Lower Multiples, More Value: Rebalancing U.S. Factor AIM Portfolio

4.19.2021

Lower Multiples, More Value: Rebalancing the U.S. Factor AIM Portfolio

Changes Made:

In addition to the above position additions, all other positions will be rebalanced to the target weights which can be seen by subscribers by launching the model in the ETF Action Terminal. These changes will be made with closing prices on Thursday, April 22, 2021.

Overview

Since the last rebalance in November, the U.S. Factor AIM Portfolio has returned 20.31%, outpacing the S&P 500 by nearly 300 basis points. The top performers in the portfolio were the value oriented positions in QVAL and VLUE, both returning just under 30%. Meanwhile, the underweights to quality (QUAL) and low volatility (FDLO) proved to be beneficial as those were the bottom performers since the rebalance. The rebalance across the AIM portfolios in November was specific to positioning for a cyclical recovery which proved to be beneficial. While we believe the cyclical recovery is still underway, this week's rebalance is focused specifically on three things:

- Lowering the portfolio valuation multiple

- Increasing value characteristics to stay aligned with ongoing cyclical recovery

- Increased financials exposure and size tilt

With that being said, the below gives more detail on the portfolio changes.

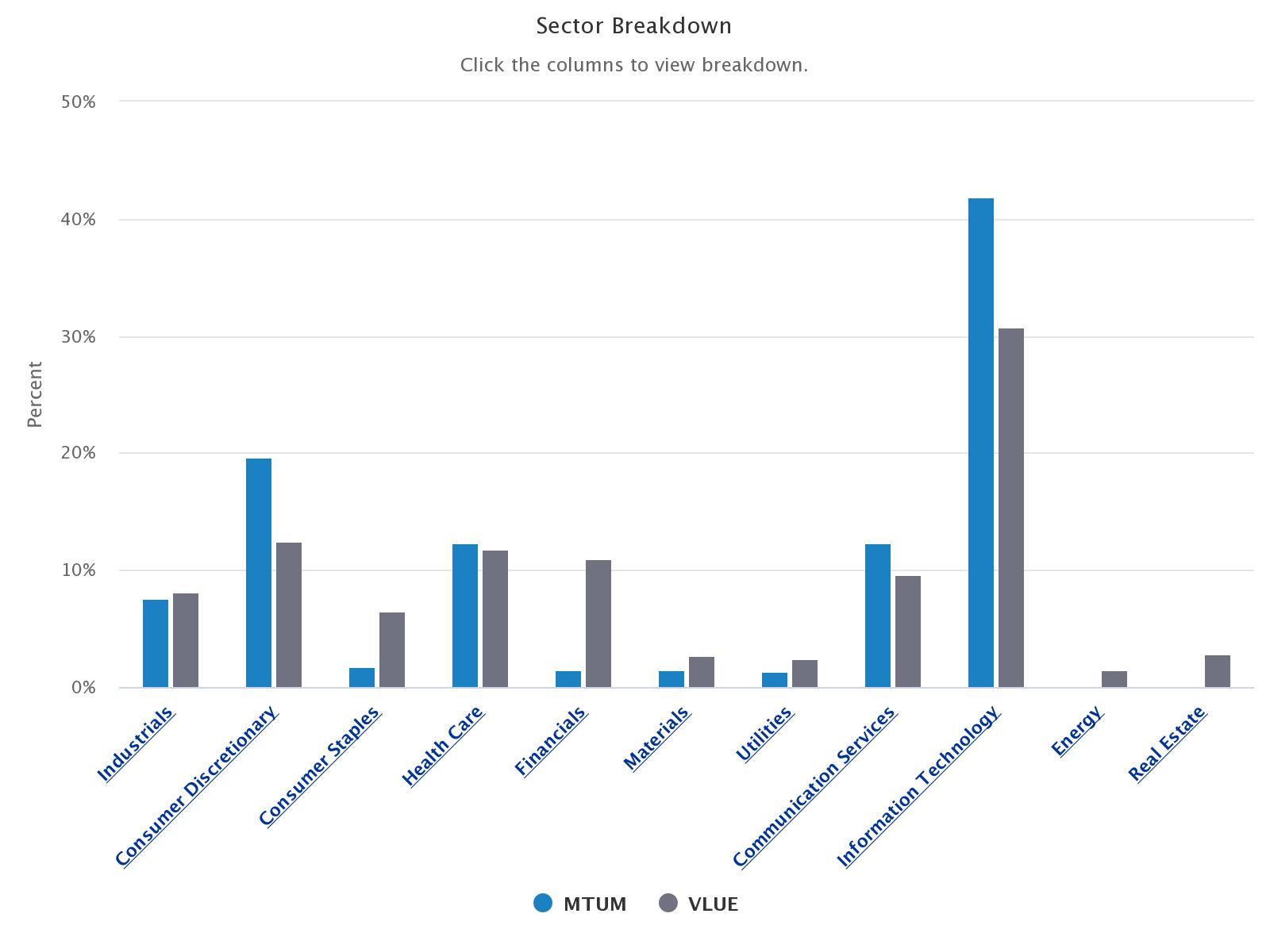

Increase VLUE to 25% (From 20%), Decrease MTUM to 15% (From 20%)

The 5% addition to VLUE's position will bring the total allocation given to value factor ETFs (VLUE & QVAL) to 40% while the total allocation to momentum ETFs (MTUM & QMOM) will drop to 25%. As mentioned above, this will effectively lower the overall portfolio valuation multiple and introduce a slightly higher exposure to the financials sector. Currently MTUM is trading at a 48x multiple on earnings whereas VLUE is at 18x. SPY currently trades at 29x trailing twelve-month earnings to put MTUM and VLUE in perspective.

The investment committee believes that lowering the overall portfolio multiple to be a prudent decision given the recent surge to new highs in equity markets paired with the likelihood of increased yields (weighing on high valuations while also benefitting financials). Additonally, we believe that the recent outperformance in value names is not yet over as we move through the recovery phase of the domestic economy.

Moving 5% from MTUM to VLUE helps lower the overall valuation multiple of the U.S. Factor AIM Portfolio. MTUM is trading at 48x earnings while VLUE is only trading at 18x earnings.

.jpeg)

Source: ETF Action

If yields continue to increase, financials may be better positioned relative to some other rate sensitive sectors. VLUE has a greater weight to this sector than MTUM which we believe to be opportunistic.

Source: ETF Action

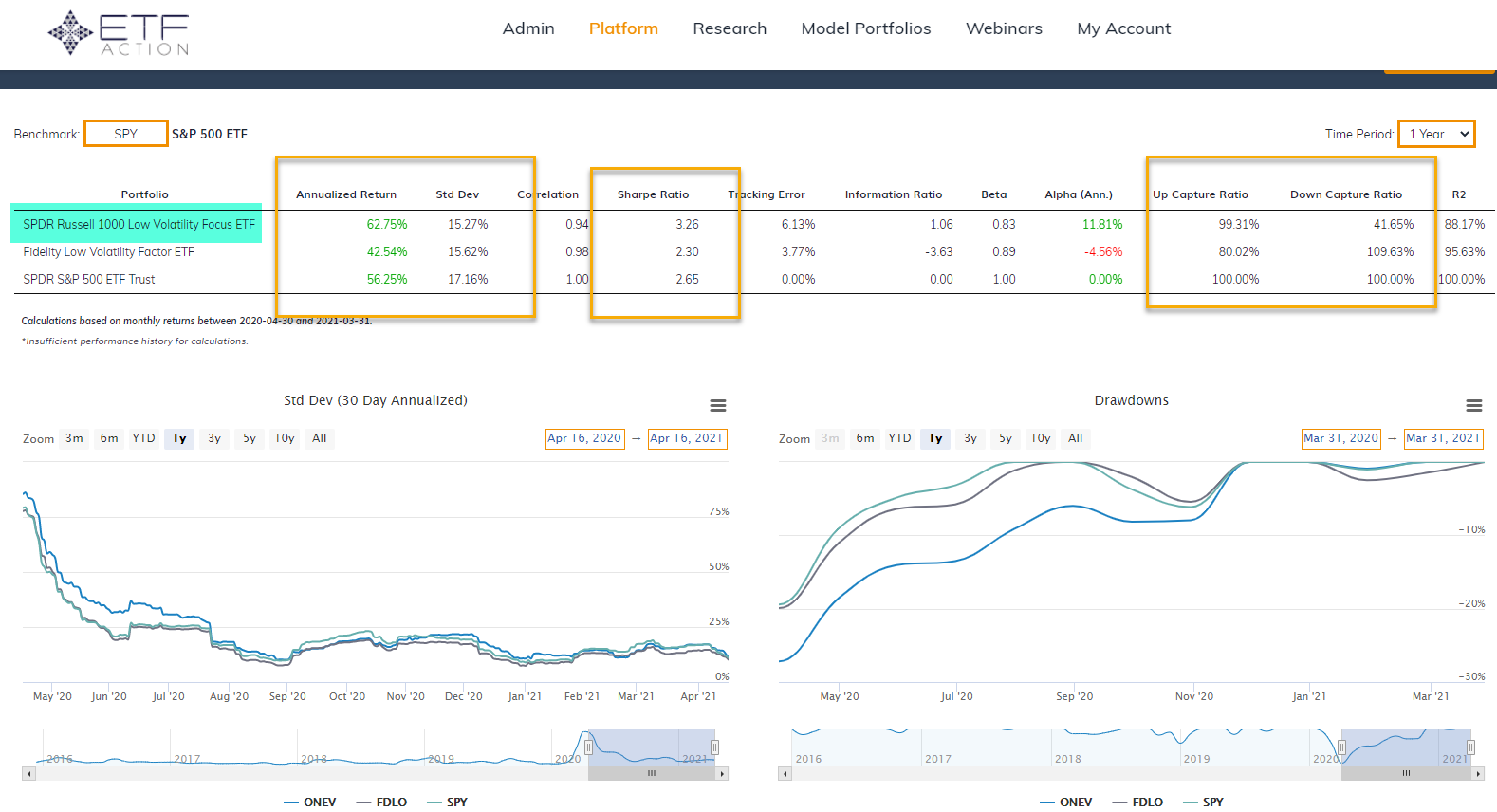

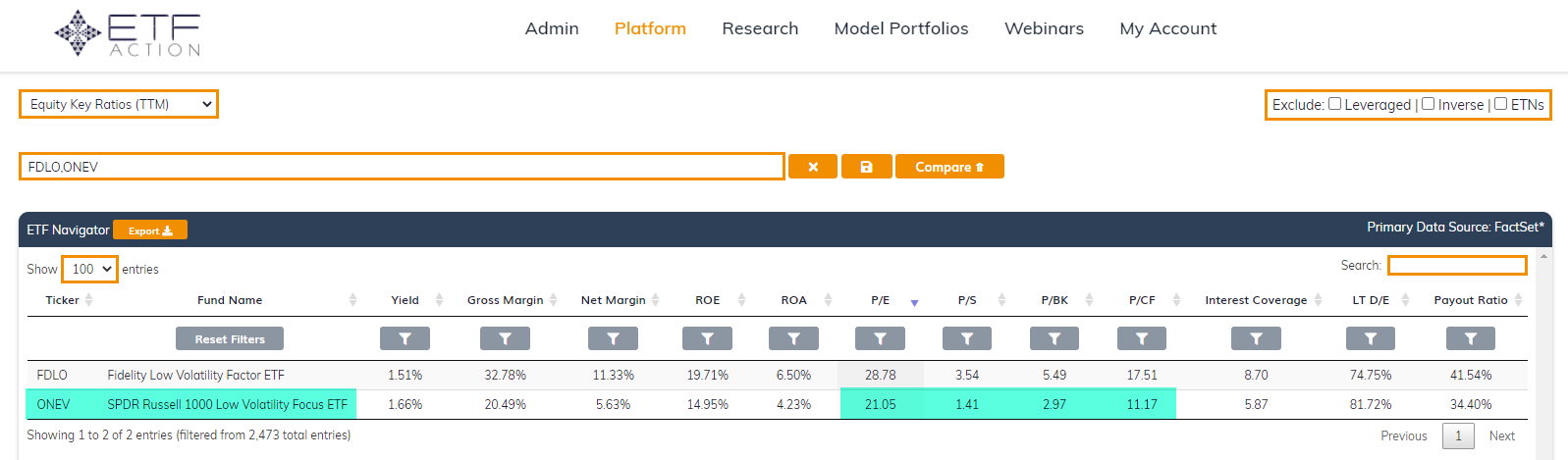

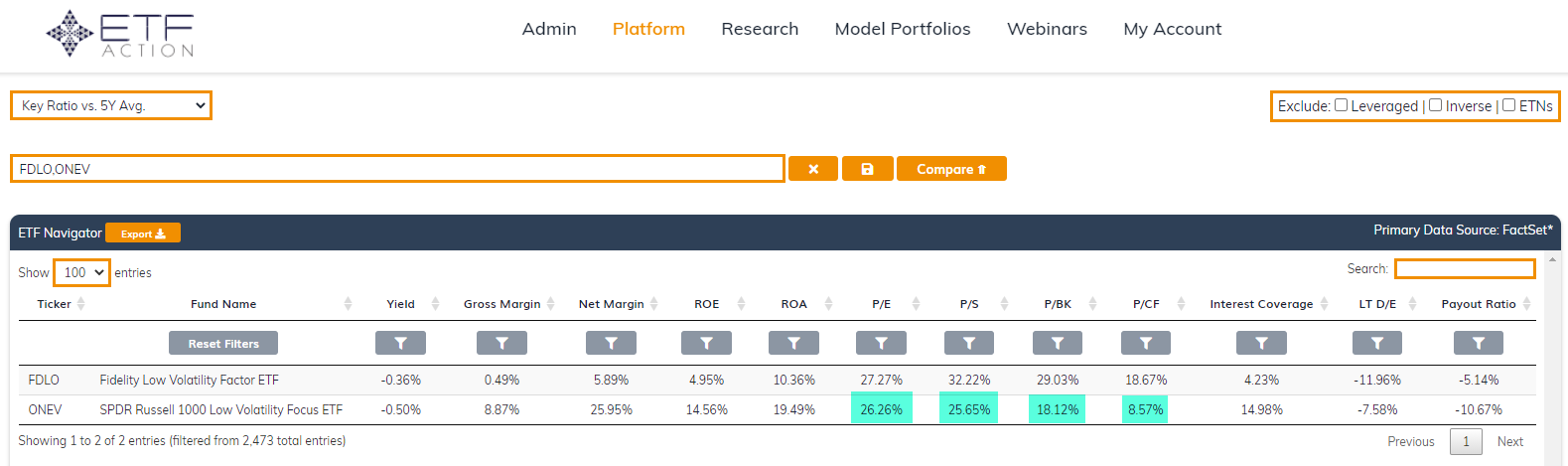

Replace 15% Low Volatility Position In FDLO With 15% In ONEV

Similar to the 5% swap from momentum (MTUM) to value (VLUE) above, the decision to replace the Fidelity Low Volatility Factor ETF (FDLO) with the SPDR Russell 1000 Low Volatility Focus ETF (ONEV) was to lower overall valuation multiples and introduce more financials exposure. Additionally, the replacement provides a tilt to more mid and small-cap names and lowers the overall expense ratio of the model (FDLO charges 0.29%, ONEV charges 0.20%). Given the current environment, we believe that the relative smaller-cap exposure paired with greater value characteristics is better positioned during the economic recovery and provides prudency in the event of another surge in yields.

For example, risk and performance data for ONEV has bested those of FDLO over the near-term. ONEV has better risk adjusted returns (sharpe ratios) and up/down capture ratios while maintaining lower volatility. We believe this trend to continue.

Over the near-term during the economic recovery, ONEV has demonstrated much better risk/performance due to its size/value tilt, a trend we expect to continue.

Source: ETF Action

ONEV maintains cheaper valuation characteristics on an absolute and relative basis compared to FDLO.

Source: ETF Action

Overall, the objective of this rebalance is to position the U.S. Factor AIM Portfolio better for a cyclical recovery while lowering overall valuation metrics. We will check back in on the new portfolio rebalance in a month to see how the changes are working. As always, please send any questions to team@etfaction.com.

Alex Shepard is the COO & Director of Research at ETF Action. Inquiries can be sent to alex@etfaction.com

Important Disclosures

All ETF Action Model Portfolios are made available to subscribers for informational purposes only and do not represent actual investments. The opinions expressed herein are just that, and should not be construed as any type of investment advice. Full terms of service, including terms of use, copyrights, and disclaimers are available here.

To learn more about the ETF Action AIM Portfolios, please visit www.etfaction.com/models or reach out to team@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.