This Week In ETFs

3.5.2021

This Week In ETFs

Week of Mar. 1-5, 2021

Quick Stats

Total # of ETFs: 2,444

Total AUM: $5.76 trillion

Average Expense Ratio: 0.54%

5-Day Net Flows: $12.67 billion

30-Day Net Flows: $109.30 billion

90-Day Net Flows: $316.12 billion

YTD Net Flows: $164.92 billion

1-Year Net Flows: $591.94 billion

What happened in ETF markets this week? We crunch the numbers below.

NOTE: Unless otherwise stated, data range is from Monday through Thursday's close. ETNs and leveraged/inverse ETFs are excluded.

Best Performing ETFs

The week's top performing fund was the Breakwave Dry Bulk Shipping ETF (BDRY), which rose 20.06%.

But fossil fuel ETFs rose sharply as well. Three of the week's top five performers were ETFs that track master limited partnerships (MLPS), which are "tollroad"-style infrastructure companies, such as oil and gas pipelines. The InfraCap MLP ETF (AMZA) rose 11.43%, the Alerian MLP ETF (AMLP) rose 9.81%, and the Global X MLP ETF (MLPA) rose 8.43%. The First Trust Natural Gas ETF (FCG) also rose 9.40%.

Worst Performing ETFs

The week's worst performing fund was the U.S. Equity Cumulative Dividends FundSeries 2027 (IDIV), which dropped 25.61%.

Several thematic ETFs also saw declines, including the Simplify Volt Fintech Disruption ETF (VFIN), which fell 12.94%; the ETFMG Treatments Testing and Advancements ETF (GERM), which dropped 12.30%; the Invesco Solar ETF (TAN), which dropped 12.02%; and the TrueShares Technology, AI & Deep Learning ETF (LRNZ), which dropped 11.83%.

ETFs with the Largest 5-Day Net Inflows

Core emerging markets funds saw the most net inflows this week, including the Vanguard FTSE Emerging Markets ETF (VWO), which gained $1.25 billion; and the iShares Core MSCI Emerging Markets ETF (IEMG), which gained $1.05 billion in net assets.

Other top flows getters included the iShares Russell 2000 ETF (IWM), which gained $1.21 billion in net assets; the Financial Select Sector SPDR Fund (XLF), which gained $1.05 billion; and the iShares 20+ Year Treasury Bond ETF (TLT), which gained $993 million.

ETFs with the Largest 5-Day Net Outflows

Technology stocks and gold saw the largest outflows this week, with the Invesco QQQ Trust (QQQ), which lost $3.54 billion in net assets; and the SPDR Gold Shares (GLD), which lost $1.21 billion.

Other big outflows were seen from bond ETFs, such as the iShares Core U.S. Aggregate Bond ETF (AGG), which saw $1.03 billion in outflows; and the iShares TIPS Bond ETF (TIP), which lost $919 million.

The iShares U.S. Real Estate ETF (IYR) also lost $625 million in net assets.

Best/Worst Performing Thematic ETF Over The Past 5 Years

In the ETF Action Classification system, we classify 151 ETFs as "Thematic," which together total $133.5 billion in assets under management.

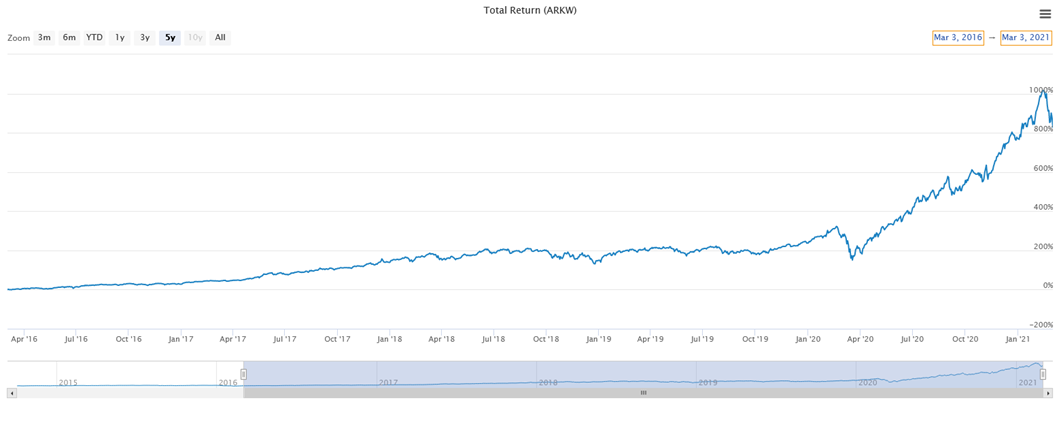

Over the past five years, the best performing thematic ETF has been the ARK Next Generation Internet ETF (ARKW), up 53.91% on an annualized basis:

Source: ETF Action

Meanwhile, the worst performing thematic ETF has been the ETFMG Alternative Harvest ETF (MJ), up just 1.54% on an annualized basis. However, keep in mind this track record still includes performance data from before 2017, when the vehicle that became MJ switched indexes from a Latin American real estate fund (LARE) to a cannabis ETF.

Source: ETF Action

Notable Launches: 2/26-3/4

- VanEck Vectors Social Sentiment ETF (BUZZ): Holds the 75 mid-to-large cap stocks with the most positive social media mentions. AI-based index used to serve as benchmark for BUZ, which closed in 2018. Notable for its partnership/endorsement with Barstool Sports' Dave Portnoy.

- ALPS Active REIT ETF (REIT): Non-transparent active ETF that tracks U.S. REITs. The first such fund to use the Blue Tractor model, which publishes a portfolio of 100% of holdings daily, in at least 90% of their accurate weights.

- FT Cboe Vest Gold Strategy Target Income ETF (IGLD): Holds FLEX options on the SPDR Gold Trust (GLD), as well as Treasuries and cash-like instruments, to track gold prices while generating income.

- JPMorgan Short Duration Core Plus ETF (JSCP): Actively managed short-term bond fund that targets fixed income instruments with a duration of three years or less.

- Alger Mid Cap 40 ETF (FRTY): Actively managed mid-cap fund focusing on 40 high conviction growth stocks.

- TrueShares Structured Outcome (March) ETF (MARZ): Ninth ETF in TrueShares's structured outcome product suite. Tracks the S&P 500 while providing an 8-12% buffer on losses over a one-year period, starting in March.

- Fidelity Investment Grade Bond ETF (FIGB) and Fidelity Investment Grade Securitized ETF (FSEC): Two actively managed investment grade bond ETFs focusing on debt and securitized debt, respectively. Based on and share portfolio managers with two existing, similarly named Fidelity mutual funds.

- Notable Closures: 2/26-3/4

No closures this week.

Notable Filings: 2/26-3/4

- The bitcoin ETF clock has been reset: Cboe has re-filed a 19-b4 form to list the VanEck Bitcoin ETF; VanEck resubmitted its paperwork earlier this year. The SEC is on the hook to approve or deny.

- iShares has filed for a "mini" version of its iShares Gold Trust.

- Change Finance has filed for an international version of its fossil fuel-free large cap fund.

- First Trust has filed for several new thematic ETFs, including an ARK-esque "innovation leaders" fund, a streaming & gaming ETF and a healthcare technology fund.

- ProShares has filed for a concentrated momentum ETF based on the Nasdaq-100.

- ETF newcomer Mairs & Power has filed for an ETF that would track Minnesota municipal bonds.

Lara Crigger is the Editor-in-Chief of ETF Action. Contact her at lara@etfaction.com

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.