The Daily Note Archives

Daily Note

4.24.2024

As investors digested the latest batch of corporate earnings results, the rally continued for U.S. equity markets on Tuesday. Spotify surged more than 11% on the day after surpassing Wall Street’s Q1 estimates and issuing encouraging 2Q guidance. UPS gained 2.4% after the delivery giant surpassed expectations for earnings. GE Aerospace jumped more than 8.3% after beating earnings expectations and PepsiCo fell nearly 3% after reporting that recalls and a weaker lower-income consumer hurt demand in the U.S. After the close, Tesla missed estimates on the top and bottom lines and reported a 9% drop in revenue in the first quarter, the steepest year-over-year decline since 2012. Google parent company Alphabet and Microsoft round out the technology-heavy earnings week on Thursday. New home sales accelerated in March at a faster-than-expected pace as mortgage rates declined over the month, the Commerce Department reported Tuesday. Sales of single-family homes totaled 693K for the month, considerably higher than the downwardly revised 637K in February and better than the 669K estimate. After dipping in January, the median sales price jumped back up to $430,700, the highest level since August 2023. Durable Goods Orders data is due out on Wednesday.

Equities:

- The NASDAQ 100 (QQQ) led the way once again, increasing 1.49%, the S&P 500 (SPY) gained 1.19% and the Dow Jones Industrial Average (DIA) added 69 bps

- Small-Caps (IJR) rose 1.78% while Mid-Caps (IJH) climbed 1.21%

- Growth-oriented pockets of the markets outperformed on Tuesday with Pure Growth (RPG) jumping 2.25% and High Beta (SPHB), Momentum (SPMO), and Growth (SPYG) all climbing at least 1.60%

- All other factors finished higher with Quality (SPHQ) gaining 1.24% and Value (SPYV) advancing 73 bps

- Emerging Markets (EEM) added 82 bps, lifted by Thailand (THD, +1.79%), Mexico (EWW, +1.36%), South Africa (EZA, +1.36%), and China (MCHI, +1.29%)

- Developed ex-U.S. Markets (EFA) were up 1.09% on strength from the Netherlands (EWN, +2.04%), Germany (EWG, +1.81%), and Hong Kong (EWH, +1.73%)

Sectors:

- Materials (XLB) was the lone U.S. sector in negative territory yesterday, slipping 86 bps

- XLB was once again pulled lower by Metals & Mining (XME, -1.41%)

- Communication Services (XLC) and Technology (XLK) were both up around 1.50% while Industrials (XLI) rose 1.39% and Health Care (XLV) added 1.30%

- Consumer Discretionary (XLY, +1.19%) and Real Estate (XLRE, +91 bps) also saw strong returns

- XLRE received a boost from Homebuilders (XHB, +2.67%)

Themes:

- Another strong day for global themes as Advanced Materials (REMX, -14 bps) was the only segment to see losses

- Cannabis (MJ) popped 5.43% followed by Disruptive Tech (ARKW, +3.20%) and Multi-Theme (ARKK, +2.98%)

- Evolving Consumer (SOCL), Cloud Computing (SKYY), Mobile Payments (IPAY), FinTech (FINX), Online Retail (IBUY), Blockchain (BLOK), Clean Energy (PBW), Cyber Security (HACK), Connectivity (FIVG), and Space (UFO) all climbed more than 2%

- 3D Printing (PRNT, +88 bps) was the only was the only other segment to rise less than 1%

Commodities & Yields:

- Broad Commodities (DJP) added just 9 bps as Energy (DBE) rose 96 bps and Industrial Metals (DBB) sank 2.02%

- Natural Gas (UNG) jumped 2.6% and Copper (CPER) fell 1.57%

- The U.S. Dollar (UUP) declined 41 bps, U.S. Aggregate Bonds (AGG) increased 21 bps, and Preferred & Income Securities (PFF) climbed 97 bps

- At the close, the U.S. 2-Year Treasury Yield stood at 4.935% and the U.S. 10-Year Treasury Yield stood at 4.607%

Daily Note

4.23.2024

U.S. equity markets bounced back on Monday from another disappointing week last week as investors awaited key earnings reports and a slew of economic data due out this week. Chipmaker and artificial intelligence favorite Nvidia climbed 4.4% yesterday, after sinking nearly 14% last week, its worst since September 2022. Verizon declined almost 5% on the day after missing revenue expectations and reported continued customer losses. Tesla earnings will be released tomorrow, along with results from UPS, Lockheed Martin, Invesco, Visa, Pepsi, and Spotify, amongst other companies. Meta Platforms, Microsoft, and Alphabet are all set to report earnings later this week. The New Home Sales report will also be released on Tuesday followed by an update on U.S. GDP on Thursday, and the Personal Consumption Expenditures (PCE) report on Friday.

Equities:

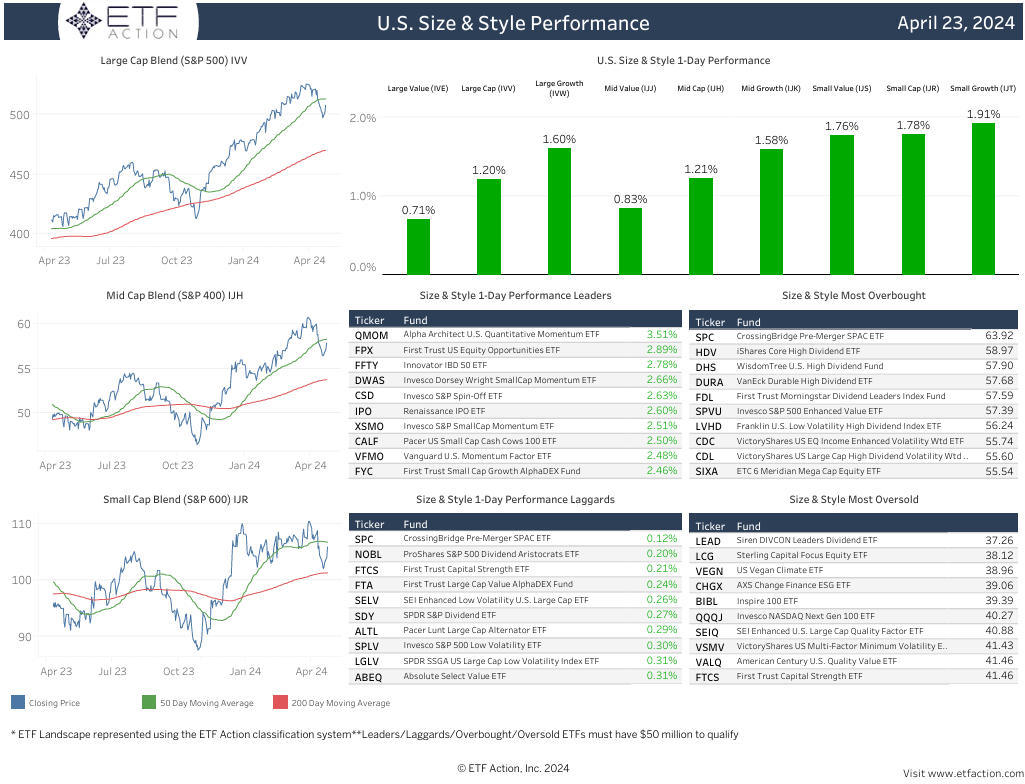

- The NASDAQ 100 (QQQ) rose 1.01% and exited oversold territory, the S&P 500 (SPY) gained 92 bps, and the Dow Jones Industrial Average (DIA) added 68 bps

- Mid-Caps (IJH) also jumped 1.03% while Small-Caps (IJR) increased 86 bps

- All U.S. factor strategies saw gains yesterday, Momentum (SPMO), High Beta (SPHB), Pure Value (RPV), Enhanced Value (SPVU), and Quality (SPHQ) all increased more than 1%

- Developed ex-U.S. Markets (EFA) and Emerging Markets (EEM) advanced 1.17% and 1.08%, respectively

- EFA was lifted by South Korea (EWY, +2.22%) and Hong Kong (EWH, +1.97%)

- EEM benefitted from solid returns from Vietnam (VNM, +2.62%) and China (MCHI, +1.98%)

Sectors:

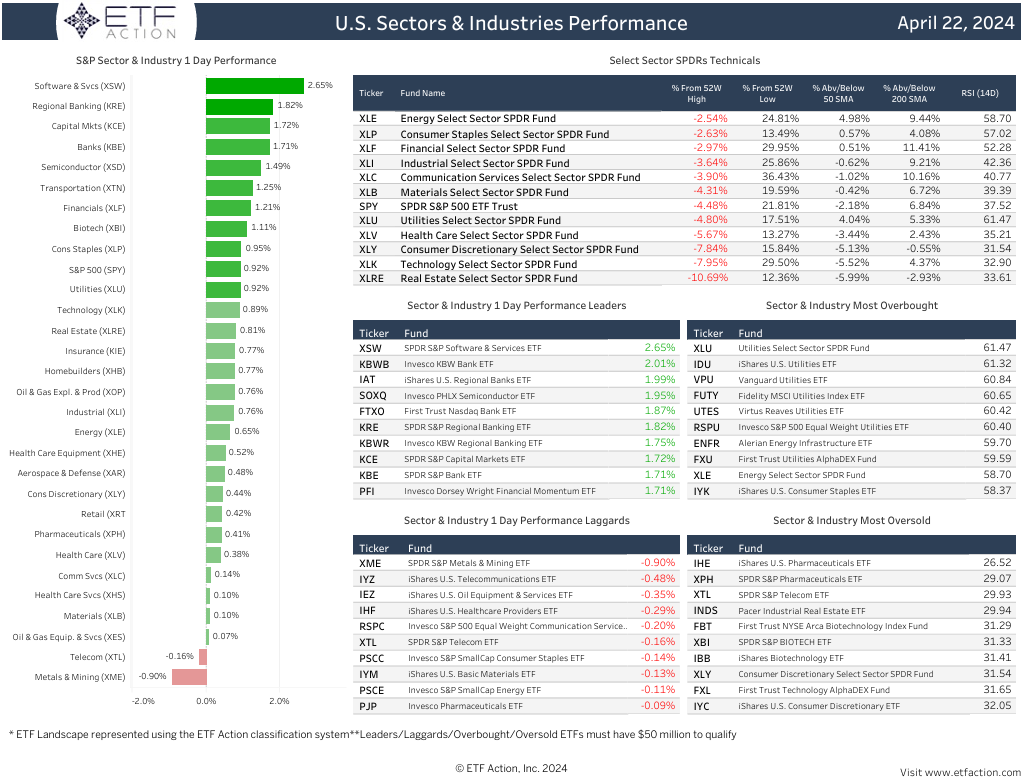

- All U.S. sectors finished higher on Monday, led by Financials (XLF, +1.21%)

- XLF was bolstered by Regional Banks (KRE, +1.82%) and Banks (KBE, +1.71%)

- Consumer Staples (XLP), Utilities (XLU), and Technology (XLK) were all up around 90 bps, Real Estate (XLRE) and Industrials (XLI) gained around 80 bps

- Materials (XLB) lagged, adding just 10 bps. XLB was impacted by Metals & Mining (XME), which slipped 90 bps

- XLRE, XLK, and Consumer Discretionary (XLY) exited oversold territory

Themes:

- Just 3 global thematic segments were in the red yesterday: Cannabis (MJ, -1.34%), Advanced Materials (REMX, -90 bps), and Space (UFO, -33 bps)

- Blockchain (BLOK) was the best performing segment, jumping 3.84%

- FinTech (FINX) was up 2%, eSports & Video Games (ESPO), Disruptive Tech (ARKW), Mobile Payments (IPAY), and Multi-Theme (ARKK) were all up more than 1.40%

- Evolving Consumer (SOCL, +1.33%), Genomics (ARKG, +1.29%), and Cloud Computing (SKYY, +1.24%) were also strong

- The Valkyrie Bitcoin Miners ETF (WGMI) and the VanEck Digital Transformation ETF (DAPP) each surged more than 10% on the day

Commodities & Yields:

- Broad Commodities (DJP) dipped 12 bps, pulled lower by Precious Metals (DBP, -2.98%) and Agriculture (DBA, -1.21%)

- Silver (SLV) sank 4.85% and Gold (GLD) slipped 2.47% while Wheat (WEAT) and Natural Gas (UNG) both gained more than 3.5%

- U.S. Aggregate Bonds (AGG) added 6 bps, Preferred Income & Securities (PFF) rose 49 bps, and the U.S. Dollar (UUP) inched higher by 3 bps

- At the close, the U.S. 2-Year Treasury Yield stood at 4.971% and the U.S. 10-Year Treasury Yield stood at 4.613%

Daily Note

4.21.2024

The losing streak continued for the NASDAQ 100 (QQQ) and the S&P 500 (SPY) on Friday as Nvidia plunged 10% and Netflix declined more than 9%. QQQ and SPY both finished lower last week. The Dow Jones Industrial Average (DIA) saw positive returns on Friday and for last week. DIA was lifted by American Express, which jumped more than 5% following stronger-than-expected earnings results. Super Micro Computer, another semiconductor name, plummeted more than 20% on Friday, a sign that investors were rotating heavily out of the sector that led the recent bull market. Chicago Federal Reserve President Austan Goolsbee said Friday that inflation progress has “stalled,” meaning policymakers likely will have to be patient before cutting interest rates. According to the CME FedWatch Tool, there is a 3.2% probability of a rate cut at the May FOMC meeting and a 16.6% probability of a rate cut at the July meeting. This week, investors will be looking towards New Home Sales data, Durable Goods Orders figures, an update on U.S. GDP, Pending Home Sales data, and the Personal Consumption Expenditures (PCE) report.

Equities:

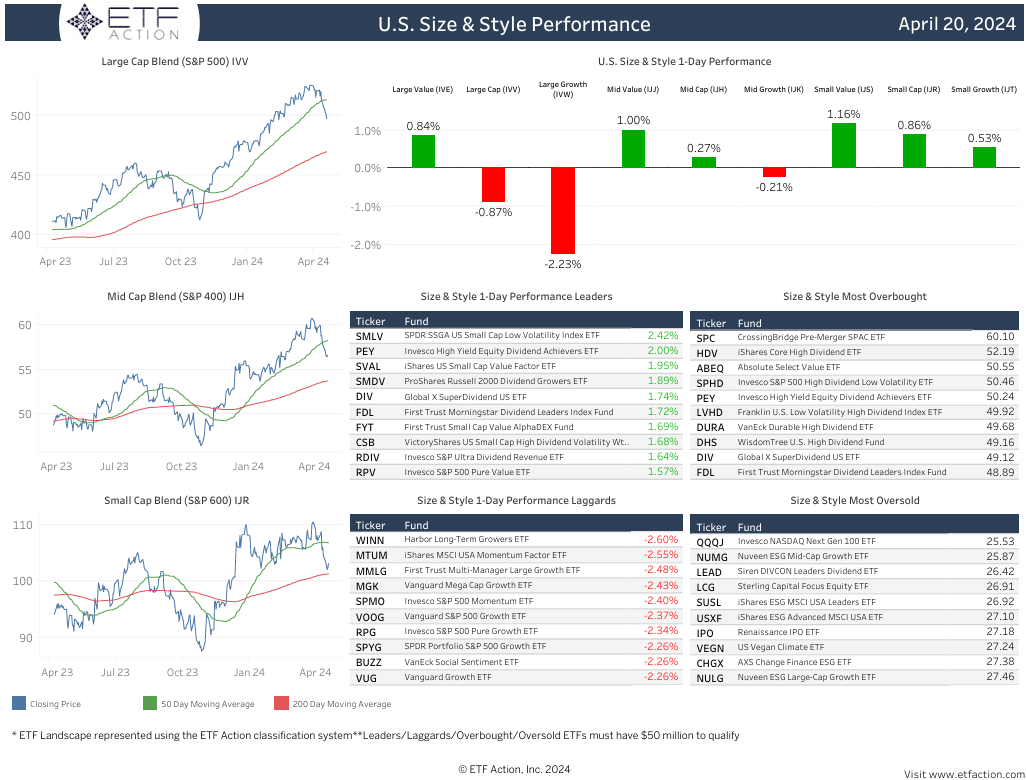

- On Friday, QQQ fell 2.07%, SPY sank 87 bps, and DIA added 57 bps

- QQQ and SPY were down 5.39% and 3.07%, respectively, last week while DIA inched higher by 3 bps

- QQQ entered oversold territory, all three major averages trading below relative 50-day moving averages but above relative 200-day moving averages

- Pure Value (RPV), Dividend (SPYD), and Low Volatility (SPLV) were all up more than 1% on Friday, Momentum (SPMO), Pure Growth (RPG), and Growth (SPYG) all slipped more than 2%

- Most factors were in the red last week, SPMO, RPG, and SPYG all declined more than 5%

- RPG is the only factor strategy sitting in oversold territory

- Developed ex-U.S. Markets (EFA) added 4 bps on Friday with Switzerland (EWL) climbing 1.15%

- Emerging Markets (EEM, 40 bps) were pulled lower by Taiwan (EWT, -2.10%) and Thailand (THD, -1.63%)

- EFA dipped 2.02% and EEM dropped 1.45% for the week

Sectors:

- Technology (XLK, -2.06%) underperformed once again on Friday, dragged lower by Semiconductors (XSD, -3.13%)

- Communication Services (XLC) fell 1.10% and Consumer Discretionary (XLY) slipped 88 bps

- Utilities (XLU, +1.54%), Financials (XLF, +1.38%), Energy (XLE, +1.20%), and Consumer Staples (XLP, +98 bps) were the top performers on the day

- XLF was boosted by Regional Banks (KRE, +2.62%) and Banks (KBE, +2.33%)

- Most sectors saw losses last week, XLK was down 6.27% and XLY dropped 4.15%

- XLU and XLP each gained more than 1% for the week

- XLK, XLY, and Real Estate (XLRE) all sit in oversold territory

Themes:

- Most global thematic segments posted negative returns on Friday

- Big Data (AIQ), Connectivity (FIVG), Disruptive Tech (ARKW), and Multi-Theme (ARKK) all sank more than 2%

- 3D Printing (PRNT) rose 92 bps and Digital Infrastructure (SRVR) added 81 bps

- All segments declined more than 1% last week with most dropping more than 3%

- Genomics (ARKG) and ARKK both plunged nearly 10% while Clean Energy (PBW) fell 8.74%

- 13 of the 28 segments sit in oversold territory, PBW and Solar (TAN) trading at 52-week lows

Commodities & Yields:

- Broad Commodities (DJP) climbed 1.05% on Friday, lifted by Copper (CPER, +1.15%) and Agriculture (DBA, +2.24%)

- Industrial Metals (DBB) have jumped 13.55% in the past month and DBA has risen 12.57%

- The U.S. Dollar (UUP) was flat on Friday, U.S. Aggregate Bonds (AGG) added 10 bps, and Preferred & Income Securities (PFF) gained 59 bps

- At Friday’s close, the U.S. 2-Year Treasury Yield stood at 4.990% and the U.S. 10-Year Treasury Yield stood at 4.647%

Daily Note

4.19.2024

Mixed session for U.S. equity markets on Thursday as treasury yields moved higher once again. The U.S. 2-Year jumped up back near 5% and the U.S. 10-Year rose close to 4.65% intraday yesterday. On the economic front, the Philadelphia Federal Reserve’s manufacturing index rose to 15.5 for the month, up more than 12 points from March and better than 2.5 estimate. Initial filings for unemployment claims held steady at 212K for the week ended April 13, indicating that companies remain reluctant to lay off workers. Existing home sales fell 4.3% on the month to a seasonally adjusted rate of 4.19 million, compared to the estimates for a decline of 4.8% and a total level of 4.17 million. The median existing home price jumped to $393,500 and inventory increased 1.11 million to the equivalent of 3.2 months of supply. Netflix topped quarterly earnings and revenue estimates and announced it will no longer report quarterly membership numbers or average revenue per user starting next year. Total memberships rose 16% in the first quarter, reaching 269.6 million, well above expectations.

Equities:

- The NASDAQ 100 (QQQ) and the S&P 500 (SPY) fell 57 bps and 21 bps, respectively, while the Dow Jones Industrial Average (DIA) added 10 bps

- 5th consecutive losing session for SPY

- All 3 major averages on pace for another losing week this week

- Growth-oriented pockets of the markets lagged yet again, S&P 500 Pure Growth (RPG, -67 bps), S&P 500 Momentum (SPMO, -60 bps), and S&P 500 Growth (SPYG, -51 bps)

- S&P 500 Pure Value (RPV) and S&P 500 Dividend (SPYD) both advanced 42 bps

- Emerging Markets (EEM) rose 40 bps on strength from China (MCHI, +1.28%)

- Developed ex-U.S. Markets (EFA, -27 bps) dragged lower by Australia (EWA, -85 bps) and the Netherlands (EWN, -63 bps)

Sectors:

- Technology (XLK, -1.14%) was the worst performing U.S. sector for the 2nd consecutive session, impacted by Semiconductors (XSD, -1.99%)

- Consumer Discretionary (XLY) declined 62 bps, Industrials (XLI) and Energy (XLE) each dropped more than 30 bps

- Utilities (XLU), Communication Services (XLC), and Consumer Staples (XLP) all climbed around 50 bps, Financials (XLF) also added 35 bps

- Real Estate (XLRE) and Health Care (XLV) remain in oversold territory

Themes:

- Another mixed session for global thematic themes yesterday, Evolving Consumer (SOCL, +2.07%) and Cannabis (MJ, +1.06%) were top performers

- Clean Energy (PBW) sank 2.05% to fresh 52-week lows

- Advanced Materials (REMX), Biotech (SBIO), and Solar (TAN) all dropped at least 1%

- TAN also hit new 52-week lows and is nearing oversold territory

Commodities & Yields:

- U.S. Aggregate Bonds (AGG, -28 bps), 20+ Year Treasury Bonds (TLT, -50 bps), U.S. Dollar (UUP, +21 bps)

- At the close, the U.S. 2-Year Treasury Yield stood at 4.988% and the U.S. 10-Year Treasury Yield stood at 4.637%.

- Broad Commodities (DJP) dipped 4 bps despite solid returns from Agriculture (DBA, +2.05%) and Industrial Metals (DBB, +1.36%)

Daily Note

4.18.2024

Equities: U.S. equity markets finished lower yesterday with the NASDAQ 100 (QQQ) declining 1.22%, the S&P 500 (SPY) falling 59 bps, and the Dow Jones Industrial Average (DIA) dipping 14 bps. All three major average are approaching oversold territory and are now trading more than 2% below relative 50-day moving averages. Mid-Caps (IJH) and Small-Caps (IJR) also dropped more than 80 bps. According to the latest Beige Book report filed Wednesday, the U.S. economy grew “slightly” over the past six weeks while price increases moved at a “modest” pace and employment showed “slight” gains as well. The Federal Reserve also noted that consumer spending “barely increased”, that home sales “strengthened” across most areas, and characterized the economic outlook as “cautiously optimistic.” Earnings wise, United Airlines surged more than 17% on the day after posting a narrower-than-expected loss and beating on revenue while J.B. Hunt Transport Services dropped more than 8% after missing analysts’ expectations on the top and bottom lines. Existing Home Sales figures and Jobless Claims data will be released on Thursday along with a slew of speeches from Federal Reserve officials.

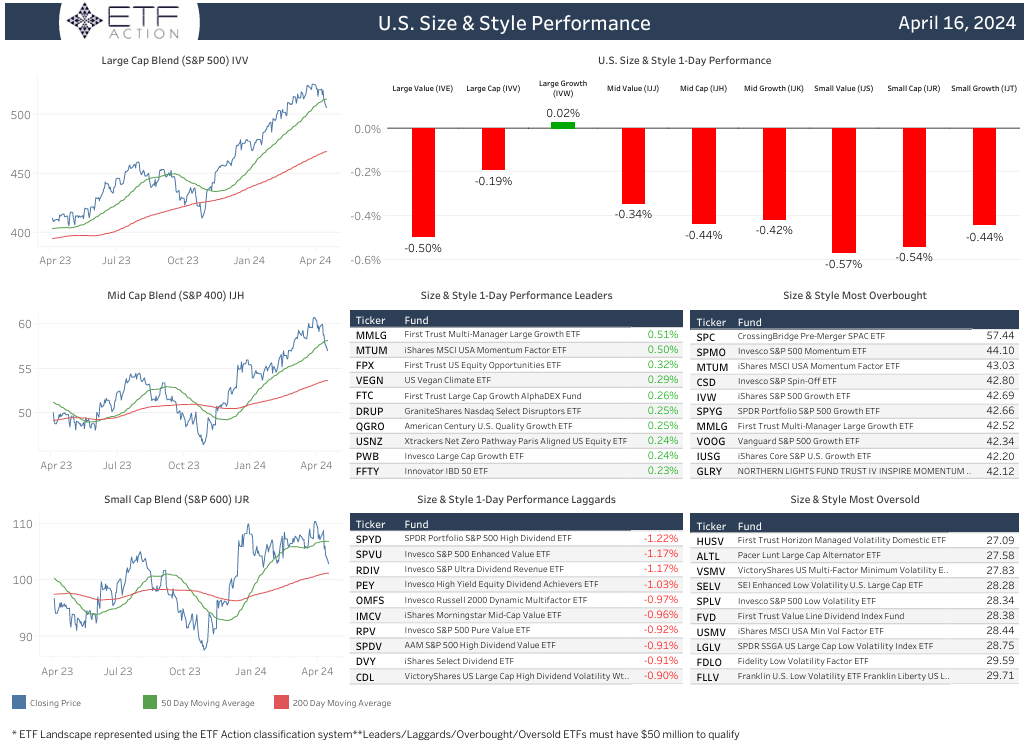

U.S. factor strategies were mixed on Wednesday. S&P 500 High Dividend Low Volatility (SPHD) was up 62 bps while S&P 500 Dividend (SPYD) and S&P 500 Pure Value (RPV) rose around 50 bps. Growth-oriented pockets of the markets lagged once again with S&P 500 Pure Growth (RPG) sinking 1.37% and S&P 500 Momentum (SPMO) declining 1.22%. S&P 500 Growth (SPYG) also dipped 97 bps and S&P 500 Quality (SPHQ) slipped 95 bps. Developed ex-U.S. Markets (EFA) added 7 bps, buoyed by Australia (EWA, +1.12%). The Netherlands (EWN) and Japan (EWJ) both sank more than 1%. Emerging Markets (EEM, -8 bps) were pulled lower by Thailand (THD, -1.42%).

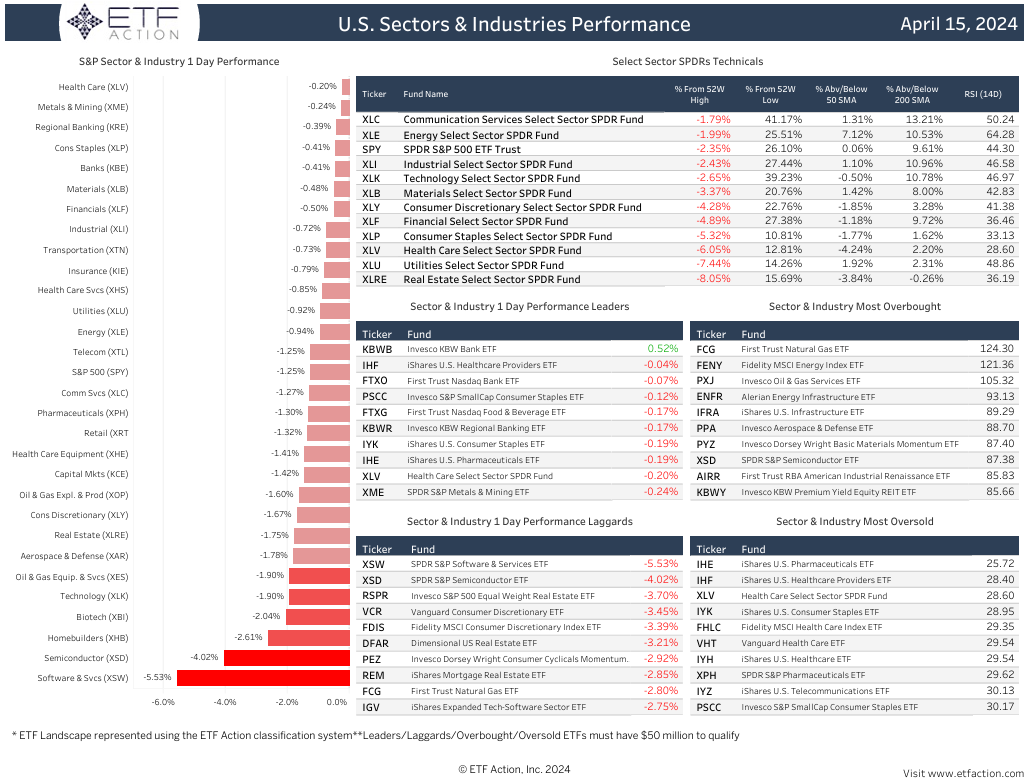

Sectors: Just 4 of the 11 U.S. sectors registered positive returns yesterday with Utilities (XLU) popping 2.09%. Consumer Staples (XLP) rose 37 bps while Financials (XLF) and Materials (XLB) both increased just over 20 bps. Technology (XLK) underperformed, falling 1.44% on weakness from Semiconductors (XSD, -2.18%). Real Estate (XLRE) also declined 83 bps, Consumer Discretionary (XLY) dropped 48 bps, and Energy (XLE) sank 29 bps. Health Care (XLV, -17 bps) and Communication Services (XLC, 9 bps) saw modest losses on the day. XLU and XLE are the only sectors trading above relative 50-day and 200-day moving averages.

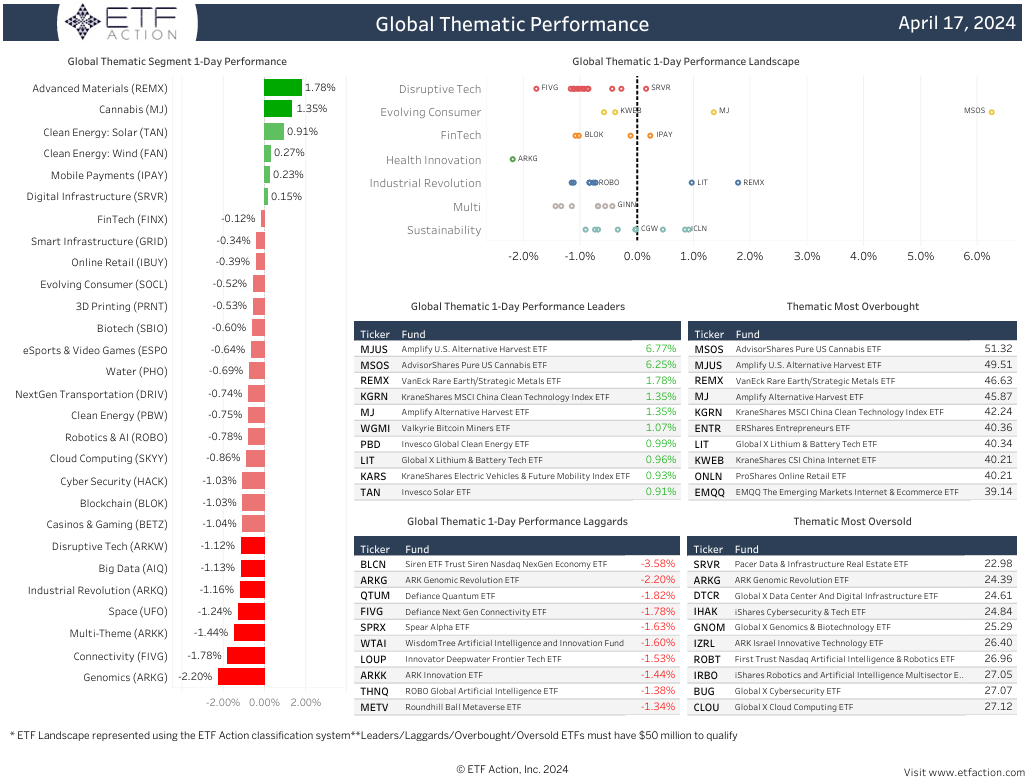

Themes: Most global thematic segments were in negative territory on Wednesday with Genomics (ARKG, -2.20%) falling the furthest. Connectivity (FIVG), Multi-Theme (ARKK), Space (UFO), Industrial Revolution (ARKQ), Big Data (AIQ), Disruptive Tech (ARKW), Casinos & Gaming (BETZ), Blockchain (BLOK), and Cyber Security (HACK) were all down more than 1%. Advanced Materials (REMX) and Cannabis (MJ) were the best performing segments, climbing 1.78% and 1.35%, respectively. Solar (TAN, +91 bps) also rose off 52-week highs. The Amplify U.S. Alternative Harvest ETF (MJUS) and the AdvisorShares Pure US Cannabis ETF (MSOS) both jumped more than 6% on the day.

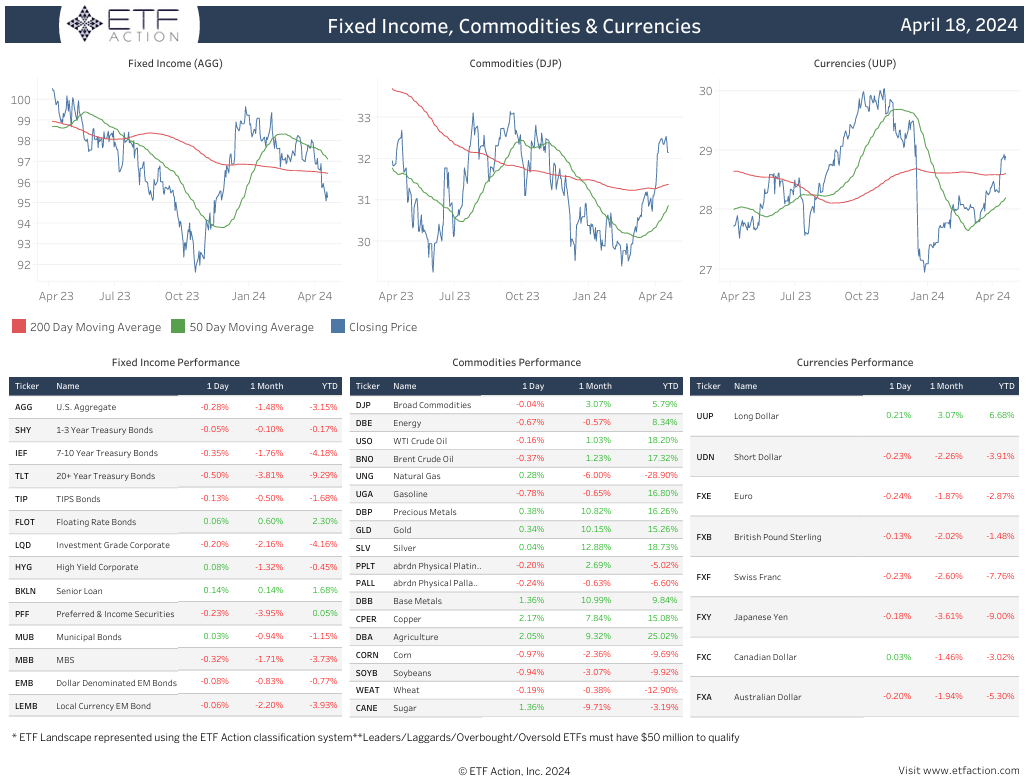

Commodities & Yields: At yesterday’s close, the U.S. 2-Year Treasury Yield stood at 4.932% and the U.S. 10-Year Treasury Yield stood at 4.859%. The U.S. Dollar (UUP) slipped 31 bps, U.S. Aggregate Bonds (AGG) increased 46 bps, and 20+ Year Treasury Bonds gained 1.11%. Broad Commodities (DJP, -77 bps) were pulled lower by Energy (DBE), which sank 2.65%. WTI Crude Oil (USO) and Gasoline (UGA) were both down around 3%. Agriculture (DBA) and Industrial Metals (DBB) were both up around 1.30%.

Daily Note

4.17.2024

Equities: Mixed session for U.S. equity markets on Tuesday as investors digested fresh commentary from Federal Reserve Chairman Jerome Powell. The Dow Jones Industrial Average (DIA) advanced 18 bps and the NASDAQ 100 (QQQ) added 1 bps while the S&P 500 (SPY) declined 18 bps. Powell stated yesterday that the U.S. economy, while otherwise strong, has not seen inflation come back to the central bank’s goal, pointing to the further likelihood that interest rates will not be cut any time soon. Since July 2023, the Fed has kept its benchmark interest rate in a target range between 5.25%-5.5%, the highest in 23 years. That was the result of 11 consecutive rate hikes that began in March 2022. The U.S. 2-Year spiked above 5.0% and the U.S. 10-Year jumped near 4.70% intraday following the remarks. In other economic news, industrial production rose 0.4% in March but fell 1.8% in Q1 while housing starts and building permits both missed expectations. On the earnings front, Morgan Stanley posted stronger-than-expected earnings and revenue results while Bank of America reported that profit fell 18% from the previous year and revenue slipped 1.6%. Johnson & Johnson reported mixed results and UnitedHealth handily topped revenue expectations for the quarter. Investors will be looking towards the release of the Beige Book on Wednesday in addition to a handful of speeches from Fed officials.

Just 3 U.S. factor strategies were in the green yesterday: S&P 500 Pure Growth (RPG, +17 bps), S&P 500 Growth (SPYG, +3 bps), and S&P 500 Quality (SPHQ, +2 bps). S&P 500 Dividend (SPYD) and S&P 500 Enhanced Value (SPVU) both around 1.20% while S&P 500 Pure Value (RPV) decreased 92 bps. Emerging Markets (EEM, -1.32%) were dragged lower by Indonesia (EIDO, -2.93%), Mexico (EWW, -2.51%), Brazil (EWZ, -2.37%), and Taiwan (EWT, -2.27%). Developed ex-U.S. Markets (EFA) tumbled 99 bps on weakness from Australia (EWA, -2.06%), Hong Kong (EWH, -1.87%), and South Korea (EWY, -1.56%). EFA and EEM are approaching oversold territory.

Sectors: Real Estate (XLRE) underperformed other U.S. sectors once again on Tuesday, slipping 1.53%. XLRE entered oversold territory and has fallen 7% in the past month. Utilities (XLU) declined 1.32%, Energy (XLE) dropped 87 bps, and Materials (XLB) slid 77 bps. Financials (XLF, -68 bps) and Consumer Discretionary (XLY, -57 bps) were also weak. XLF was impacted by Banks (KBE) and Regional Banks (KRE), which both decreased more than 1.25%. Technology (XLK) gained 12 bps. Consumer Staples (XLP) and Health Care (XLV) were the only other sectors in positive territory on the day, each adding 4 bps.

Themes: Global themes continued to lag broader markets yesterday with just 3 segments posting modest gains: eSports & Video Games (ESPO, +13 bps), Cloud Computing (SKYY, +12 bps), and Connectivity (FIVG, +12 bps). Genomics (ARKG) and Advanced Materials (REMX) were the worst performing segments, slipping 3.17% and 2.94%, respectively. Solar (TAN, -2.12%) and Clean Energy (PBW, -1.81%) each hit fresh 52-week lows while Digital Infrastructure (SRVR, -1.78%) continued to fall further into oversold territory and Multi-Theme (ARKK) declined 1.64%. Cannabis (MJ) is the only segment trading above its 50-day moving average.

Commodities & Yields: Broad Commodities (DJP) fell 40 bps on Tuesday as Agriculture (DBA) tumbled 2.30% and Industrial Metals (DBB) dropped 91 bps. Soybean (SOYB), Sugar (CANE), and Copper (CPER) were all down more than 1% and Silver (SLV) decreased 2.31%. U.S. Aggregate Bonds (AGG) sank 28 bps, 20+ Year Treasury Bonds (TLT) retreated 66 bps, and the U.S. Dollar (UUP) added 14 bps. At yesterday’s closing bell, the U.S. 2-Year Treasury Yield stood at4.964% and the U.S. 10-Year Treasury Yield stood at 4.657%.

Daily Note

4.16.2024

Equities: After another losing week last week, U.S. equity markets continued to push lower on Monday with the NASDAQ 100 (QQQ) slipping 1.65%, the S&P 500 (SPY) falling 1.25%, and the Dow Jones Industrial Average (DIA) retreating 65 bps. Small-Caps (IJR) and Mid-Caps (IJH) were also down around 1%. Markets faced pressure from stubborn treasury yields that continue to rise. The U.S. 2-Year advanced above 4.95% while the U.S. 10-Year jumped above 4.65% intraday yesterday. The Commerce Department reported on Monday that retail sales increased 0.7% month-over-month in March, well above the +0.3% estimate but below the upwardly revised +0.9% February figure. Year-over-year, sales rose 4.0%. The results indicate that consumers more than kept up with the pace of inflation as the Consumer Price Index (CPI) increased 3.5% for the year. Separately, Salesforce declined more than 7% yesterday following reports that the software company was in talks to acquire data management firm Informatica. Goldman Sachs climbed almost 3% on the day after topping earnings and revenue expectations. Revenue jumped 16% from the previous year to $14.21 billion, topping analysts’ estimates by more than $1 billion. On Tuesday, Housing Starts & Permits data will be released and Fed Chair Jerome Powell is scheduled to speak.

Growth-oriented pockets of the markets underperformed yesterday with S&P 500 Growth (SPYG) sliding 1.79%, S&P 500 Pure Growth (RPG) dropping 1.66%, and S&P 500 Momentum (SPMO) declining 1.51%. All other U.S. factor strategies were also in the red. S&P 500 Enhanced Value (SPVU) dipped just 18 bps. Emerging Markets (EEM) decreased 64 bps as South Africa (EZA) fell 1.59%. Taiwan (EWT) and Brazil (EWZ) were both down 1.47% as well while Mexico (EWW) dipped 1.31%. Developed ex-U.S. Markets (EFA) sank 30 bps, pulled lower by Hong Kong (EWH, -1.39%) and Australia (EWA, -71 bps).

Sectors: Technology (XLK) and Real Estate (XLRE) were the worst performing U.S. sectors on Monday, sinking 1.90% and 1.75%, respectively. XLK was impacted by Software & Services (XSW, -5.53%) and Semiconductors (XSD, -4.02%) while XLRE was dragged lower by Homebuilders (XHB, -2.61%). XLRE is the only sector trading below its 50-day and 200-day moving average and is nearing oversold territory. Consumer Discretionary (XLY) also dropped 1.67% and Communication Services (XLC) slipped 1.27% while Energy (XLE) and Utilities (XLU) both fell more than 90 bps. Health Care (XLV) saw the best returns on the day, dipping 20 bps.

Themes: All global thematic segments finished in negative territory on Monday with most dropping more than 1.50%. Multi-Theme (ARKK, -4.58%) and Disruptive Tech (ARKW, -4.33%) fell the furthest. Blockchain (BLOK) was down 3.93%, Genomics (ARKG) declined 3.86%, and Solar (TAN) dipped 3.31%. TAN hit fresh 52-week lows while ARKG entered oversold territory, joining Digital Infrastructure (SRVR, -1.52%) and Space (UFO, -2.29%). Clean Energy (PBW) also decreased 2.66% to new 52-week lows. Online Retail (IBUY), Cyber Security (HACK), Cloud Computing (SKYY), and Industrial Revolution (ARKQ) were all down more than 2.35%. Water (PHO) dipped 61 bps and was the top performing segment.

Commodities & Yields: The U.S. Dollar (UUP) added 17 bps, U.S. Aggregate Bonds (AGG) declined 60 bps, and Preferred & Income Securities (PFF) dropped 1.71% yesterday. At Monday’s close, the U.S. 2-Year Treasury Yield stood at 4.938% and the U.S. 10-Year Treasury Yield stood at 4.606%. Broad Commodities (DJP) gained 59 bps, bolstered by Industrial Metals (DBB, +1.44%) and Precious Metals (DBP, +2.03%). Silver (SLV) added 3.04%, Gold (GLD) rose 1.87%, and Copper (CPER) jumped 2.40%. Natural Gas (UNG) fell 5.04%.

Daily Note

4.15.2024

Equities: U.S. equity markets tumbled on Friday with the NASDAQ 100 (QQQ) slipping 1.59%, the S&P 500 (SPY) falling 1.38%, and the Dow Jones Industrial Average (DIA) declining 1.21%. All three major averages finished lower last week as DIA dropped 2.31%, SPY decreased 1.46%, and QQQ dipped 50 bps. Small-Caps (IJR) and Mid-Caps (IJH) were also down more than 1.50% on Friday and sank around 2.90% last week. JPMorgan Chase retreated more than 6% on Friday after reporting that net interest income, a key measure of what it makes through lending activities, could be a little short of what Wall Street analysts are expecting in 2024. CEO Jamie Dimon also warned about persistent inflationary pressures weighing on the economy. According to the University of Michigan’s consumer sentiment index, consumers are also growing worried about the persistent inflationary pressures. The index came in at 77.9 for April, which is below the 79.9 consensus estimate. Year-ahead and long-run inflation expectations also ticked up, reflecting frustrations over sticky inflation. This week, investors will be looking towards Retail Sales data, Housing Starts & Permits figures. The Industrial Production report, and Existing Home Sales results. Fed Chairman Jerome Powell will also speak on Tuesday.

All U.S. factor strategies were in the red on Friday and for last week. S&P 500 Low Volatility (SPLV, -79 bps) was the only factor to decline less than 1% On Friday while S&P 500 High Beta (SPHB) slid 2.40% and S&P 500 Pure Growth (RPG) dropped 2.04%. S&P 500 Pure Value (RPV) was the worst performing factor last week, slipping nearly 4%. Most factors were down more than 2% for the week. Developed ex-U.S. Markets (EFA) retreated 1.62% on Friday as South Korea (EWY) and Hong Kong (EWH) both sank more than 3%. Emerging Markets (EEM, -2.29%) were pulled lower by China (MCHI, -3.11%) and South Africa (EZA, -2.70%). EEM and EFA both fell around 2% last week.

Sectors: Utilities (XLU, -76 bps) was the only U.S. sector to sink less than 1% on Friday. Materials (XLB) saw the worst returns, slipping 1.77%. Communication Services (XLC), Energy (XLE, -1.63%), Consumer Discretionary (XLY), and Technology (XLK) all fell more than 1.60% while Health Care (XLV) dropped 1.49% and Financials (XLF) declined 1.33%. XLV was dragged lower by Biotech (XBI, 3.43%) and Pharmaceuticals (XPH, -3.00%). XLV also entered oversold territory and is now trading more than 4% below its 50-day moving average. All sectors posted losses last week with XLF, XLB, and XLV all decreasing more than 3%. XLK dipped just 50 bps on the week.

Themes: All global thematic segments were down more than 1% on Friday. Cannabis (MJ) underperformed, plunging 4.99%, while Advanced Materials (REMX) and Clean Energy (PBW) each declined more than 4%. PBW hit new 52-week lows. Solar (TAN), Blockchain (BLOK), Multi-Theme (ARKK), Genomics (ARKG), Disruptive Tech (ARKW), Biotech (SBIO), and 3D Printing (PRNT) all dropped more than 3% on the day. All segments were in negative territory last week. MJ plummeted more than 11% for the week and PBW, Casinos & Gaming (BETZ), and BLOK all fell more than 4%. Most segments have also seen negative returns in the past month with ARKG retreating more than 12%.

Commodities & Yields: The U.S. Dollar (UUP) rose 80 bps, U.S. Aggregate Bonds (AGG) added 19 bps, and 20+ Year Treasury Bonds (TLT) gained 53 bps on Friday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.882% and the U.S. 10-Year Treasury Yield stood at 4.499%. Broad Commodities (DJP) dipped 2 bps on the day as Gold (GLD) fell 1.32%, Silver (SLV) dropped 1.46%, and Sugar (CANE) declined 2.30%. Corn (CORN) was also up 1.22%.

Daily Note

4.12.2024

Equities: As investors digested March’s Producer Price Index (PPI) results, U.S. equity markets were higher on Thursday with the NASDAQ 100 (QQQ) climbing 1.60% to new 52-week highs and the S&P 500 (SPY) advancing 76 bps. The Dow Jones Industrial Average (DIA) inched higher by just 1 bps while Small-Caps (IJR) added 43 bps and Mid-Caps (IJH) rose 5 bps. The Labor Department reported yesterday that the PPI, a measure of inflation at the wholesale level, increased 0.2% for the month, less than the +0.3% consensus estimate. However, on a 12-month basis, the PPI rose 2.1%, the biggest gain since April 2023, indicating pipeline pressures that could keep inflation elevated. Excluding food and energy, the core PPI also rose 0.2% for the month and 2.4% for the year. Treasury yields were steady on Thursday with the U.S. 2-Year hovering around 4.95% and the U.S. 10-Year trading above 4.55% intraday. Separately, initial filings for jobless benefits dropped 11K from the previous week to 211K, which was below the 217K estimate. On Friday, investors will be looking towards Import & Export Prices figures along with Consumer Sentiment data. Several banks will report earnings Friday, including JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, and State Street.

Most U.S. factor strategies saw negative returns yesterday with S&P 500 Value + Momentum (SPVM) dropping 96 bps. S&P 500 Enhanced Value (SPVU) and S&P 500 Low Volatility (SPLV) both slipped more than 80 bps. Growth-oriented pockets of the markets outperformed with S&P 500 Momentum (SPMO), S&P 500 Growth (SPYG), and S&P 500 Pure Growth (RPG) all gaining more than 1.40%. Emerging Markets (EEM) increased 61 bps as South Africa (EZA) jumped 1.40% and China (MCHI) rose 77 bps. Developed ex-U.S. Markets (EFA, +27 bps) were lifted by South Korea (EWY, +2.48%) and Japan (EWJ, +88 bps).

Sectors: Technology (XLK) surged 2.00% on Thursday and outpaced other U.S. sectors. XLK was bolstered by Semiconductors (XSD, +2.34%). Communication Services (XLC) and Consumer Discretionary (XLY) each climbed more than 80 bps while Industrials (XLI) and Real Estate (XLRE) each added 11 bps. XLC sits just 14 bps from new 52-week highs. Financials (XLF) lagged, falling 71 bps as Insurance (KIE) declined another 2.71%. Health Care (XLV) dropped 41 bps, Consumer Staples (XLP) sank 24 bps, and Utilities (XLU) retreated 20 bps. XLV continues to move closer to oversold territory.

Themes: Biotech (SBIO, +2.01%) was the top performing global thematic segment yesterday. Most segments were in the green with Connectivity (FIVG), Big Data (AIQ), Multi-Theme (ARKK), and Disruptive Tech (ARKW) all rising around 1.50%. Advanced Materials (REMX), Biotech (SBIO), Online Retail (IBUY), Industrial Revolution (ARKQ), and Cloud Computing (SKYY) were all up more than 1%. Cannabis (MJ) declined 99 bps on the day but is still up more than 25% over the past month. Solar (TAN) was down 66 bps while Clean Energy (PBW) and 3D Printing (PRNT) both sank around 30 bps.

Commodities & Yields: U.S. Aggregate Bonds (AGG) added 2 bps, 20+ Year Treasury Bonds (TLT) declined 45 bps, and the U.S. Dollar (UUP) increased 7 bps yesterday. At the closing bell, the U.S. 2-Year Treasury Yield stood at 4.965% and the U.S. 10-Year Treasury Yield stood at 4.593%. Broad Commodities (DJP) dropped 26 bps as Natural Gas (UING) slipped 5.23%, Gold (GLD) popped 1.94%, and Wheat (WEAT) decreased 1.48%.

Daily Note

4.11.2024

Equities: Following a hotter-than-expected Consumer Price Index (CPI) report, equity markets finished sharply lower on Wednesday. The Dow Jones Industrial Average (DIA) declined 1.11%, the S&P 500 (SPY) fell 1.00%, and the NASDAQ 100 (QQQ) sank 87 bps. Mid-Caps (IJH) also dropped 2.03% while Small-Caps (IJR) retreated nearly 3%. The Labor Department reported yesterday that the core CPI rose 0.4% month-over-month and 3.5% year-over-year in March, bot figures were above estimates. Core CPI, which excludes volatile food and energy prices, increased 0.4% on the month and 3.8% for the year. Energy rose 1.1% last month after climbing 2.3% in February, while shelter costs, which make up about one third of the weighting in the CPI, were higher by 0.4% on the month and up 5.7% from a year ago. The U.S. 2-Year Treasury Yield jumped up near 5% and the U.S. 10-Year Treasury Yield surged above 4.55% intraday Wednesday after the results. The probability of a rate cut at the June meeting now stands at 19.5% and the probability of a rate cut at the July meeting now stands at 42.8%, according to the CME FedWatch Tool. The minutes for the March Federal Open Market Committee (FOMC) meeting were also released yesterday and indicated that officials remained uncertain about the persistence of high inflation. Several members expressed the view that recent data had not increased their confidence that inflation was moving sustainably down to 2%. All eyes will now be on Thursday’s Producer Price Index (PPI) report.

No U.S. factor strategies were in positive territory yesterday with most factors falling more than 1%. S&P 500 High Beta (SPHB) slumped 2.83%, S&P 500 Dividend (SPYD) dipped 2.66%, and S&P 500 Pure Value (RPV) dropped 2.05%. Developed ex-U.S. Markets (EFA) and Emerging Markets (EEM) were both down around 1.35% on the day. EFA was impacted by weakness from South Korea (EWY, -3.83%), Australia (EWA, -2.25%), and Japan (EWJ, -1.56%). EEM was pulled lower by Brazil (EWZ, -2.76%), South Africa (EZA, -2.50%), and Mexico (EWW, -1.96%).

Sectors: Energy (XLE) was the lone U.S. sector in the green on Wednesday, adding 31 bps. XLE was lifted by Oil & Gas Equipment & Services (XES, +67 bps) and Oil & Gas Exploration & Production (XOP, +34 bps), the only industries to see gains for the day. Real Estate (XLRE) plummeted 4.11% as Homebuilders (ITB) retreated 3.71%. Utilities (XLU) also declined 1.71% while Materials (XLB), Consumer Discretionary (XLY), and Financials (XLF) were all down around 1.50%. XLF was impacted by sizeable losses from Regional Banks (KRE, -4.96%) and Banks (KBE, -4.14%). Technology (XLK, -1.23%) and Health Care (XLV, -1.17%) also underperformed.

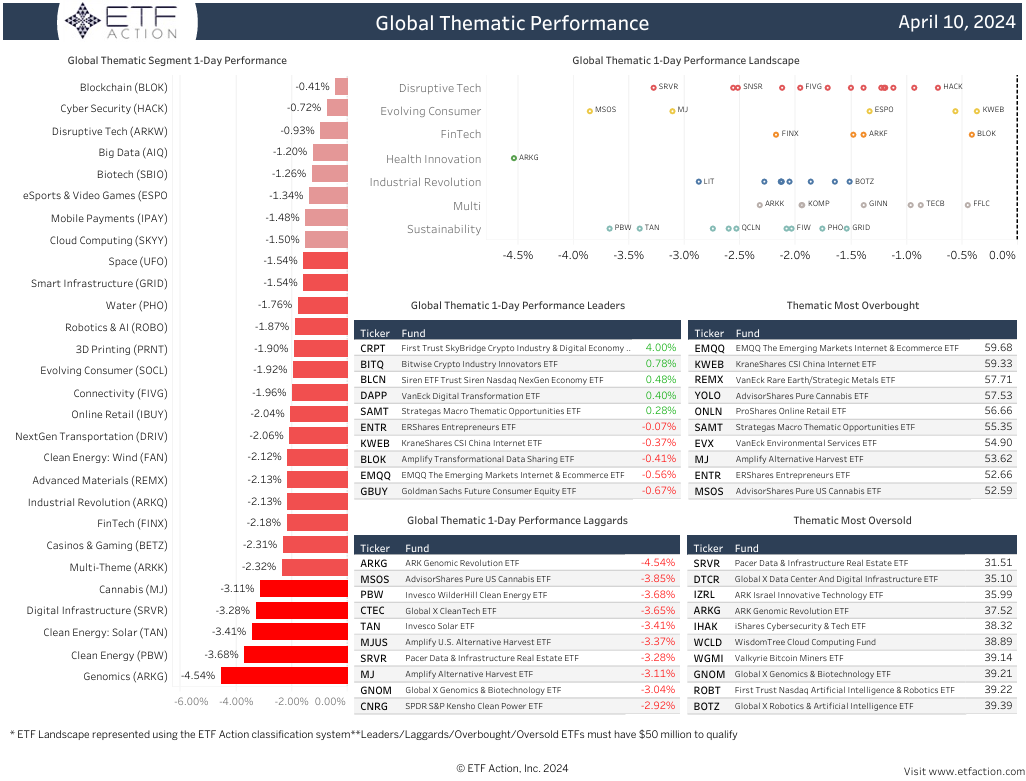

Themes: All global thematic segments posted losses yesterday with Genomics (ARKG, -4.54%) falling the furthest. Clean Energy (PBW), Solar (TAN), Digital Infrastructure (SRVR), and Cannabis (MJ) all declined more than 3% while Multi-Theme (ARKK), Casinos & Gaming (BETZ), FinTech (FINX), Industrial Revolution (ARKQ), Advanced Materials (REMX), Wind (FAN), NextGen Transportation (DRIV), and Online Retail (IBUY) all dropped more than 2%. Blockchain (BLOK) was the best performing segment of the day, adding 41 bps. SRVR and ARKG are approaching oversold territory.

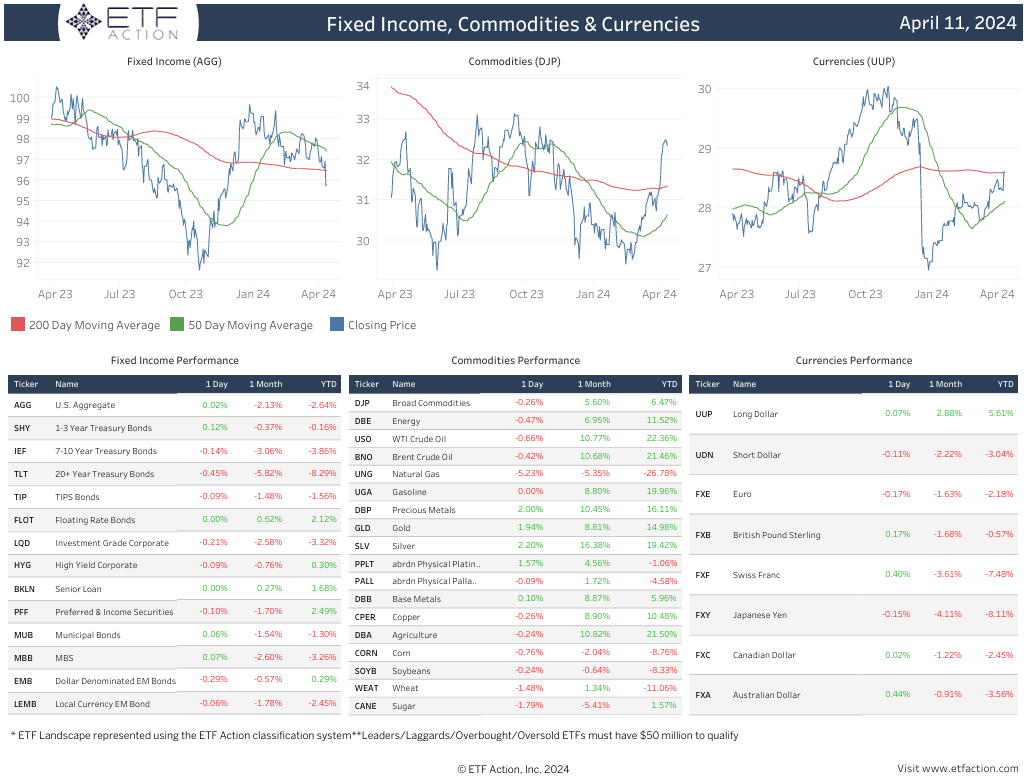

Commodities & Yields: At Wednesday’s closing bell, the U.S. 2-Year Treasury Yield stood at 4.971% and the U.S. 10-Year Treasury Yield stood at 4.550%. The U.S. Dollar (UUP) popped 1.06%, U.S. Aggregate Bonds (AGG) dropped 1.20% and 20+ Year Treasury Bonds (TLT) fell 2.18%. Broad Commodities (DJP) dipped 15 bps yesterday as Natural Gas (UNG) sank 1.14%, Gold (GLD) declined 95 bps, and Sugar (CANE) decreased 70 bps. WTI Crude Oil (USO) was up more than 1%.