The Market Lens

1.11.2021

3 ETF Questions For 2021

Let me level with you: I'm not much for making predictions. If you're looking for someone to peer inside their crystal ball for what the future holds… well, the ETF industry is full of wizards much smarter than me.

What I can do—what I love to do—is ask questions. It's a habit that successfully carried me through fifteen years as a financial journalist and, before that, as a code monkey in an astrophysics lab.

So as I look forward to the next twelve months, I'm holding off on making any big bets. Instead, I'm focusing on some of the big questions still left unanswered—and no, "Will we get a bitcoin ETF?" isn't one of them.

1. Can "ESG" Survive As An Investment Thesis?

Don't get me wrong: I'm not calling for some kind of fossil fuel Renaissance here. But as environmental, social and governance (ESG) ETFs become more and more popular—and capture more and more market share—I suspect this segment may become a victim of its own success.

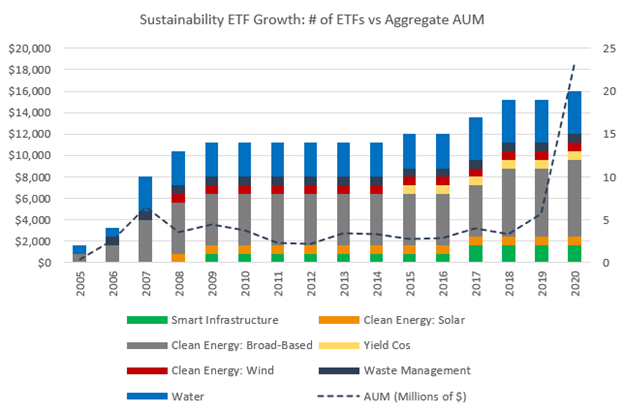

Sustainability ETFs, which are a subset of ESG ETFs, had a bang-up 2020.

Source: ETF Action

I say that for two reasons. First, it never made much sense to lump environmental, social and governance investment criteria together, except in fairly limited contexts—namely, in the evaluation of climate risk, which has increasingly become an issue of social and corporate responsibility, as well.

The second is that investing according to one's values inherently, even tautologically, depends on the individual. Expressing those values is best achieved in targeted ways: through a portfolio of laser-focused thematic ETFs, for example, or direct indexing.

As time goes on, I suspect we'll see a re-splintering of "ESG" ETFs into various thematic disciplines—clean energy providers, low-carbon stocks, social justice, and so on. The narrower, the better; thus giving more options to investors seeking to reflect their individual value sets.

But what of broad-based ESG ETFs, which eject "worst offender" stocks but generally seek to replicate returns of the broader market?

Eventually I think the idea of evaluating stocks based on their exposures to various environmental, social and governance risks will become so commonplace that it just becomes table stakes for ETF issuers--meaning, we'll stop even talking about it, except when it doesn't happen. (Such as how, for years, PIMCO didn't advertise that they had incorporated ESG methodology into their investment process – not until they realized it was good marketing.)

But if the ESG approach becomes so common that it loses all its marketing punch, I still don't think funds like ESGU or USSG are going away. On the contrary, I suspect that assets in these funds one day will come to rival that of IVV or VOO. Maybe not this year. Maybe not even in the next five years. But one day.

And when it does happen, those ETFs will have long since dropped the obsolete acronym "ESG" from their names.

2. Will Active ETF Flows Actually Surpass Index ETF Flows?

For decades, active management was like the Rodney Dangerfield of ETFs: It just couldn't get no respect. Not from issuers, not from investors. Nobody.

Then last year happened.

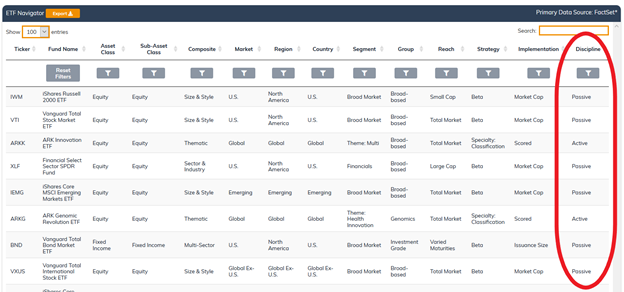

Of the 314 ETFs that launched in 2020, 129 of them were active. That's more than 40%—a much higher percentage than in years past. (In the ETF Terminal, you can find out whether an ETF is active or passive under the "Discipline" field of the "ETF Action Classification" menu.)

You can find out whether an ETF is active or passive by checking the "Discipline" column in the ETF Navigator.

Source: ETF Action

What's more, those active ETF launches gobbled up almost half of net investment flows entering new products: From January through November last year, passive ETF launches netted about $7.3 billion in flows, while active ETF launches netted $6.0 billion.

Sorry, index ETFs.

So what turned the tide in favor of active ETFs?

First and foremost, the ETF Rule. Passed in late 2019, this regulation streamlined the ETF launch process and, importantly, allowed every issuer the use of "custom baskets" – a back-end, issuer-side trading process whose mechanics don't really matter much to this discussion. What matters is that custom baskets significantly improve ETF issuers' trading efficiency—and now all issuers can use them.

And boy, are they. Last year, even with the pandemic, we saw a flood of new entrants to the ETF space—lured, in great part, by the newly granted ability to use custom baskets.

But that's not the whole story. There was a fair bit of performance-chasing, too. In some market segments—in particular, thematic slices and fixed income strategies—active management far outperformed the passive competition. For example, ARK ETFs' signature, five fund active suite each saw returns last year ranging from 100-160%:

2020 returns for ARK's active ETF suite ranged from 108% for ARKQ to 189% for ARKG. Whew.

Source: ETF Action

Cathie Wood and her team at ARK ETFs made a strong investment case for the power of active management—and investors answered, pouring an astonishing $20 billion into the product suite over the course of 2020.

With these two trends in place, I can't believe that those active ETF launches last year will end up being a fluke. So now I find myself in the position of asking a question I would never have considered five years ago: Will flows into active ETFs soon outpace flows into passive ones?

3. Does transparency save investors money?

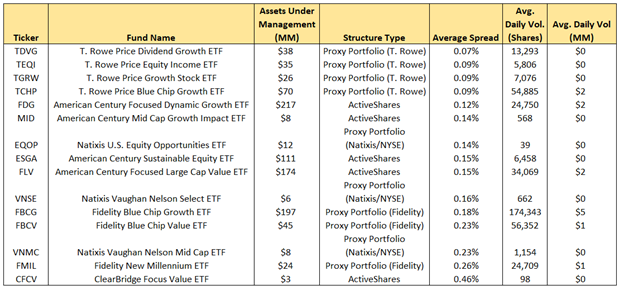

For years, I and many ETF investors simply took it on faith that knowing what we owned was a good thing. Last year, that faith was brought under the microscope, with the launch of the first nontransparent active ETFs, including funds from American Century, ClearBridge, T. Rowe Price, Natixis, Fidelity and Invesco.

Now, I'm not going to weigh in on the existential utility of these products. Like all ETFs, they're designed to serve a certain purpose for a certain investor.

What I'm more interested in is how they trade. I dug into the details in a Twitter thread last month, but my big takeaway was that the cost to enter and exit these products varies wildly—and it doesn't seem connected to the size of the fund or the specific nontransparent structure used.

Of the 15 nontransparent ETFs with track records longer than one month, spreads range from 0.07% to 0.46%.

Source: ETF Action

The average trading spread for a nontransparent ETF is 0.17%. Add that to their higher-than-usual management cost—the average expense ratio for a nontransparent ETF is 0.58%—and you're left with a total cost of ownership experience that's several factors higher than comparable transparent funds.

Comparable index funds, that is. Transparent active ETFs, however, tell another story.

You see, the average expense ratio for a transparent active U.S. size & style ETF is 0.62%, or four basis points higher than that of nontransparent ETFs. What's more, their average spread is 0.25% -- again, higher than that of nontransparent active funds.

Does that mean nontransparent structures are actually a better mousetrap for active ETFs? Honestly, we don't have enough data yet. There are only 19 nontransparent ETFs, most of which have been around for less than six months, and which fall into that narrow U.S. size & style category. Compare that to 423 transparent active ETFs, covering all manners of segment, style and strategy, and with track records of five years, ten years, or more.

But I can't stop wondering about the possibility that this foundational belief of mine—that portfolio transparency is always, always a good thing—could be wrong, at least when it comes to the cost of ownership. It's a question I want—need—answered.

Maybe if all you crystal ball watchers find out anything, you could let me know?

Lara Crigger is the Editor-In-Chief of ETF Action. Contact her at lara@etfaction.com.