The Market Lens

1.25.2021

How GameStop's Short Squeeze Impacts ETF Investors

Well, that didn't take long: Our first genuine Market Drama of 2021 has emerged.

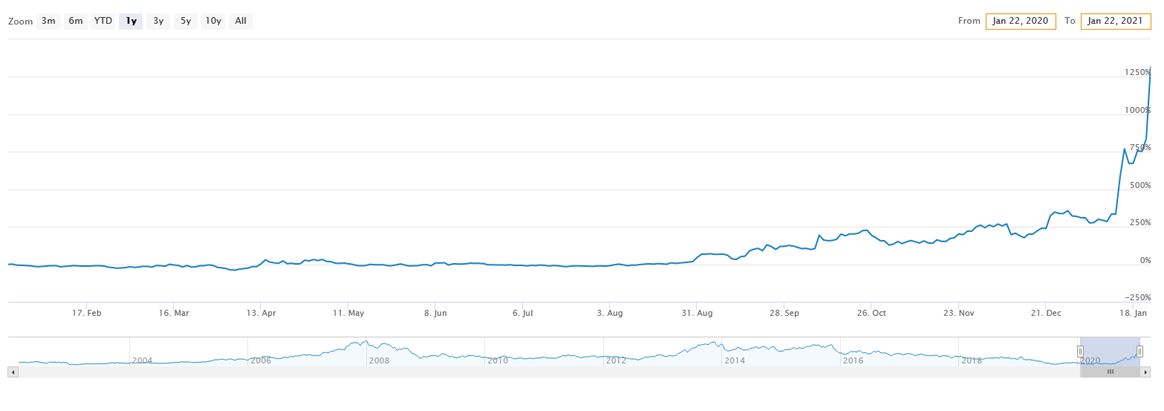

Below are the one-year returns for GameStop (GME), a brick-and-mortar retailer that sells new and used video games:

Source: ETF Action

How We Did It: Input ticker into "Stock Visualizer -> Single Stock," then click on the "Performance" tab.

Your eyes aren't playing tricks on you. That steep rise is real: GameStop's stock is up an incredible 245.06% year-to-date—this, despite the fact that brick-and-mortars continue to suffer plunging foot traffic and sales due to the global COVID-19 pandemic.

GameStop's meteoric rise is a wild story, and savvy ETF investors will want to keep an eye on what happens next.

Putting The Short Squeeze On GME

By most rational measures, GameStop's future prospects look pretty grim. Despite the growth surge in global video gaming, an industry that is expected to reach $175 billion this year, the retailer has ceded much of its market share to more digitally savvy competitors, including Amazon, Steam, and the console-makers themselves.

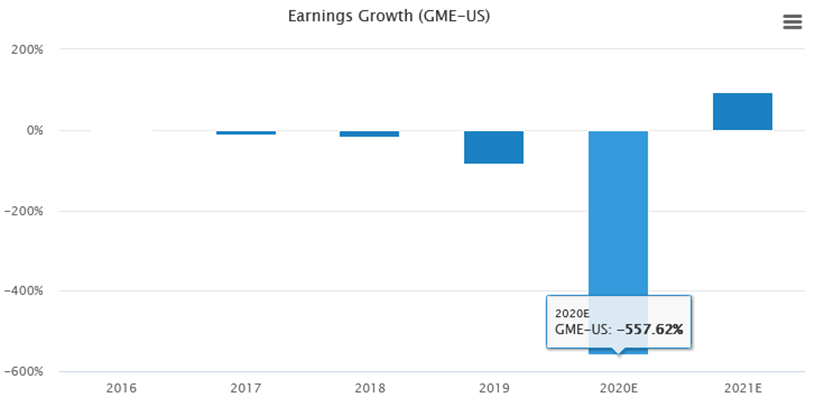

While analysts do expect some modest earnings rebound for GameStop in 2021, the company's estimated earnings growth for the year that has just passed is truly ugly, with a decline of 557.62% estimated for 2020:

Source: ETF Action

How We Did It: Input ticker in "Stock Visualizer -> Single Stock," then click on the "Fundamentals" tab.

Given this dismal outlook, it's no wonder that several big traders have decided to short the stock—which is where our story starts to get hairy.

Over the past week or two, retail day traders frequenting the reddit r/WallStreetBets have disagreed with this call, and vehemently so. So they banded together to enact a "short squeeze" on GameStop's stock price.

A short squeeze occurs when an investor (or in the case of r/WallStreetBets, many investors) buys up lots of call options contracts, which give the holder the option—but not the obligation—to buy a stock at a certain price. The market makers selling those call options must then purchase that stock to maintain their net zero exposure. The more calls that are bought, the more shares of the underlying the brokers must buy to stave off losses.

The options investor, however, isn't actually forced to buy the underlying stock. They simply have the option available to them to do so.

In this particular case, many redditors were buying 'out-of-the-money' options, meaning that the strike price (that is, the contracted price that the stock would've been bought at) was higher than the current market price—essentially making the option not worth exercising. (Confused? It's easier to understand via example: If I had a call option that allowed me to buy GameStop for $5, but when it came time to buy GameStop's stock was actually trading at $4, why would I ever bother to use the contract? I'd just buy it at $4, rather than $5.)

In other words, along with the straight-up bulls, many redditors were intentionally buying up options contracts on GameStop they'd never exercise, so that the market makers selling them would buy up the underlying GameStop shares—thus pushing GameStop's prices higher and higher. By the end of day on Friday, Bloomberg reporter Sarah Ponczek had reported that more than a million call options on GameStop stock had traded in one day.

(**Edit to add: So why would the redditors go through all these hoops, anyway? To make money, of course: lots and lots of money. Deep out-of-the-money options are essentially a leveraged bet, allowing their holders to significantly increase their potential payout with very little upfront cash. Combine that with the excess pressure put on the stock from all the counterparties needing to buy to hedge their exposures, and voila: the r/WSB'ers just made a boatload of cash.)

By Friday's close, GME had risen almost 80% and traded volumes in excess of 197 million shares—even though there are only 45 million in outstanding shares. (The math works out, because you can short a single stock many times.)

Is this legal? Um. We'll let the SEC decide that one.

Is it impactful? You bet your butt it is.

(By the way, there's more to this story, including a short seller whistleblower and threats made to a short seller's family. Ars Technica has a great write-up.)

GME's Impact On ETFs

One easily-missed takeaway from this story: As a result of the short squeeze, at least one market maker has walked away from the GameStop stock entirely. For now, it's just one. But if that were to happen en masse, then what are ETFs holding GameStop stock supposed to do?

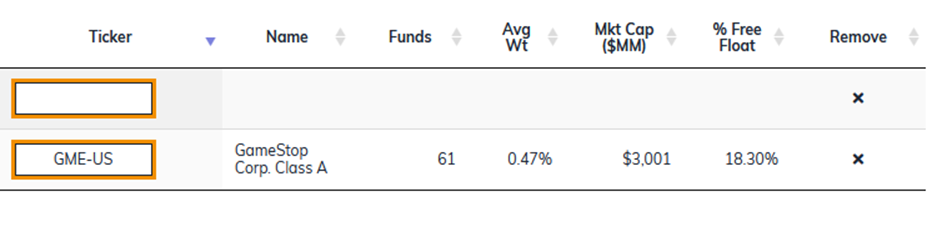

It's not an idle question. About 18% of GameStop's outstanding free float shares are held by ETFs:

Source: ETF Action

How We Did It: In the Security Lookup tool, input the ticker in the orange box on the left, then check the "% free float" column.

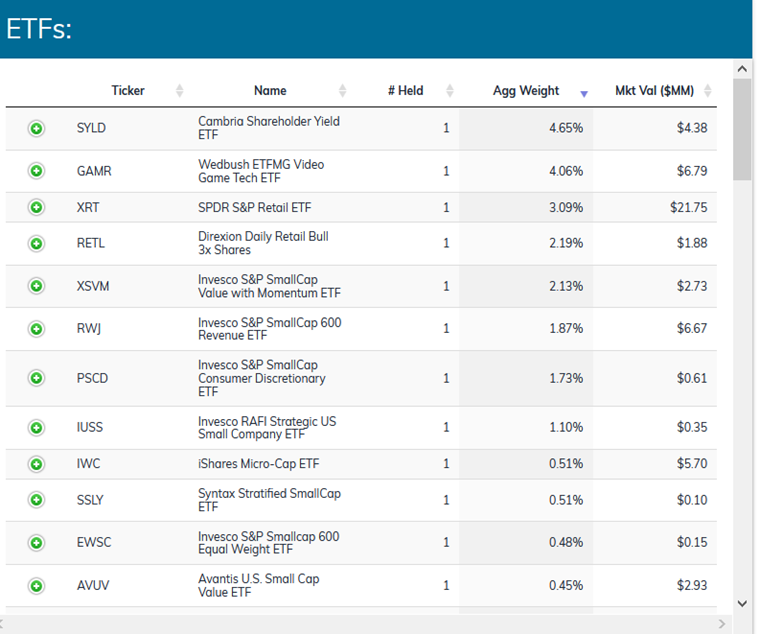

Granted, those shares are fairly spread out among 61 ETFs; the stock appears mostly in weights less than 1.0%, in small cap and factor ETFs. Still, there are three ETFs with a substantial enough GameStop allocation to give me pause: the SPDR S&P Retail ETF (XRT), which weights 3.09% of its portfolio in GameStop; the Wedbush ETFMG Video Game Tech ETF (GAMR), which weights 4.06%; and the Cambria Shareholder Yield ETF (SYLD), which weights 4.65%:

Source: ETF Action

How We Did It: In the Security Lookup tool, input the ticker in the orange box on the left. ETFs that hold this stock will appear on the right, in decreasing order by aggregate weight.

If suddenly these ETFs can't secure the GameStop shares they need in order to effect creates and redeems, then, well, they're simply out of luck. Meaning, the portfolio managers have to deliver a creation basket without GameStop in it, usually replacing that holding with cash.

Sometimes that kind of thing happens in ETF Land. Stocks experience trading halts every day.

But it's not great for investors. Not being able to replicate a creation basket introduces tracking error for the ETF compared to its index, and of course, more difficult executions increase the fund's trading costs. That adds up—usually in the form of a hit to returns.

But rather than worrying issuers, though, I think this whole debacle might actually inspire them. I'm willing to bet that within three to six months, we'll see at least one ETF issuer file for an actively managed, "online retail trader" ETF that tracks trades made popular by r/WallStreetBets and/or similar communities. Who knows, maybe it'll even be another short squeeze ETF, like the late Active Alts Contrarian ETF (SQZZ), which closed in 2018. From chaos comes opportunity, right?

Only One Of 4 Video Game ETFs Holds GME

There's an ironic epilogue to this tale: Despite selling video games, GameStop only appears in one of the four video gaming ETFs, the aforementioned GAMR. That's because the other three ETFs focus on eSports and digital gaming, and brick-and-mortar retailers don't fit within their investment objective.

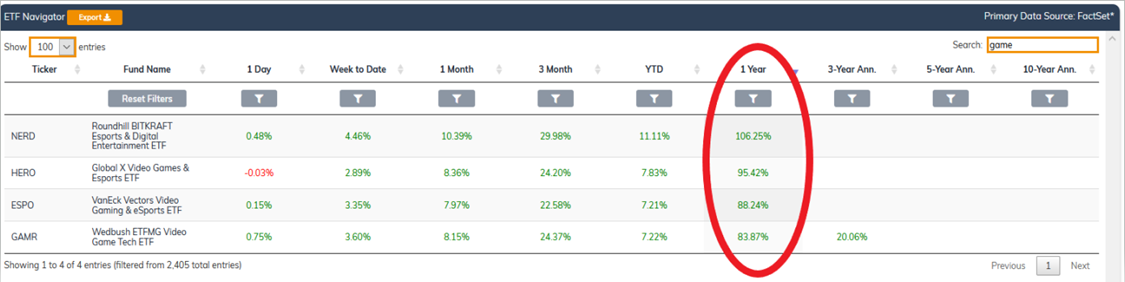

For what it's worth, all four gaming ETFs have been doing pretty well over the past 12-months, though GAMR has lagged the rest:

Source: ETF Action

How We Did It: In the ETF Terminal, type in a keyword into the Search function to find ETFs that match that keyword, then navigate to "Performance" in the ETF Navigator drop down menu.

But with GME going "to the moon," as the redditors put it, we could be in for a reversal of fortune for GAMR over the days and weeks ahead. Only time will tell, but I'm popping the popcorn—in my opinion, this is the ETF to watch. At least until the next drama comes along.

Lara Crigger is the Editor-in-Chief at ETF Action. You can contact her at lara@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.