This Week In ETFs

2.26.2021

This Week In ETFs

Week of Feb. 22-26, 2021

Quick Stats

Total # of ETFs: 2,435

Total AUM: $5.85 trillion

Average Expense Ratio: 0.54%

5-Day Net Flows: $19.65 billion

30-Day Net Flows: $111.93 billion

90-Day Net Flows: $292.12 billion

YTD Net Flows: $147.32 billion

1-Year Net Flows: $564.58 billion

What happened in ETF markets this week? We crunch the numbers below.

NOTE: Unless otherwise stated, data range is from Monday through Thursday's close. ETNs and leveraged/inverse ETFs are excluded.

Best Performing ETFs

Four of the five top performing ETFs this week were oil equities ETFs: As energy prices have skyrocketed, they've propelled share prices for companies in oil services and exploration/production higher. The VanEck Vectors Oil Services ETF (OIH) rose 10.92%; the iShares U.S. Oil Equipment & Services ETF (IEZ) rose 9.06%; the VanEck Vectors Unconventional Oil & Gas ETF (FRAK) rose 8.09%; and the Invesco Dynamic Energy Exploration & Production ETF (PXE) rose 7.77%.

The week's top performer, however, was the ProShares VIX Short-Term Futures ETF (VIXY), up 11.02%.

Worst Performing ETFs

Several disruptive tech ETFs pulled back this week. The Simplify Volt Fintech Disruption ETF (VFIN) fell the most, by 17.97%, followed by the Amplify Transformational Data Sharing ETF (BLOK), which fell 15.28%. Two ARK ETFs were also among the worst performers: the ARK Innovation ETF (ARKK), which fell 15.14%, and the ARK Next Generation Internet ETF (ARKW), which fell 13.40%.

The ERShares Entrepreneurs ETF (ENTR) also dropped 15.21%.

ETFs with the Largest 5-Day Net Inflows

Core S&P 500 ETFs led the week in inflows. The iShares Core S&P 500 ETF (IVV) gained $2.47 billion in net assets, while the SPDR S&P 500 ETF Trust (SPY) gained $2.15 billion.

Other big flows gainers included the Financial Select Sector SPDR Fund (XLF), which rose by $2.08 billion; the iShares Russell 2000 ETF (IWM), which rose by $1.26 billion; and the Vanguard Total Stock Market ETF (VTI), which rose by $591 million.

ETFs with the Largest 5-Day Net Outflows

Gold saw the biggest outflows this week, as the SPDR Gold Shares (GLD) lost $1.88 billion in net assets. Broad bond ETFs also saw big outflows, including the SPDR Bloomberg Barclays High Yield Bond ETF (JNK), which lost $1.77 billion; the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), which lost $1.60 billion; and the iShares 20+ Year Treasury Bond ETF (TLT), which lost $439 million.

The Technology Select Sector SPDR Fund (XLK) also saw outflows of $526 million.

Best & Worst Performing ETFs Over The Past 10 Years

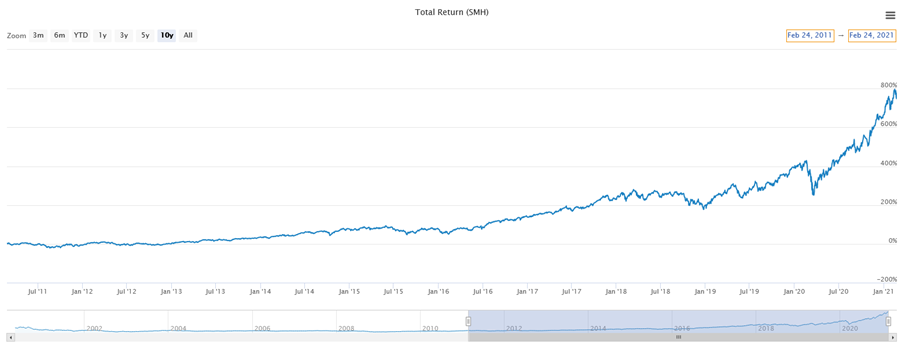

Looking toward the long-term, the ETF that has had the highest annualized performance over the past ten years is the VanEck Vectors Semiconductors ETF (SMH), which has risen 23.15%:

Source: ETF Action

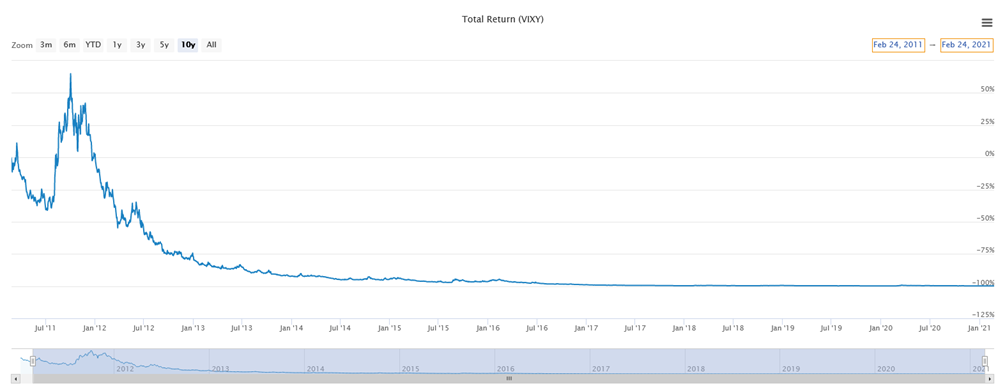

The ETF with the worst annualized performance over the past ten years is the ProShares VIX Short-Term Futures ETF (VIXY), which has fallen 46.28%:

Notable Launches: 2/19-2/25

- Humankind U.S. Stock ETF (HKND): ESG ETF that holds U.S. large caps stocks whose businesses promote "healthier, safer, more equitable, and longer lives." Costs 0.11%, making it the second cheapest ESG ETF on the market.

- Invesco International Developed Dynamic Multifactor ETF (IMFL): Multifactor ETF that tracks developed, ex-US stocks, shifting factor exposure in response to changing market conditions.

- Global X China Disruption ETF (KEJI): Active ETF that focuses on disruptive innovation in Chinese markets. Can hold more than just Chinese-listed stocks.

- Xtrackers S&P MidCap 400 ESG ETF (MIDE): Companion to SNPE. ESG mid cap ETF that covers an S&P Dow Jones Index (as compared to an MSCI benchmark).

- Xtrackers S&P SmallCap 600 ESG ETF (SMLE): Companion to SNPE. ESG small cap ETF that covers an S&P Dow Jones Index (as compared to an MSCI benchmark).

- Corbett Road Tactical Opportunity ETF (OPPX): Active ETF that invests in both "core" and "opportunistic" equities, along with some allocation to cash & fixed income ETFs. Switches between equities and cash/fixed income ETFs based on a proprietary scoring system.

Notable Closures: 2/19-2/25

No closures this week.

Notable Filings: 2/19-2/25

- ETFMG has filed for a companion fund to its first-mover marijuana ETF, MJ. The ETFMG U.S. Alternative Harvest ETF would be active and focus on U.S.-only cannabis stocks, much like AdvisorShares's MSOS.

- SoFi has filed for a companion fund to its weekly income bond ETF, TGIF. WKLY would invest in stocks, making dividend distributions to investors each week on Thursdays.

- SonicShares has filed for an ETF that would track airlines, hotels, and cruise line operators.

- Simplify ETFs has filed for a series of new convexity-based funds, including an inverse volatility fund, an inflation ETF that invests in real assets, a gold fund-of-funds, and an interest rate hedge bond ETF.

- Aptus has filed for the International Drawdown Managed Equity ETF (IDME), an active ETF that would invest in foreign equities while limiting downside risk via put options on indexes or ETFs.

- iShares has filed for a BBB-rated corporate bond ETF, similar to their BB-rated one that launched a few months back.

- Strategy Shares has filed for an investment-grade corporate bond ETF that's hedged with gold.

Lara Crigger is the Editor-in-Chief of ETF Action. Contact her at lara@etfaction.com

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.