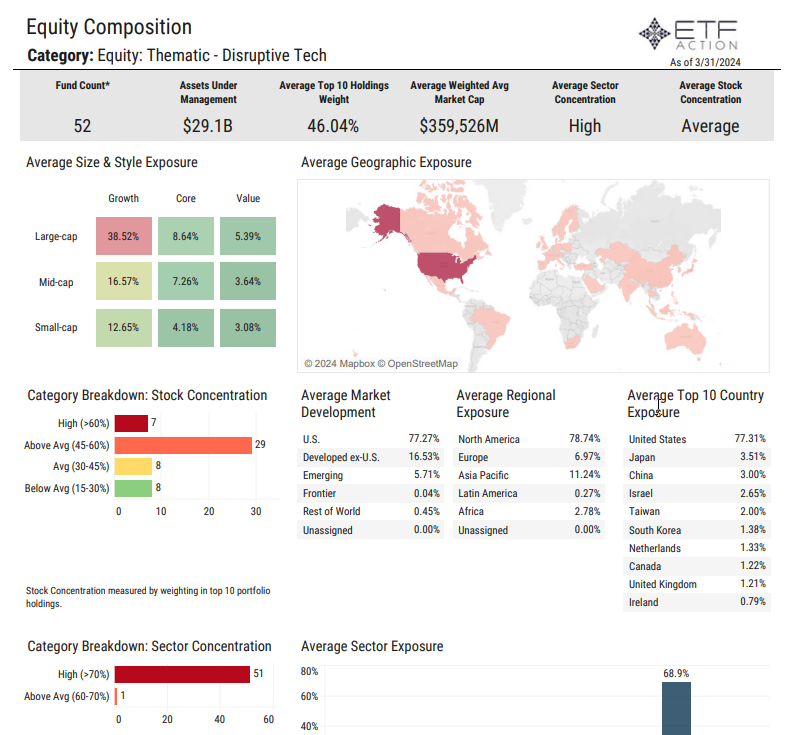

- The Equity: Thematic - Disruptive Tech category is comprised of 52 ETFs with $29.1 billion in total assets under management

- 6 of the ETFs in the category have more than $1 billion in AUM, the First Trust NASDAQ Cybersecurity ETF (CIBR) is the largest ETF at $6.6 billion

- 6 ETFs in the category have average daily volume higher than $10 million while 24 ETFs have ADV below $500K

- The average expense ratio is 56 bps, the average lifespan is 5.64 years, and the average TTM yield is 0.76%

- Industrials ETFs gathered $120 million in net inflows in March. The Global X Artificial Intelligence & Technology ETF (AIQ)gathered $250 million in net inflows while CIBR saw $56 million in net outflows on the month

- March performance was split: 32 ETFs posted gains while 20 ETFs posted losses, average 1-month reutrn was +0.32% and average 1-year return was +30.59%

- The Clockwise Core Equity & Innovation ETF (TIME) was the best performer of the group in March, up 4.26%

- The WisdomTree Cybersecurity Fund (WCBR) lagged in March, sinking 5.91%

- The category average exposure tilts towards Large-cap Growth (38%), U.S. exposure (78%), and the tech sector (69%).

- The category shows most funds have high groqwth ratings, below average value ratings, and average quality ratings.

Daily Note

4.24.2024

As investors digested the latest batch of corporate earnings results, the rally continued for U.S. equity markets on Tuesday. Spotify surged more than 11% on the day after surpassing Wall Street’s Q1 estimates and issuing encouraging 2Q guidance. UPS gained 2.4% after the delivery giant surpassed expectations for earnings. GE Aerospace jumped more than 8.3% after beating earnings expectations and PepsiCo fell nearly 3% after reporting that recalls and a weaker lower-income consumer hurt demand in the U.S. After the close, Tesla missed estimates on the top and bottom lines and reported a 9% drop in revenue in the first quarter, the steepest year-over-year decline since 2012. Google parent company Alphabet and Microsoft round out the technology-heavy earnings week on Thursday. New home sales accelerated in March at a faster-than-expected pace as mortgage rates declined over the month, the Commerce Department reported Tuesday. Sales of single-family homes totaled 693K for the month, considerably higher than the downwardly revised 637K in February and better than the 669K estimate. After dipping in January, the median sales price jumped back up to $430,700, the highest level since August 2023. Durable Goods Orders data is due out on Wednesday.

Equities:

- The NASDAQ 100 (QQQ) led the way once again, increasing 1.49%, the S&P 500 (SPY) gained 1.19% and the Dow Jones Industrial Average (DIA) added 69 bps

- Small-Caps (IJR) rose 1.78% while Mid-Caps (IJH) climbed 1.21%

- Growth-oriented pockets of the markets outperformed on Tuesday with Pure Growth (RPG) jumping 2.25% and High Beta (SPHB), Momentum (SPMO), and Growth (SPYG) all climbing at least 1.60%

- All other factors finished higher with Quality (SPHQ) gaining 1.24% and Value (SPYV) advancing 73 bps

- Emerging Markets (EEM) added 82 bps, lifted by Thailand (THD, +1.79%), Mexico (EWW, +1.36%), South Africa (EZA, +1.36%), and China (MCHI, +1.29%)

- Developed ex-U.S. Markets (EFA) were up 1.09% on strength from the Netherlands (EWN, +2.04%), Germany (EWG, +1.81%), and Hong Kong (EWH, +1.73%)

Sectors:

- Materials (XLB) was the lone U.S. sector in negative territory yesterday, slipping 86 bps

- XLB was once again pulled lower by Metals & Mining (XME, -1.41%)

- Communication Services (XLC) and Technology (XLK) were both up around 1.50% while Industrials (XLI) rose 1.39% and Health Care (XLV) added 1.30%

- Consumer Discretionary (XLY, +1.19%) and Real Estate (XLRE, +91 bps) also saw strong returns

- XLRE received a boost from Homebuilders (XHB, +2.67%)

Themes:

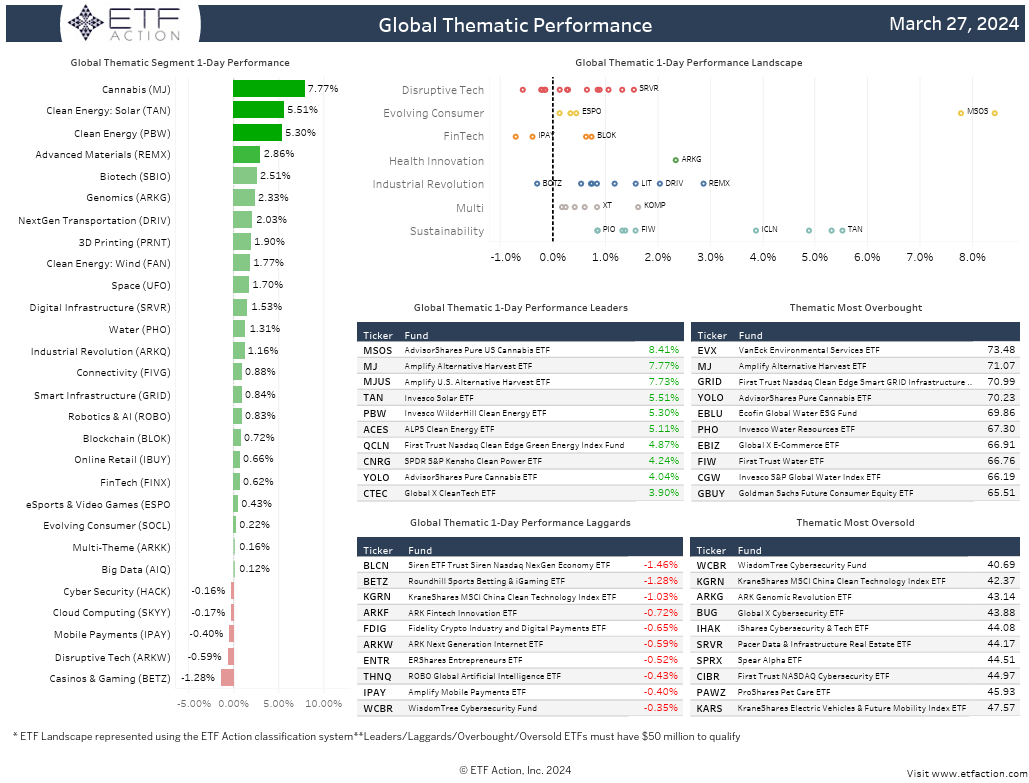

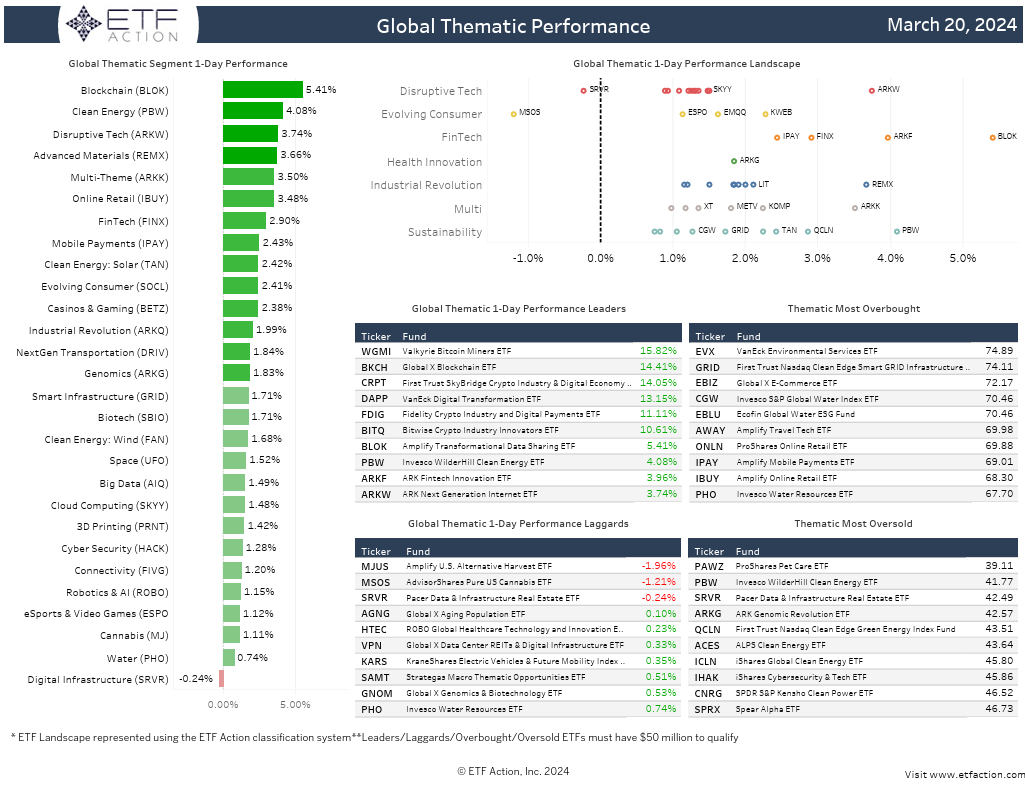

- Another strong day for global themes as Advanced Materials (REMX, -14 bps) was the only segment to see losses

- Cannabis (MJ) popped 5.43% followed by Disruptive Tech (ARKW, +3.20%) and Multi-Theme (ARKK, +2.98%)

- Evolving Consumer (SOCL), Cloud Computing (SKYY), Mobile Payments (IPAY), FinTech (FINX), Online Retail (IBUY), Blockchain (BLOK), Clean Energy (PBW), Cyber Security (HACK), Connectivity (FIVG), and Space (UFO) all climbed more than 2%

- 3D Printing (PRNT, +88 bps) was the only was the only other segment to rise less than 1%

Commodities & Yields:

- Broad Commodities (DJP) added just 9 bps as Energy (DBE) rose 96 bps and Industrial Metals (DBB) sank 2.02%

- Natural Gas (UNG) jumped 2.6% and Copper (CPER) fell 1.57%

- The U.S. Dollar (UUP) declined 41 bps, U.S. Aggregate Bonds (AGG) increased 21 bps, and Preferred & Income Securities (PFF) climbed 97 bps

- At the close, the U.S. 2-Year Treasury Yield stood at 4.935% and the U.S. 10-Year Treasury Yield stood at 4.607%

Daily Note

4.23.2024

U.S. equity markets bounced back on Monday from another disappointing week last week as investors awaited key earnings reports and a slew of economic data due out this week. Chipmaker and artificial intelligence favorite Nvidia climbed 4.4% yesterday, after sinking nearly 14% last week, its worst since September 2022. Verizon declined almost 5% on the day after missing revenue expectations and reported continued customer losses. Tesla earnings will be released tomorrow, along with results from UPS, Lockheed Martin, Invesco, Visa, Pepsi, and Spotify, amongst other companies. Meta Platforms, Microsoft, and Alphabet are all set to report earnings later this week. The New Home Sales report will also be released on Tuesday followed by an update on U.S. GDP on Thursday, and the Personal Consumption Expenditures (PCE) report on Friday.

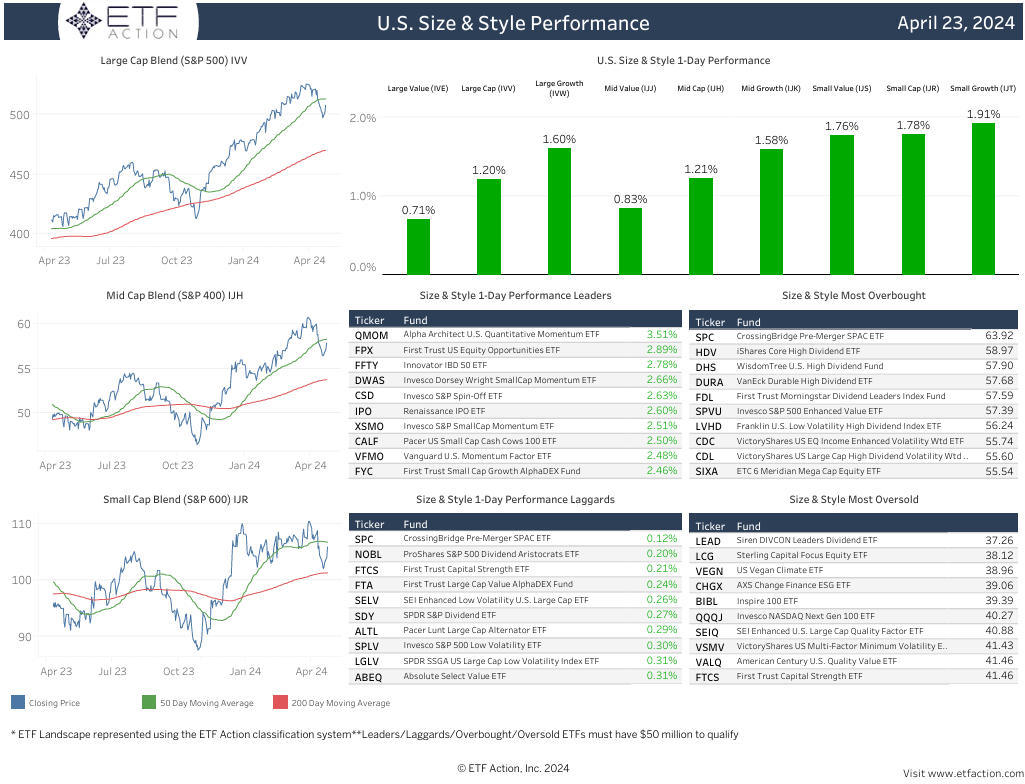

Equities:

- The NASDAQ 100 (QQQ) rose 1.01% and exited oversold territory, the S&P 500 (SPY) gained 92 bps, and the Dow Jones Industrial Average (DIA) added 68 bps

- Mid-Caps (IJH) also jumped 1.03% while Small-Caps (IJR) increased 86 bps

- All U.S. factor strategies saw gains yesterday, Momentum (SPMO), High Beta (SPHB), Pure Value (RPV), Enhanced Value (SPVU), and Quality (SPHQ) all increased more than 1%

- Developed ex-U.S. Markets (EFA) and Emerging Markets (EEM) advanced 1.17% and 1.08%, respectively

- EFA was lifted by South Korea (EWY, +2.22%) and Hong Kong (EWH, +1.97%)

- EEM benefitted from solid returns from Vietnam (VNM, +2.62%) and China (MCHI, +1.98%)

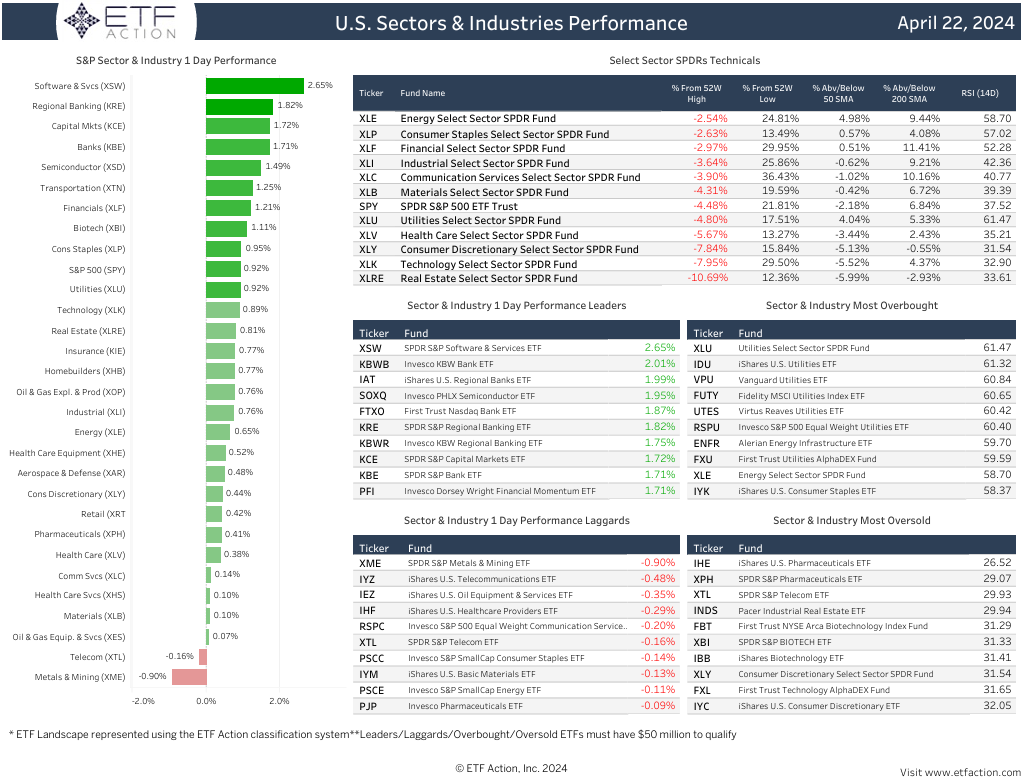

Sectors:

- All U.S. sectors finished higher on Monday, led by Financials (XLF, +1.21%)

- XLF was bolstered by Regional Banks (KRE, +1.82%) and Banks (KBE, +1.71%)

- Consumer Staples (XLP), Utilities (XLU), and Technology (XLK) were all up around 90 bps, Real Estate (XLRE) and Industrials (XLI) gained around 80 bps

- Materials (XLB) lagged, adding just 10 bps. XLB was impacted by Metals & Mining (XME), which slipped 90 bps

- XLRE, XLK, and Consumer Discretionary (XLY) exited oversold territory

Themes:

- Just 3 global thematic segments were in the red yesterday: Cannabis (MJ, -1.34%), Advanced Materials (REMX, -90 bps), and Space (UFO, -33 bps)

- Blockchain (BLOK) was the best performing segment, jumping 3.84%

- FinTech (FINX) was up 2%, eSports & Video Games (ESPO), Disruptive Tech (ARKW), Mobile Payments (IPAY), and Multi-Theme (ARKK) were all up more than 1.40%

- Evolving Consumer (SOCL, +1.33%), Genomics (ARKG, +1.29%), and Cloud Computing (SKYY, +1.24%) were also strong

- The Valkyrie Bitcoin Miners ETF (WGMI) and the VanEck Digital Transformation ETF (DAPP) each surged more than 10% on the day

Commodities & Yields:

- Broad Commodities (DJP) dipped 12 bps, pulled lower by Precious Metals (DBP, -2.98%) and Agriculture (DBA, -1.21%)

- Silver (SLV) sank 4.85% and Gold (GLD) slipped 2.47% while Wheat (WEAT) and Natural Gas (UNG) both gained more than 3.5%

- U.S. Aggregate Bonds (AGG) added 6 bps, Preferred Income & Securities (PFF) rose 49 bps, and the U.S. Dollar (UUP) inched higher by 3 bps

- At the close, the U.S. 2-Year Treasury Yield stood at 4.971% and the U.S. 10-Year Treasury Yield stood at 4.613%

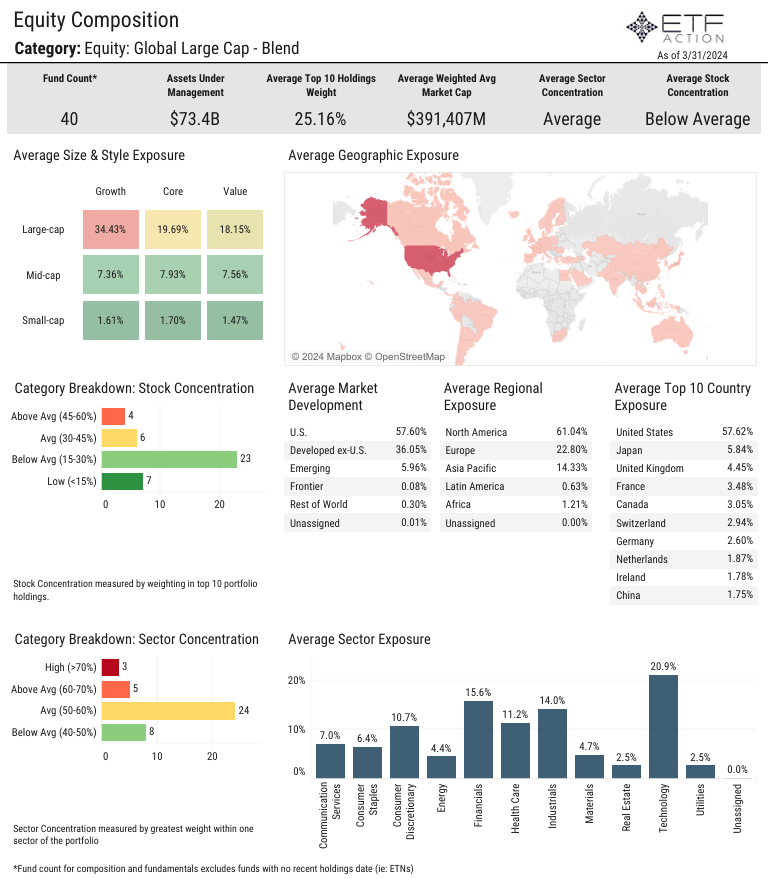

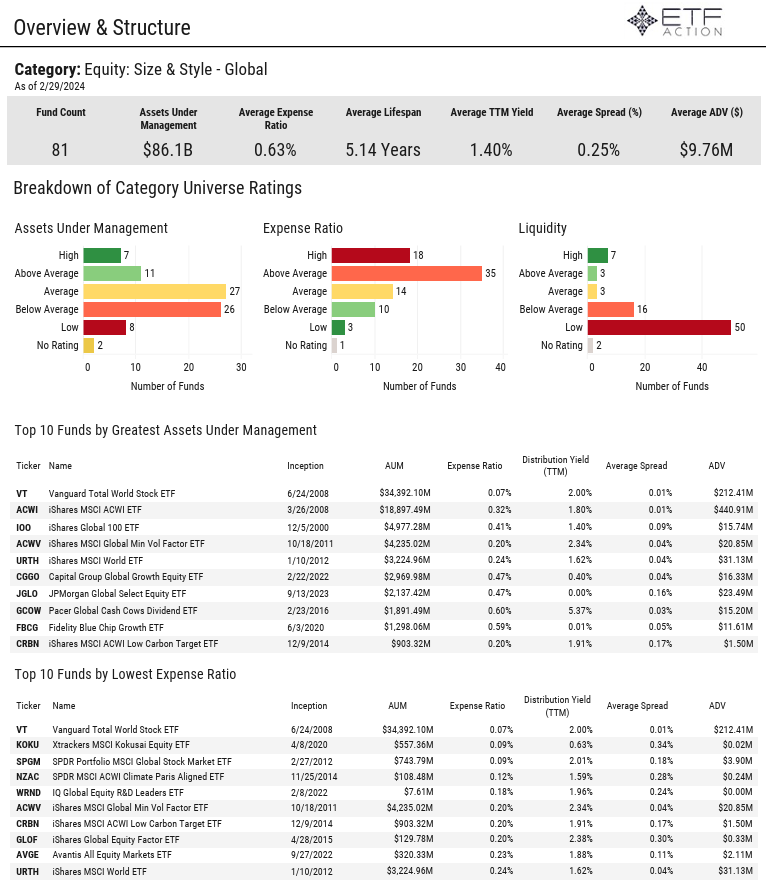

Global Large Cap Blend Category Report

4.23.2024

- The Equity: Global Large Cap - Blend category is made up of 40 ETf with $73.4 billion in total assets under management

- The Vanguar Total World Stock ETF (VT) and the iShares MSCI ACWI ETF (ACWI) are the largest ETFs in the category with $35.9 AUM and $19.6 billion AUM, respectively

- Notably, VT's expense ratio is 7 bps versus 32 bps for ACWI

- The average expense ratio of the category is 50 bps, the average lifespan is 5.88 years, and the average TTM yield is 1.24%

- 25 ETFs in the category have average daily volume below $500K, ACWI's ADV stands at $392.79 million, the highest in the category

- The category saw $610 million in net inflows in March and has gathered $2.63 billion in net inflows year-to-date

- VT saw the largest net inflows in the past 3 months with $1.5 billion

- All ETFs in the category posted gains in March, average 1-month return was +3.18% and average YTD return was +7.62%

- The Innovator Gradient Tactical Rotation Strategy ETF (IGTR) was the best performer last month, rising 6.23%, IGTR is up nearly 16% YTD

- The category is heavily tilted towards large cap growth names (34.43%) but has below average stock concentration

- The highest average sector exposure is Technology (20.9%) followed by Financials (15.6%)

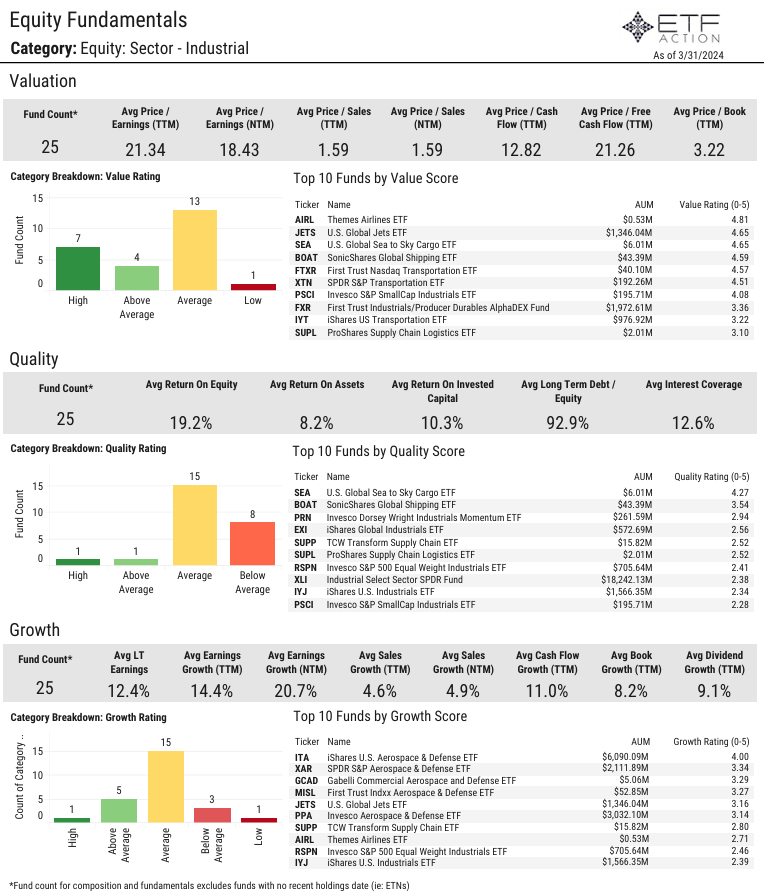

Industrials Category Report

4.22.2024

- The Equity: Sector - Industrial category is comprised of 25 ETFs with $43.8 billion in total assets under management

- 9 of the ETFs in the category have more than $1 billion in AUM, the Industrial Select Sector SPDR Fund (XLI) is the largest ETF at $18.2 billion

- 7 ETFs in the category have average daily volume higher than $10 million while 9 ETFs have ADV below $500K

- The average expense ratio is 45 bps, the average lifespan is 11.28 years, and the average TTM yield is 1.62%

- Industrials ETFs gathered $870 million in net inflows in March, XLI gathered $714.1 million in net inflows while the U.S. Global Jets ETF (JETS) saw $105.5 million in net outflows on the month

- Just 3 ETFs in the category posted losses last month, average 1-month reutrn was +3.13% and average 1-year return was +23.89%

- The SonicShares Global Shipping ETF (BOAT) lagged in March, sinking 2.49%

- The Invesco Aerospace & Defense ETF (PPA) has the highest sharpe ratio (3-year) relative to the iShares MSCI ACWI ETF (ACWI)

- The category is relatively diverse from a size and style perspective, average exposure to Europe at 9.05%

- The average price to earnings TTM is 21.34%, average return on equity is 19.2%, and the average dividend growth (TTM) is 9.1%

Daily Note

4.21.2024

The losing streak continued for the NASDAQ 100 (QQQ) and the S&P 500 (SPY) on Friday as Nvidia plunged 10% and Netflix declined more than 9%. QQQ and SPY both finished lower last week. The Dow Jones Industrial Average (DIA) saw positive returns on Friday and for last week. DIA was lifted by American Express, which jumped more than 5% following stronger-than-expected earnings results. Super Micro Computer, another semiconductor name, plummeted more than 20% on Friday, a sign that investors were rotating heavily out of the sector that led the recent bull market. Chicago Federal Reserve President Austan Goolsbee said Friday that inflation progress has “stalled,” meaning policymakers likely will have to be patient before cutting interest rates. According to the CME FedWatch Tool, there is a 3.2% probability of a rate cut at the May FOMC meeting and a 16.6% probability of a rate cut at the July meeting. This week, investors will be looking towards New Home Sales data, Durable Goods Orders figures, an update on U.S. GDP, Pending Home Sales data, and the Personal Consumption Expenditures (PCE) report.

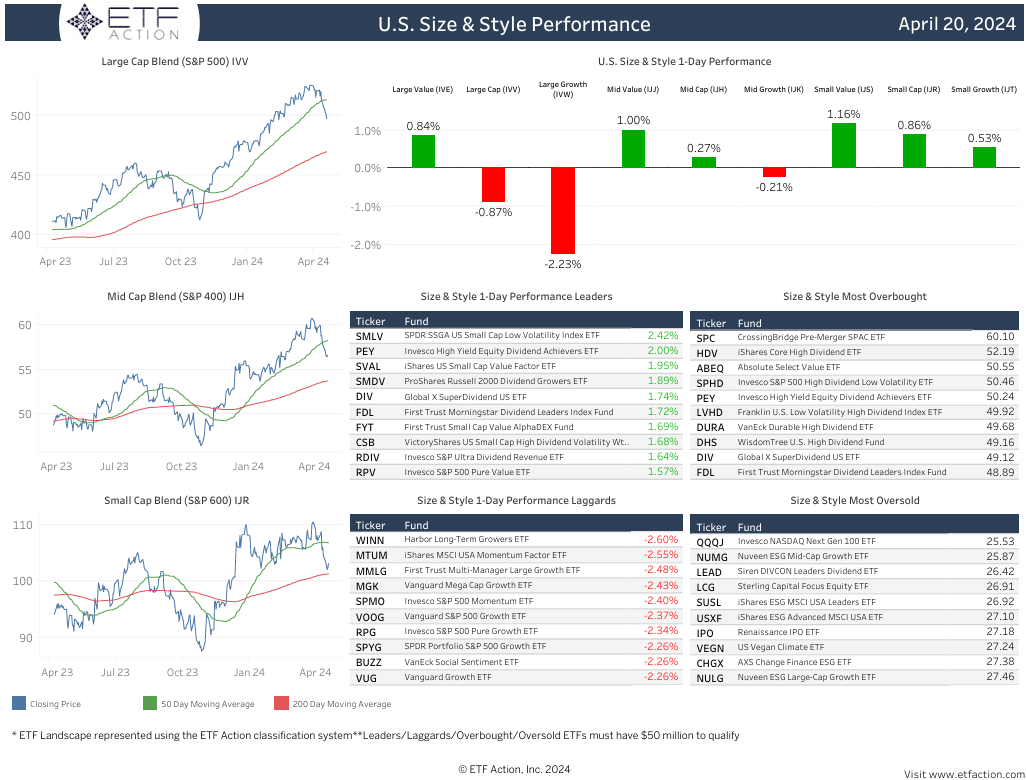

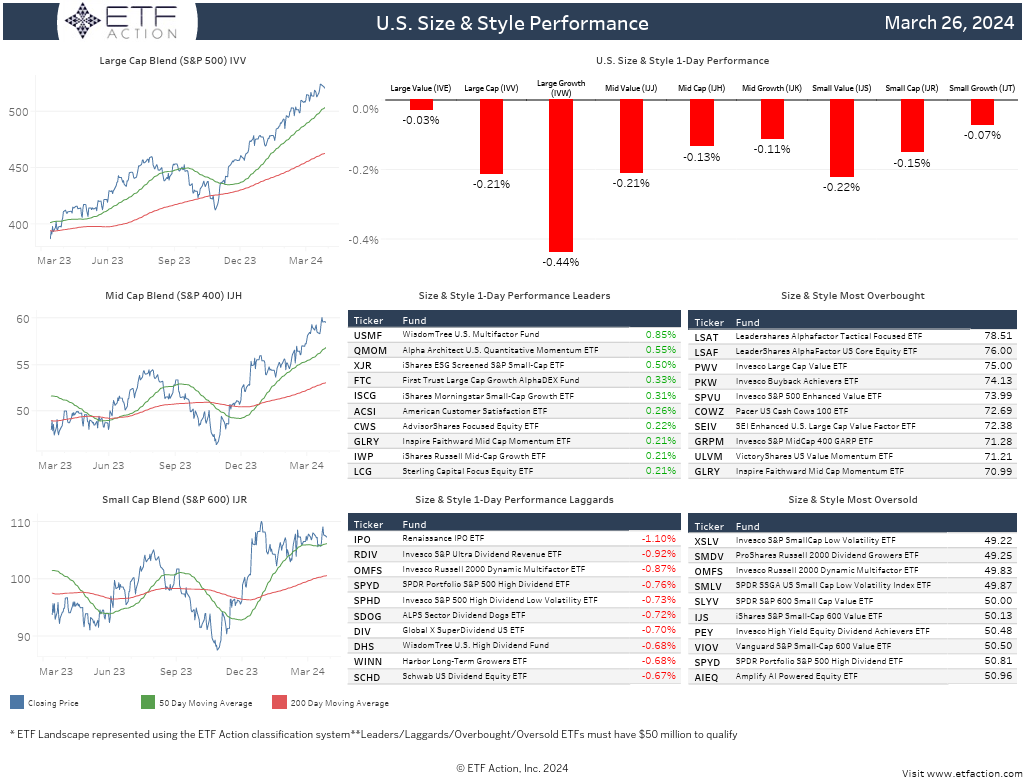

Equities:

- On Friday, QQQ fell 2.07%, SPY sank 87 bps, and DIA added 57 bps

- QQQ and SPY were down 5.39% and 3.07%, respectively, last week while DIA inched higher by 3 bps

- QQQ entered oversold territory, all three major averages trading below relative 50-day moving averages but above relative 200-day moving averages

- Pure Value (RPV), Dividend (SPYD), and Low Volatility (SPLV) were all up more than 1% on Friday, Momentum (SPMO), Pure Growth (RPG), and Growth (SPYG) all slipped more than 2%

- Most factors were in the red last week, SPMO, RPG, and SPYG all declined more than 5%

- RPG is the only factor strategy sitting in oversold territory

- Developed ex-U.S. Markets (EFA) added 4 bps on Friday with Switzerland (EWL) climbing 1.15%

- Emerging Markets (EEM, 40 bps) were pulled lower by Taiwan (EWT, -2.10%) and Thailand (THD, -1.63%)

- EFA dipped 2.02% and EEM dropped 1.45% for the week

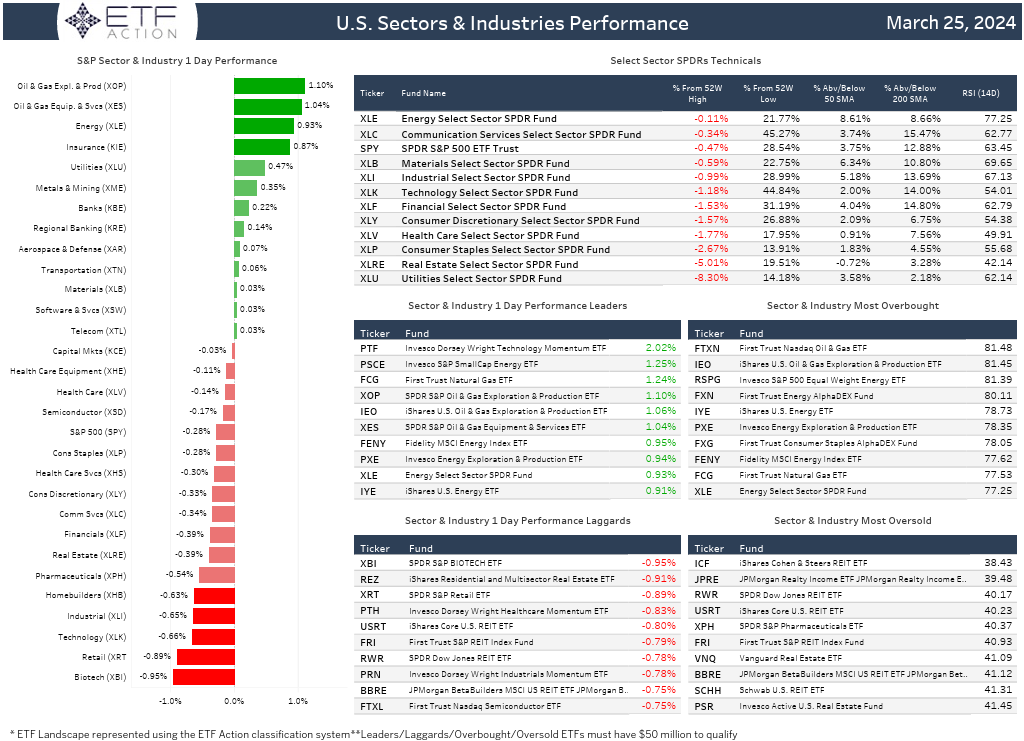

Sectors:

- Technology (XLK, -2.06%) underperformed once again on Friday, dragged lower by Semiconductors (XSD, -3.13%)

- Communication Services (XLC) fell 1.10% and Consumer Discretionary (XLY) slipped 88 bps

- Utilities (XLU, +1.54%), Financials (XLF, +1.38%), Energy (XLE, +1.20%), and Consumer Staples (XLP, +98 bps) were the top performers on the day

- XLF was boosted by Regional Banks (KRE, +2.62%) and Banks (KBE, +2.33%)

- Most sectors saw losses last week, XLK was down 6.27% and XLY dropped 4.15%

- XLU and XLP each gained more than 1% for the week

- XLK, XLY, and Real Estate (XLRE) all sit in oversold territory

Themes:

- Most global thematic segments posted negative returns on Friday

- Big Data (AIQ), Connectivity (FIVG), Disruptive Tech (ARKW), and Multi-Theme (ARKK) all sank more than 2%

- 3D Printing (PRNT) rose 92 bps and Digital Infrastructure (SRVR) added 81 bps

- All segments declined more than 1% last week with most dropping more than 3%

- Genomics (ARKG) and ARKK both plunged nearly 10% while Clean Energy (PBW) fell 8.74%

- 13 of the 28 segments sit in oversold territory, PBW and Solar (TAN) trading at 52-week lows

Commodities & Yields:

- Broad Commodities (DJP) climbed 1.05% on Friday, lifted by Copper (CPER, +1.15%) and Agriculture (DBA, +2.24%)

- Industrial Metals (DBB) have jumped 13.55% in the past month and DBA has risen 12.57%

- The U.S. Dollar (UUP) was flat on Friday, U.S. Aggregate Bonds (AGG) added 10 bps, and Preferred & Income Securities (PFF) gained 59 bps

- At Friday’s close, the U.S. 2-Year Treasury Yield stood at 4.990% and the U.S. 10-Year Treasury Yield stood at 4.647%

Daily Note

4.19.2024

Mixed session for U.S. equity markets on Thursday as treasury yields moved higher once again. The U.S. 2-Year jumped up back near 5% and the U.S. 10-Year rose close to 4.65% intraday yesterday. On the economic front, the Philadelphia Federal Reserve’s manufacturing index rose to 15.5 for the month, up more than 12 points from March and better than 2.5 estimate. Initial filings for unemployment claims held steady at 212K for the week ended April 13, indicating that companies remain reluctant to lay off workers. Existing home sales fell 4.3% on the month to a seasonally adjusted rate of 4.19 million, compared to the estimates for a decline of 4.8% and a total level of 4.17 million. The median existing home price jumped to $393,500 and inventory increased 1.11 million to the equivalent of 3.2 months of supply. Netflix topped quarterly earnings and revenue estimates and announced it will no longer report quarterly membership numbers or average revenue per user starting next year. Total memberships rose 16% in the first quarter, reaching 269.6 million, well above expectations.

Equities:

- The NASDAQ 100 (QQQ) and the S&P 500 (SPY) fell 57 bps and 21 bps, respectively, while the Dow Jones Industrial Average (DIA) added 10 bps

- 5th consecutive losing session for SPY

- All 3 major averages on pace for another losing week this week

- Growth-oriented pockets of the markets lagged yet again, S&P 500 Pure Growth (RPG, -67 bps), S&P 500 Momentum (SPMO, -60 bps), and S&P 500 Growth (SPYG, -51 bps)

- S&P 500 Pure Value (RPV) and S&P 500 Dividend (SPYD) both advanced 42 bps

- Emerging Markets (EEM) rose 40 bps on strength from China (MCHI, +1.28%)

- Developed ex-U.S. Markets (EFA, -27 bps) dragged lower by Australia (EWA, -85 bps) and the Netherlands (EWN, -63 bps)

Sectors:

- Technology (XLK, -1.14%) was the worst performing U.S. sector for the 2nd consecutive session, impacted by Semiconductors (XSD, -1.99%)

- Consumer Discretionary (XLY) declined 62 bps, Industrials (XLI) and Energy (XLE) each dropped more than 30 bps

- Utilities (XLU), Communication Services (XLC), and Consumer Staples (XLP) all climbed around 50 bps, Financials (XLF) also added 35 bps

- Real Estate (XLRE) and Health Care (XLV) remain in oversold territory

Themes:

- Another mixed session for global thematic themes yesterday, Evolving Consumer (SOCL, +2.07%) and Cannabis (MJ, +1.06%) were top performers

- Clean Energy (PBW) sank 2.05% to fresh 52-week lows

- Advanced Materials (REMX), Biotech (SBIO), and Solar (TAN) all dropped at least 1%

- TAN also hit new 52-week lows and is nearing oversold territory

Commodities & Yields:

- U.S. Aggregate Bonds (AGG, -28 bps), 20+ Year Treasury Bonds (TLT, -50 bps), U.S. Dollar (UUP, +21 bps)

- At the close, the U.S. 2-Year Treasury Yield stood at 4.988% and the U.S. 10-Year Treasury Yield stood at 4.637%.

- Broad Commodities (DJP) dipped 4 bps despite solid returns from Agriculture (DBA, +2.05%) and Industrial Metals (DBB, +1.36%)

Daily Note

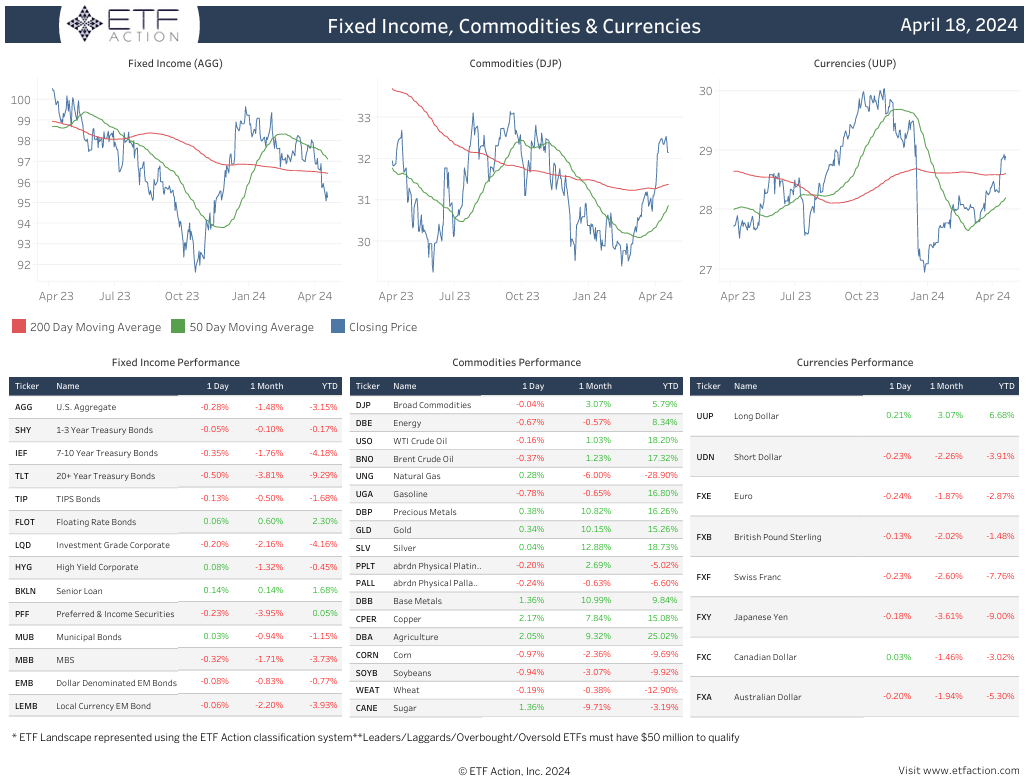

4.18.2024

Equities: U.S. equity markets finished lower yesterday with the NASDAQ 100 (QQQ) declining 1.22%, the S&P 500 (SPY) falling 59 bps, and the Dow Jones Industrial Average (DIA) dipping 14 bps. All three major average are approaching oversold territory and are now trading more than 2% below relative 50-day moving averages. Mid-Caps (IJH) and Small-Caps (IJR) also dropped more than 80 bps. According to the latest Beige Book report filed Wednesday, the U.S. economy grew “slightly” over the past six weeks while price increases moved at a “modest” pace and employment showed “slight” gains as well. The Federal Reserve also noted that consumer spending “barely increased”, that home sales “strengthened” across most areas, and characterized the economic outlook as “cautiously optimistic.” Earnings wise, United Airlines surged more than 17% on the day after posting a narrower-than-expected loss and beating on revenue while J.B. Hunt Transport Services dropped more than 8% after missing analysts’ expectations on the top and bottom lines. Existing Home Sales figures and Jobless Claims data will be released on Thursday along with a slew of speeches from Federal Reserve officials.

U.S. factor strategies were mixed on Wednesday. S&P 500 High Dividend Low Volatility (SPHD) was up 62 bps while S&P 500 Dividend (SPYD) and S&P 500 Pure Value (RPV) rose around 50 bps. Growth-oriented pockets of the markets lagged once again with S&P 500 Pure Growth (RPG) sinking 1.37% and S&P 500 Momentum (SPMO) declining 1.22%. S&P 500 Growth (SPYG) also dipped 97 bps and S&P 500 Quality (SPHQ) slipped 95 bps. Developed ex-U.S. Markets (EFA) added 7 bps, buoyed by Australia (EWA, +1.12%). The Netherlands (EWN) and Japan (EWJ) both sank more than 1%. Emerging Markets (EEM, -8 bps) were pulled lower by Thailand (THD, -1.42%).

Sectors: Just 4 of the 11 U.S. sectors registered positive returns yesterday with Utilities (XLU) popping 2.09%. Consumer Staples (XLP) rose 37 bps while Financials (XLF) and Materials (XLB) both increased just over 20 bps. Technology (XLK) underperformed, falling 1.44% on weakness from Semiconductors (XSD, -2.18%). Real Estate (XLRE) also declined 83 bps, Consumer Discretionary (XLY) dropped 48 bps, and Energy (XLE) sank 29 bps. Health Care (XLV, -17 bps) and Communication Services (XLC, 9 bps) saw modest losses on the day. XLU and XLE are the only sectors trading above relative 50-day and 200-day moving averages.

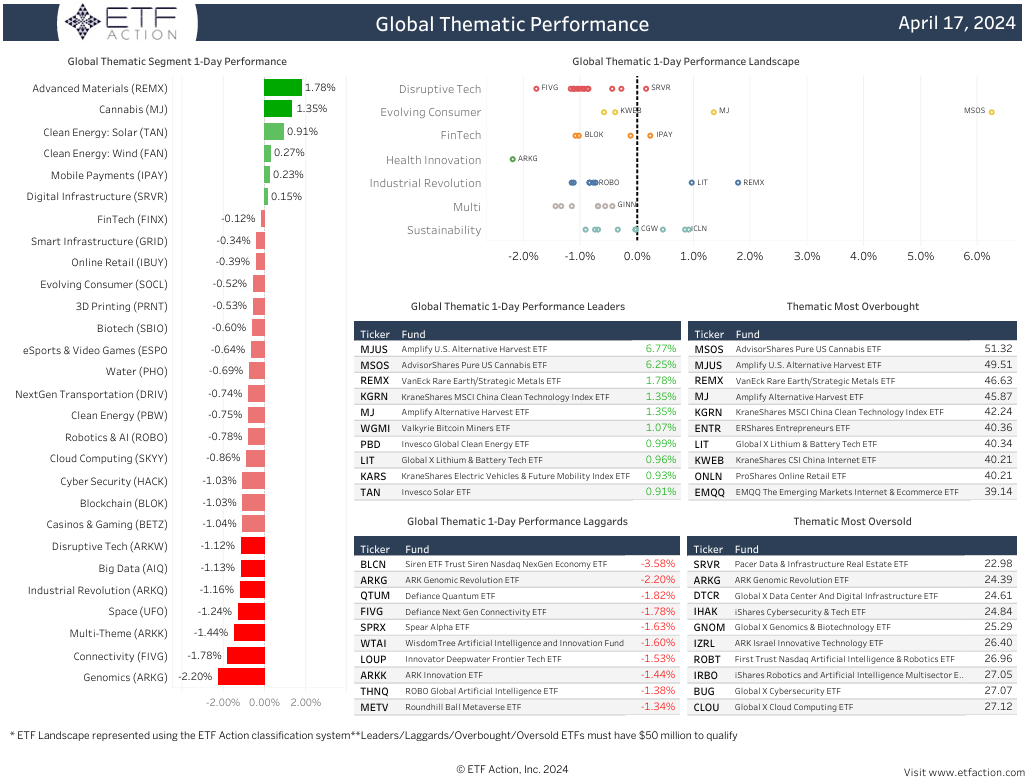

Themes: Most global thematic segments were in negative territory on Wednesday with Genomics (ARKG, -2.20%) falling the furthest. Connectivity (FIVG), Multi-Theme (ARKK), Space (UFO), Industrial Revolution (ARKQ), Big Data (AIQ), Disruptive Tech (ARKW), Casinos & Gaming (BETZ), Blockchain (BLOK), and Cyber Security (HACK) were all down more than 1%. Advanced Materials (REMX) and Cannabis (MJ) were the best performing segments, climbing 1.78% and 1.35%, respectively. Solar (TAN, +91 bps) also rose off 52-week highs. The Amplify U.S. Alternative Harvest ETF (MJUS) and the AdvisorShares Pure US Cannabis ETF (MSOS) both jumped more than 6% on the day.

Commodities & Yields: At yesterday’s close, the U.S. 2-Year Treasury Yield stood at 4.932% and the U.S. 10-Year Treasury Yield stood at 4.859%. The U.S. Dollar (UUP) slipped 31 bps, U.S. Aggregate Bonds (AGG) increased 46 bps, and 20+ Year Treasury Bonds gained 1.11%. Broad Commodities (DJP, -77 bps) were pulled lower by Energy (DBE), which sank 2.65%. WTI Crude Oil (USO) and Gasoline (UGA) were both down around 3%. Agriculture (DBA) and Industrial Metals (DBB) were both up around 1.30%.

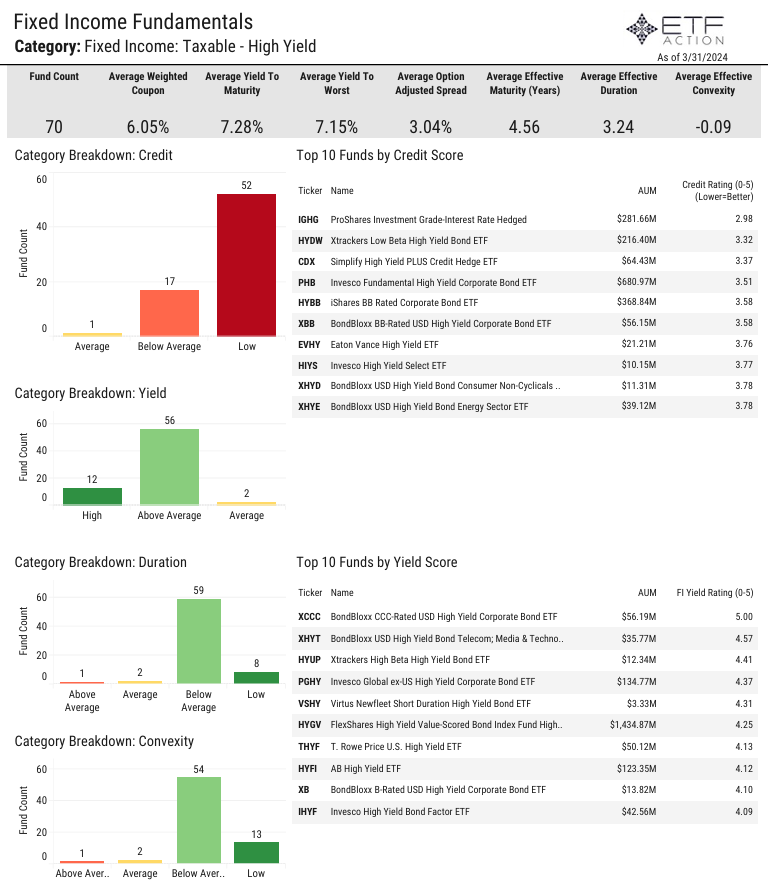

Fixed Income - Taxable High Yield Category Report

4.18.2024

- There are 70 ETFs categorized as Fixed Income: Taxable - High Yield, total assets under management for the category is $72.4 billion

- The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) is the largest ETF in the category with $16.9 billion in AUM and has the highest average daily volume at $2.8 billion

- 35 ETFs in the cateogry have ADV below $500K, average ADV for the category is $55.87 million

- The average expense ratio is 40 bps, the average lifespan is 5.87 years, and the average TTM yield is 5.45%

- The category has seen $1.15 billion in net inflows year-to-date, HYG has seen $2.1 billion in net outflows thus far in 2024

- All ETFs in the category were positive in March, average 1-month return was +1.15% and average 1-year return was +10.63%

- The BondBloxx CCC-Rated USD High Yield Corporate Bond ETF (XCCC) has the highest yield rating in the cateogry

- Average weighted coupon is 6.05%, average yield to maturity is 7.28%, and average effective maturity is 4.56 years

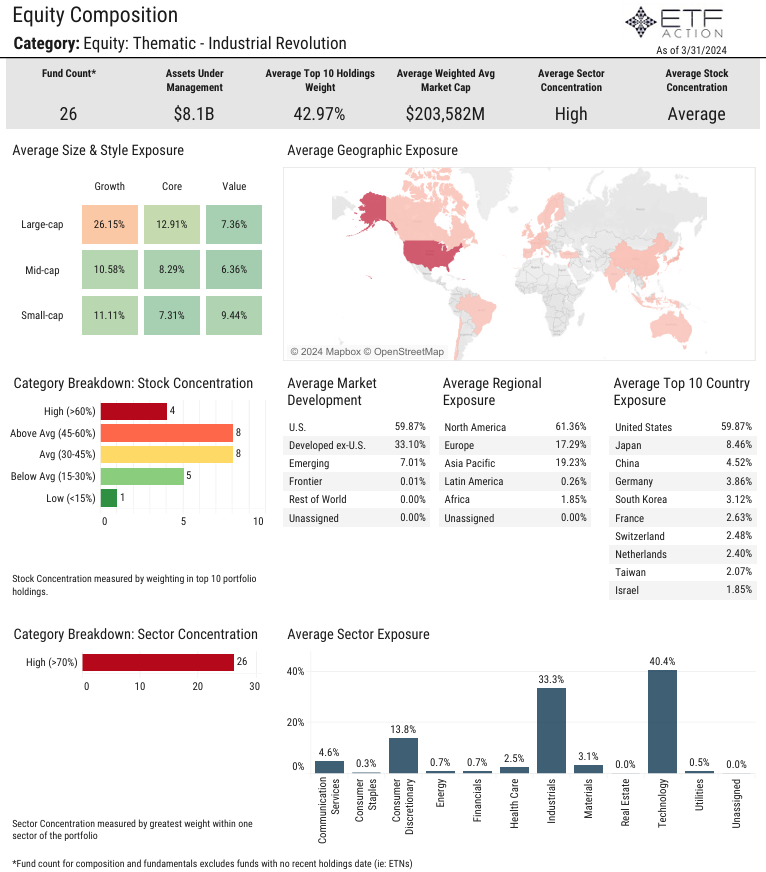

Industrial Revolution Category Report

4.17.2024

- The Equity: Thematic - Industrial Revolution category is made up of 26 ETFs with $8.1 billion in total assets under management

- Just 2 ETFs in the category have over $1 billion in AUM: the Global X Robotics & Artificial Intelligence ETF (BOTZ) with $2.9 billion and the ROBO Global Robotics & Automation Index ETF (BOTZ) with $1.4 billion

- The average expense ratio of the category is 59 bps, the average lifespan is 5.23 years, and the average TTM yield is 0.76%

- 14 Industrial Revolution ETFs have average daily volume below $500K, average ADV for the cateogry is $2.61 million

- BOTZ has the largest ADV at $37.5 million

- The category has seen modest net outflows thus far in 2024 but has gathered $620 million in net inflows over the past year

- BOTZ has gathered $645 million in net inflows in the last year while the Global X Autonomous & Electric Vehicles ETF (DRIV) has seen $291.9 million in net outflows

- 21 of the 26 ETFs in the category registered positive returns in March, average 1-month return was +1.72% and average 1-year return was +9.38%

- The Global X Defense Tech ETF (SHLD) jumped more than 6% last month

- The category is heavily tilted to Large Cap Growth names but is relatively diverse from a regional exporsure perspective

- Industrial Revolution ETFs have high average sector exposre to Technology (40.4%) and Industrials (33.3%)

Daily Note

4.17.2024

Equities: Mixed session for U.S. equity markets on Tuesday as investors digested fresh commentary from Federal Reserve Chairman Jerome Powell. The Dow Jones Industrial Average (DIA) advanced 18 bps and the NASDAQ 100 (QQQ) added 1 bps while the S&P 500 (SPY) declined 18 bps. Powell stated yesterday that the U.S. economy, while otherwise strong, has not seen inflation come back to the central bank’s goal, pointing to the further likelihood that interest rates will not be cut any time soon. Since July 2023, the Fed has kept its benchmark interest rate in a target range between 5.25%-5.5%, the highest in 23 years. That was the result of 11 consecutive rate hikes that began in March 2022. The U.S. 2-Year spiked above 5.0% and the U.S. 10-Year jumped near 4.70% intraday following the remarks. In other economic news, industrial production rose 0.4% in March but fell 1.8% in Q1 while housing starts and building permits both missed expectations. On the earnings front, Morgan Stanley posted stronger-than-expected earnings and revenue results while Bank of America reported that profit fell 18% from the previous year and revenue slipped 1.6%. Johnson & Johnson reported mixed results and UnitedHealth handily topped revenue expectations for the quarter. Investors will be looking towards the release of the Beige Book on Wednesday in addition to a handful of speeches from Fed officials.

Just 3 U.S. factor strategies were in the green yesterday: S&P 500 Pure Growth (RPG, +17 bps), S&P 500 Growth (SPYG, +3 bps), and S&P 500 Quality (SPHQ, +2 bps). S&P 500 Dividend (SPYD) and S&P 500 Enhanced Value (SPVU) both around 1.20% while S&P 500 Pure Value (RPV) decreased 92 bps. Emerging Markets (EEM, -1.32%) were dragged lower by Indonesia (EIDO, -2.93%), Mexico (EWW, -2.51%), Brazil (EWZ, -2.37%), and Taiwan (EWT, -2.27%). Developed ex-U.S. Markets (EFA) tumbled 99 bps on weakness from Australia (EWA, -2.06%), Hong Kong (EWH, -1.87%), and South Korea (EWY, -1.56%). EFA and EEM are approaching oversold territory.

Sectors: Real Estate (XLRE) underperformed other U.S. sectors once again on Tuesday, slipping 1.53%. XLRE entered oversold territory and has fallen 7% in the past month. Utilities (XLU) declined 1.32%, Energy (XLE) dropped 87 bps, and Materials (XLB) slid 77 bps. Financials (XLF, -68 bps) and Consumer Discretionary (XLY, -57 bps) were also weak. XLF was impacted by Banks (KBE) and Regional Banks (KRE), which both decreased more than 1.25%. Technology (XLK) gained 12 bps. Consumer Staples (XLP) and Health Care (XLV) were the only other sectors in positive territory on the day, each adding 4 bps.

Themes: Global themes continued to lag broader markets yesterday with just 3 segments posting modest gains: eSports & Video Games (ESPO, +13 bps), Cloud Computing (SKYY, +12 bps), and Connectivity (FIVG, +12 bps). Genomics (ARKG) and Advanced Materials (REMX) were the worst performing segments, slipping 3.17% and 2.94%, respectively. Solar (TAN, -2.12%) and Clean Energy (PBW, -1.81%) each hit fresh 52-week lows while Digital Infrastructure (SRVR, -1.78%) continued to fall further into oversold territory and Multi-Theme (ARKK) declined 1.64%. Cannabis (MJ) is the only segment trading above its 50-day moving average.

Commodities & Yields: Broad Commodities (DJP) fell 40 bps on Tuesday as Agriculture (DBA) tumbled 2.30% and Industrial Metals (DBB) dropped 91 bps. Soybean (SOYB), Sugar (CANE), and Copper (CPER) were all down more than 1% and Silver (SLV) decreased 2.31%. U.S. Aggregate Bonds (AGG) sank 28 bps, 20+ Year Treasury Bonds (TLT) retreated 66 bps, and the U.S. Dollar (UUP) added 14 bps. At yesterday’s closing bell, the U.S. 2-Year Treasury Yield stood at4.964% and the U.S. 10-Year Treasury Yield stood at 4.657%.

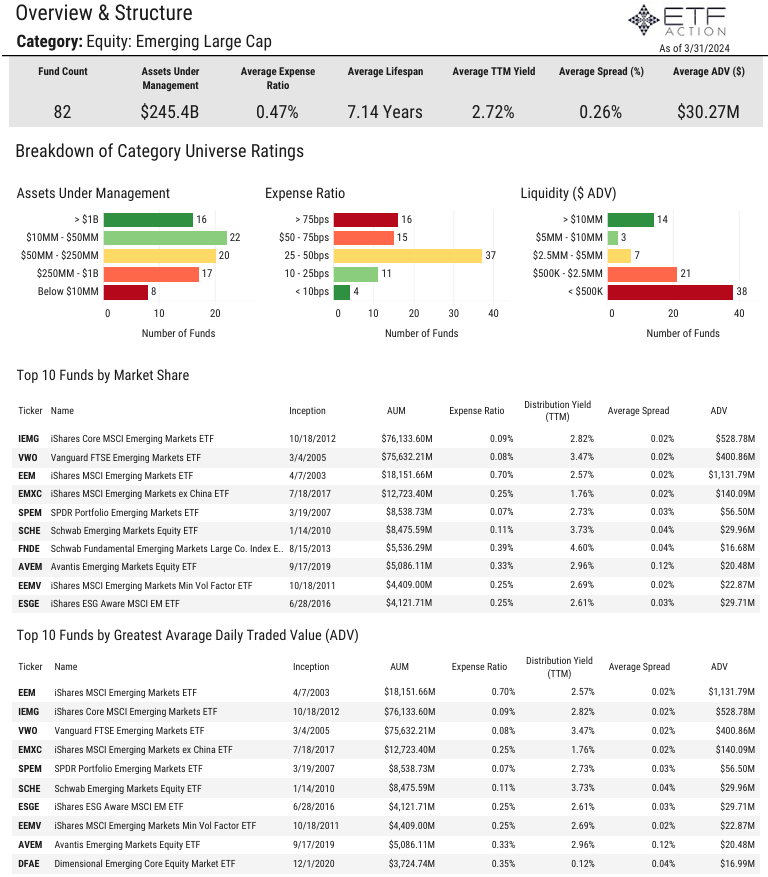

Emerging Markets Large Cap Category Report

4.16.2024

- The Equity: Emerging Large Cap category is made up ofo 82 ETFs with $245.5 billion in total assets under management

- 16 of the ETFs in the category have more than $1 billion in AUM, the largest is the iShares Core MSCI Emerging Markets ETF (IEMG) with $76.1 billion in AUM

- The average expense ratio is 47 bps but 16 ETFs have expense ratios above 75 bps

- The average lifespan is 7.14 years, the average TTM yield is 2.72%, and the average spread is 0.26%

- The average ADV is $30.27 million but 38 ETFs in the category have ADV below $500K

- Large Cap Emerging Market ETFs continue to see solid net inflows gathering $1.77 billion in March and $11.16 billion in the past year

- The iShares MSCI Emerging Markets ex China ETF (EMXC) saw the largest net inflows in March with $1.61 billion and has gathered more than $8.1 billion in the past year

- Just 4 ETFs in the category posted losses last month, average 1-month return was +2.12% and average 1-year return was +11.61%

- The SPDR S&P Emerging Markets Dividend ETF (EDIV) is the only ETF in the category with positve alpha (3-year) relative to the iShares MSCI ACWI ex U.S. ETF (ACWX)

- The largest average country exposures for the category are Taiwan (1841%), China (17.60%), and India (16.96%)

- The category has high average sector exposures to Financials (21.7%) and Technology (21.4%)

Daily Note

4.16.2024

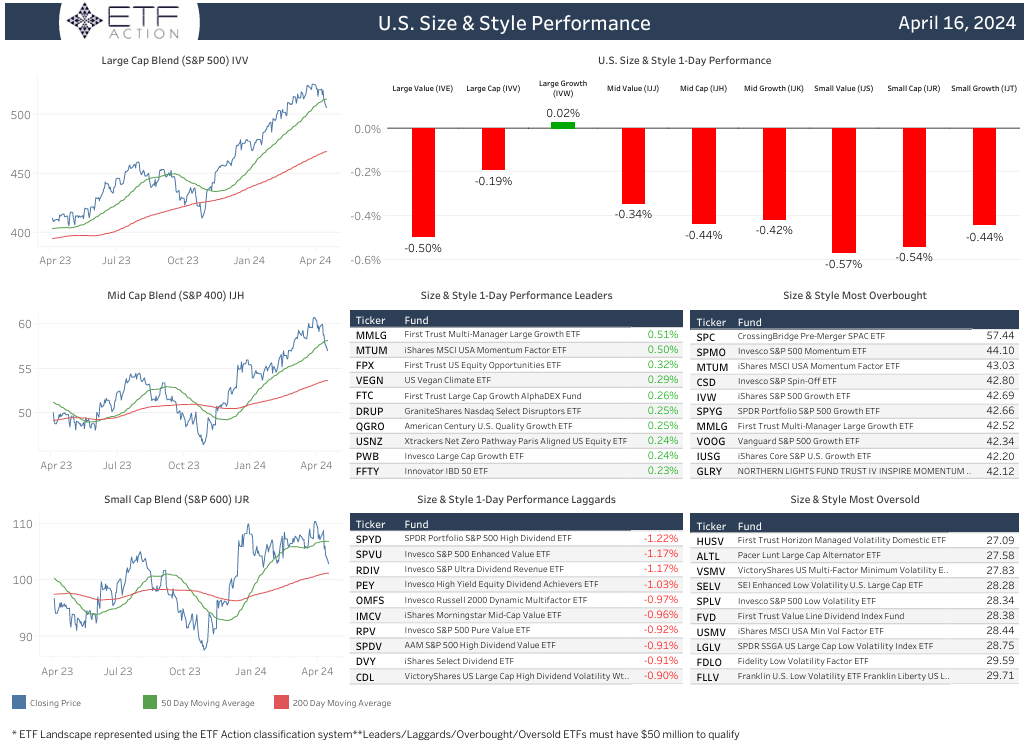

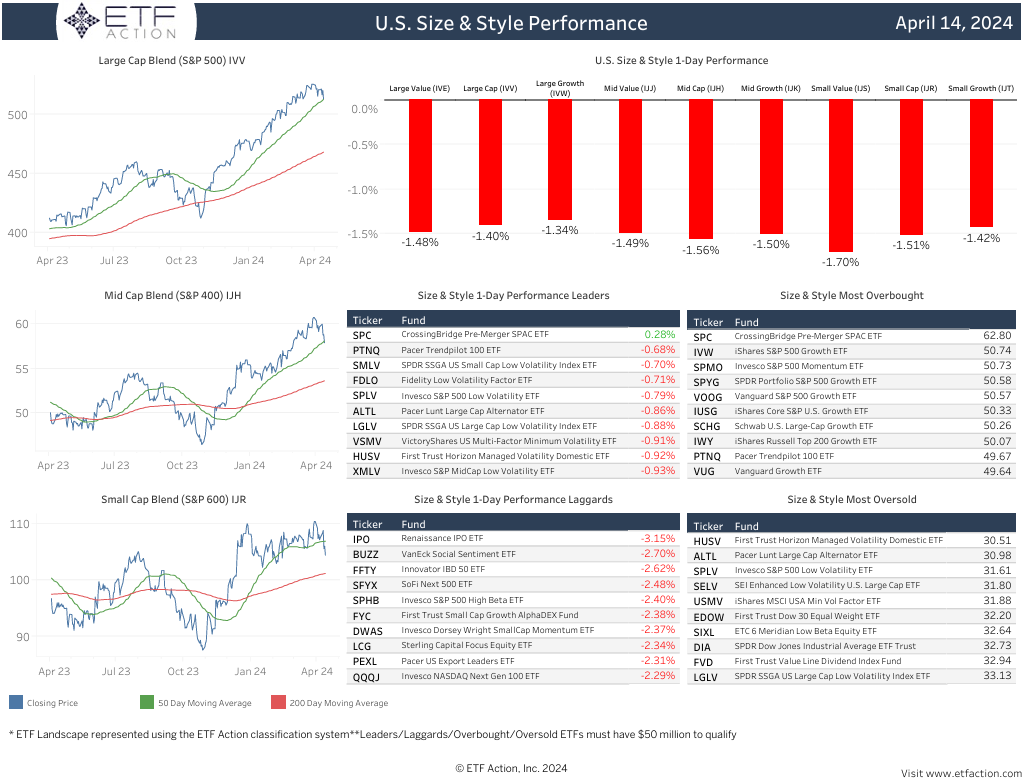

Equities: After another losing week last week, U.S. equity markets continued to push lower on Monday with the NASDAQ 100 (QQQ) slipping 1.65%, the S&P 500 (SPY) falling 1.25%, and the Dow Jones Industrial Average (DIA) retreating 65 bps. Small-Caps (IJR) and Mid-Caps (IJH) were also down around 1%. Markets faced pressure from stubborn treasury yields that continue to rise. The U.S. 2-Year advanced above 4.95% while the U.S. 10-Year jumped above 4.65% intraday yesterday. The Commerce Department reported on Monday that retail sales increased 0.7% month-over-month in March, well above the +0.3% estimate but below the upwardly revised +0.9% February figure. Year-over-year, sales rose 4.0%. The results indicate that consumers more than kept up with the pace of inflation as the Consumer Price Index (CPI) increased 3.5% for the year. Separately, Salesforce declined more than 7% yesterday following reports that the software company was in talks to acquire data management firm Informatica. Goldman Sachs climbed almost 3% on the day after topping earnings and revenue expectations. Revenue jumped 16% from the previous year to $14.21 billion, topping analysts’ estimates by more than $1 billion. On Tuesday, Housing Starts & Permits data will be released and Fed Chair Jerome Powell is scheduled to speak.

Growth-oriented pockets of the markets underperformed yesterday with S&P 500 Growth (SPYG) sliding 1.79%, S&P 500 Pure Growth (RPG) dropping 1.66%, and S&P 500 Momentum (SPMO) declining 1.51%. All other U.S. factor strategies were also in the red. S&P 500 Enhanced Value (SPVU) dipped just 18 bps. Emerging Markets (EEM) decreased 64 bps as South Africa (EZA) fell 1.59%. Taiwan (EWT) and Brazil (EWZ) were both down 1.47% as well while Mexico (EWW) dipped 1.31%. Developed ex-U.S. Markets (EFA) sank 30 bps, pulled lower by Hong Kong (EWH, -1.39%) and Australia (EWA, -71 bps).

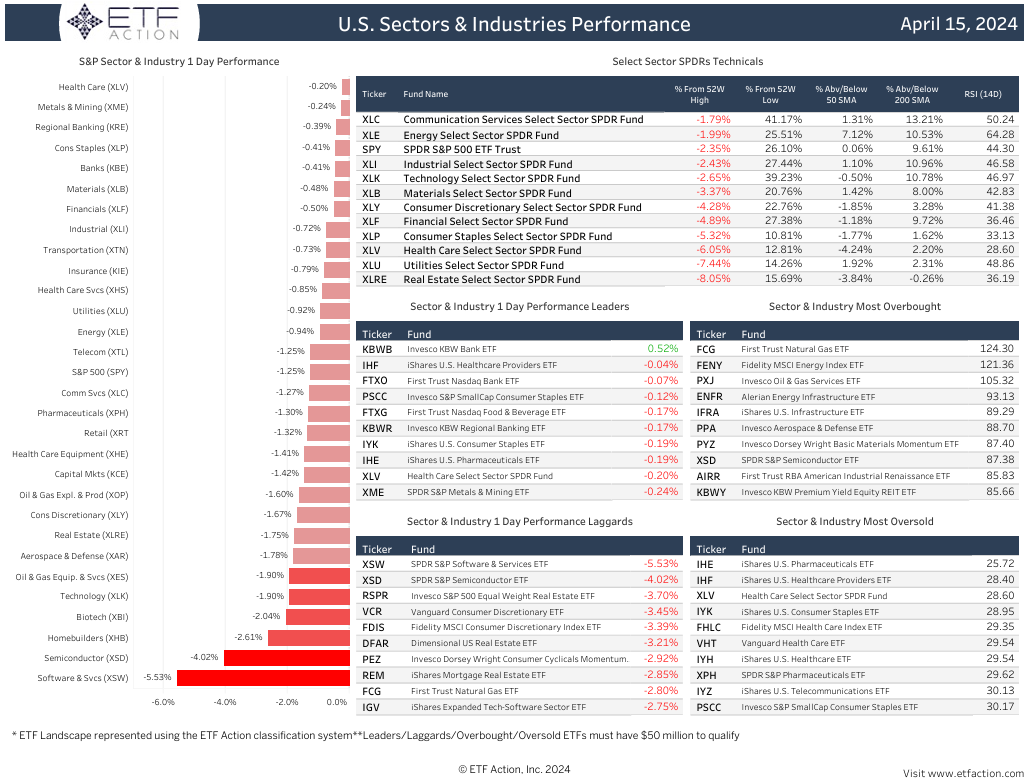

Sectors: Technology (XLK) and Real Estate (XLRE) were the worst performing U.S. sectors on Monday, sinking 1.90% and 1.75%, respectively. XLK was impacted by Software & Services (XSW, -5.53%) and Semiconductors (XSD, -4.02%) while XLRE was dragged lower by Homebuilders (XHB, -2.61%). XLRE is the only sector trading below its 50-day and 200-day moving average and is nearing oversold territory. Consumer Discretionary (XLY) also dropped 1.67% and Communication Services (XLC) slipped 1.27% while Energy (XLE) and Utilities (XLU) both fell more than 90 bps. Health Care (XLV) saw the best returns on the day, dipping 20 bps.

Themes: All global thematic segments finished in negative territory on Monday with most dropping more than 1.50%. Multi-Theme (ARKK, -4.58%) and Disruptive Tech (ARKW, -4.33%) fell the furthest. Blockchain (BLOK) was down 3.93%, Genomics (ARKG) declined 3.86%, and Solar (TAN) dipped 3.31%. TAN hit fresh 52-week lows while ARKG entered oversold territory, joining Digital Infrastructure (SRVR, -1.52%) and Space (UFO, -2.29%). Clean Energy (PBW) also decreased 2.66% to new 52-week lows. Online Retail (IBUY), Cyber Security (HACK), Cloud Computing (SKYY), and Industrial Revolution (ARKQ) were all down more than 2.35%. Water (PHO) dipped 61 bps and was the top performing segment.

Commodities & Yields: The U.S. Dollar (UUP) added 17 bps, U.S. Aggregate Bonds (AGG) declined 60 bps, and Preferred & Income Securities (PFF) dropped 1.71% yesterday. At Monday’s close, the U.S. 2-Year Treasury Yield stood at 4.938% and the U.S. 10-Year Treasury Yield stood at 4.606%. Broad Commodities (DJP) gained 59 bps, bolstered by Industrial Metals (DBB, +1.44%) and Precious Metals (DBP, +2.03%). Silver (SLV) added 3.04%, Gold (GLD) rose 1.87%, and Copper (CPER) jumped 2.40%. Natural Gas (UNG) fell 5.04%.

Daily Note

4.15.2024

Equities: U.S. equity markets tumbled on Friday with the NASDAQ 100 (QQQ) slipping 1.59%, the S&P 500 (SPY) falling 1.38%, and the Dow Jones Industrial Average (DIA) declining 1.21%. All three major averages finished lower last week as DIA dropped 2.31%, SPY decreased 1.46%, and QQQ dipped 50 bps. Small-Caps (IJR) and Mid-Caps (IJH) were also down more than 1.50% on Friday and sank around 2.90% last week. JPMorgan Chase retreated more than 6% on Friday after reporting that net interest income, a key measure of what it makes through lending activities, could be a little short of what Wall Street analysts are expecting in 2024. CEO Jamie Dimon also warned about persistent inflationary pressures weighing on the economy. According to the University of Michigan’s consumer sentiment index, consumers are also growing worried about the persistent inflationary pressures. The index came in at 77.9 for April, which is below the 79.9 consensus estimate. Year-ahead and long-run inflation expectations also ticked up, reflecting frustrations over sticky inflation. This week, investors will be looking towards Retail Sales data, Housing Starts & Permits figures. The Industrial Production report, and Existing Home Sales results. Fed Chairman Jerome Powell will also speak on Tuesday.

All U.S. factor strategies were in the red on Friday and for last week. S&P 500 Low Volatility (SPLV, -79 bps) was the only factor to decline less than 1% On Friday while S&P 500 High Beta (SPHB) slid 2.40% and S&P 500 Pure Growth (RPG) dropped 2.04%. S&P 500 Pure Value (RPV) was the worst performing factor last week, slipping nearly 4%. Most factors were down more than 2% for the week. Developed ex-U.S. Markets (EFA) retreated 1.62% on Friday as South Korea (EWY) and Hong Kong (EWH) both sank more than 3%. Emerging Markets (EEM, -2.29%) were pulled lower by China (MCHI, -3.11%) and South Africa (EZA, -2.70%). EEM and EFA both fell around 2% last week.

Sectors: Utilities (XLU, -76 bps) was the only U.S. sector to sink less than 1% on Friday. Materials (XLB) saw the worst returns, slipping 1.77%. Communication Services (XLC), Energy (XLE, -1.63%), Consumer Discretionary (XLY), and Technology (XLK) all fell more than 1.60% while Health Care (XLV) dropped 1.49% and Financials (XLF) declined 1.33%. XLV was dragged lower by Biotech (XBI, 3.43%) and Pharmaceuticals (XPH, -3.00%). XLV also entered oversold territory and is now trading more than 4% below its 50-day moving average. All sectors posted losses last week with XLF, XLB, and XLV all decreasing more than 3%. XLK dipped just 50 bps on the week.

Themes: All global thematic segments were down more than 1% on Friday. Cannabis (MJ) underperformed, plunging 4.99%, while Advanced Materials (REMX) and Clean Energy (PBW) each declined more than 4%. PBW hit new 52-week lows. Solar (TAN), Blockchain (BLOK), Multi-Theme (ARKK), Genomics (ARKG), Disruptive Tech (ARKW), Biotech (SBIO), and 3D Printing (PRNT) all dropped more than 3% on the day. All segments were in negative territory last week. MJ plummeted more than 11% for the week and PBW, Casinos & Gaming (BETZ), and BLOK all fell more than 4%. Most segments have also seen negative returns in the past month with ARKG retreating more than 12%.

Commodities & Yields: The U.S. Dollar (UUP) rose 80 bps, U.S. Aggregate Bonds (AGG) added 19 bps, and 20+ Year Treasury Bonds (TLT) gained 53 bps on Friday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.882% and the U.S. 10-Year Treasury Yield stood at 4.499%. Broad Commodities (DJP) dipped 2 bps on the day as Gold (GLD) fell 1.32%, Silver (SLV) dropped 1.46%, and Sugar (CANE) declined 2.30%. Corn (CORN) was also up 1.22%.

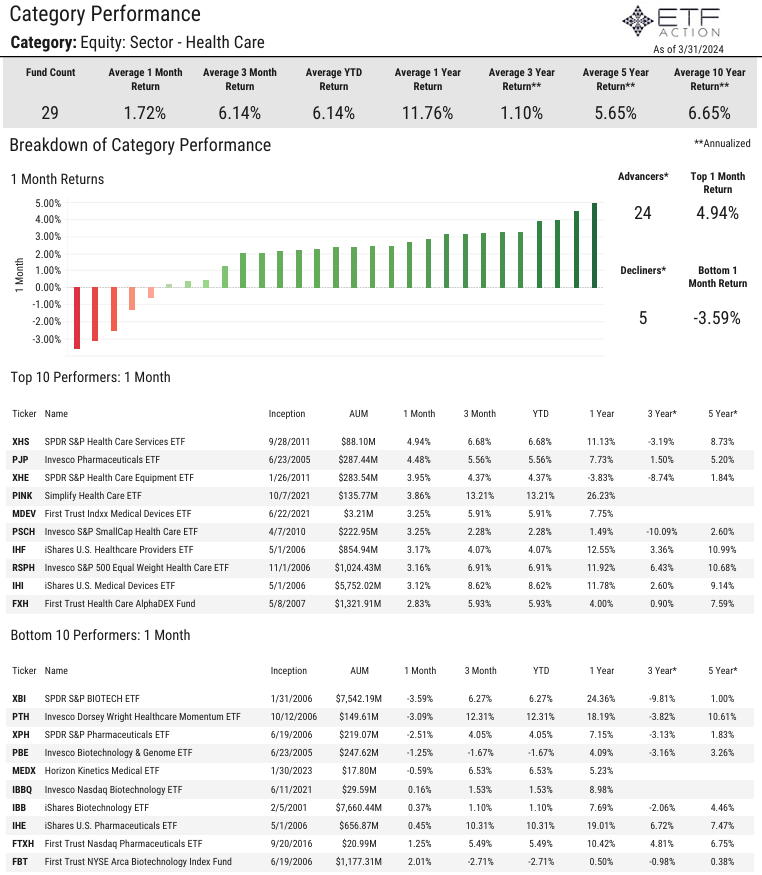

Health Care Category Report

4.15.2024

- The Equity: Sector - Health Care category is made up of 29 ETFs with $99.0 billion in total assets under management

- The Health Care Select Sector SPDR Fund (XLV) is the largest ETF in the category with $41.3 billion in AUM followed by the Vanguard Health Care ETF (VHT) with $18.2 billion in AUM

- The average expense ratio of the category is 44 bps, the average lifespan is 14.24 years, and the average TTM yield is 0.86%

- About half of the Health Care ETFs have low liquidity ratings, average daily volume for the category is $92.68 million

- XLV and the SPDR S&P Biotech ETF (XBI) are the only ETFs in the category with average daily volume above $1 billion

- Health Care ETFs saw $170 million in net outflows in March but have gathered $450 million in net inflows year-to-date

- The iShares U.S. Medical Devices ETF (IHI) gathered $85.6 million in net inflows last month while XLV saw $99.2 million in net outflows

- Most Health Care ETFs posted gains in March, average 1-month return was +1.72% and average YTD return was +6.14%

- The SPDR S&P Health Care Services ETF (XHS) and the Invesco Pharmaceuticals ETF (PJP) both climbed more than 4% on the month while XBI slid 3.59%

- The VanEck Pharmaceutical ETF (PPH) has the highest sharpe ratio (3-year) relative to the iShares MSCI ACWI ETF (ACWI) at 0.80

- Average up capture of the category is 66.32% and average down capture is 97.18%

- The category has high and above average stock concentration but is relatively diverse from a size and style perspective

- 25 of the 29 Health Care ETFs have high or above average growth ratings

- The Harbor Health Care ETF (MEDI) has the highest growth rating (4.09) while XHS has the highest value rating (4.02)

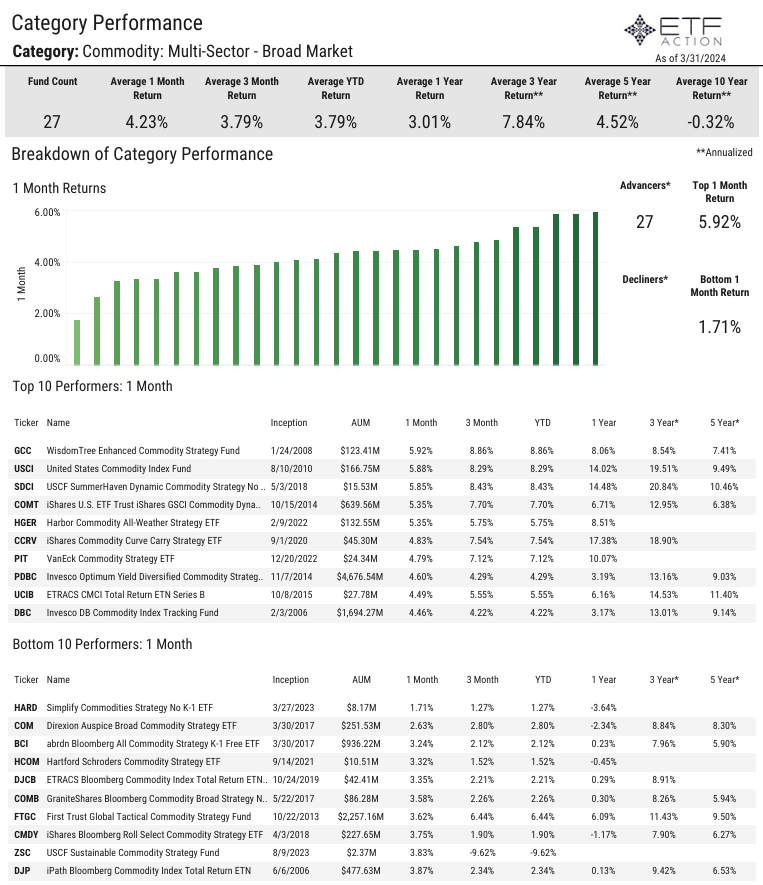

Broad Based Commodity Category Report

4.12.2024

- The Commodity: Multi-Sector - Broad Based category is comprised of 27 ETFs with $13.6 billion in total assets under management

- The average expense ratio of the category is 61 bps, the average lifespan is 6.96 years, and the average TTM yield is 2.82%

- Just 4 ETFs in the category have more than $1 billion in AUM, the Invesco Optimum Yield Diversified Commodity Strategy (PDBC) is the largest with $4.7 billion in AUM

- 7 ETFs in the category have an expense ratio above 75 bps

- 9 ETFs in the category have an average daily volume of less than $500K, average ADV is $4.14 million

- Multi-Sector Commodity ETFs have seen $430 million in net outflows year-to-date and $2.43 billion in net outflows over the last year

- PDBC has seen $763 million in net outflows in the last year

- Almost ETFs in the category registered positive returns in March, average 1-month return was +4.23% and average 3-month return was +3.79%

- The WisdomTree Enhanced Commodity Strategy Fund (GCC) was the best perfomer last month, rising 5.92%

Daily Note

4.12.2024

Equities: As investors digested March’s Producer Price Index (PPI) results, U.S. equity markets were higher on Thursday with the NASDAQ 100 (QQQ) climbing 1.60% to new 52-week highs and the S&P 500 (SPY) advancing 76 bps. The Dow Jones Industrial Average (DIA) inched higher by just 1 bps while Small-Caps (IJR) added 43 bps and Mid-Caps (IJH) rose 5 bps. The Labor Department reported yesterday that the PPI, a measure of inflation at the wholesale level, increased 0.2% for the month, less than the +0.3% consensus estimate. However, on a 12-month basis, the PPI rose 2.1%, the biggest gain since April 2023, indicating pipeline pressures that could keep inflation elevated. Excluding food and energy, the core PPI also rose 0.2% for the month and 2.4% for the year. Treasury yields were steady on Thursday with the U.S. 2-Year hovering around 4.95% and the U.S. 10-Year trading above 4.55% intraday. Separately, initial filings for jobless benefits dropped 11K from the previous week to 211K, which was below the 217K estimate. On Friday, investors will be looking towards Import & Export Prices figures along with Consumer Sentiment data. Several banks will report earnings Friday, including JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, and State Street.

Most U.S. factor strategies saw negative returns yesterday with S&P 500 Value + Momentum (SPVM) dropping 96 bps. S&P 500 Enhanced Value (SPVU) and S&P 500 Low Volatility (SPLV) both slipped more than 80 bps. Growth-oriented pockets of the markets outperformed with S&P 500 Momentum (SPMO), S&P 500 Growth (SPYG), and S&P 500 Pure Growth (RPG) all gaining more than 1.40%. Emerging Markets (EEM) increased 61 bps as South Africa (EZA) jumped 1.40% and China (MCHI) rose 77 bps. Developed ex-U.S. Markets (EFA, +27 bps) were lifted by South Korea (EWY, +2.48%) and Japan (EWJ, +88 bps).

Sectors: Technology (XLK) surged 2.00% on Thursday and outpaced other U.S. sectors. XLK was bolstered by Semiconductors (XSD, +2.34%). Communication Services (XLC) and Consumer Discretionary (XLY) each climbed more than 80 bps while Industrials (XLI) and Real Estate (XLRE) each added 11 bps. XLC sits just 14 bps from new 52-week highs. Financials (XLF) lagged, falling 71 bps as Insurance (KIE) declined another 2.71%. Health Care (XLV) dropped 41 bps, Consumer Staples (XLP) sank 24 bps, and Utilities (XLU) retreated 20 bps. XLV continues to move closer to oversold territory.

Themes: Biotech (SBIO, +2.01%) was the top performing global thematic segment yesterday. Most segments were in the green with Connectivity (FIVG), Big Data (AIQ), Multi-Theme (ARKK), and Disruptive Tech (ARKW) all rising around 1.50%. Advanced Materials (REMX), Biotech (SBIO), Online Retail (IBUY), Industrial Revolution (ARKQ), and Cloud Computing (SKYY) were all up more than 1%. Cannabis (MJ) declined 99 bps on the day but is still up more than 25% over the past month. Solar (TAN) was down 66 bps while Clean Energy (PBW) and 3D Printing (PRNT) both sank around 30 bps.

Commodities & Yields: U.S. Aggregate Bonds (AGG) added 2 bps, 20+ Year Treasury Bonds (TLT) declined 45 bps, and the U.S. Dollar (UUP) increased 7 bps yesterday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.965% and the U.S. 10-Year Treasury Yield stood at 4.593%. Broad Commodities (DJP) dropped 26 bps as Natural Gas (UING) slipped 5.23%, Gold (GLD) popped 1.94%, and Wheat (WEAT) decreased 1.48%.

Daily Note

4.11.2024

Equities: Following a hotter-than-expected Consumer Price Index (CPI) report, equity markets finished sharply lower on Wednesday. The Dow Jones Industrial Average (DIA) declined 1.11%, the S&P 500 (SPY) fell 1.00%, and the NASDAQ 100 (QQQ) sank 87 bps. Mid-Caps (IJH) also dropped 2.03% while Small-Caps (IJR) retreated nearly 3%. The Labor Department reported yesterday that the core CPI rose 0.4% month-over-month and 3.5% year-over-year in March, bot figures were above estimates. Core CPI, which excludes volatile food and energy prices, increased 0.4% on the month and 3.8% for the year. Energy rose 1.1% last month after climbing 2.3% in February, while shelter costs, which make up about one third of the weighting in the CPI, were higher by 0.4% on the month and up 5.7% from a year ago. The U.S. 2-Year Treasury Yield jumped up near 5% and the U.S. 10-Year Treasury Yield surged above 4.55% intraday Wednesday after the results. The probability of a rate cut at the June meeting now stands at 19.5% and the probability of a rate cut at the July meeting now stands at 42.8%, according to the CME FedWatch Tool. The minutes for the March Federal Open Market Committee (FOMC) meeting were also released yesterday and indicated that officials remained uncertain about the persistence of high inflation. Several members expressed the view that recent data had not increased their confidence that inflation was moving sustainably down to 2%. All eyes will now be on Thursday’s Producer Price Index (PPI) report.

No U.S. factor strategies were in positive territory yesterday with most factors falling more than 1%. S&P 500 High Beta (SPHB) slumped 2.83%, S&P 500 Dividend (SPYD) dipped 2.66%, and S&P 500 Pure Value (RPV) dropped 2.05%. Developed ex-U.S. Markets (EFA) and Emerging Markets (EEM) were both down around 1.35% on the day. EFA was impacted by weakness from South Korea (EWY, -3.83%), Australia (EWA, -2.25%), and Japan (EWJ, -1.56%). EEM was pulled lower by Brazil (EWZ, -2.76%), South Africa (EZA, -2.50%), and Mexico (EWW, -1.96%).

Sectors: Energy (XLE) was the lone U.S. sector in the green on Wednesday, adding 31 bps. XLE was lifted by Oil & Gas Equipment & Services (XES, +67 bps) and Oil & Gas Exploration & Production (XOP, +34 bps), the only industries to see gains for the day. Real Estate (XLRE) plummeted 4.11% as Homebuilders (ITB) retreated 3.71%. Utilities (XLU) also declined 1.71% while Materials (XLB), Consumer Discretionary (XLY), and Financials (XLF) were all down around 1.50%. XLF was impacted by sizeable losses from Regional Banks (KRE, -4.96%) and Banks (KBE, -4.14%). Technology (XLK, -1.23%) and Health Care (XLV, -1.17%) also underperformed.

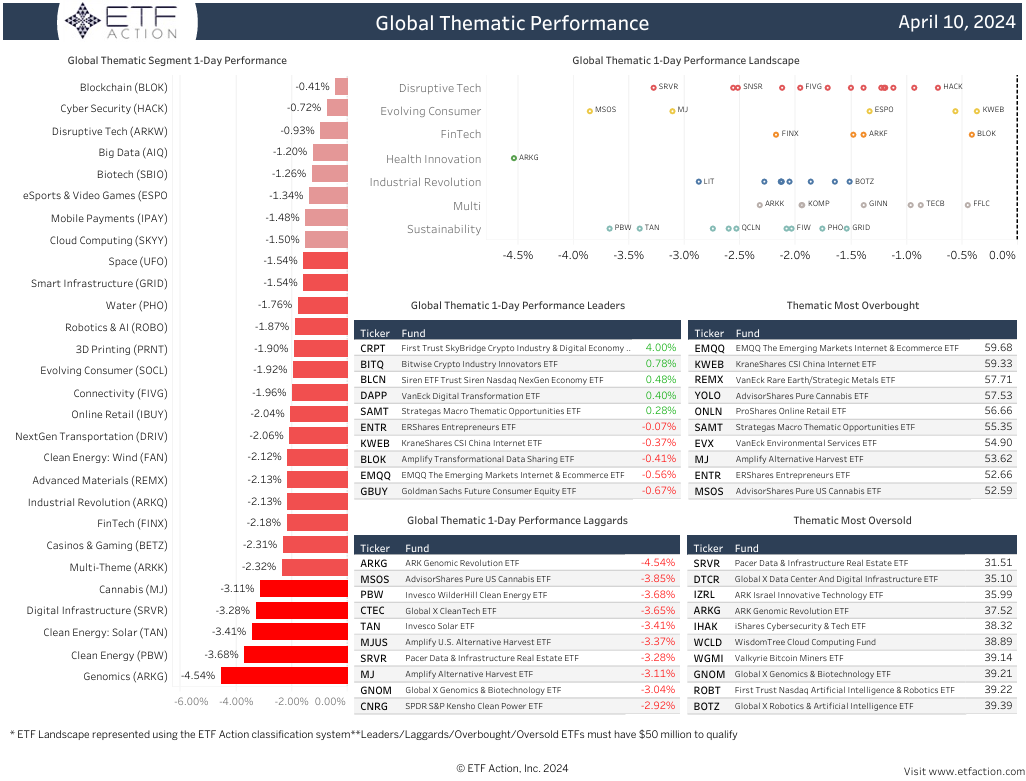

Themes: All global thematic segments posted losses yesterday with Genomics (ARKG, -4.54%) falling the furthest. Clean Energy (PBW), Solar (TAN), Digital Infrastructure (SRVR), and Cannabis (MJ) all declined more than 3% while Multi-Theme (ARKK), Casinos & Gaming (BETZ), FinTech (FINX), Industrial Revolution (ARKQ), Advanced Materials (REMX), Wind (FAN), NextGen Transportation (DRIV), and Online Retail (IBUY) all dropped more than 2%. Blockchain (BLOK) was the best performing segment of the day, adding 41 bps. SRVR and ARKG are approaching oversold territory.

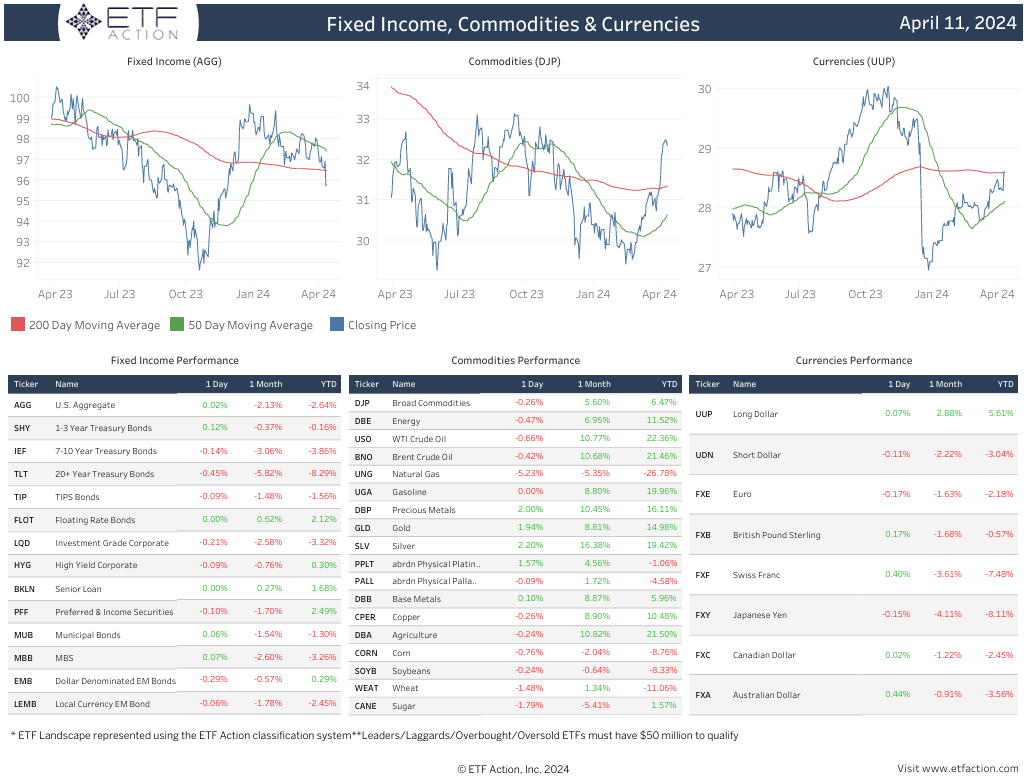

Commodities & Yields: At Wednesday’s closing bell, the U.S. 2-Year Treasury Yield stood at 4.971% and the U.S. 10-Year Treasury Yield stood at 4.550%. The U.S. Dollar (UUP) popped 1.06%, U.S. Aggregate Bonds (AGG) dropped 1.20% and 20+ Year Treasury Bonds (TLT) fell 2.18%. Broad Commodities (DJP) dipped 15 bps yesterday as Natural Gas (UNG) sank 1.14%, Gold (GLD) declined 95 bps, and Sugar (CANE) decreased 70 bps. WTI Crude Oil (USO) was up more than 1%.

Daily Note

4.10.2024

Equities: Ahead of Wednesday’s key Consumer Price Index (CPI) report, U.S. markets were mixed yesterday with The NASDAQ 100 (QQQ) and the S&P 500 (SPY) gaining 37 bps and 12 bps, respectively, and the Dow Jones Industrial Average (DIA) dipping 7 bps. QQQ and SPY are now trading within 1% of new 52-week highs. DIA is trading just below its 50-day moving average but more than 7% above its 200-day moving average. Small Caps (IJR) also rose 46 bps while Mid Caps (IJH) added 13 bps. Treasury yields eased on Tuesday with the U.S. 2-Year falling below 4.75% and the U.S. 10-Year sinking near 4.350% intraday. Alphabet climbed more than 1% ahead of the company’s Google Cloud Next Event keynote presentation. Earlier in the day, the company unveiled new custom Arm-based chips, taking a cue from Microsoft and Amazon, which have undertaken similar strategies. The CPI, which measures costs for a wide-ranging basket of goods and services, is expected to register monthly increases of 0.3% for the headline figure as well as the core figure that excludes volatile food and energy. On a yearly basis, that would put the inflation rates at 3.4% and 3.7%, respectively, a 0.2% increase for the headline rate from February and just a 0.1% decrease for the core rate. The Producer Price Index (PPI) figures will be released on Thursday.

Most U.S. factor strategies were in the green on Tuesday, led by S&P 500 High Beta (SPHB, +93 bps) and S&P 500 Dividend (SPYD, +77 bps). S&P 500 Momentum (SPMO, -42 bps) and S&P 500 Pure Growth (RPG, -39 bps) underperformed while S&P 500 Value (SPYV) added 24 bps. Developed ex- U.S. Markets (EFA) inched lower by 1 bps yesterday as Germany (EWG) sank 70 bps. South Korea (EWY) and France (EWQ) also declined around 50 bps and Hong Kong (EWH) increased 1.09%. Emerging Markets (EEM) advanced 67 bps, bolstered by solid returns from Thailand (THD, +2.49%), South Africa (EZA, +1.91%), Taiwan (EWT, +1.70%), and Brazil (EWZ, +1.45%). China (MCHI) also rose 90 bps.

Sectors: All U.S. sectors finished higher yesterday, except for Financials (XLF, -57 bps) and Industrials (XLI, -23 bps). XLF was dragged lower by Insurance (KIE, -1.67%) and XLI was impacted by Aerospace & Defense (XAR, -1.04%). Real Estate (XLRE) outpaced other sectors, jumping 1.27%. Utilities (XLU), Technology (XLK), Consumer Staples (XLP), and Consumer Discretionary (XLY) were all up around 50 bps while Health Care (XLV) increased 36 bps and Materials (XLB) rose 24 bps. XLK received a boost from Semiconductors (XSD, +2.18%) while XLV was lifted by Health Care Equipment (XHE, +1.67%) and Biotech (XBI, +1.37%). XLB hit fresh 52-week highs and is approaching overbought territory.

Themes: Solar (TAN) shined on Tuesday, advancing 4.07%. Most other global thematic segments were in positive territory for the day with Genomics (ARKG) gaining 3.30%, Advanced Materials (REMX) rising 2.94%, and Clean Energy (PBW) increasing 2.42%. Digital Infrastructure (SRVR, +1.59%) and NextGen Transportation (DRIV, +1.39%) were also strong. Cannabis (MJ) and Blockchain (BLOK) were the worst performing segments on the day, sinking 3.24% and 2.23%, respectively. Just 3 other segments saw losses yesterday: Disruptive Tech (ARKW, -38 bps), Mobile Payments (IPAY, -15 bps), and Smart Infrastructure (GRID, -4 bps).

Commodities & Yields: Broad Commodities (DJP) added 4 bps on Tuesday as Natural Gas (UNG) jumped 2.86%, Silver (SLV) gained 1.26%), and Corn (CORN) fell1.00%. WTI Crude Oil (USO) and Wheat (WEAT) each declined 1.28%. U.S. Aggregate Bonds (AGG) increased 34 bps, 20+ Year Treasury Bonds (TLT) advanced 93 bps, and the U.S. Dollar (UUP) dipped 3 bps. At yesterday’s close, the U.S. 2-Year Treasury Yield stood at 4.743% and the U.S. 10-Year Treasury Yield stood at 4.362%.

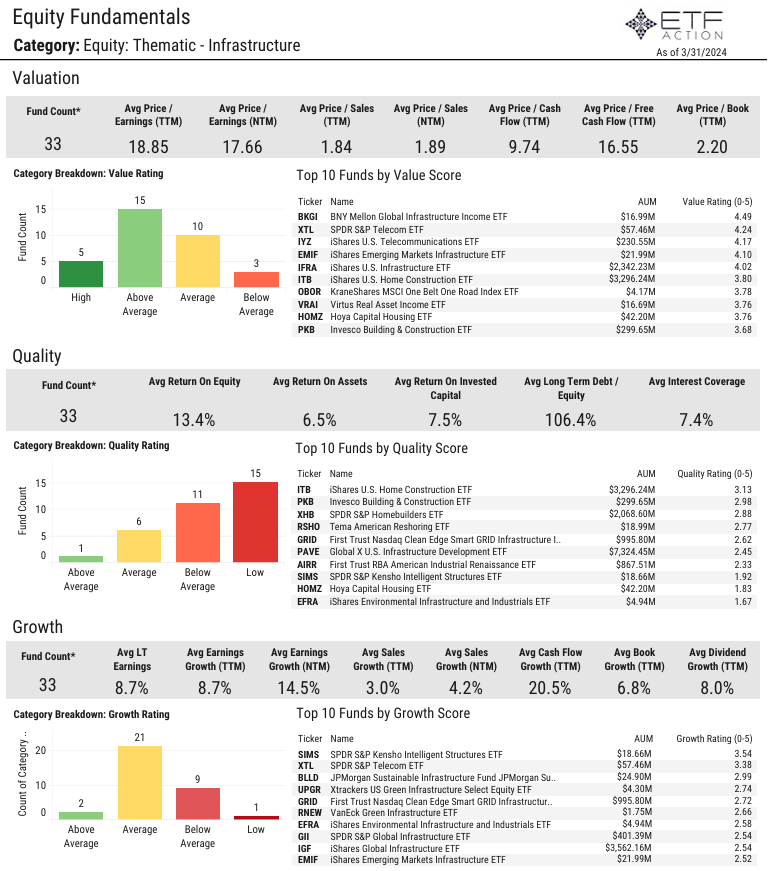

Infrastructure Category Report

4.10.2024

- The average expense ratio of the 33 Infrastructure ETFs is 51 bps, the average lifespan is 8.21 years, and the average TTM yield is 1.92%

- The Thematic - Infrastructure category has $24.6 billion in total assets under management, the largest ETF in the category is the Global X U.S. Infrastructure Development ETF (PAVE) with $7.3 billion in AUM

- Just 5 other ETFs in the category have over $1 billion in AUM (IGF, ITB, IFRA, NFRA, XHB)

- 21 of the 33 ETFs in the category have below $500K in average daily volume, average ADV is $17.80 million

- Infrastructure ETFs gathered nearly $1 billion in net inflows in March and have seen $2.31 billion in net inflows in the past year

- PAVE gathered $501.7 million in net inflows last month and $1.42 billion in net inflows over the last year

- Just 2 ETFs in the category posted losses in March (SRVR, XTL), average 1-month return was +3.68% and average 1-year return was +15.25%

- The SPDR S&P Homebuilders ETF (XHB) rose 8.44% last month and has surged nearly 70% in the past year

- The average 3-year average volatility relative to ACWI is 21.14%, average shapre ratio is 0.17, and average down capture is 107.15%

- The category is relatively diverse from a size & style perspective and has average stock concentration

- The highest average sector exposures for Infrastructure ETFs are Industrials (30.8%), Utilities (17.8%), and Real Estate (15.6%)

- Average price to earnings (TTM) is 18.85, average return on equity is 13.4%. and average dividend growth (TTM) is 8.0%

Daily Note

4.9.2024

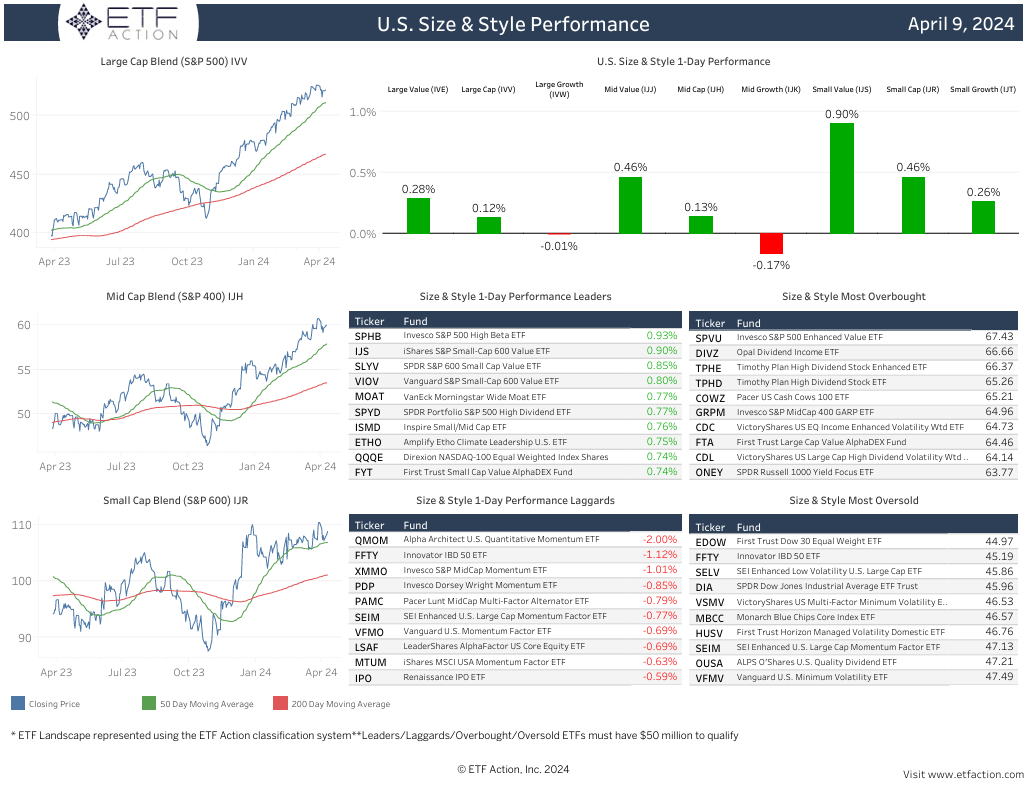

Equities: Major averages were little changed on Monday following a losing week last week. The S&P 500 (SPY) and the Dow Jones Industrial Average (DIA) each rose 6 bps while the NASDAQ 100 (QQQ) added 3 bps. Small-Caps (IJR) and mid-Caps (IJH) outperformed, climbing 72 bps and 44 bps, respectively. Markets faced headwinds from treasury yields, which continued to push higher. The U.S.2-Year approached 4.80% and the U.S. 10-Year topped 4.45% intraday yesterday. Tesla jumped nearly 5% on Monday after CEO Elon Musk announced the company will reveal its robotaxi product on August 8th. Tesla has declined more than 33% year-to-date and recently reported Q1 vehicle deliveries that were lower than the same period a year ago. Bitcoin ETFs were also up more than 6% on the day. Investors are awaiting Wednesday’s Consumer Price Index (CPI) results followed by Thursday’s Producer Price Index (PPI) results, which will provide more clarity on inflationary pressures. According to the CME FedWatch Tool, there is a 0% chance that the Fed will cut rates at the next meeting and a 51.3% chance of a rate cut at the June meeting.

S&P 500 High Beta (SPHB) led other U.S. factor strategies on Monday, climbing 1.12%. S&P 500 Dividend (SPYD) also increased 90 bps and S&P 500 Pure Value (RPV) added 22 bps while S&P 500 Momentum (SPMO) slipped 37 bps and S&P 500 Quality (SPHQ) dipped 5 bps. Emerging Markets (EEM) rose 65 bps on strength from Brazil (EWZ, +2.23%), Taiwan (EWT, +72 bps), and India (INDA, +69 bps). Developed ex-U.S. Markets (EFA, +49 bps) were boosted by Germany (EWG, +73 bps) and France (EWQ, +71 bps). Hong Kong (EWH) dipped 19 bps.

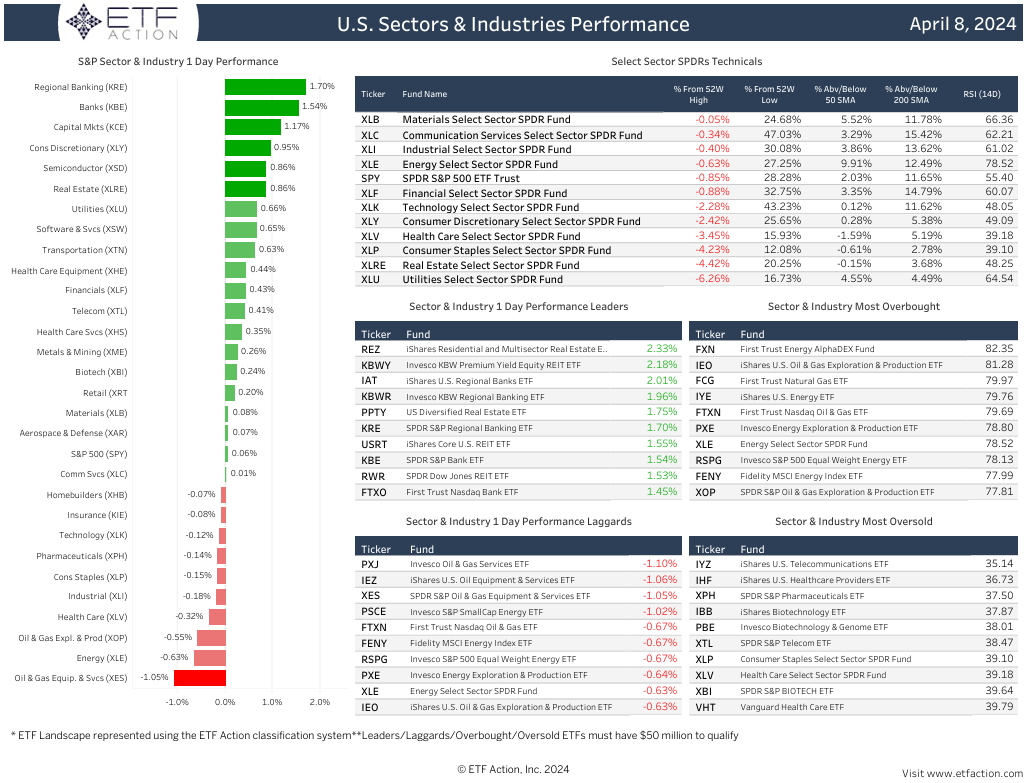

Sectors: U.S. sectors were mixed yesterday with Consumer Discretionary (XLY, +95 bps) seeing the strongest returns. Real Estate (XLRE) gained 86 bps, Utilities (XLU) increased 66 bps, and Financials (XLF) were up 43 bps. XLF was bolstered by Regional Banks (KRE, +1.70%), Banks (KBE, +1.54%), and Capital Markets (KCE, +1.17%). After outperforming last week, Energy (XLE) slipped 63 bps, lagging other sectors. Health Care (XLV) also fell 32 bps while Industrials (XLI), Consumer Staples (XLP), and Technology (XLK) all declined around 15 bps. XLV, XLP, and XLRE are the only sectors trading below relative 50-day moving averages.

Themes: Advanced Materials (REMX), Disruptive Tech (ARKW), and Multi-Theme (ARKK) were the top performing global thematic segments on Monday, all advancing more than 2%. FinTech (FINX) and Blockchain (BLOK) all gained more than 1.65% while 3D Printing (PRNT) climbed 1.58%, Industrial Revolution (ARKQ) increased 1.55% and Genomics (ARKG) rose 1.44%. Solar (TAN, +1.41%) and Clean Energy (PBW, +1.18%) recovered from Friday’s losses. Evolving Consumer (SOCL) was the weakest returns, declining 71 bps. Casinos & Gaming (BETZ) also dropped 45 bps.

Commodities & Yields: U.S. Aggregate Bonds (AGG) dipped 9 bps, Preferred & Income Securities (PFF) fell 19 bps, and the U.S. Dollar (UUP) slipped 14 bps yesterday. At Monday’s closing bell, the U.S. 2-Year Treasury Yield stood at 4.793% and the U.S. 10-Year Treasury Yield stood at 4.422%. Broad Commodities (DJP) added 37 bps with Agriculture (DBA) dropping 80 bps, Industrial Metals (DBB) advancing 89 bps, and Precious Metals (DBP) rising 83 bps. Natural Gas (UNG) jumped 3.63% while Silver (SLV) and Copper (CPER) were both up more than 1%.

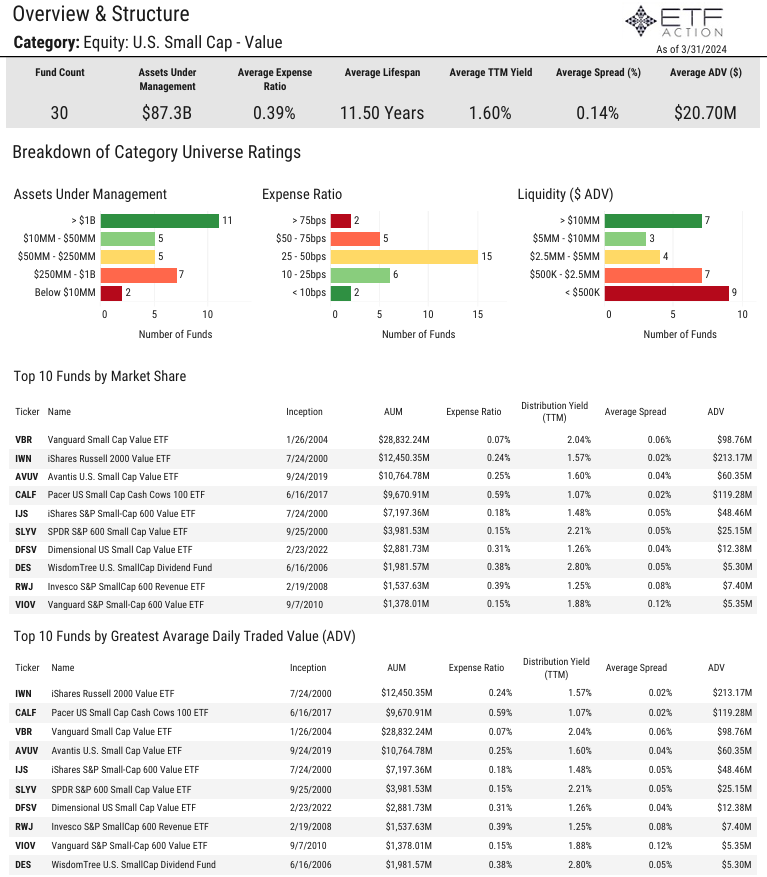

U.S. Small Cap Value Category Report

4.9.2024

- The U.S. Small Cap - Value category is comprised of 30 ETFs with $87.3 billion in total assets under management

- The average expense ratio of the category is 39 bps, the average lifespan is 11.50 years, and the average TTM yield is 1.60%

- 11 ETFs in the category have more than $1 billion in AUM and 2 ETFs have less than $10 million in AUM

- The Vanguard Small Cap Value ETF (VBR) is the largest ETF in the category with $28.8 billion

- The average daily volume of the category is $20.70 million, the iShares Russell 2000 Value ETF (IWN) has the highest ADV with $213.17 million

- U.S. Small Cap - Value ETFs gathered $1.18 billion in net inflows in March and $4.17 billion in net inflows int the 1st quarter

- All ETFs in the category gained more than 1.60% in March, average 1-month return was +3.93% and average return for Q1 was +2.54%

- The Themes US Small Cap Cash Flow Champions ETF (SMCF, +8.20%) was the best performer last month

- The average 3-year volatility relative to the S&P 500 (SPY) was 21.75% and average correlation was 0.80

- The average top 10 holdings weight is just 12.07% and average weighted average market cap was $2.99 billion

- The category has high average sector exposure towards Financials (23.0%), Industrials (17.2%), and Consumer Discretionary (16.1%)

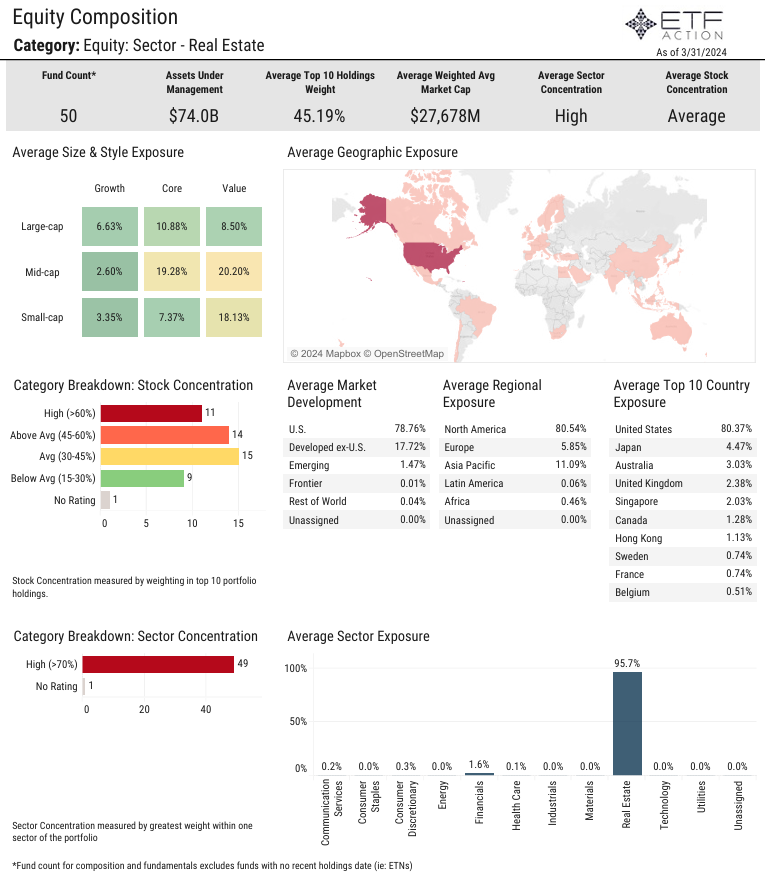

Real Estate Category Report

4.8.2024

- The 50 Real Estate ETFs have $74.0 billion in assets under management, the Vanguard Real Estate ETF (VNQ) is the largest ETF in the category with $33.8 billion in AUM

- The average expense ratio of the category is 42 bps, the average lifespan is 9.33 years, and the average TTM yield is 3.17%

- 25 of the ETFs in the category have average daily volume below $500K, the iShares U.S. Real Estate ETF (IYR) has the largest ADV at $591.5 million

- Real Estate ETFs gathered $2.13 billion in net inflows in March, IYR saw the largest net inflows with $1.1 billion

- All Real Estate ETFs registered positive returns last month, average return was +3.05% and average YTD return was -1.65%

- The iShares International Developed Real Estate ETF (IFGL) and the iShares International Developed Property ETF (WPS) both jumped more than 6.4% in March

- The ALPS Active REIT ETF (REIT) has the highest sharpe ratio (3-year) relative to the iShares MSCI ACWI ETF (ACWI)

- The average top 10 holdings weight of the category is 45.19%

- The category has high average tilts to Mid-Cap Value (20.20%), Mid-Cap Core (19.28%), and Small-Cap Value (18.13%) names

- Average price to earnings (TTM) of the category is 28.02, the average return on equity is 6.3%, and the average dividend growth (TTM) is 6.9%

Daily Note

4.8.2024

Equities: Following a stronger-than-expected Employment Situation report, U.S. markets posted gains on Friday. The NASDAQ 100 (QQQ) climbed 1.18%, the S&P 500 (SPY) rose 1.04%, and the Dow Jones Industrial Average (DIA) increased 74 bps. Despite Friday’s positive returns, all three major averages finished lower last week with DIA declining 2.24%, SPY sinking 89 bps, and QQQ falling 80 bps. The Labor Department reported on Friday that nonfarm payrolls jumped 303K in March, well above the +200K estimates and higher than the downwardly revised +270K gain in February. Wages rose 0.3% for the month and 4.1% from a year ago, both in line with estimates. The unemployment rate edged lower to 3.8%, as expected, even though the labor force participation rate moved higher to 62.7%. Treasury yields pushed higher following the strong jobs report with the U.S. 2-Year nearing 4.75% and the U.S. 10-Year increasing above 4.40% intraday. This week, investors will be looking towards the Consumer Price Index (CPI) and Producer Price Index (PPI) results along with the release of the latest Federal Open Market Committee (FOMC) meeting minutes and several speeches from Fed officials.

All U.S. factor strategies were in the green on Friday, led by S&P 500 Momentum (SPMO, +1.82%). S&P 500 Pure Growth (RPG) and S&P 500 Growth (SPYG) both advanced more than 1.50% and S&P 500 Quality (SPHQ) rose 1.16%. S&P 500 Dividend (SPYD) added just 30 bps on the day. SPMO increased 29 bps last week while all other factors saw losses. S&P 500 High Beta (SPHB) tumbled 2.26% and SPYD dropped 1.99%. Developed ex-U.S. Markets (EFA, +32 bps) were lifted by the Netherlands (EWN, +1.10%) on Friday. Hong Kong (EWH) and Australia (EWA) each gained more than 50 bps. Emerging Markets (EEM) were up 22 bps on strength from Thailand (THD, +1.60%), Mexico (EWW, +1.47%), and South Africa (EZA, +1.46%). EEM rose 41 bps last week while EFA slipped 1.11%.

Sectors: Industrials (XLI) jumped 1.39% on Friday, outpacing all other U.S. sectors, all of which were in positive territory. Technology (XLK), Energy (XLE), and Communication Services (XLC) all advanced more than 1% while Financials (XLF) increased 95 bps, Materials (XLB) gained 90 bps, and Health Care (XLV) climbed 89 bps. XLE hit new 52-week highs and was boosted by Oil & Gas Equipment & Services (XES, +1.47%). XLB was bolstered by Metals & Mining (XME, +1.42%) and XLV benefitted from strong returns from Health Care Equipment (XHE, +1.42%). Consumer Staples (XLP) was the worst performer on the day, adding just 16 bps. XLE surged nearly 4% last week. XLC also gained 1.05% while all other sectors declined. XLV sank 3.05%, Real Estate (XLRE) fell 2.91%, and Consumer Discretionary (XLY) retreated 2.75%.

Themes: Most global thematic segments saw positive returns on Friday with Cannabis (MJ, +1.90%) leading the charge. Casinos & Gaming (BETZ, +1.42%), Cloud Computing (SKYY, +1.33%), and Online Retail (IBUY, +1.28%) were all strong. Evolving Consumer (SOCL), Cyber Security (HACK), and Biotech (SBIO) were all up more than 1% while Big Data (AIQ) and eSports & Video Games (ESPO) both gained more than 80 bps. Solar (TAN) and Clean Energy (PBW) underperformed, slipping 1.35% and 99 bps, respectively. Blockchain (BLOK) and Advanced Materials (REMX) each fell more than 60 bps. Genomics (ARKG) and BLOK each plunged around 7% last week while Multi-Theme (ARKK) and Space (UFO) each declined nearly 6%. MJ was the best performing segment for the week, climbing 2.63%.

Commodities & Yields: The U.S. Dollar (UUP) added 11 bps, U.S. Aggregate Bonds (AGG) slipped 49 bps, and 20+ Year Treasury Bonds (TLT) dropped 1.39% on Friday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.732% and the U.S. 10-Year Treasury Yield stood at 4.378%. Broad Commodities (DJP) gained 70 bps as Gold (GLD) climbed 1.71%, Silver (SLV) jumped 2.20%, Copper (CPER) increased 1.07%, and Agriculture (DBA) advanced 1.13%. SLV is up 15.51% over the past month.

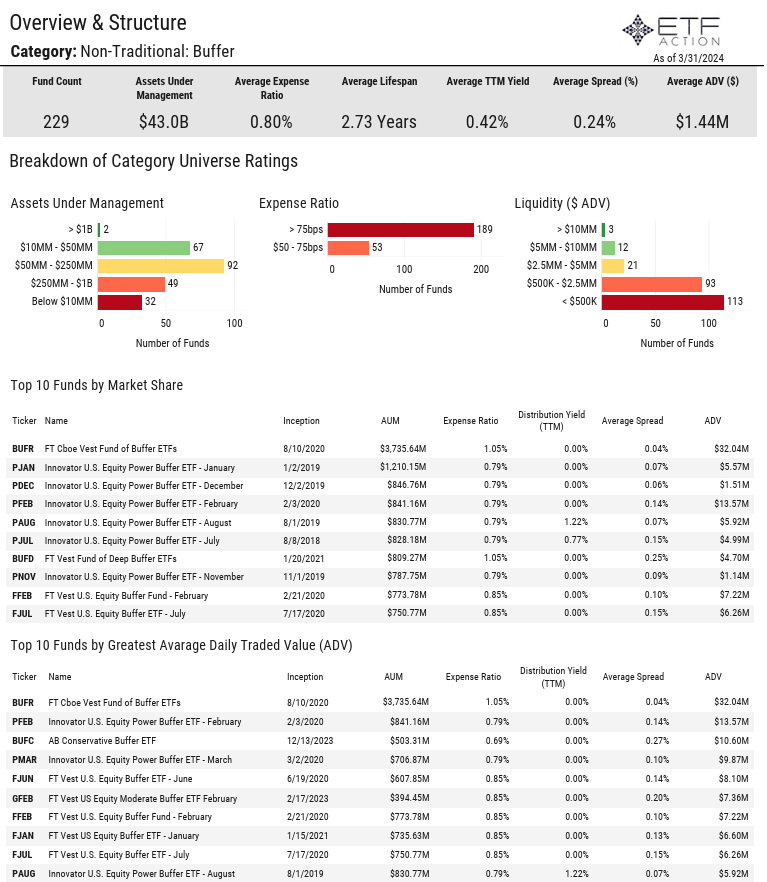

Buffer ETFs Category Report

4.5.2024

- The Non-Traditional: Buffer category is comprised of 229 ETFs with $43.0 billion in total assets under management

- The average expense ratio of the category is 80 bps, the average lifespan is 2.73 years, and the average TTM yield is 0.42%

- Just 2 ETFs in the category have more than $1 billion in AUM, the FT Cboe Vest Fund of Buffer ETFs (BUFR) is the largest with $3.7 billion in AUM

- 53 ETFs in the category have an expense ratio below 75 bps

- 113 ETFs in the category have an average daily volume of less than $500K, average ADV is $1.44 million

- Buffer ETFs gathered $90 million in net inflows in March and have seen $3.30 billion in net inflows year-to-date

- Almost all Buffer ETFs registered positive returns in March, average 1-month return was +1.32% and average YTD return was +3.91%

- The FT Vest Gold Strategy Quarterly Buffer ETF (BGLD) was the best performer last month, climbing more than 6%

- BUFR gained 1.49% in March and has jumped more than 20% over the past year

Daily Note

4.5.2024

Equities: Ahead of Friday’s Employment Situation report, major averages were down sharply on Thursday. The NASDAQ 100 (QQQ) declined 1.53%, the Dow Jones Industrial Average (DIA) slipped 1.34%, and the S&P 500 (SPY) fell 1.22%. Markets were shaken by more cautious rhetoric from Federal Reserve officials. Yesterday, Minneapolis Federal Reserve President Neel Kashkari expressed caution that interest rate cuts might not happen this year unless there’s more progress on inflation. Richmond Federal Reserve President Thomas Barkin also noted Thursday that inflation data this year has been “a little less encouraging” but a strong labor market and macro economy allow Fed officials “time for the clouds to clear” before cutting rates. After rising above 4.40% intraday Wednesday, the U.S 10-Year was trading around 4.35% yesterday. The Labor Department Reported that jobless claims totaled 221K for the week ended March 30, up 9K from the previous week and higher than the 213K estimate. That was the highest total since January 27. In other economic news, the Commerce Department reported that the trade deficit rose to $68.9 billion in February, up $1.3 billion on the month and higher than the $67.7 billion estimate. That was the highest imbalance on the goods and services measure going back to April 2023.

All U.S. factor strategies dropped at least 50 bps yesterday with most falling more than 85 bps. S&P 500 Pure Growth (RPG) sank 2.08%, S&P 500 Growth (SPYG) and S&P 500 High Beta (SPHB) each declined 1.52%, and S&P 500 Quality (SPHQ) retreated 1.43%. S&P 500 Pure Value (RPV) and S&P 500 Momentum (SPMO) both decreased 1.34%. Emerging Markets (EEM) dipped 36 bps on weakness from Thailand (THD, -1.03%) and Taiwan (EWT, -40 bps). China (MCHI) slid 40 bps. Developed ex-U.S. Markets (EFA) slipped 86 bps as France (EWQ), the Netherlands (EWN), and Japan (EWJ) were all down more than 1%.

Sectors: All U.S. sectors finished in negative territory on Thursday with Technology (XLK, -1.58%) falling the furthest. Health Care (XLV) also sank 1.44%, dragged lower by Biotech (XBI, -1.70%), and Communication Services (XLC) fell 1.35%. Consumer Discretionary (XLY), Financials (XLF), and Materials (XLB) all slid more than 1% followed by Industrials (XLI, -88 bps) and Real Estate (XLRE). Energy (XLE) inched lower by just 6 bps and remains in overbought territory. Oil & Gas Exploration & Production (XOP) was the only industry to see gains yesterday, adding just 3 bps. All sectors are trading above relative 200-day moving averages.

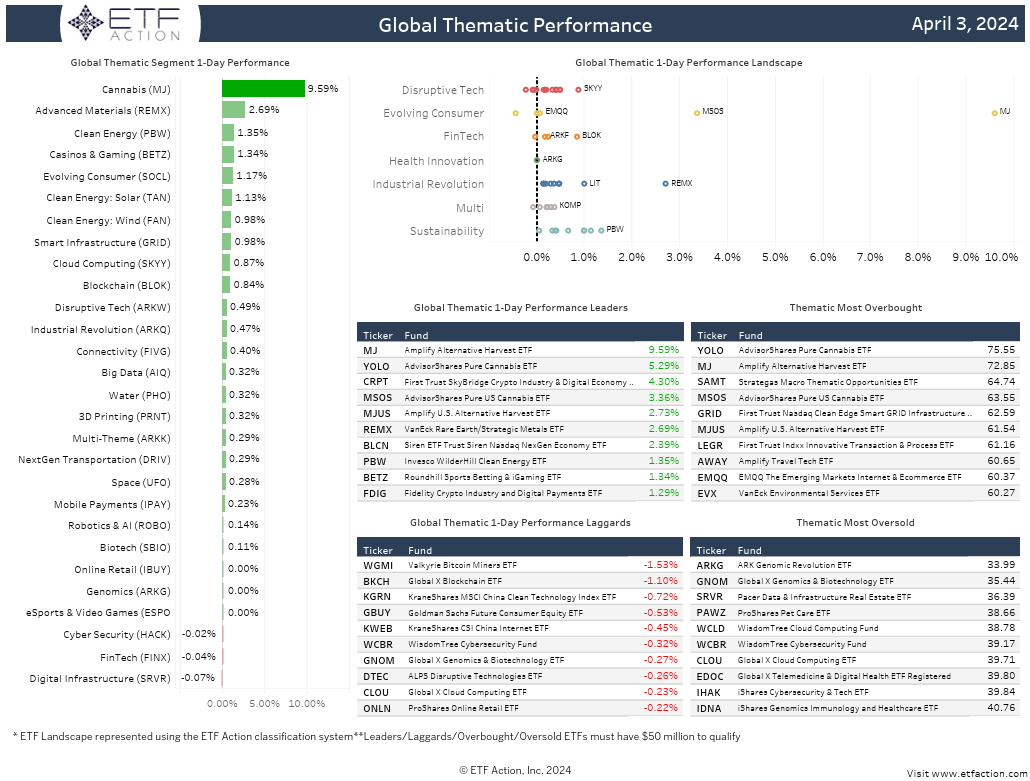

Themes: Volatility continued for Cannabis (MJ) as it plummeted 7.88% on Thursday following a 9.59% gain on Wednesday. All other global thematic segments were in the red with most dropping more than 1%. Biotech (SBIO) declined 2.17%, Mobile Payments (IPAY) fell 1.94%, and Online Retail (IBUY) retreated 1.83%. Blockchain (BLOK) and Connectivity (FIVG) both slipped more than 1.70% while FinTech (FINX), Genomics (ARKG), and Advanced Materials (REMX) all sank around 1.60%. ARKG is approaching oversold territory and is trading more than 10% below its 50-day and 200-day moving averages.

Commodities & Yields: At yesterday’s closing bell, the U.S. 2-Year Treasury Yield stood at 4.641% and the U.S. 10-Year Treasury Yield stood at 4.309%. The U.S. Dollar (UUP) was flat, U.S. Aggregate Bonds (AGG) rose 24 bps, and 20+ Year Treasury Bonds (TLT) increased 72 bps on Thursday. Broad Commodities (DJP) inched higher by 3 bps as WTI Crude Oil (USO) gained 1.26%, Natural Gas (UNG) slumped 3.92%, Silver (SLV) dropped 97 bps, and Industrial Metals (DBB) advanced 48 bps.

Daily Note

4.4.2024

Equities: The NASDAQ 100 (QQQ) and the S&P 500 (SPY) added 22 bps and 11 bps, respectively, on Wednesday while the Dow Jones Industrial Average (DIA) dipped 9 bps. Meanwhile, Small-Caps (IJR) gained 64 bps and Mid-Caps (IJH) advanced 45 bps. Investors weighed comments from Federal Reserve Chairman Jerome Powell and other Fed officials yesterday. Powell said Wednesday it will take a while for policymakers to evaluate the current state of inflation, keeping the timing of potential interest rate cuts uncertain. Atlanta Federal Reserve President Raphael Bostic expressed concern Wednesday about the pace of inflation and indicated he doesn’t think interest rate cuts should come until much later in the year. Separately, ADP reported private payrolls increased 184K in March, up from the upwardly revised +155K gain in February. March’s job growth was the fastest pace since July 2023. ADP also reported that wages for workers who stayed in their jobs increased 5.1% from a year ago, the same rate as February after showing a steady easing going well back into 2023. Intel sank more than 8% on the day after the revealing a $7 billion operating loss within its semiconductor manufacturing segment. Jobless claims data will be released Thursday followed by the Employment Situation report on Friday.

U.S. factor strategies were mixed yesterday with S&P 500 Growth (RPG) climbing 80 bps, S&P 500 Pure Value (RPV) rising 66 bps, and S&P 500 Low Volatility (SPLV) slipping 51 bps. S&P 500 Momentum (SPMO) also increased 54 bps, S&P 500 High Beta (SPHB) advanced 43 bps, and S&P 500 Value (SPYV) dropped 18 bps. Developed ex-U.S. Markets (EFA) gained 56 bps as the Netherlands (EWN) and Germany (EWG) both increased more than 95 bps. Emerging Markets (EEM) inched higher by 7 bps with South Africa (EZA) adding 46 bps and China (MCHI) declining 30 bps.

Sectors: Consumer Staples (XLP) was the worst performing U.S. sector on Wednesday, falling 1.10%. Utilities (XLU) also declined 40 bps while Health Care (XLV) and Financials (XLF) saw modest losses. Communication Services (XLC) advanced 79 bps followed by Energy (XLE, +68 bps), Materials (XLB, +62 bps), and Industrials (XLI, +51 bps). XLE received a boost from Oil & Gas Equipment & Services (XES, +2.03%) and XLB was lifted by Metals & Mining (XME, +2.19%). XLE and XLC both hit new 52-week highs. XLE and XLB are the only sectors sitting in overbought territory. Technology (XLK) also added 27 bps on the day.

Themes: Cannabis (MJ) rocketed 9.59% yesterday, handily outpacing other global thematic segments. Advanced Materials (REMX) increased 2.69% while Clean Energy (PBW), Casinos & Gaming (BETZ), Evolving Consumer (SOCL), and Solar (TAN) climbed more than 1%. Wind (FAN) and Smart Infrastructure (GRID) both rose 98 bps, Cloud Computing (SKYY) advanced 87 bps, and Blockchain (BLOK) gained 84 bps. Just three segments saw slight losses on Wednesday: Digital Infrastructure (SRVR, -7 bps), FinTech (FINX, -4 bps), and Cyber Security (HACK, -2 bps).

Commodities & Yields: U.S. Aggregate Bonds (AGG) added 6 bps, Preferred & Income Securities (PFF) rose 31 bps, and the U.S. Dollar (UUP) dropped 46 bps on Wednesday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.679% and the U.S. 10-Year Treasury Yield stood at 4.355%. Broad Commodities (DJP) jumped 1.46% as Industrial Metals (DBB) surged 3.07% and Precious Metals (DBP) climbed 1.40%. Silver (SLV) and Copper (SLV) both jumped more than 3%.

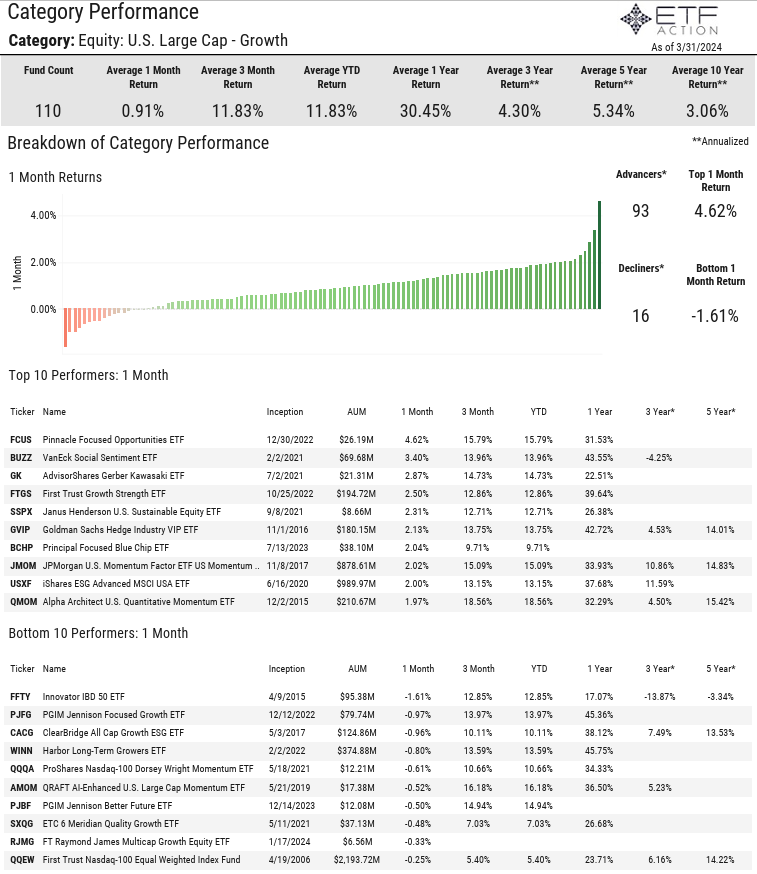

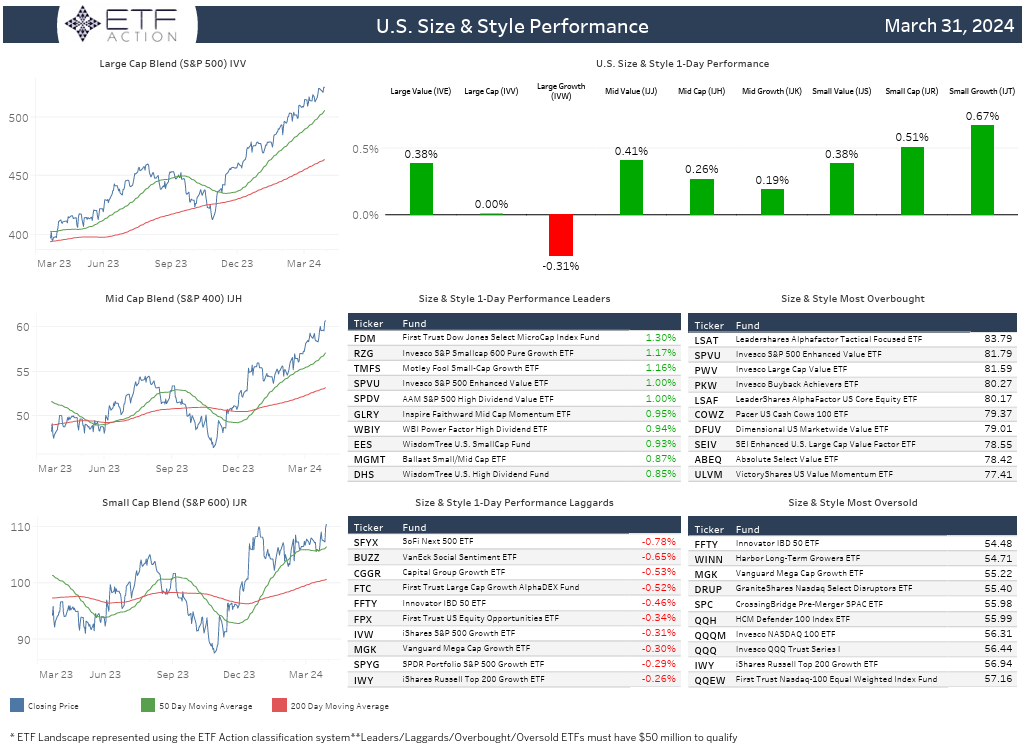

U.S. Large Cap Growth Category Report

4.3.2024

- The U.S. Large Cap - Growth category is comprised of 110 ETFs with $722.1 billion in total assets under management

- The average expense ratio of the category is 48 bps, the average lifespan is 6.79%, and the average TTM yield is 0.40%

- 29 ETFs in the category have more than $1 billion in AUM, the Invesco QQQ Trust Series I (QQQ) is the largest with $259.9 billion in AUM followed by the Vanguard Growth ETF (VUG) with $118.6 billion in AUM

- 12 ETFs in the category have expense ratios below 10 bps versus 22 with expense ratios greater than 75 bps

- U.S. Large Cap - Growth ETFs gathered $10.47 billion in net inflows in March and $24.66 billion in net inflows int the 1st quarter

- Most ETFs in the category saw positive returns in March, average 1-month return was +0.91% and average return for Q1 was +11.83%

- The Pinnacle Focused Opportunities ETF (FCUS, +4.62%) was the top performer in March

- The average 3-year volatility relative to the S&P 500 (SPY) was 21.39 and average correlation was 0.92

- The average top 10 holdings weight is 44.80% and average weighted average market cap was $802.1 billion

- U.S. Large Cap - Growth ETFs have high average sector concentration towards Technology (39.0%)

Daily Note

4.3.2024

Equities: U.S. equity markets declined on Tuesday following cautious rhetoric from Federal Reserve officials. The Dow Jones Industrial Average (DIA) dropped 94 bps, the NASDAQ 100 (QQQ) fell 86 bps, and the S&P 500 (SPY) sank 64 bps. Small-Caps (IJR) and Mid-Caps (IJH) also slipped 1.75% and 1.32%, respectively. Cleveland Fed President Loretta Mester said Tuesday she still expects interest rate cuts this year but ruled out the next policy meeting in May. San Francisco Fed President Mary Daly also said Tuesday that three reductions this year is a “very reasonable baseline” though she said nothing is guaranteed. The U.S. 10-Year continued to push higher yesterday touching 4.40% intraday. Tesla retreated nearly 5% on the day after reporting disappointing vehicle deliveries in the 1st quarter. Deliveries decreased 8.5% from the same quarter last year and was the company’s first year-over-year decline in deliveries since 2020. UnitedHealth also plunged 6.44% after the Centers for Medicare & Medicaid Services announced the 2025 rate for Medicare Advantage and prescription drug coverage. On the economic front, the Job Openings & Labor Turnover Survey (JOLTS) showed that available positions were little changed in February at 8.76 million. However, the ratio of openings to available workers declined considerably, down to 1.35 from 1.43 the previous month, indicating more loosening of the labor market. Federal Reserve Chairman Jerome Powell will speak on Wednesday along with several other officials.

Growth-oriented pockets of the markets underperformed yesterday with S&P 500 High Beta (SPHB) falling 1.80% and S&P 500 Pure Growth (RPG) sinking 1.23%. All other U.S. factor strategies finished lower. S&P 500 Low Volatility (SPLV, -26 bps) and S&P 500 Dividend (SPYD, -50 bps) were the top performers. Emerging Markets (EEM) added 32 bps on Tuesday on strength from South Africa (EZA, +1.05%) and Brazil (EWZ, +57 bps). Developed ex-U.S. Markets (EFA) dropped 70 bps as Switzerland (EWL), the Netherlands (EWN), Germany (EWG), and France (EWQ) all slipped more than 1%.

Sectors: Energy (XLE) climbed 1.40% on Tuesday, handily outpacing other U.S. sectors. XLE hit fresh 52-week highs and was bolstered by Oil & Gas Equipment & Services (XES, +2.23%) and Oil & Gas Exploration & Production (XOP, +72 bps). Utilities (XLU) added just 17 bps and was the only other sector in positive territory. Health Care (XLV, -1.56%) and Consumer Discretionary (XLY, -1.47%) were the worst performers. XLV was pulled lower by Health Care Services (XHS, -2.75%) and Health Care Equipment (XHE, -2.45%). Real Estate (XLRE) sank 1.11%, Technology (XLK) declined 96 bps, and Financials (XLF), Consumer Staples (XLP), and Industrial (XLI) all dropped around 50 bps.

Themes: All global thematic segments were in the red yesterday, except for Cannabis (MJ, +97 bps). Genomics (ARKG) plunged 4.41% followed by Solar (TAN, -3.73%), Clean Energy (PBW, -3.39%), Multi-Theme (ARKK, -2.97%), Blockchain (BLOK, -2.90%), and Space (UFO, -2.83%). Biotech (SBIO), Disruptive Tech (ARKW) and Industrial Revolution (ARKQ) were both down more than 2% while Online Retail (IBUY) slid 1.81%, NextGen Transportation (DRIV) dropped 1.58%, 3D Printing (PRNT) retreated 1.55%, and Casinos & Gaming (BETZ) declined 1.46%. The Valkyrie Bitcoin Miners ETF (WGMI) and the VanEck Digital Transformation ETF (DAPP) both plummeted more than 7% on the day.

Commodities & Yields: The U.S. Dollar (UUP) dipped 14 bps, U.S. Aggregate Bonds (AGG) slipped 7 bps, and Preferred & Income Securities (PFF) fell 73 bps yesterday. At the close, the U.S. 2-Year Treasury Yield stood at 4.701% and the U.S. 10-Year Treasury Yield stood at 4.365%. Broad Commodities (DJP, +91 bps) were lifted by Energy (DBE, +1.82%), Precious Metals (DBP, +2.04%), and Industrial Metals (DBB, +1.11%). Silver (SLV) jumped 4.29% while WTI Crude Oil (USO), Gasoline (UGA), and Gold (GLD) were all up more than 1%. Agriculture (DBA) also dropped 1.24%.

Sustainability Category Report

4.3.2024

- The average expense ratio of the 36 Sustainability ETFs is 62 bps, the average lifespan is 6.59 years, and the average TTM yield is 1.17%

- The category has relatively high expense ratios and low liquidity relative to the broader market

- 26 ETFs in the category have average ADV below $500K and just 2 ETFs in the category have assets under management greater than $1 billion

- The iShares Global Clean Energy ETF (ICLN) has $2.42 billion in AUM followed by the Invesco Solar ETF (TAN) with $1.28 billion in AUM

- Sustainability ETFs saw nearly $1 billion in net outflows in Q1 and have seen $2.36 billion in net outflows over the past year

- ICLN saw $334.7 million in net outflows in March and has seen $1.13 billion in net outflows over the past year

- The category saw mixed returns in March, the Macquarie Energy Transition ETF (PWER, +9.07%) was the top performer and the First Trust Nasdaq Clean Edge Green Energy Index Fund (QCLN, -6.95%) was the worst performer

- Average 1-year return is -12.86% and the average 3-year annualized return for the category is -6.68%

- The category has above average stock concentration and above average/ high volatility ratings

- Highest average sector exposure is Industrials (35.0%), Utilities (25.6%), and Technology (18.8%)

Daily Note

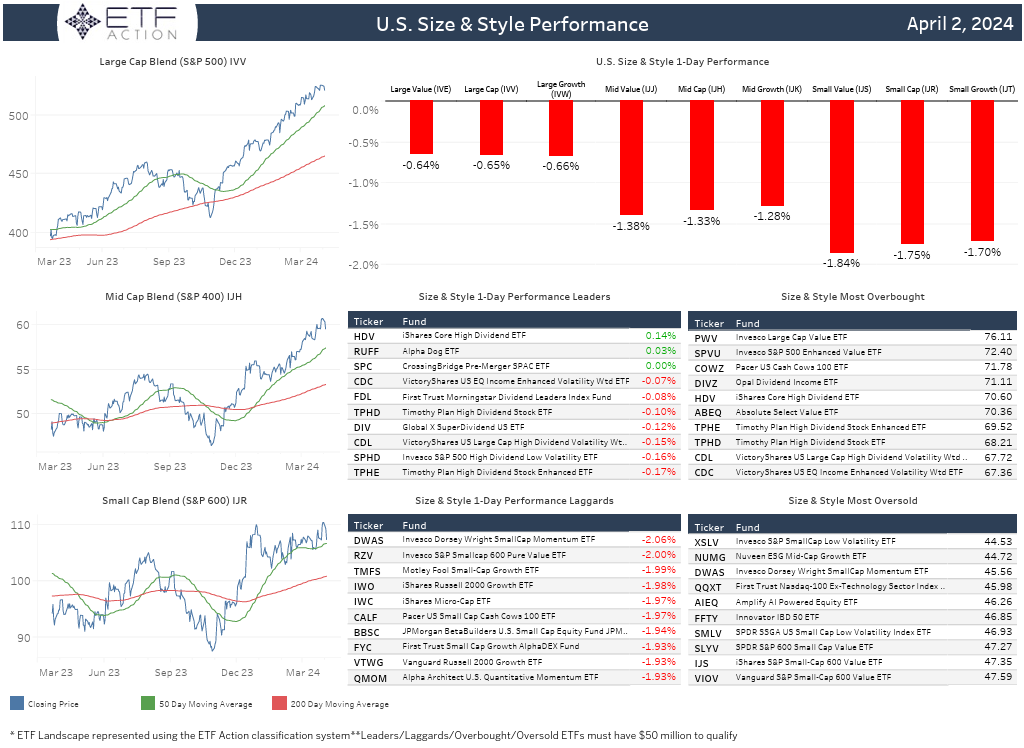

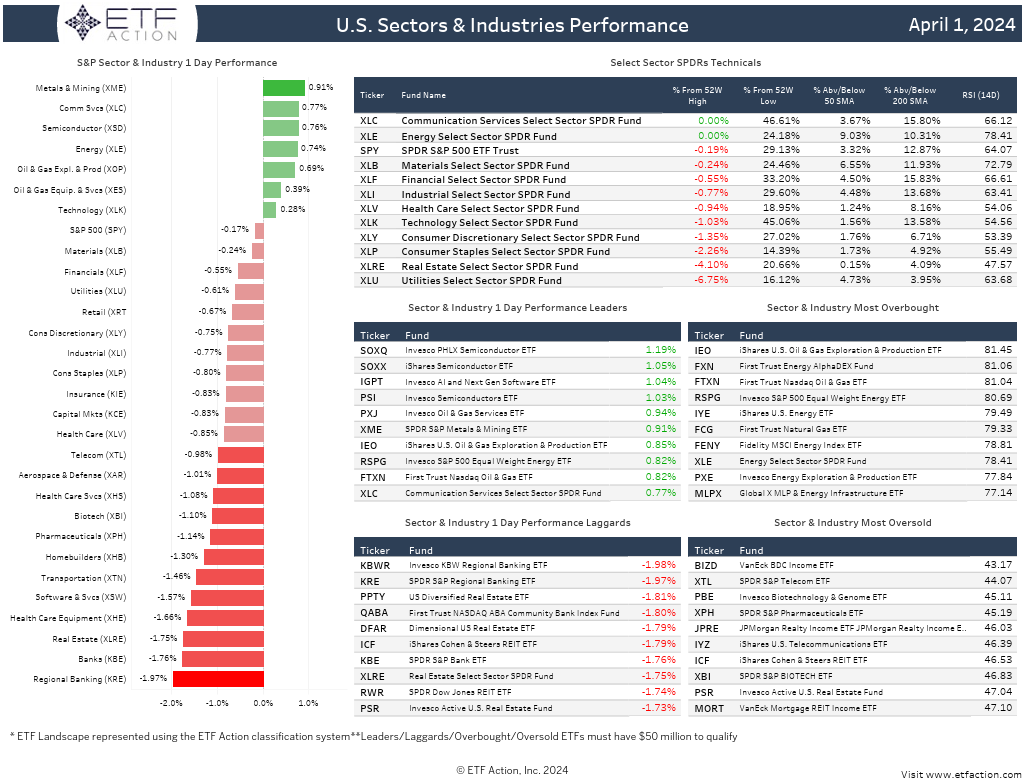

4.2.2024

Equities: The NASDAQ 100 (QQQ) gained 21 bps while the Dow Jones Industrial Average (DIA) slipped 61 bps and the S&P 500 (SPY) dipped 17 bps to start the 2nd quarter. Investors digested the Personal Consumption Expenditures (PCE) Index results, released during the market’s closure for Good Friday. Core PCE, which excludes food and energy, showed inflation rose 2.8% on a 12-month basis in February, in line with expectations. On a monthly basis, the measure was up 0.3% from a month ago, the Commerce Department said. Treasury yields rose yesterday with the U.S. 2-Year climbing above 4.70% and the U.S. 10-Year approached 4.35%. According to the ISM Manufacturing Index, manufacturing in the U.S. expanded in March for the first time in 17 months. The index increased to 50.3 in March, up from 47.8 in February and better than the 48.1 estimate. The index measures the percentage of companies reporting expansion against contraction, so any figure above 50 indicates growth. Production posted the biggest gain, rising 6.2 points to 54.6, while prices also accelerated to 55.8, an increase of 3.3 points. Several Federal Reserve officials will speak on Tuesday. Factory Orders data and the Job Openings & Labor Turnover Survey (JOLTS) results will also be released.