ETF All-Stars: Cannabis

1.21.2021

Top 10 Cannabis Stocks:

Is The Tail Wagging The Dog?

Last week, we introduced the ETF All-Stars® Select Top 10 Lists, using the methodology to suss out the Top 10 Genomics Stocks.

This week, we turn our attention to cannabis, one of the hottest investment themes that has emerged, especially since the election. And, well, we've got some good news and some bad news.

The good news is this: Clear consensus has emerged among ETF indexers and active managers alike about what constitutes a "cannabis stock."

But the bad news is that the underlying cannabis sector remains modest—at least, in comparison to investor hype—leading us to wonder if the current investible pure play universe is even large enough to handle significant investment without the underlying security prices being pushed around.

When the tail wags the dog in ETF Land, that is a big problem.

Inside The 7 Cannabis ETFs

ETF Action classifies seven pure play ETFs in its "Cannabis" segment: the ETFMG Alternative Harvest ETF (MJ), the AdvisorShares Pure US Cannabis ETF (MSOS), the AdvisorShares Pure Cannabis ETF (YOLO), the Cannabis ETF (THCX), the Global X Cannabis ETF (POTX), the Amplify Seymour Cannabis ETF (CNBS), and the Cambria Cannabis ETF (TOKE).

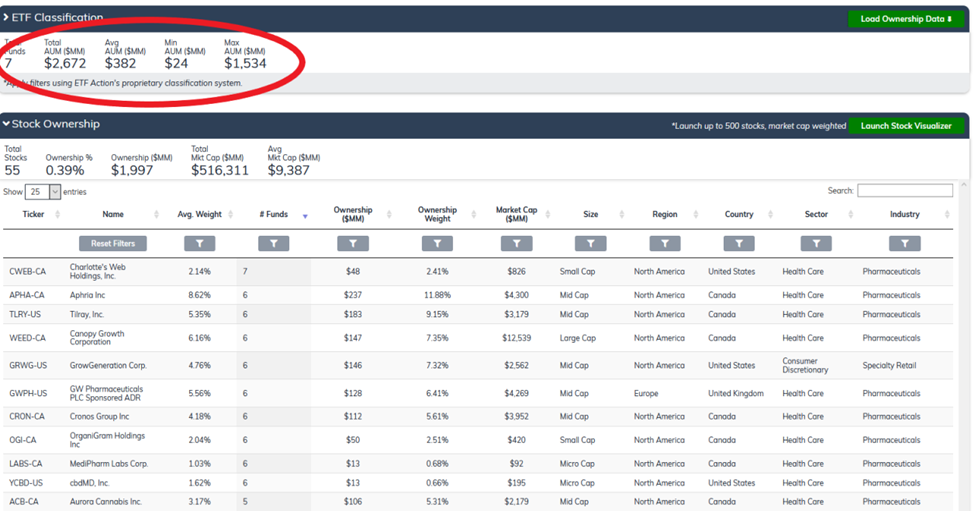

Together, those seven ETFs, which total roughly $2.7 billion in investor assets, comprise 55 unique stocks:

Source: ETF Action

How We Did It: Input tickers for the seven cannabis ETFs into the Ownership Screener, then click the green "Load Ownership Data" button in the top right corner of the "ETF Classification" window.

(By the way, you might be wondering why we excluded the MicroSectors Cannabis ETN and the MicroSectors Cannabis 2X Leveraged ETN from our analysis. It's simple: As ETNs, these products aren't portfolios, but debt notes tied to the return of an index. So while the note's counterparty will need to buy the securities, the ETN itself doesn't actually hold any stocks at all.)

Now, 55 stocks isn't a massive investible universe. What's more, most of these cannabis stocks are small caps and microcaps; though the average market cap of our set is about $9.3 billion, that figure is skewed by a few multi-billion dollar names.

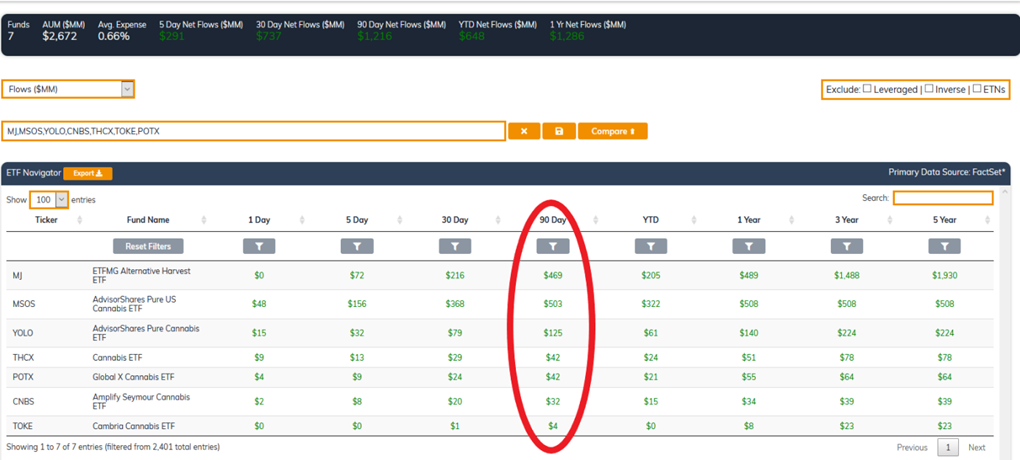

But the small size of the cannabis market hasn't deterred investors, of course. Over the past 90 days, these seven cannabis ETFs have brought in huge flows, topping $1.2 billion in new net investment:

Source: ETF Action

How We Did It: Input tickers for the seven cannabis ETFs into the ETF Navigator, then select the "Flows" tab.

In the first 20 days of 2021 alone, the seven ETFs have netted an eyepopping $648 million!

The Top 10 Cannabis Stocks

Due to the small size of the investible universe, it's probably not that surprising that we should find consistency among the portfolios of cannabis ETFs. After all, there are only so many ways you can slice the pie, right?

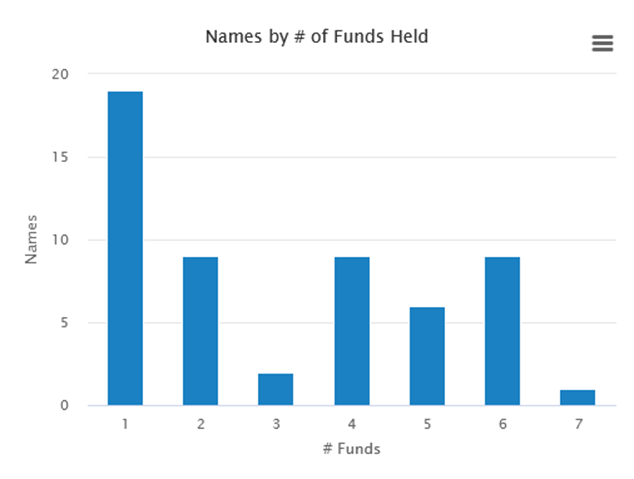

Of these 55 unique stocks, one name appears in all seven funds, another nine appear in six of the seven, while another six appear in five of the seven:

Source: ETF Action

How We Did It: Input tickers for the seven cannabis ETFs into the ETF Overlap Screener, which can be found on the left-hand sidebar.

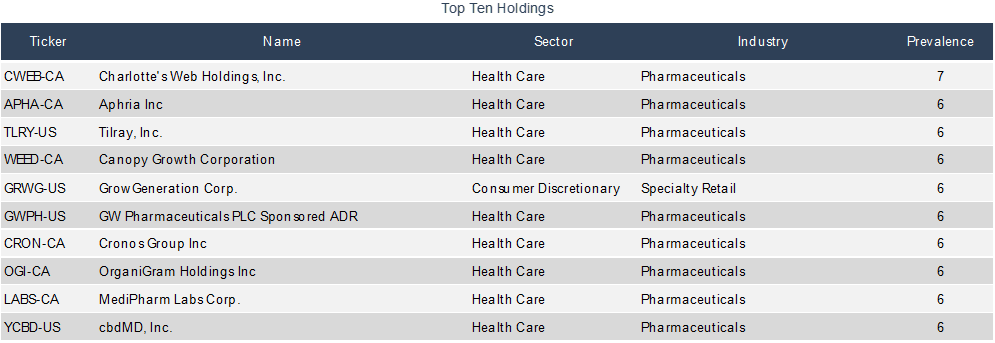

The top ten most prevalent cannabis stocks are listed in our ETF All-Stars® Cannabis Select Top 10 List below. We determine "prevalence" by measuring the total market value of a stock held across all the thematic ETFs in that segment. So, for example, Aphria, Inc (APHA-CA) and Canopy Growth both have a prevalence of 6, meaning they appear in six out of the seven ETFs in our segment. But Aphria ranks slightly higher than Canopy in our top 10 list, because those six ETFs hold more of Aphria's market value ($241 million) than they do Canopy's ($149 million).

Source: ETF Action

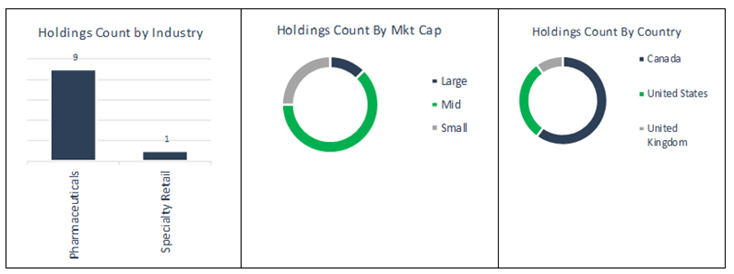

You've probably noticed the pattern in these top ten stocks: Almost all of the most-held cannabis stocks are pharma stocks: Specifically, mid-cap pharmaceutical companies based in either Canada or the U.S.:

Source: ETF Action

Again, that specificity is due to the small size of the cannabis industry at present. As the space grows and diversifies, additional sectors and geographical regions will emerge, of course.

But for now? We hope you like Tilray clones. Because that's pretty much all you've got.

Is The Cannabis Industry Too Small For ETF Investment?

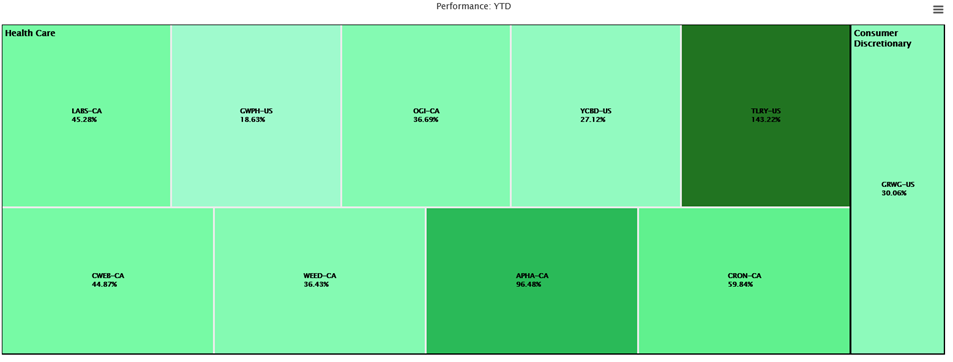

All ten of these stocks have gained substantially since the start of the year. The best performer of the bunch is Tilray, Inc (TLRY), which has jumped 143%, and Aphria, Inc. (APHA-CA), which has risen 96%.

Source: ETF Action

How we did it: In the Model Tracker tool, click "New Model", then input the 10 ETF All-Stars™ tickers, giving each stock equal weights. Then click on "Stock Visualizer -> Summary Stats" to view heatmaps across a range of time periods and data points.

Strong returns are promising, of course. But I just keep circling back to the fact that the cannabis industry is so gosh darn small. As a result of that, ETFs end up owning a disconcerting proportion of some of these stocks, particularly the smallest ones.

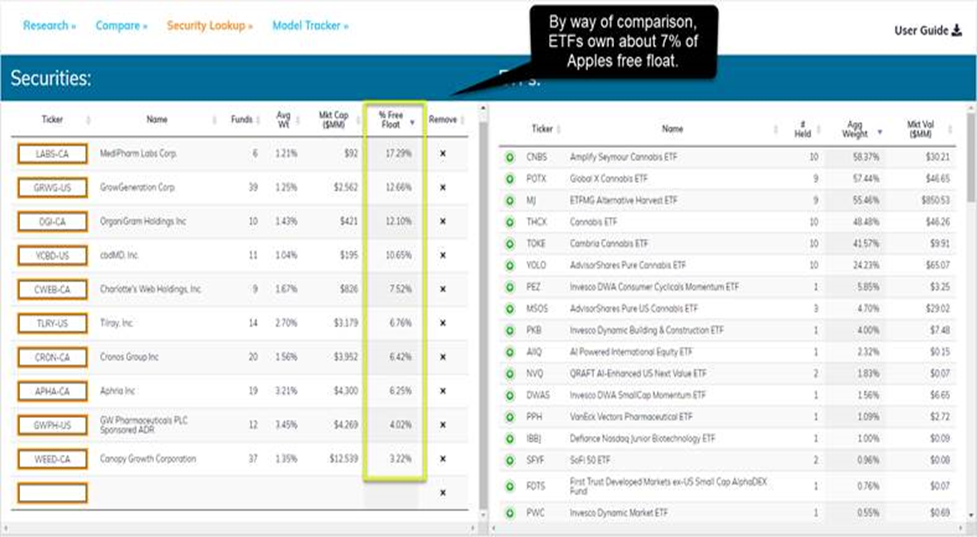

Take MediPharm Labs Corp (LABS-CA), the smallest stock on our top ten list; it has a mere $92 million in market capitalization. ETFs own about 17% of MediPharm's current free float shares. In comparison, ETFs own only 7% of Apple (AAPL):

Source: ETF Action

How we did it: In the Security Lookup tool, input the seven ETF tickers, then look for the "% Free Float" column.

The story's the same for GrowGeneration Corp. (GRWS-US), which has 13% of its free float owed by ETFs; or OrganiGram Holdings Inc (OGI-CA), which is 12% owned by ETFs.

ETFs make a convenient, one-stop-shop investment vehicle, for sure. But would cannabis investors actually put much money as they are into a penny stock like MediPharm, if it weren't already inside an ETF?

As cannabis ETF flows rise and fund performance skyrockets, I wonder if we're in fact witnessing a real-time case of the tail wagging the dog. That is to say, as investors pile into high-performing cannabis ETFs, money flows into the underlying small- and microcap stocks, which in turn boosts those stocks' returns, which in turn helps push the ETF returns higher… the cycle never ends. Until it does.

Long-term, the prospects for cannabis investing look solid, and I do believe that the size of the publicly traded market will catch up to the ETF demand. But for now, the space is small and illiquid--and that gives me serious pause.

Lara Crigger is the Editor-In-Chief of ETF Action. Contact her at lara@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.