ETF All-Stars

3.11.2021

ETF All-Stars®: The Top 10 Cybersecurity Stocks

Finding The Cream Of The Crop

Earlier this month, hackers from the state-sponsored Chinese hacking group Hafnium broke into Microsoft Exchange email servers, breaching accounts for as many as 60,000 customers around the world, including the European Banking Authority.

It's the latest in a slew of high-profile attacks over the past few years, a trend only exacerbated by COVID and the shift to 100% remote work. Last year's victims ranged from Carnival Cruise Lines to Facebook, from T-Mobile to the government of Polk County, Florida.

Of course, it isn't just the big, headline-grabbing attacks that can cripple economies. Fintech News reported that in 2020, 80% of companies had seen an increase in cyberattacks, with a new attack occurring every 39 seconds.

Data protection has never been more important. In response, we've seen accelerating expansion in the burgeoning cybersecurity sector, with now hundreds of companies offering products and service to combat this growing threat.

Yet despite the massive growth that has already taken place, we think the ETF All-Stars® show there's still plenty of room left to grow.

Big Flows Into Cybersecurity ETFs

Flows into cybersecurity ETFs have accelerated recently, with the seven funds in the sector seeing combined net inflows of $2.8 billion over the past 12 months. That's roughly 43% of their total current invested assets.

However, performance has varied significantly from fund to fund. We see a 24 percentage point disparity in returns for the four ETFs with track records of at least 12 months, from a rise of 60% for the ETFMG Prime Cyber Security ETF (HACK), to an 85% gain for the Global X Cybersecurity ETF (BUG):

Source: ETF Action

How We Did It: The ETF Terminal, Compare Lens

Building The ETF All-Stars® Cyber Security Top 10 Select List

All told, there are now seven cybersecurity ETFs, including a leveraged product—the ProShares Ultra Nasdaq Cybersecurity ETF (UCYB)—and an ETF that uses options—the Simplify Volt Cloud and Cybersecurity Disruption ETF (VCLO).

To calculate our ETF All-Stars®, however, we set these exotic products aside and focus on the five others: the $3.2 billion First Trust NASDAQ Cybersecurity ETF (CIBR), the $2.0 billion ETFMG Prime Cyber Security ETF (HACK), the $787 million Global X Cybersecurity ETF (BUG), the $390 million iShares Cybersecurity & Tech ETF (IHAK), and the $13 million WisdomTree Cybersecurity Fund (WCBR).

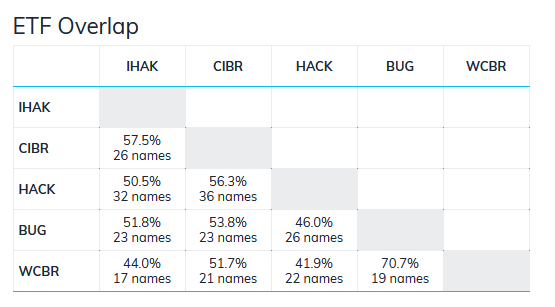

Together these ETFs, which have $6.5 billion in assets invested, comprise 77 unique companies. And there's a fair amount of agreement among these stocks: 15 names appear in all five funds, while another 10 stocks appear in four of the five. In fact, the two biggest funds in the space, CIBR and HACK, exhibit a portfolio overlap of 56%:

Source: ETF Action

How We Did It: The ETF Overlap Analyzer

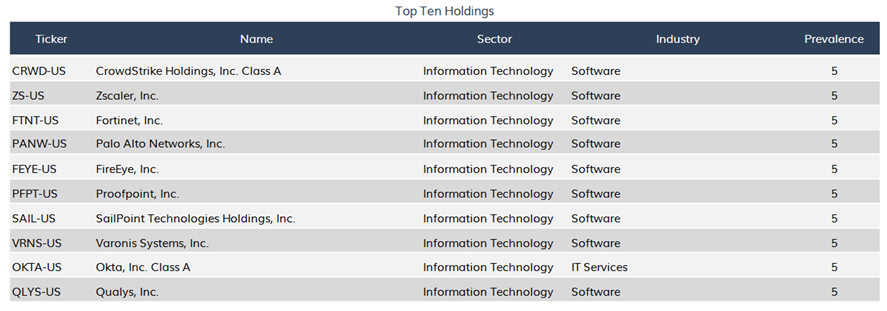

From this set of 77 stocks, we pull the ten most prevalent to construct our ETF All-Stars® Cyber Security Select Top 10 List. As a reminder, prevalence is a measure of not just frequency of appearance, but also market value held. For example, while all five cybersecurity ETFs hold shares of Radware, Ltd. (RDWR), the total market value held in Radware ($45.96 million) is less than the total market value held in Qualys, Inc (QLYS) ($157 million), meaning, Qualys makes the cut for the ETF All-Stars® Cyber Security Top 10 Select List, but Radware does not.

Source: ETF Action

Top 10 Cybersecurity Stocks: Software Developers Of Varying Size

It should come as little surprise that all ten of these names are information technology stocks, and nine of the ten are U.S. software developers. (The lone exception is Okta, Inc. (OKTA), which is more of an IT services shop.)

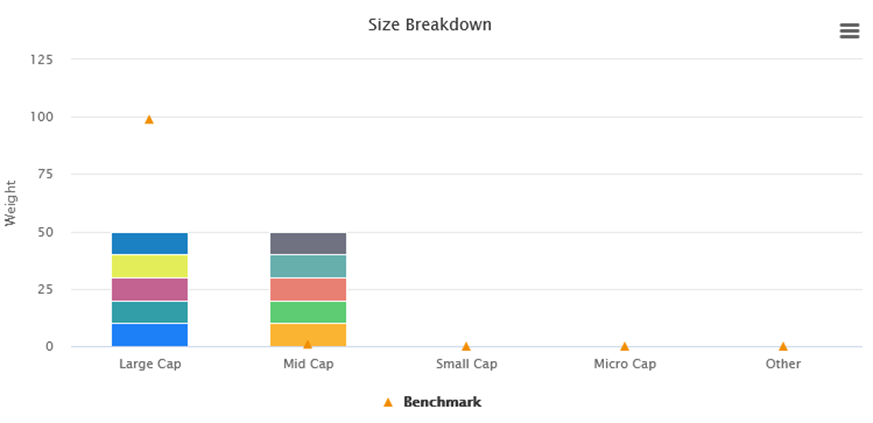

Though all the stocks come from the same sector, their market capitalizations vary significantly. The ETF All-Stars® Cyber Security Select Top 10 List is split evenly between midcaps and large caps, ranging from the $3.7 billion Qualys (QYLS) to the $40.5 billion CrowdStrike (CRWD).

We see this as reflecting a relatively small industry, with significant growth potential still remaining. After all, the SPDR S&P 500 ETF Trust (SPY) contains nearly 150 stocks with market capitalizations higher than $50 billion. Even the biggest cybersecurity firm doesn't come close to that threshold yet.

Source: ETF Action

How We Did It: The Model Tracker. Benchmark is set to SPY.

Top 10 Cybersecurity Stocks: Performance, Valuations & Growth

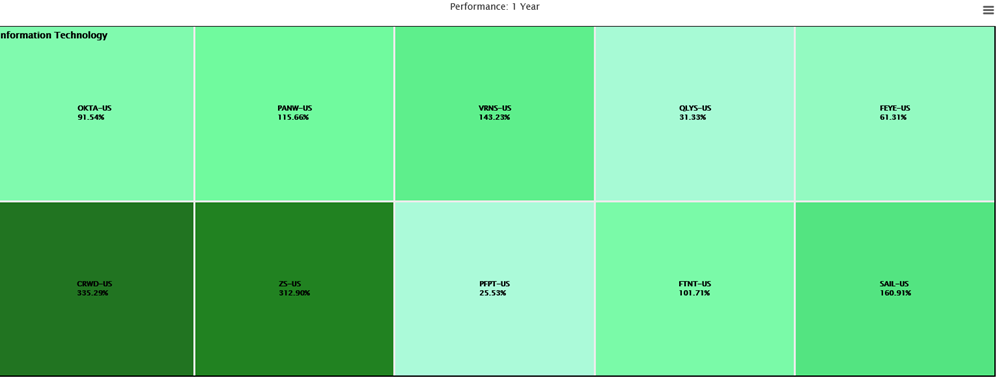

Notably, if you held the 10-stock basket of ETF All-Stars® over the past year, instead of any of the cybersecurity ETFs, you would have seen significant outperformance in an already outperforming sector. Over the past 12 months, an equal-weighted portfolio of the ETF All-Stars® Cyber Security Select Top 10 List saw an average gain of 94%, compared to BUG's 85%::

Source: ETF Action

How We Did It: The Portfolio Visualizer

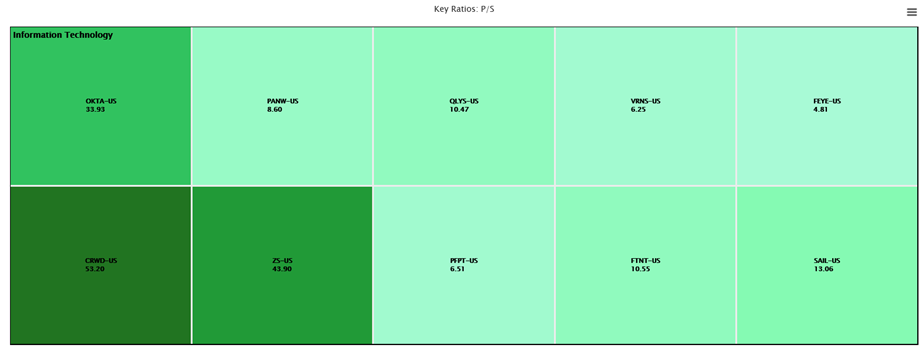

Looking toward valuations, we find a wide range of price/sales* (P/S) ratios for the cybersecurity ETF All-Stars®, ranging from a P/S ratio of 4.8 for FireEye, Inc. (FEYE) to 53.2 for CrowdStrike (CRWD):

(* In this analysis, we've looked at sales metrics specifically, because some of these ETF All-Stars® companies are still posting negative earnings.)

Source: ETF Action

How We Did It: The Portfolio Visualizer

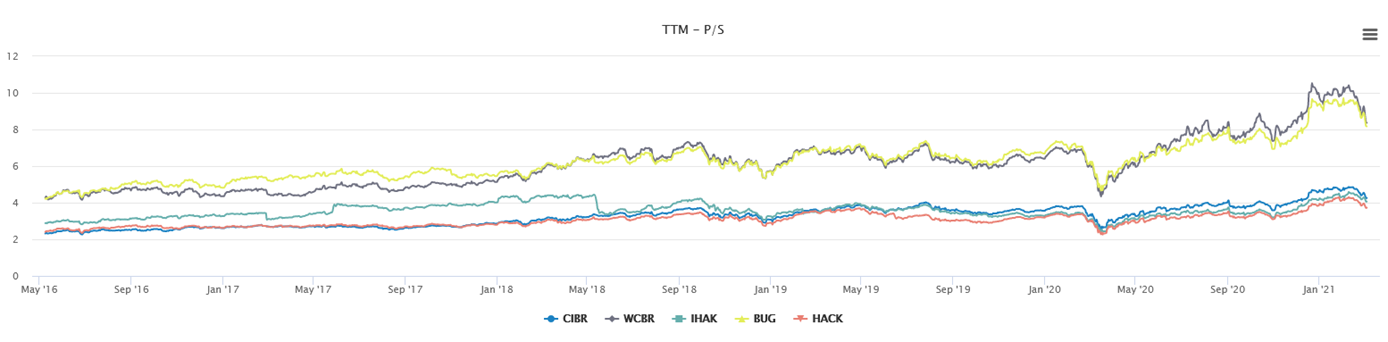

Those are strong valuations, compared to average valuations for the cybersecurity ETFs from which they originate (which have an average P/S ratio of 5.7):

Source: ETF Action

How We Did It: The ETF Terminal, Compare Lens

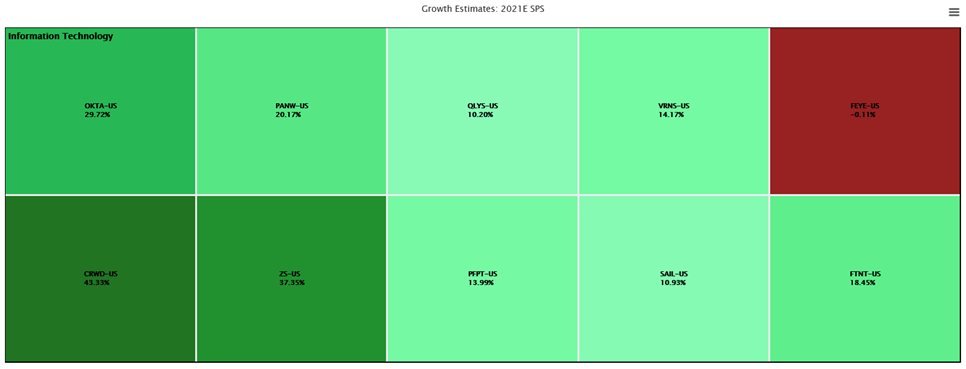

At first blush, that might seem to indicate that the ETF All-Stars® stocks are relatively overvalued—and yes, CrowdStrike's P/S ratio of 53 does sound slightly expensive. Yet these valuations are largely backed up by strong growth estimates. Currently, analysts estimate that the stocks inside the ETF All-Stars® Cyber Security Select Top 10 List will see an average sales per share (SPS) growth of 19.8% for both fiscal years 2021 and 2022:

Source: ETF Action

How We Did It: The Portfolio Visualizer

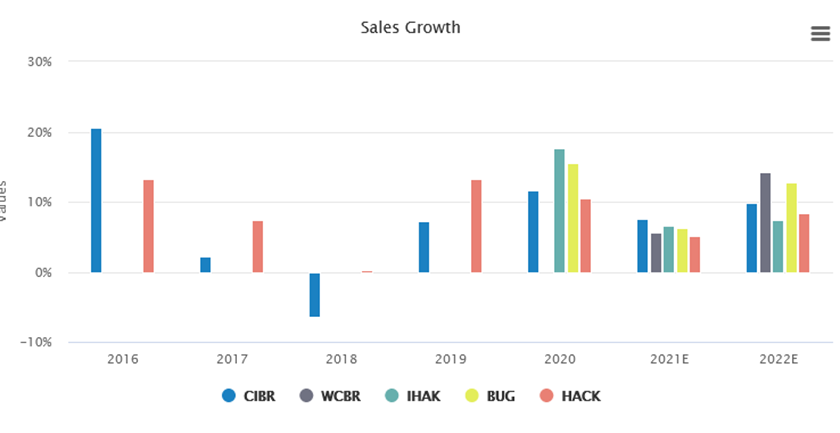

That easily outpaces the estimated SPS growth of the cybersecurity ETFs from which these ten stocks were culled, which is only 6.23% on average for 2021 and 10.5% for 2022:

Source: ETF Action

How We Did It: The ETF Terminal, Compare Lens

The ETF All-Stars® Live Up To Their Name

Clearly, cyber threats aren't going away. That's going to create significant tailwinds for the expanding cybersecurity sector—as well as accelerating interest from investors looking for attractive plays.

Between their clear outperformance, solid valuations, and attractive growth potential, the stocks in the ETF All-Stars® Cyber Security Select Top 10 List live up to the "all-stars" title. Even in a space with so many strong options, these stocks appear to be among the cream of the crop.

Lara Crigger is the Editor-in-Chief of ETF Action. Contact her at lara@etfaction.com.

Alex Shepard is the Director of Research for ETF Action. Contact him at alex@etfaction.com.

Want to get this story and stories like it delivered right to your inbox?

Sign up to receive The Morning Focus newsletter.