Monday Morning QB - April 12 Preview

4.12.2021

Monday Morning QB Preview - March 29, 2021

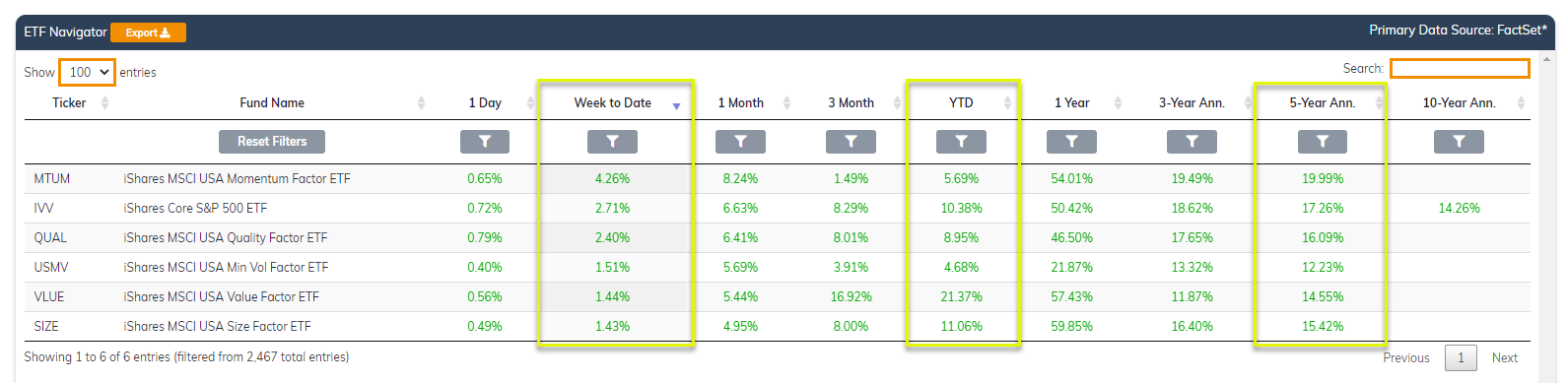

Winners & Losers: Return to the New Normal?

The biggest story of the first quarter was the return of value and cyclical stocks but so far in the second quarter it's been back to the old new. Large/mega Caps, momentum/growth and technology heavy sectors were by far the biggest winners last week. Was the first quarter simply another head fake or is there still room to run for the unloved sectors and strategies of the past decade?

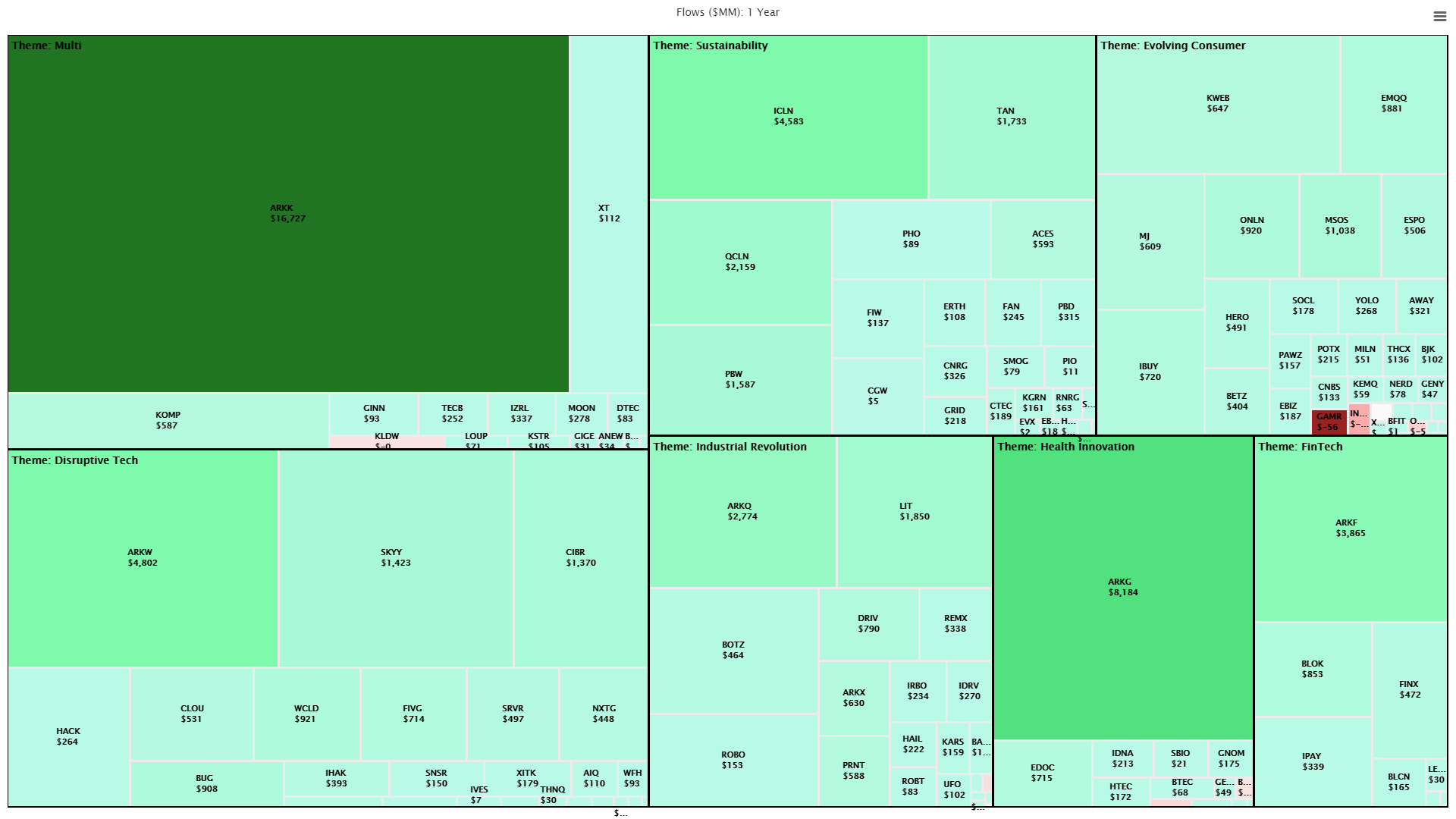

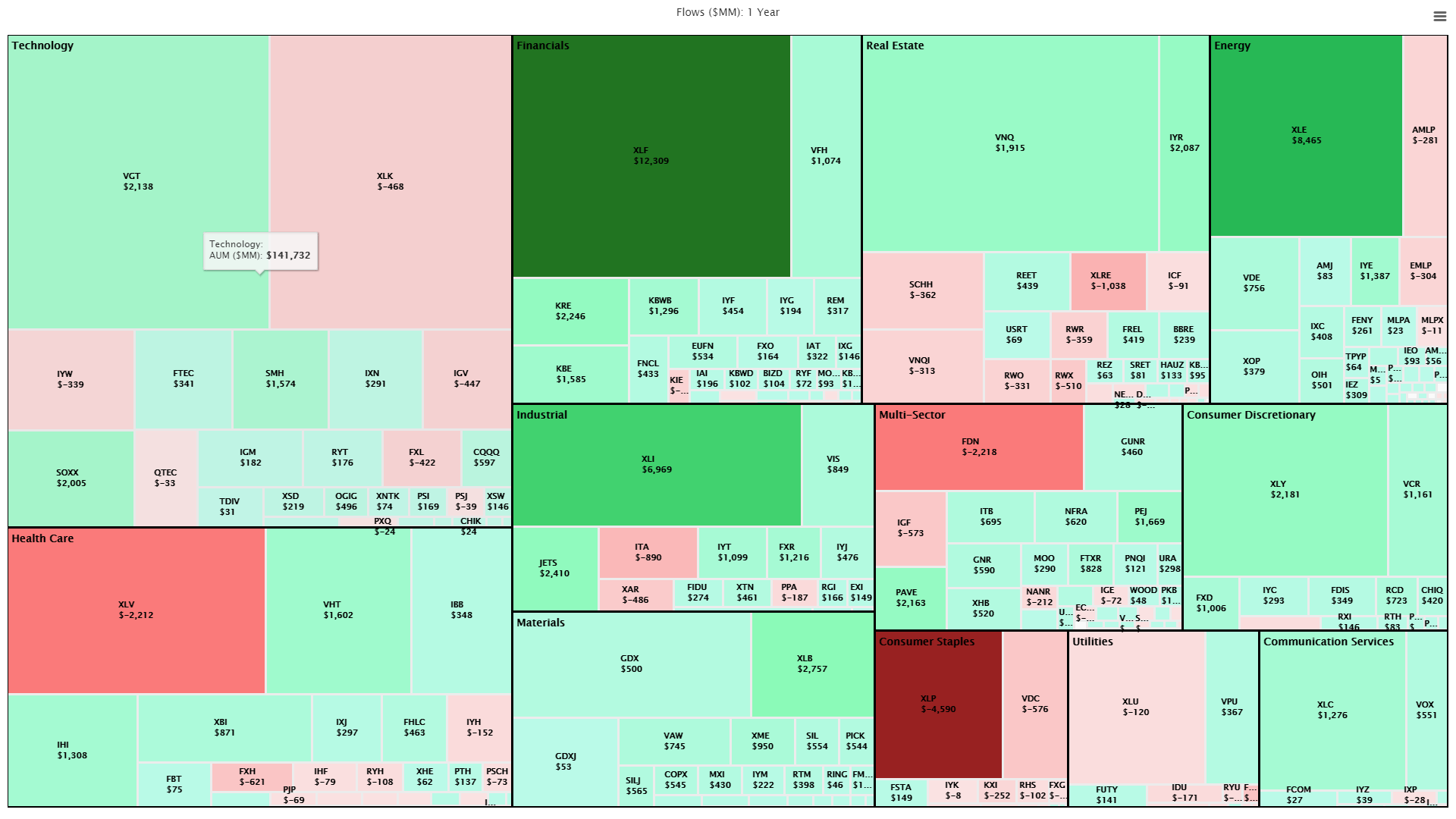

Follow the Flows: Are Themes the New Sectors?

Flows into ETFs we classify as thematic have seen an eye-popping $77B in net inflows over the past year and now have over $130 billion in AUM. To put this in perspective the more established sector and industry ETF category saw a similar $76 billion in net inflows in the same time frame but have total AUM over $600 billion. While flows are similar the difference is that because sector and industry ETFs are more mature they often see broad rotations over different time periods where as thematics have seen mostly only inflows. However, recently that story has started to change and it makes us wonder if we will begin to see more investors using themes tactically like they do with sector and industry ETFs?

Thematic ETF Flows - 1 year

Sector & Industry ETF Flows - 1 year

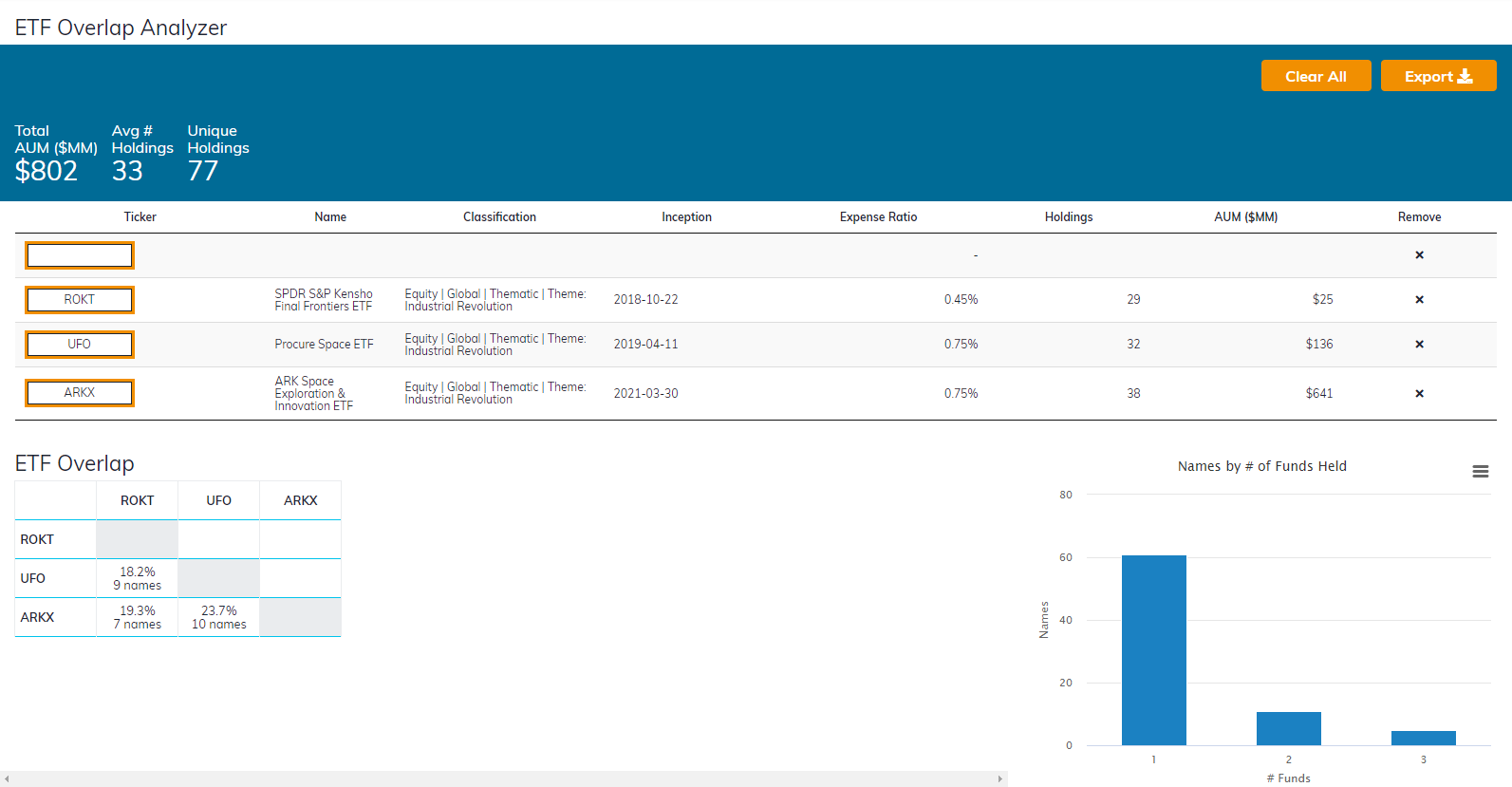

Thematic Spotlight: Exploring the Great Unknown (ARKX)

Curious to know which companies best align with space exploration? Well it turns out there's very little agreement across the three ETFs we classify as Industrial Revolution: Space. Today we explore the new ARK Space Exploration and Innovation ETF (ARKX) and compare it to the other ETFs in the category.

Weekly Rant: "Never confuse genius with luck and a bull market." John C Bogle

I recieved a weekly summary email this week that was sponsored by a new "premier investment manager" designed for "retail investors" promising a goal of "compounding your wealth 15% annually, doubling your investment every 5 years". Their claims went on to talk about how they accomplish this and had a link into a fancy website where you could "start putting your money to work like the Wall Street elite".

I won't share what newsletter was sponsored by this ridiculous claim as I like the newsletter and they're not alone in taking sponsorship money from firms willing to cross the line. The bigger picture is that bull markets are full of new investment managers with very short track records claiming they've cracked the secret code to delivering mind-boggling returns. Needless to say, I'm not buying what they're selling!!

Mike Akins is the CEO & Lead ETF Nerd at ETF Action. Inquiries can be sent to mike@etfaction.com