ETF All-Stars: The Security Selection Paradox

4.7.2021

ETF All-Stars: The Security Selection Paradox in Thematic Investing

Introduction: What Kind Of Company Is Tesla?

How do you classify Tesla within a classification system? According to GICS classification, Tesla falls within the automobile industry in the consumer discretionary sector. But what else is it? Is it a clean energy company because it is the posterchild for creating a network of vehicles that reduces carbon emissions? Or is it a robotics & AI company because most of its production lines are automated…by robots? Or is it an advanced materials company because it is exploring and developing new battery technologies? I could go on and on but the point here is that when it comes to thematic investing, classifying companies into specific buckets can be difficult.

This leads to the problem in thematic investing that we here at ETF Action call the Security Selection Paradox. Growth in thematic investing has been nothing short of explosive over the past several years. The Security Selection Paradox is the expectation that ETFs with similarly stated investment objectives that aim to capture the same narrow thematic segment will have a high overlap in common holdings. However, oftentimes this does not hold true across the thematic ETF landscape. This leaves investors with choices that don’t necessarily align with their true investment objective. Let’s explore…

Note: All data compiled throughout this report is using tools within the ETF Action platform including ETF Landscape, ETF Ownership Screener, Overlap Analyzer, Security Lookup, and ETF Terminal.

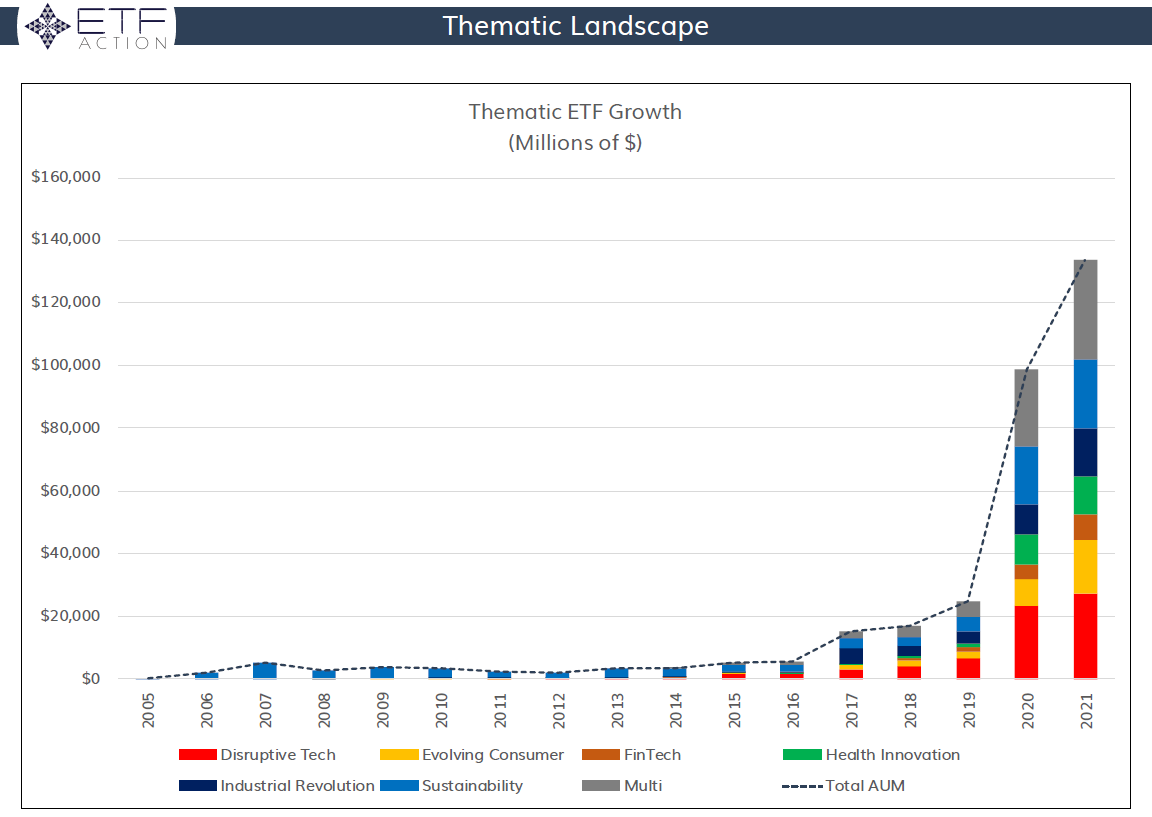

Explosion in Thematic Investing

Over the last 15 years, the thematic ETF space has gone from a few issuers and just a handful of funds, to over 35 issuers managing over 150 funds with over $130 billion in assets under management. The explosive growth has given investors endless ways to participate in some of the most popular long term secular trends, but it has also made making investment selections more difficult – which fund do I eventually choose?

An abundance of ETFs have flooded the thematic investment space over the last several years while assets have skyrocketed.

Source: ETF Action

Source: ETF Action

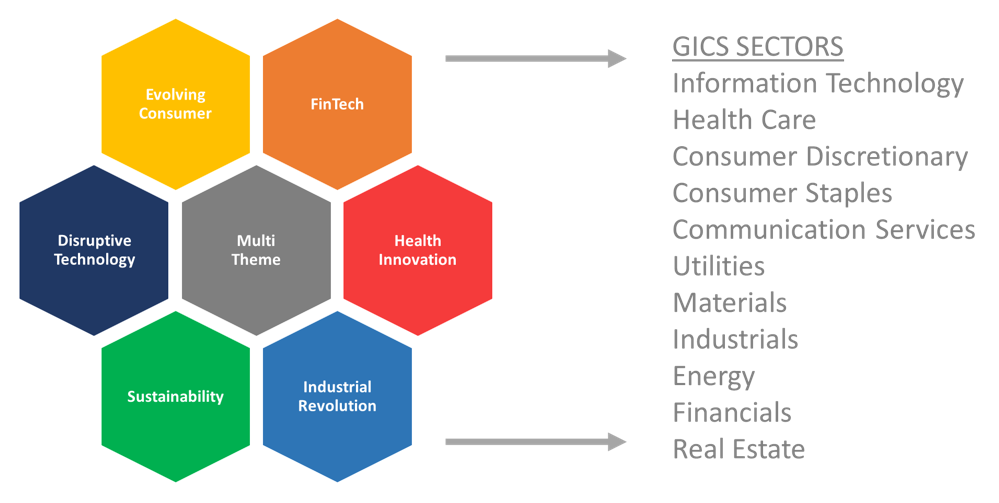

Thematic Investing Crosses Traditional Sector Boundaries

This rise in new trends has created a disconnect between traditional industry and sector classifications, making it even more difficult to decipher where ETFs that hold them should fall in the style box or typical sector model. The ETF Action Classification System was created to address this problem. We break the thematic space into seven segments: Disruptive Technology, Evolving Consumer, FinTech, Health Innovation, Industrial Revolution, Sustainability, and Multi-theme. Each broad thematic segment contains its own set of sub-categories such as Disruptive Technology – Cloud Computing or Evolving Consumer – Online Retail.

The rise in secular trend investing has created a disconnect from traditional sector investing so ETF Action has created 7 thematic segments.

Source: ETF Action

Source: ETF Action

However, just because ETFs are classified in specific segments and sub-categories does not mean the underlying companies have to follow those same boundaries which brings us back to our original question on Tesla…

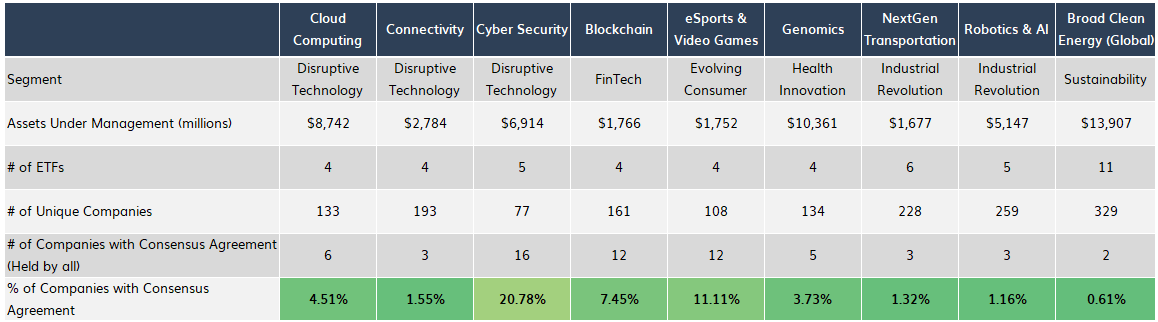

The Paradox: Overlap Among Similar Stated Strategies Is Not Great

Tesla falls into 28 different thematic ETFs covering 6 of 7 broad thematic segments, Health Innovation being the lone segment to not include the company in any of its ETFs. This is a great example of the beauty and difficulty of thematic investing: companies cross thematic borders because everyone has differing opinions on how a company should be classified.

This leads to the Security Selection Paradox. We would expect ETFs with similar stated objectives to have high overlap in common holdings but that just isn’t the case. To illustrate this we have aggregated the ETFs in some of the largest thematic sub-categories and looked at how many holdings are in common across all ETFs that fall within each sub-category. It’s shockingly low. In the groups below, the greatest % of Companies in common across the group ETFs (fall into all of the strategies) is 20.78% but on average is closer to 5%.

Despite targeting similar investment objectives, thematic ETFs in specific segments only have a few companies that they all agree on for inclusion.

Source: ETF Action

Source: ETF Action

ETF All-Stars: Need For A Consensus View To Appropriately Allocate

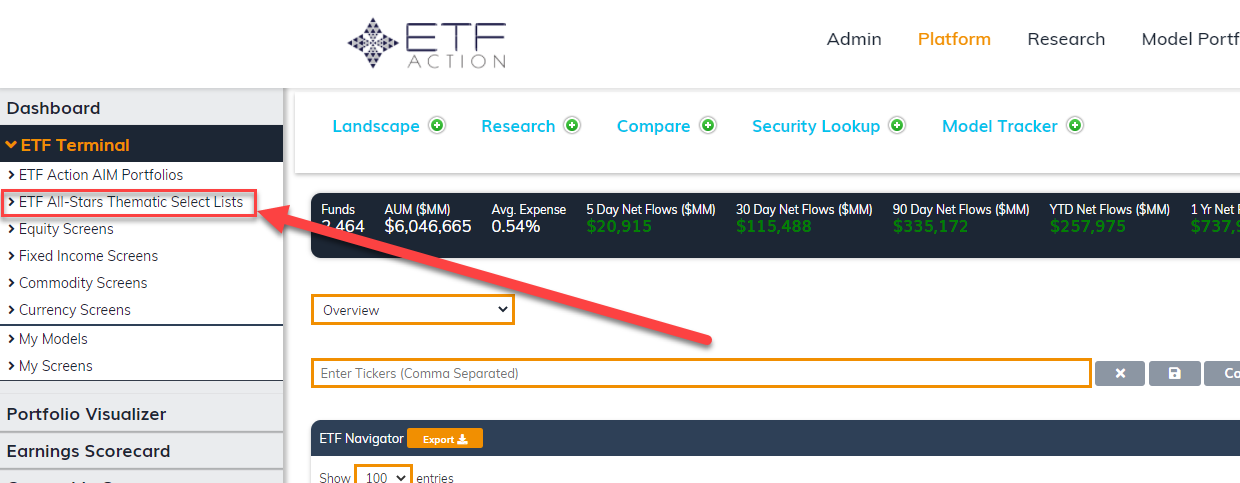

With such a small agreement on what companies should or should not be included in thematic groups, a need for a consensus view is necessary, hence the creation of the ETF All-Stars. We believe that if an investor or advisor is looking to allocate to a specific thematic group, beginning with the companies that are found most commonly across the ETF strategies that follow that specific group is a great place to start to build exposure.

Using the ETF Action platform, we provide these starting places in the form of the ETF Action All-Stars Select Top 10 lists which pulls in the companies that are most commonly found across specific thematic groups. In addition, subscribers to our platform can use the Ownership screener to find companies in common across custom screens such as factor ETFs, country ETFs, active ETFs, you name it.

Subscribers on the ETF Action platform have access to all of the ETF All-Stars Select Lists in the dropdown on the left side of the screen.

Source: ETF Action

Source: ETF Action

Want to learn more?

Please reach out to team@etfaction.com for any inquiries or if you would like to get more information on the ETF Action platform or the ETF All-Stars.

Written by: Alex Shepard is the COO & Director of Research at ETF Action while Brian Burke is the CTO.

Important Disclosures

All ETF Action Model Portfolios are made available to subscribers for informational purposes only and do not represent actual investments. The opinions expressed herein are just that, and should not be construed as any type of investment advice. Full terms of service, including terms of use, copyrights, and disclaimers are available here.

To learn more about the ETF Action AIM Portfolios, please visit www.etfaction.com/models or reach out to team@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.