ETF All-Stars: eSports & Video Games

1.28.2021

Top 10 Esports & Video Games Stocks:

Thinking Beyond GameStop

Like many people, we've been transfixed by the drama this week in GameStop (GME). (Read: "How GameStop's Short Squeeze Impacts ETF Investors.") So for this week's ETF All-Stars® Select Top 10 List, we knew what theme we just had to cover.

Video games are a massive industry, the scope of which is hard to wrap your head around unless you're a gamer yourself. Between COVID lockdowns, our new 24-7 Zoom lifestyle, and a slate of fancy new console launches, gaming revenues swelled in 2020 to an estimated $180 billion. That's bigger than movies and U.S. sports leagues, combined.

Yet GameStop, reddit darling that it is now, didn't benefit from this boom. Forget all the short squeezes and trading halts: The stock's fundamentals remain as lousy as they ever were.

Which is probably why GameStop isn't really considered a consensus video gaming stock. In fact, what we found is that the consensus view of a video game stock is actually the exact opposite of GameStop: A company that has ditched the brick-and-mortar business model altogether, instead opting for digital downloads, online play, and cloud-based streaming services.

Inside The Four Video Gaming ETFs' Portfolios

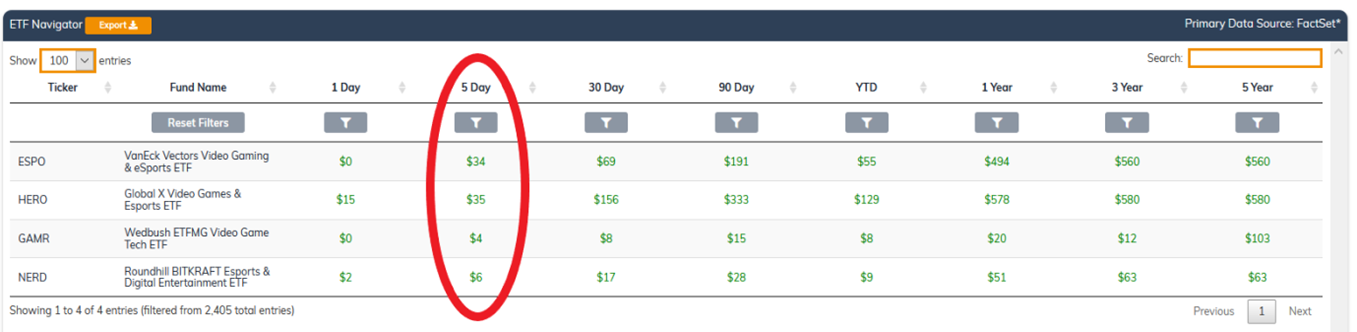

We classify four ETFs into our "eSports & Video Games" group: The $847 million VanEck Vectors Video Gaming & eSports ETF (ESPO), the $766 million Global X Video Games & Esports ETF (HERO), the $178 million Wedbush ETFMG Video Game Tech ETF (GAMR), and the $93 million Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD).

Intriguingly, although GAMR is the only video games ETF that holds GameStop, it hasn't benefitted from all the media attention, at least in terms of new net flows. Since the r/WSB drama began in earnest five days ago, GAMR has only taken in $4 million in new net assets. HERO and ESPO, meanwhile, have pulled in $35 million and $34 million, respectively.

Source: ETF Action

How We Did It: Input tickers into the ETF Navigator, then select "Flows" from the dropdown menu.

Anyway, these four ETFs, worth a combined $1.9 billion in assets, hold 99 unique stocks, ranging in size from the $95 million Cheetah Mobile (CMCM), up to the $2.4 trillion Apple, Inc. (AAPL).

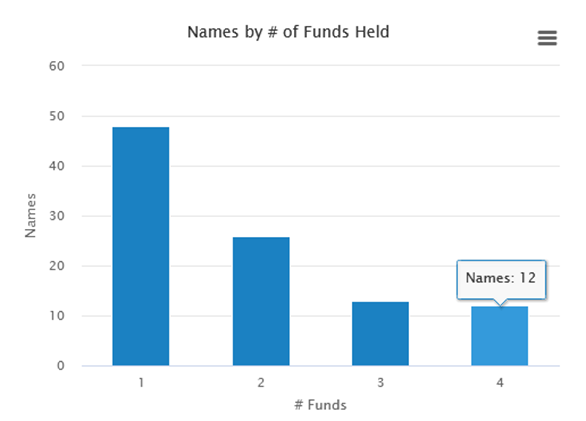

There's remarkable discrepancy among the four portfolios, despite the overlap in theme. Only 12 stocks appear in all four ETFs; in contrast, 48 stocks appear in only one of the four.

Source: ETF Action

How We Did It: Input tickers for the four video gaming ETFs into the ETF Overlap Screener, which can be found on the left-hand sidebar.

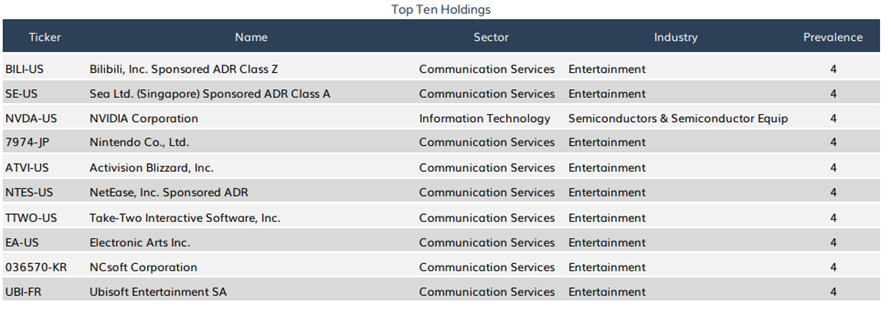

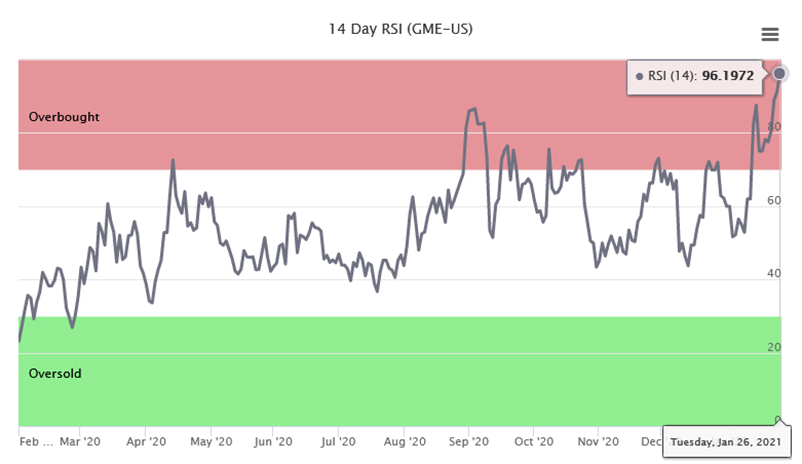

Our List Of The Top 10 Video Games Stocks

Using this information, we can construct our ETF All-Stars® ESports & Video Games Select Top 10 List (see table below).

It's a list of the top ten most prevalent stocks within these four gaming ETFs, where "prevalence" is defined by measuring a stock's total market value held across all ETFs in that segment.

Source: ETF Action

A few data points immediately jump out at me. First, all of these stocks are large caps—not a single small cap in the bunch (a big change from last week's deep dive into cannabis stocks!)

Second, the vast majority of our ETF All-Stars® stocks fall within the "Communications Services" GICS classification, a sector that's run up significantly since its spin-off in 2018. (Only one stock falls outside Communications Services: NVIDIA (NVDA-US), which makes semiconductors.)

That strong skew toward Communication Services makes intuitive sense, given that Communication Services is the home of FAANG stocks like Netflix, Twitter and Alphabet. Gaming is no longer about physical "feelies" and game cartridges; it's about socializing in online spaces and, in many cases, participating in a fully digitized economy. (Case in point: free-to-play, or F2P, games, which make their money based on sales of in-game loot.)

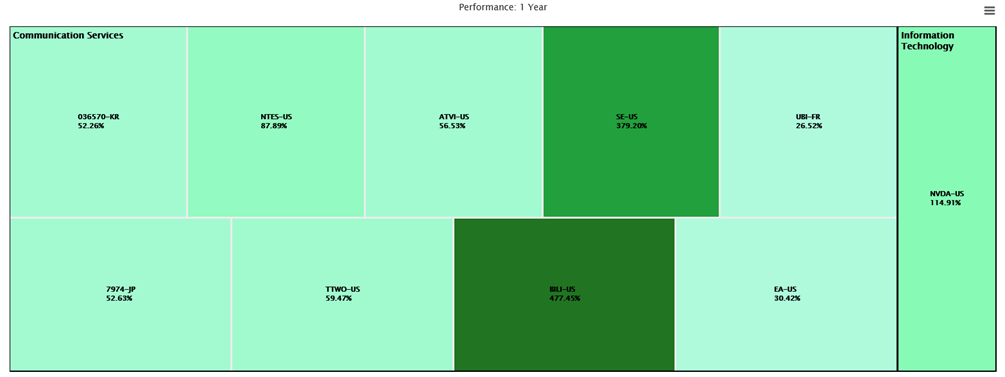

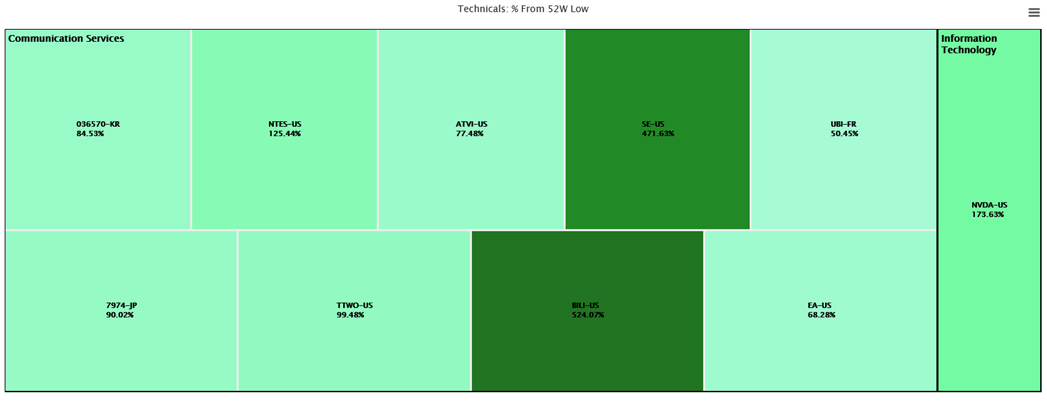

Another unifying factor among our stocks: Really, really strong pandemic-era performance. As of yesterday's close, standouts Sea, Ltd. (SE) and Bilibili, Inc. (BILI) had risen 379% and 477%, respectively. But all of the top ten video gaming stocks had seen positive net returns at least in the double digits:

Source: ETF Action

How we did it: In the Model Tracker tool, click "New Model", then input the 10 ETF All-Stars™ tickers, giving each stock equal weights. Then click on "Stock Visualizer -> Summary Stats" to view heatmaps across a range of time periods and data points.

But we're seeing more than just strong returns here—we're seeing a trend of strong returns. Our ETF All-Star® stocks keep on screaming higher and higher above their 52-week lows:

Source: ETF Action

How we did it: Same as above

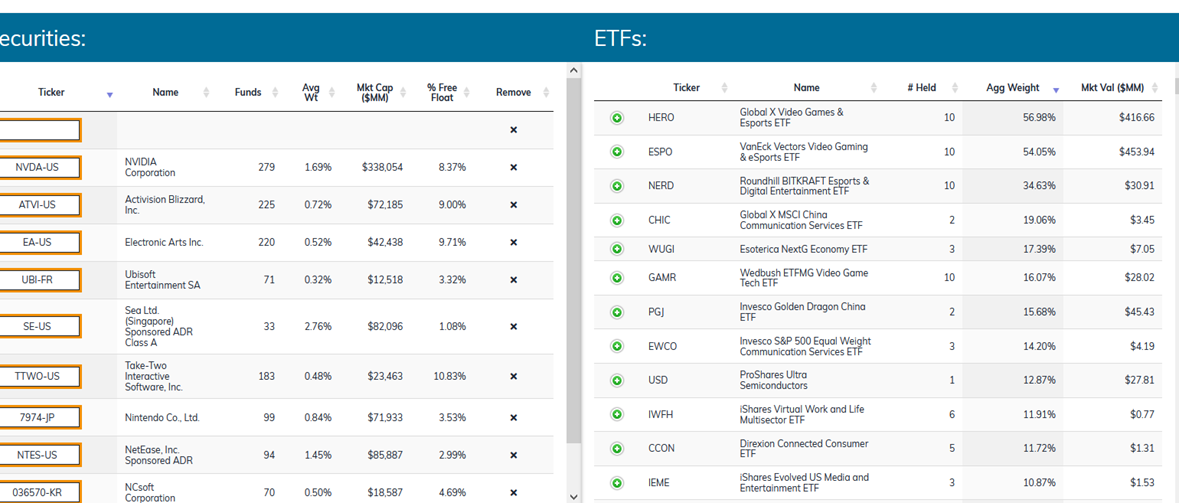

Are Video Game Stocks Getting Overheated?

At this point, GameStop isn't overheated so much as thermonuclear. Unfortunately, it looks like maybe the rest of the video game sector is running a little hot as well.

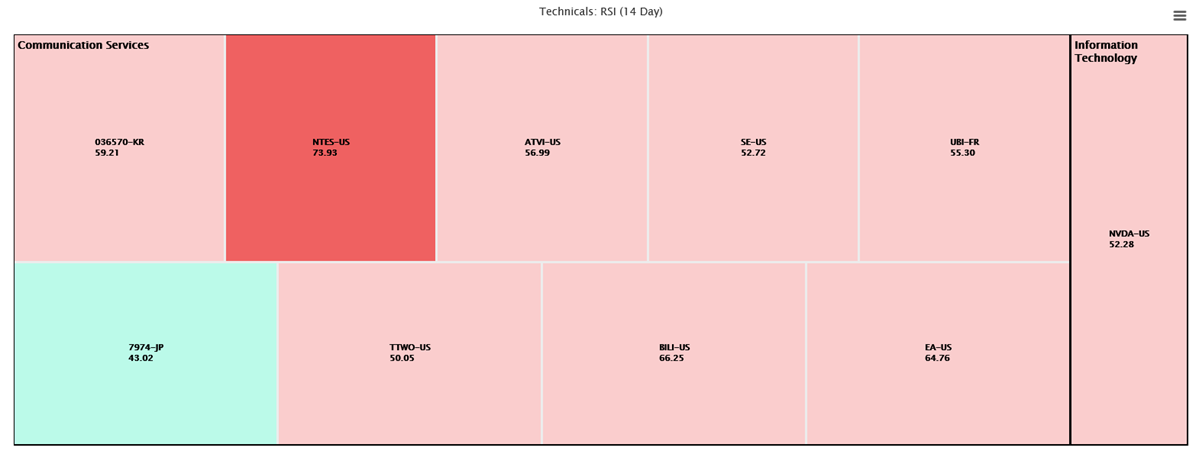

Technical analysts often use a metric known as RSI (or relative strength indicator) to identify momentum trends. How RSI is calculated and charted is beyond this discussion, but for now, all you need to know is that an RSI of 70% or above tends to signal a stock is overbought, while an RSI of 30% or below tends to signal it's oversold.

According to their RSIs, most of our video gaming stocks are at or nearing overbought territory, including NetEase (NTES), which has an RSI of 74%. NetEase may be gearing up for a pullback, if the technicals are any indication:

Source: ETF Action

How we did it: Same as above

For what it's worth, GameStop's RSI is 96.2%, which definitely puts it into the overbought camp:

Source: ETF Action

How we did it: In the Stock Visualizer, type in a ticker, then click on the "Technicals" tab for visualizations of moving averages, Bollinger bands, and 14-day RSI.

Other Ways To Access The Top 10 Video Game Stocks

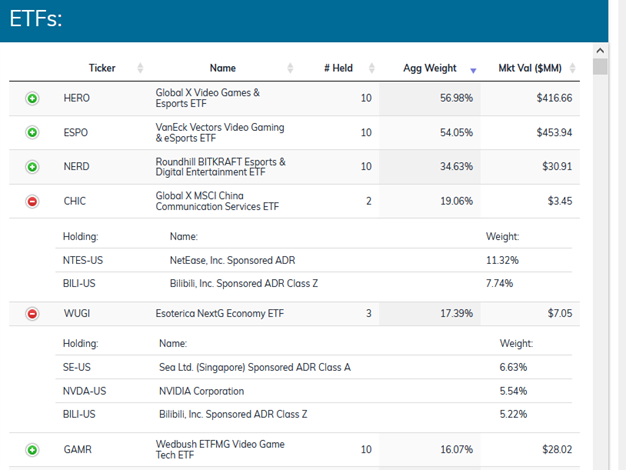

Although we generated the ETF All-Stars® Esports & Video Game Select Top 10 List using video game ETFs, several other, non-gaming-related ETFs actually makes substantial allocations to these stocks, too.

In fact, two funds actually hold more of their portfolio in our ETF All-Stars® stocks than GAMR does: the Global X MSCI China Communication Services ETF (CHIC) and the Esoterica NextG Economy ETF (WUGI), which allocate 19% and 17% of their portfolio to them, respectively. In contrast, GAMR weights 16%:

Source: ETF Action

How we did it: In the Security Lookup tool, input the ten ETF All-Star® stock tickers, then check which ETFs hold them, in the right hand table.

CHIC, which focuses on Communications Services companies located in China, holds NetEase and Bilibili. Meanwhile, WUGI, an actively managed portfolio of stocks involved in 5G, holds Bilibili, NVIDIA and Sea, Ltd.

Source: ETF Action

How we did it: While in the Security Lookup tool, click on the green plus signs next to ETF tickers to see which stocks they hold and in what amounts.

That's both the promise and the peril of bottom-up equity research: One person's video gaming stock is another person's 5G play; and one person's Chinese telecom giant is another person's eSports superstar. Very few companies fit firmly into a single thematic mold anymore, so when you have a theme you want target with individual stocks, it can be tough to even know where to start.

But that's why we developed the ETF All-Stars® Select Top 10 Lists: To help you start with the thematic ETFs and work your way backwards toward relevant equities that fit your theme. Doing so saves you time and headaches—and maybe helps you avoid the GameStops of the world, which look like a good thematic fit on the surface but just don't hold up to deeper scrutiny.

Lara Crigger is the Editor-In-Chief of ETF Action. Contact her at lara@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.