Macro Briefs Archives

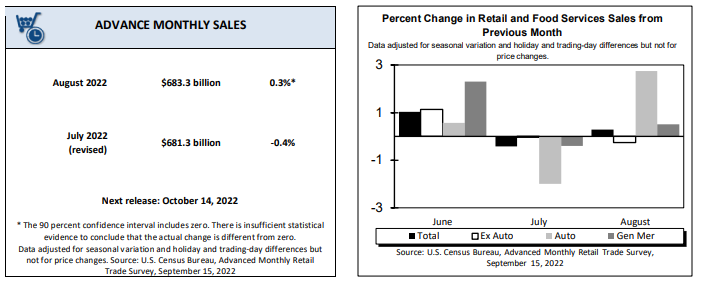

Macro Brief: Retail Sales

9.15.2022

Retail Sales increased 0.3% in August after declining 0.4% in July. 8 of 13 retail categories grew last month including a surge in sales at auto dealers

- Headline retail sales rose 0.4% to $683.3 billion in August, above consensus estimates of +0.0%

- Excluding autos & gas, sales also rose by 0.3%, below consensus estimates of +0.6%

- Sales at gas stations decreased 4.2% last month as gas prices fell to $3.70 on average per gallon according to AAA

- Gasoline stations were still up 29.3% year/year while nonstore retailers were up 11.2% year/year

- Importantly, year-over-year consumer spending is up 9.1% in August illustrating the resiliency of consumers amid rising prices

- These totals are not adjusted for inflation suggesting that spending outpaced price increases

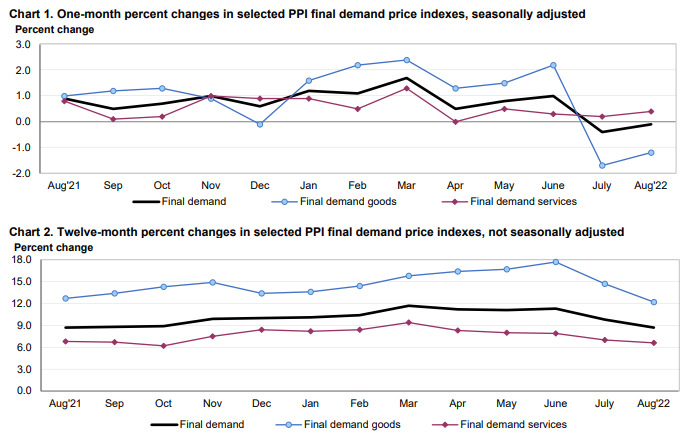

Macro Brief: Producer Price Index (PPI)

9.14.2022

The Producer Price Index (PPI) decreased 0.1% month-over-month in August, above consensus estimates of -0.4%. All eyes remain on the Federal Reserve which is expected to announce a 75 bps or 1% interest rate hike next week to battle historically high nflation

Macro Brief: CPI

9.13.2022

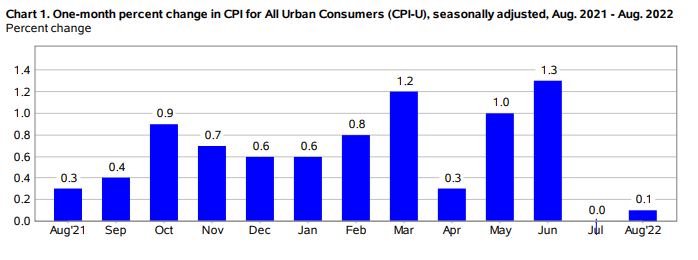

The Consumer Price Index (CPI), a key inflationary measure, increased 0.1% in August and climbed 8.3% year-over-year as higher prices for shelter and food offset a sizeable decline in gasoline prices

- Headline inflation was up 0.1% month/month in August, above consensus estimates of -0.1%

- Year-over-year, headline inflation was up 8.3%, also above consensus estimates of 8.1%

- Inflationary pressures remain near record high levels following a 1.0% jump in May and a 1.3% increase in June

- Core inflation rose 0.6% month/month, above estimates of 0.3%

- The food index increased 0.8% in August, the 21st consecutive monthly rise. Year-over-year the food index is up 11.4%, the fastest increase since May 1979

- The energy index dropped 5.0% on the month as gasoline fell 10.6% in August. Year-over-year, the energy index is up 23.8%

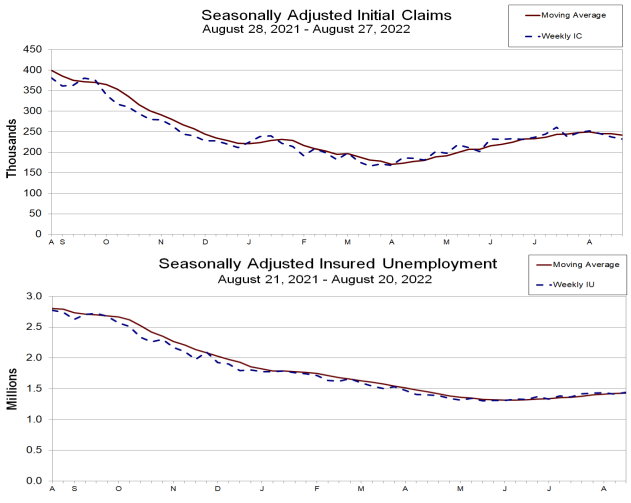

Macro Brief: Jobless Claims

9.8.2022

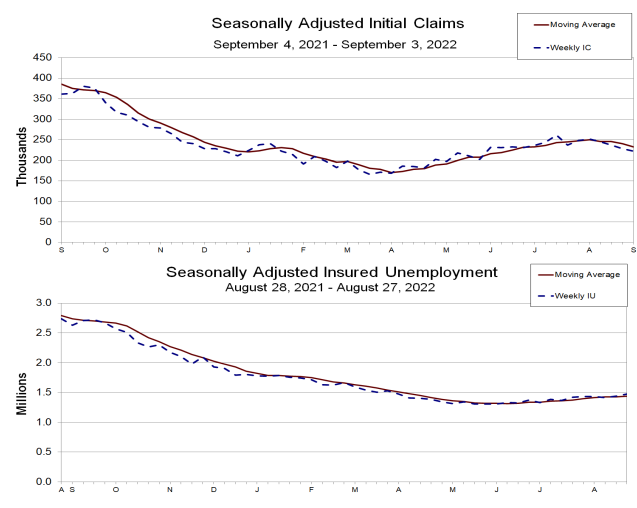

For the week ended September 3, initial jobless claims declined for the 4th consecutive week to 222K, a 3-month low

- Initial jobless claims were down 6K to 222K from the previous week's revised figures of 228K

- Continuing claims increased 36K to 1.473 million while the 4-week moving average rose 10.75K to 1.439 million

- Advance adjusted insured unemployment rate stood at 1.0%, unchanged from the previous week's figure

- The latest data is consistent with other recent gauges that show the U.S. jobs market is strong, but cooling from earlier in 2022, when hiring was more robust and layoffs were even lower

- The Federal Reserve currently has a 86% probibility of hiking another 75 bps at the September meeting according to the CME Group FedWatch Tool

Macro Brief: U.S. International Trade in Goods & Services

9.7.2022

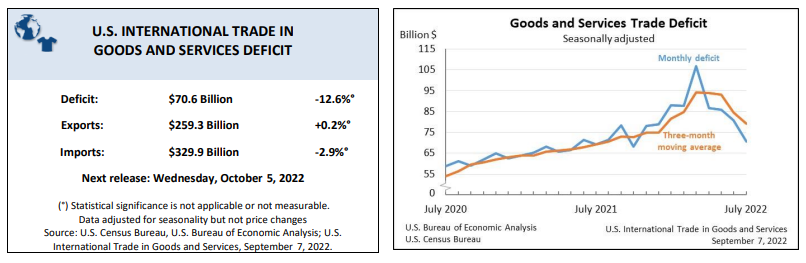

The goods and services trade deficit decreased $10.2 billion to $70.6 billion in July 2022 as the goods deficit decreased by $.2 billion to $91.1 billion while the services surplus increased $2.1 billion to $20.4 billion

Macro Brief: ISM Services

9.6.2022

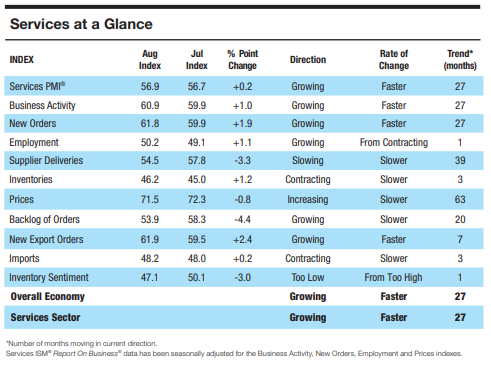

In August, the ISM Services increased just 0.2% to 56.9%, the 27th consecutive month of expansion. A reading above 50% indicates the services sector economy is generally expanding

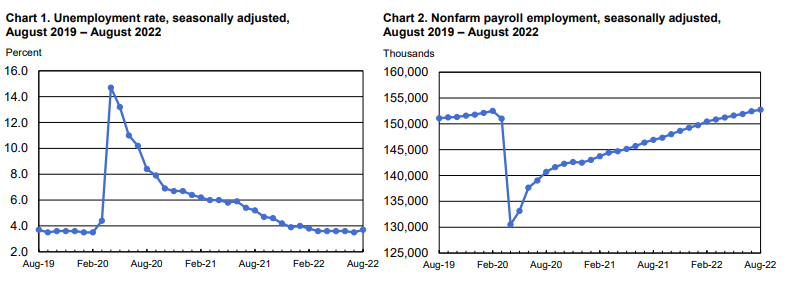

Macro Brief: Employment Situation

9.2.2022

The Employment Situation report indicated that the labor market remains strong, but job growth slowed after the blowout report in July which saw emloyment surge by 526K positions

Macro Brief: Jobless Claims

9.1.2022

For the week ended August 27, initial jobless claims dropped to 232K as the labor market remains relatively strong

- Initial jobless claims were down 5K to 232K from the previous week's revised figures of 237K

- Continuing claims increased 26K to 1.438 million while the 4-week moving average rose 4.5K to 1.429 million

- Advance adjusted insured unemployment rate stood at 1.0%, unchanged from the previous week's figure

- Despite concerns of an economic slowdown in the U.S., the jobs market has remained a bright spot indicating that hiring demand is strong and consumer spending has held up despite historically high inflation

- The Federal Reserve currently has a 76% probibility of hiking another 75 bps at the September meeting according to the CME Group FedWatch Tool

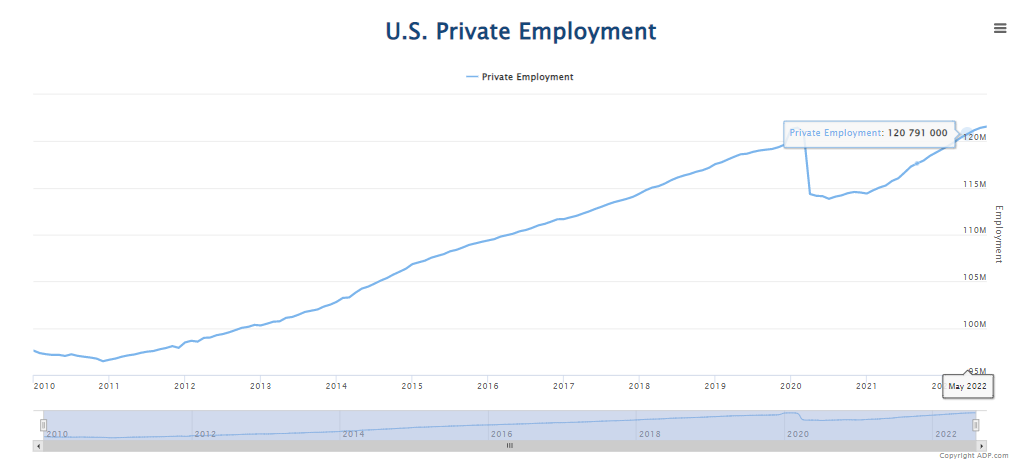

Macro Brief: ADP Employment

8.31.2022

Private sector employment increased by 132,000 jobs in August and annual pay was up 7.6%

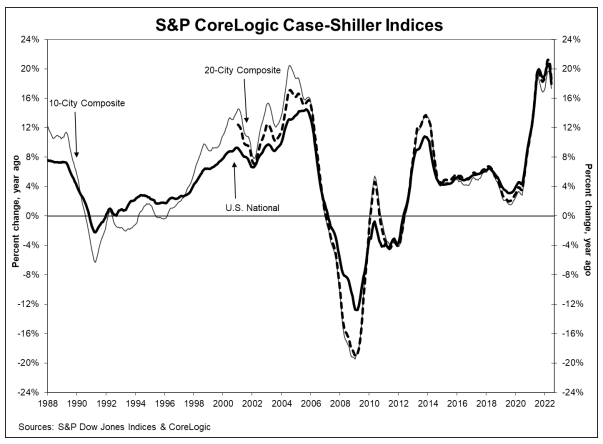

Macro Brief: S&P Corelogic Case-Shiller HPI

8.30.2022

U.S. home prices up nearly 20% year/year in June but have decelerated from the previous month

- S&P CoreLogic HPI 20-city index (SA) were up 0.4% month/month, below consensus estimates of 1.1%

- National annual price gains of 18.0%; down from 19.9% in the previous month

- Tampa, Miami, and Dallas reported the highest year-over-year gains

- As the Fed ratchets up interest rates and the cost of a mortgage increases we have seen recent cooling from the red hot housing market; more cooling likely to come

- Homebuilder ETFs: ITB, XHB, HOMZ, NAIL