Model Research Archives

U.S. Factor AIM Positioning Guide

6.20.2021

U.S. Factor AIM Portfolio returned -1.72% last week, underperforming the S&P 500 (SPY) by 1.33%

.jpeg)

Global Thematic AIM Positioning Guide

6.20.2021

Global Thematic AIM Portfolio returned -1.40% last week, outperforming the MSCI ACWI (ACWI) by 0.69%

- Top Performers: WCLD +5.32%, ARKK +2.39%, FINX +2.31%

- Bottom Performers: REMX -6.59%, BETZ -5.83%

- Since Inception Performance: +60.78% outpacing MSCI ACWI (ACWI) by 26.63%

.jpeg)

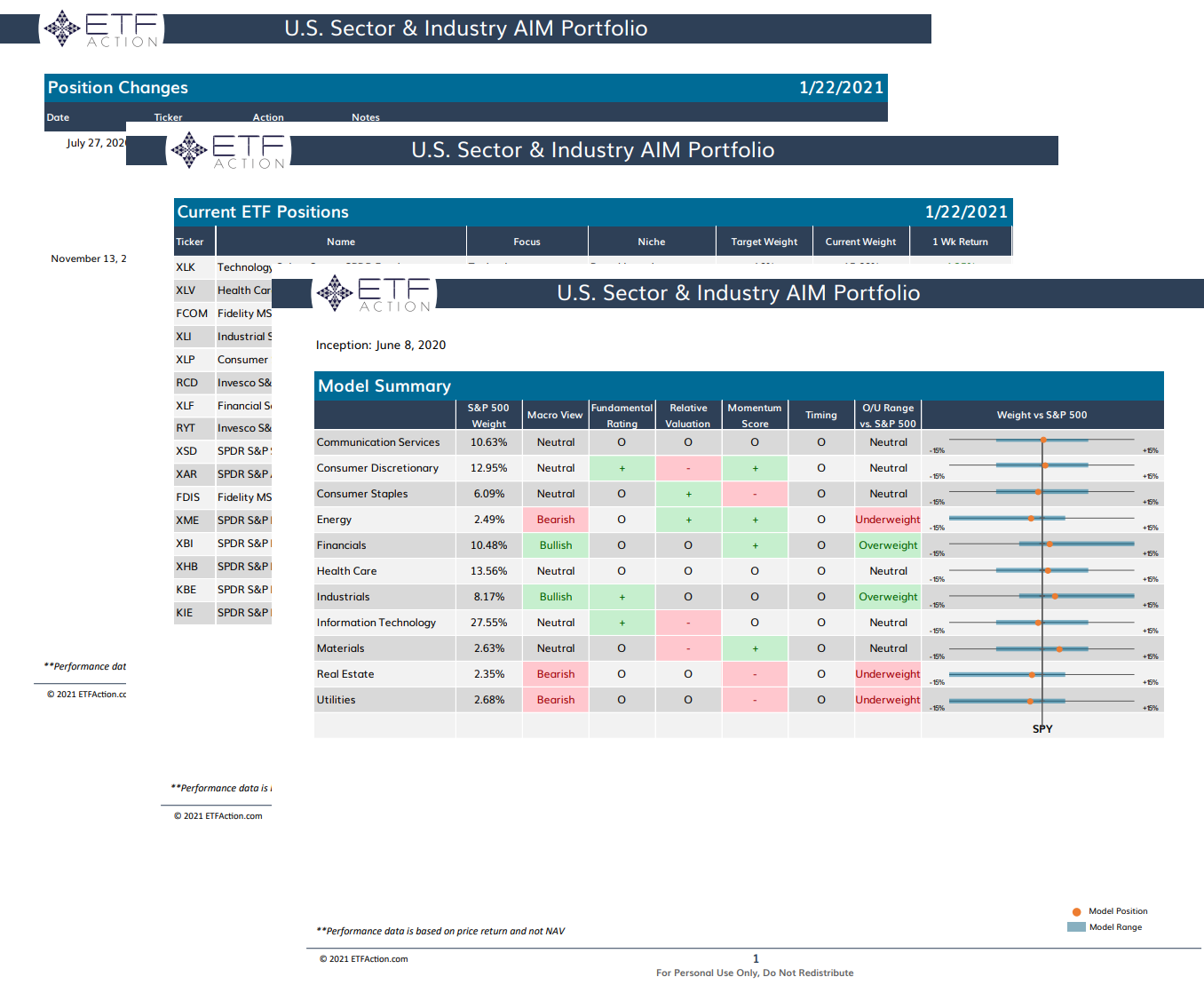

U.S. Sector & Industry AIM Positioning Guide

6.20.2021

U.S. Sector & Industry AIM Portfolio returned -1.07% last week, underperforming the S&P 500 by 0.68%

- Top Performers: XLK +0.08%

- Bottom Performers: XME -12.27%, KBE -6.93%, XLB -6.25%

- Since Inception Performance: 39.13% outperforming the S&P 500 (SPY) by 6.67%

.jpeg)

U.S. Sector & Industry AIM Positioning Guide

6.13.2021

U.S. Sector & Industry AIM Portfolio returned +0.46% last week, outperforming the S&P 500 by 0.06%

- Top Performers: XBI +7.16%, XLV +2.01%, FDIS +1.40%

- Bottom Performers: KBE -2.54%, XLF -2.37%, XLB -2.04%

- Since Inception Performance: 43.24% outperforming the S&P 500 (SPY) by 8.23%

.jpeg)

Global Thematic AIM Positioning Guide

6.13.2021

Global Thematic AIM Portfolio returned +2.55% last week, outperforming the MSCI ACWI (ACWI) by 2.14%

- Top Performers: SBIO +7.40%, WCLD +6.49%, IDNA +6.32%

- Bottom Performers: REMX -4.23%, ROBO -0.11%

- Since Inception Performance: +63.06% outpacing MSCI ACWI (ACWI) by 26.06%

.jpeg)

International Region & Country AIM Positioning Guide

6.13.2021

International Region & Country AIM Portfolio returned -0.15% last week, underperforming the MSCI ACWI ex-U.S. (IXUS) by 0.23%

- Top Performers: EWW +2.61%, EIS +1.29%, BBEU +0.89%

- Bottom Performers: EWY -1.24%, EEMA -1.04%

- Since Inception Performance: +42.05% outperforming the MSCI ACWI ex-U.S. (IXUS) by 0.77%

.jpeg)

U.S. Factor AIM Positioning Guide

6.13.2021

U.S. Factor AIM Portfolio returned -0.25% last week, underperforming the S&P 500 (SPY) by 0.65%

.jpeg)

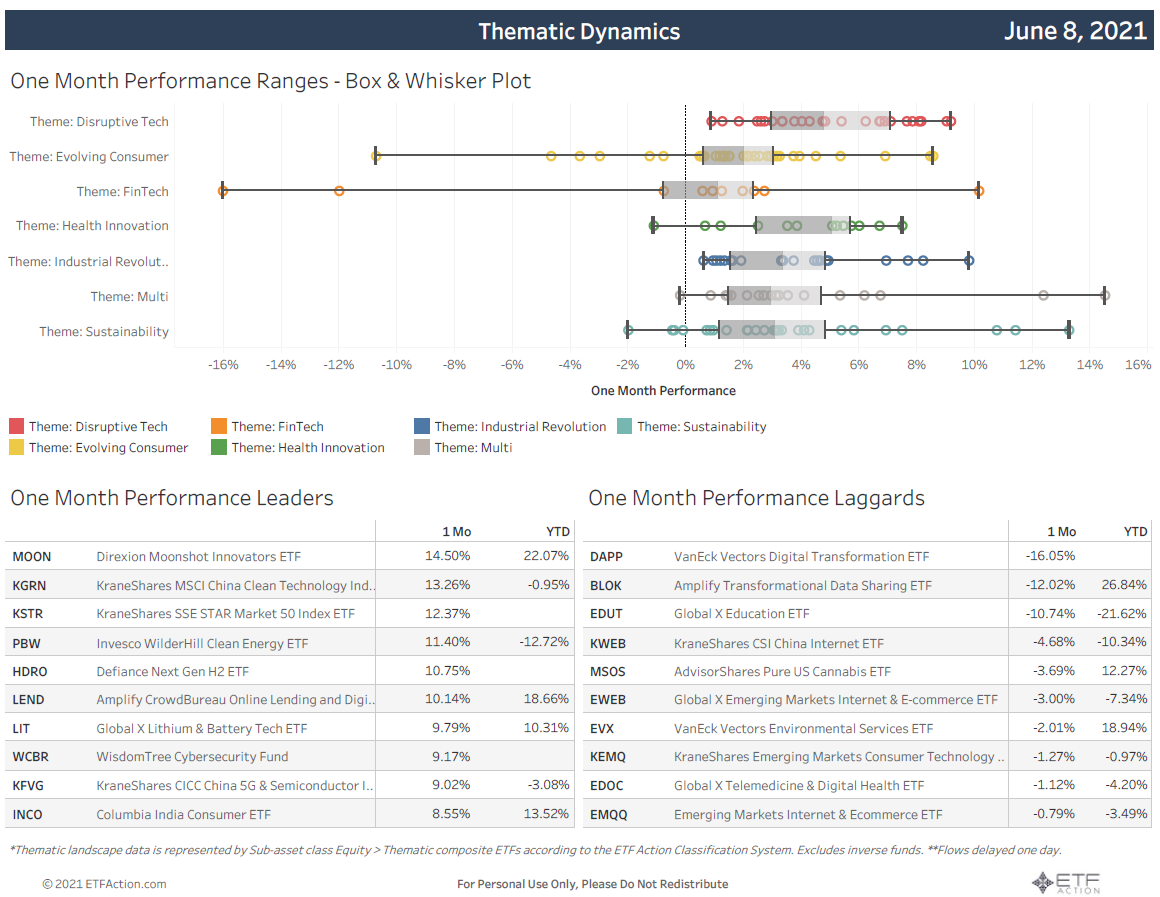

Global Thematic Playbook

6.9.2021

An overview of the U.S. Sector ETF landscape - Performance, Flows, Valuations, Earnings, & Technicals.

Global Thematic AIM Positioning Guide

6.8.2021

Global Thematic AIM Portfolio returned +0.90% last week, outperforming the MSCI ACWI (ACWI) by 0.07%

- Top Performers: REMX +5.59%, PBW +3.97%, SRVR +3.15%

- Bottom Performers: ARKK -2.31%, WCLD -0.54%, SBIO -0.49%

- Since Inception Performance: +59.01% outpacing MSCI ACWI (ACWI) by 22.57%

International Region & Country AIM Positioning Guide

6.6.2021

International Region & Country AIM Portfolio returned +1.30% last week, underperforming the MSCI ACWI ex-U.S. (IXUS) by 0.14%

- Top Performers: INDA +2.48%, EWA +2.39%, EWT +2.36%

- Bottom Performers: EIS -0.18%

- Since Inception Performance: +42.26% outperforming the MSCI ACWI ex-U.S. (IXUS) by 1.10%

.jpeg)