ETF All-Stars: Advanced Materials

4.14.2021

Top 10 Advanced Materials Stocks: A Great Place To Start Upstream

Over the last several weeks we have discussed the potential multi-trillion dollar infrastructure bill in the works in Washington and the impact that may have for investments in 5G/Connectivity and NextGen Transportation. The Biden administration has already come out and said it plans to jump start the electrification of America's roads by offering nationwide charging station infrastructure, tax incentives for electric vehicle buyers, and money to boost domestic supply of materials. That's exactly why this week we thought we would look further upstream from the NextGen Transportation segment into Advanced Materials.

While there are only a few ETFs that cover the space, it is growing quickly in assets and may stand to benefit from strong battery demand over the next decade and onward. Hence, we explore the companies that make up ETF All-Stars® Advanced Materials Select Top 10 List.

Let's begin by looking at the current Advanced Materials ETF landscape...

3 Advanced Materials ETFs: A Look At The Landscape

Despite having several strategies out for over a decade now, there are still only three Advanced Materials ETFs that total a little more than $3.6 billion in total assets under management. Over half of those assets ($1.86 billion) have come in net inflows over the past 90 days. These ETFs all fall under the thematic segment "Industrial Revolution" in the ETF Action Classification System, have global exposures, range between 0.59% and 0.75% in expense ratio, and have at least $100 million in AUM. With those similarities out of the way, let's introduce the products:

Global X Lithium Battery Tech ETF (LIT): $2.843 Billion in AUM | July 2010 Inception | 0.75% Expense Ratio

Amplify Lithium & Battery Technology ETF (BATT): $145 Million in AUM | June 2018 Inception | 0.59% Expense Ratio

VanEck Vectors Rare Earth/Strategic Metals ETF (REMX): $631 Million in AUM | October 2010 Inception | 0.60% Expense Ratio

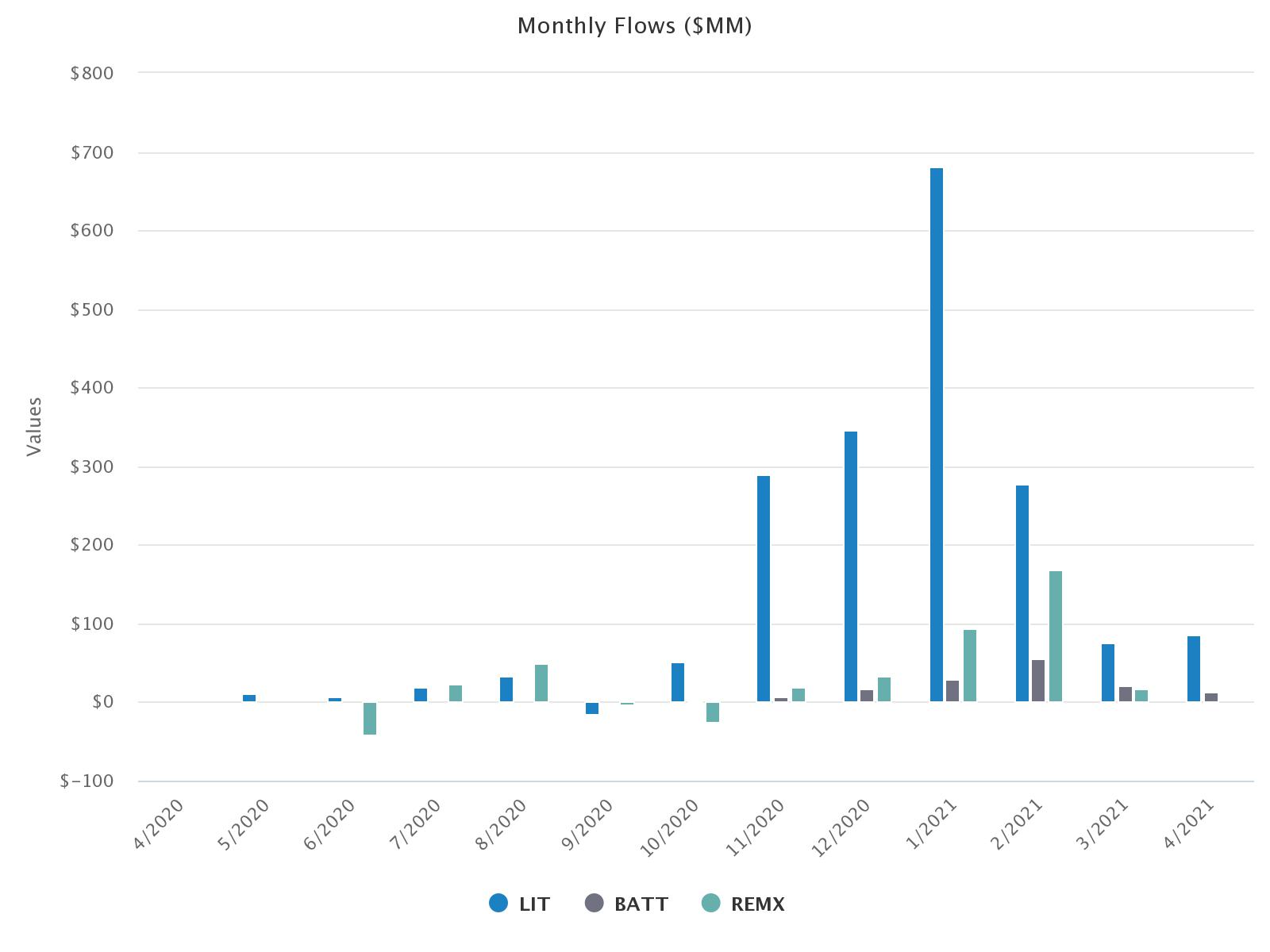

Flows Have Been Strong

Flows have really begun to accelerate over the past year with the majority of category assets coming in over the last 90 days in particular. One year net flows for these ETFs total $2.351 billion which accounts for nearly 65% of category assets. $1.868 billion of which has come in over the past three months. While all ETFs have gotten at least $100 million, the Global X Lithium & Battery Tech ETF (LIT) has by far brought in the most with $1.865 billion over the past year. LIT had record a record month of net inflows during January 2021 with $680 million.

Source: ETF Action

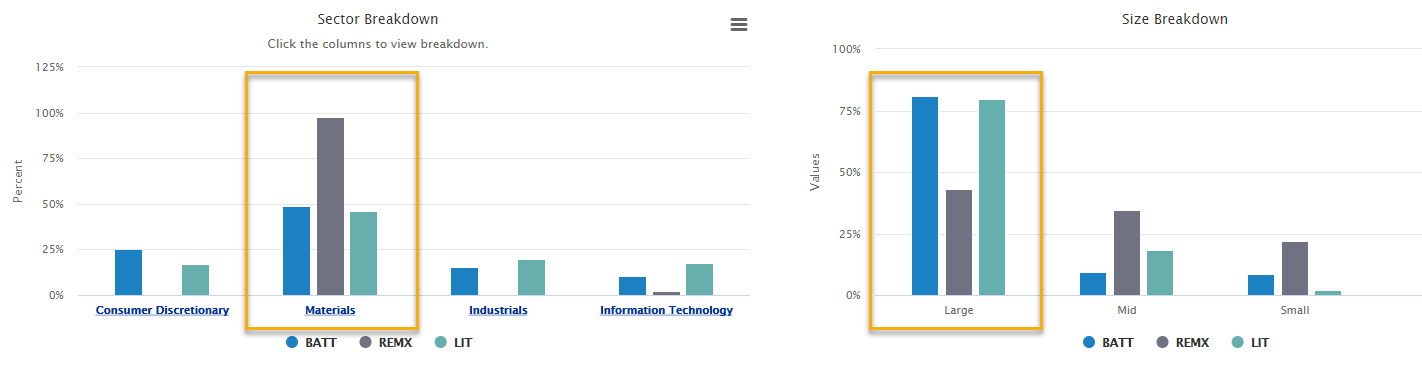

Performance Varies Since Common Inception

Going back to common inception of June 2018, performance has varied considerably for these three ETFs. LIT has been the clear outperformer, returning 85%. REMX has advanced only 15% during that same period and BATT has fallen 20%. That being said, since the beginning of 2021 REXM has been the clear winner, returning 16% while both BATT and LIT have fallen 1% and 3%, respectively.

Source: ETF Action

Why the difference? From a composition standpoint, all three ETFs have tilts to emerging markets and developed ex-U.S. companies but REMX begins to deviate at the sector and market-cap level. REMX has almost a pure exposure to the materials sector (97% whereas BATT and LIT have ~47% materials exposure) and the majority of its market-cap exposure comes from mid and small-caps, both of which have easily outperformed during the current cyclical recovery.

Source: ETF Action

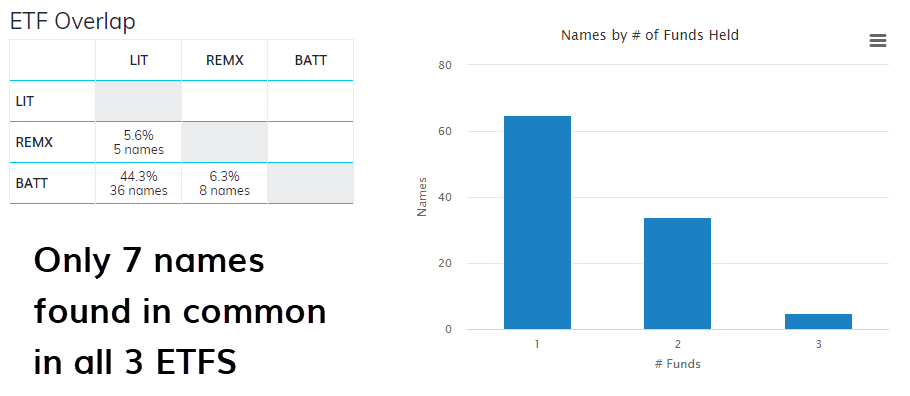

Overlap is Present But Not Robust Across All Three ETFs

Looking closer at the holdings and you will see that between these 3 ETFs, there are 101 unique companies. You will see that the greatest overlap between any of these ETFs is 44%, between LIT and BATT. Not surprisingly REMX has only 5.6% and 6.3% overlap with LIT and BATT, respectively. And as we always do with these writeups, we look to see what all three Advanced Materials classified ETFs agree upon. Only 7 companies are found in common across all three.

Source: ETF Action

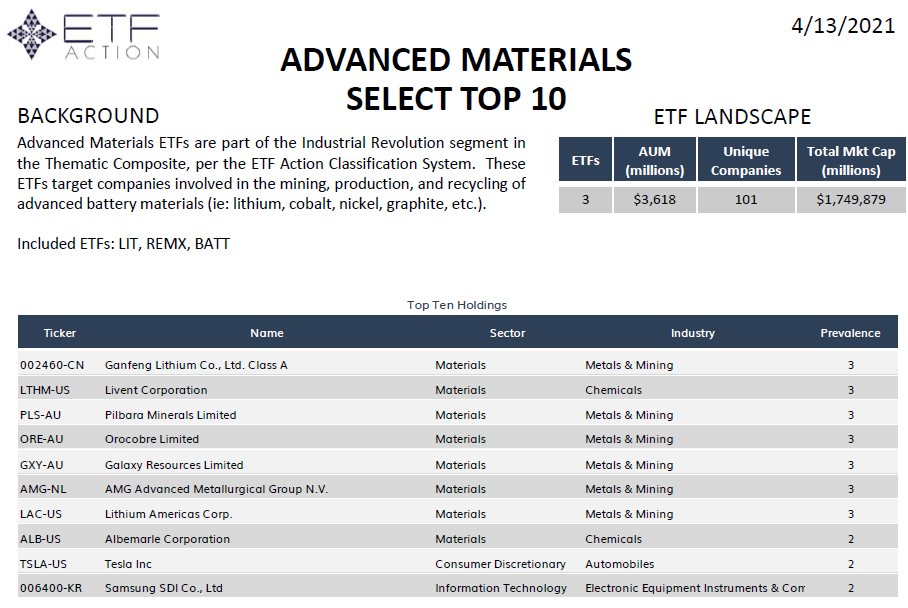

Inside The ETF All-Stars® Advanced Materials Select Top 10 List

From the holdings of the three Advanced Materials ETFs, we can construct the ETF All-Stars® Advanced Materials Select Top 10 List, a ranking of stocks based on their prevalence among the funds. (As a reminder, prevalence is a measure of the frequency of appearance (ie: ABC company is held by all 6 ETFS = 6 prevalence) while tiebreakers are settled by the total market value held.

The ETF All-Stars® Advanced Materials Select Top 10 List is depicted below:

Source: ETF Action

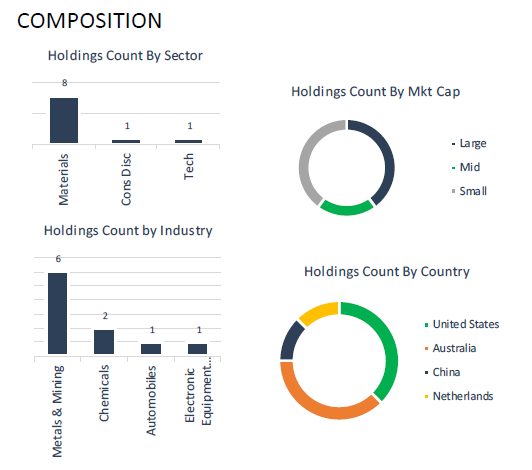

Similar to their parent ETFs, the vast majority of the ETF All-Stars® fall in the materials sector based on GICS classifications, primarily in the metals and mining industry. Other industries that we find in the select top 10 are chemicals, automobiles, and electronic equipment instruments. Geographically, companies come from Australia, China, Netherlands, and the United States. Outside of the chemical and mining companies, notable names are in Tesla and Samsung who are developers and producers (and users) of new battery technologies.

Source: ETF Action

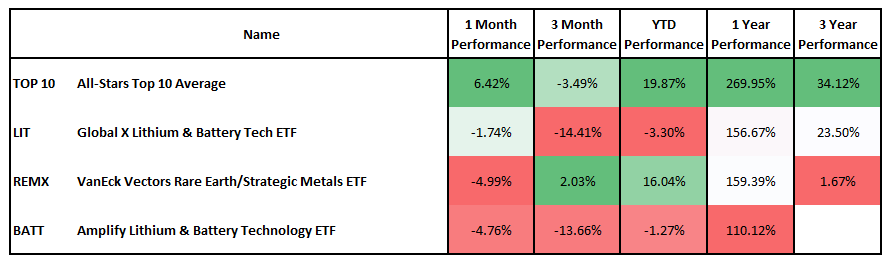

Advanced Materials All-Stars® Select Top 10 Have Performed Better

While overall the Advanced Materials ETF space has performed well with some variance over the last several years, the ETF All-Stars® have done better on an average basis. Similar to what we done in previous weeks with Select Top 10, if you were to take the Advanced Materials All-Stars and equal weight them, you would outperform over almost all time horizons over the past 3 nears (note BATT does not have a three year track record). The list of companies that are most in common among these strategies have appeared to outperform or remain in the upper tier performance wise.

Source: ETF Action

Conclusion: Advanced Materials theme Offers Upstream Opportunity With EV Revolution, All-Stars Provide A Great Starting Point

Advanced Materials has been a secular trend in the making and with an acceleration of the electric vehicle production over the coming decade, looking upstream to the companies that participate in the mining, production, and development of advanced materials stand to benefit. Money has clearly been flowing towards the Advanced Materials ETF space at an accelerating pace and we believe that to be a trend to continue. The ETF All-Stars Select Top 10 provides exposure to companies that may be in a great position to benefit.

Alex Shepard is the Director of Research for ETF Action. Contact him at alex@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.